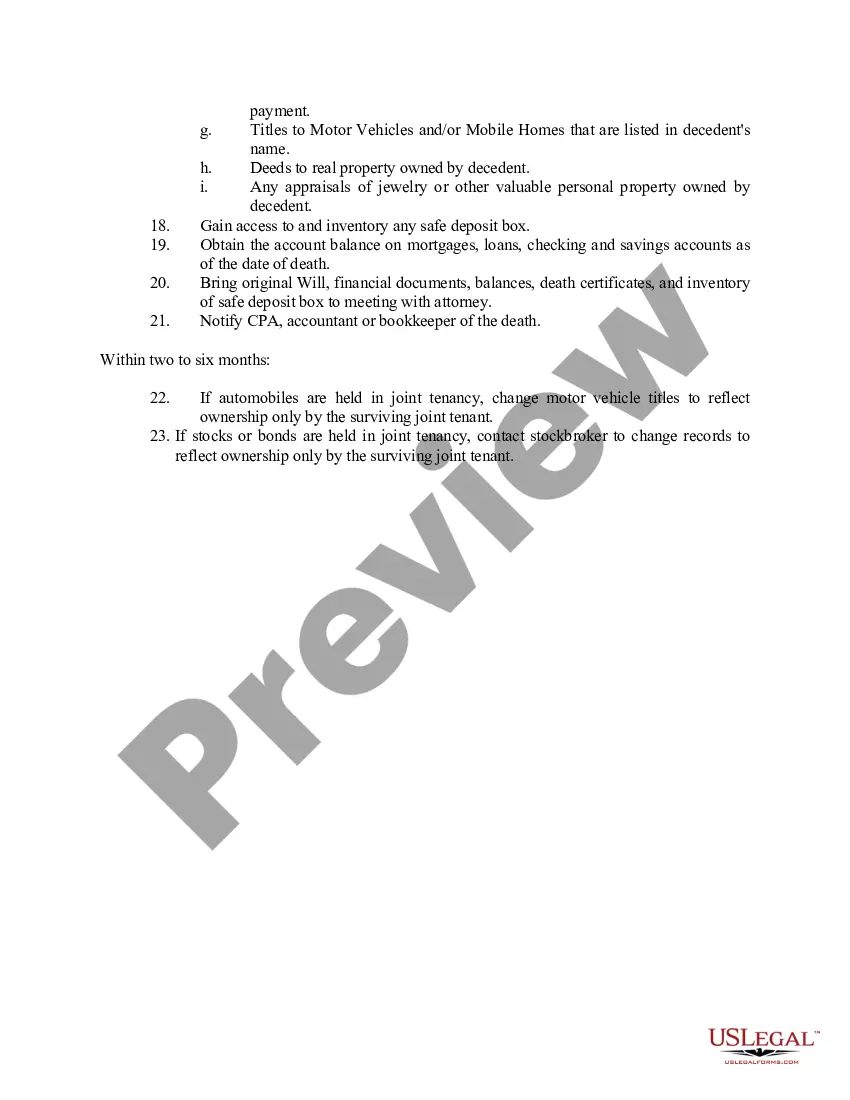

The Illinois Death To-Do List — Checklist is a comprehensive compilation of tasks and responsibilities that need to be addressed after the passing of an individual in the state of Illinois. This checklist serves as a helpful guide for family members, executors, or beneficiaries who find themselves responsible for handling the various legal, financial, and administrative matters following a loved one's death. The Illinois Death To-Do List — Checklist covers a broad range of areas and provides step-by-step guidance in completing each task seamlessly. It encompasses crucial areas such as legal matters, funeral arrangements, financial obligations, and asset distribution. By following this checklist, individuals can ensure that no essential aspect is overlooked during the intricately complex process of settling an estate in Illinois. Different types of Illinois Death To-Do List — Checklist may include: 1. Legal Matters Checklist: — Initiate the probate process if necessary — Locate and review the deceased's will or trust — Appoint an executoadministratorto— - Obtain death certificates — Notify relevant government agencies, including Social Security Administration and Department of Motor Vehicles — Notify the deceased's attorney, accountant, and financial advisor — Secure the deceased's home and belongings 2. Funeral Arrangements Checklist: — Contact a funeraHOMom— - Decide between burial or cremation and make necessary arrangements — Arrange for a memorial service or funeral — Notify family, friends, and loved ones of the funeral details — Gather important documents needed for funeral, such as the deceased's social security number and insurance policies — Choose pallbearers and plan for transportation of the deceased 3. Financial Obligations Checklist: — Notify banks, credit card companies, and insurance companies of the death — Cancel or transfer utilities, subscriptions, and memberships — Determine and settle outstanding debts and loans — File final tax returns and handle any tax-related matters — Close or transfer bank accounts and investments — Notify pension administrators or retirement plan providers 4. Asset Distribution Checklist: — Identify and locate the deceased's assets, including real estate, vehicles, and personal belongings — Determine the value of assets and obtain necessary appraisals — Distribute assets according to the deceased's will, trust, or state laws if no will exists — Transfer ownership of assets to beneficiaries or heirs — Settle outstanding bills and expenses related to the deceased's assets It is worth noting that while the Illinois Death To-Do List — Checklist serves as a comprehensive guide, it is imperative to consult with legal, financial, and tax professionals to ensure compliance with all applicable laws and regulations.

Illinois Death To Do List - Checklist

Description

How to fill out Illinois Death To Do List - Checklist?

If you want to full, obtain, or produce legitimate file templates, use US Legal Forms, the biggest selection of legitimate types, which can be found online. Make use of the site`s simple and hassle-free lookup to get the paperwork you require. Numerous templates for business and person purposes are categorized by types and claims, or search phrases. Use US Legal Forms to get the Illinois Death To Do List - Checklist in a couple of click throughs.

Should you be already a US Legal Forms consumer, log in in your account and click on the Obtain button to find the Illinois Death To Do List - Checklist. Also you can access types you formerly acquired within the My Forms tab of your account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the form for your proper town/nation.

- Step 2. Make use of the Preview option to look over the form`s content material. Don`t forget about to read the description.

- Step 3. Should you be unsatisfied with all the kind, use the Search area near the top of the display to get other models in the legitimate kind design.

- Step 4. Once you have identified the form you require, go through the Get now button. Choose the rates program you like and add your qualifications to sign up to have an account.

- Step 5. Procedure the deal. You should use your charge card or PayPal account to finish the deal.

- Step 6. Find the structure in the legitimate kind and obtain it on your gadget.

- Step 7. Total, change and produce or indicator the Illinois Death To Do List - Checklist.

Every legitimate file design you acquire is your own property for a long time. You possess acces to every single kind you acquired with your acccount. Go through the My Forms portion and select a kind to produce or obtain again.

Remain competitive and obtain, and produce the Illinois Death To Do List - Checklist with US Legal Forms. There are thousands of expert and condition-specific types you may use to your business or person requires.