Illinois Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Illinois Underwriter Agreement - Self-Employed Independent Contractor?

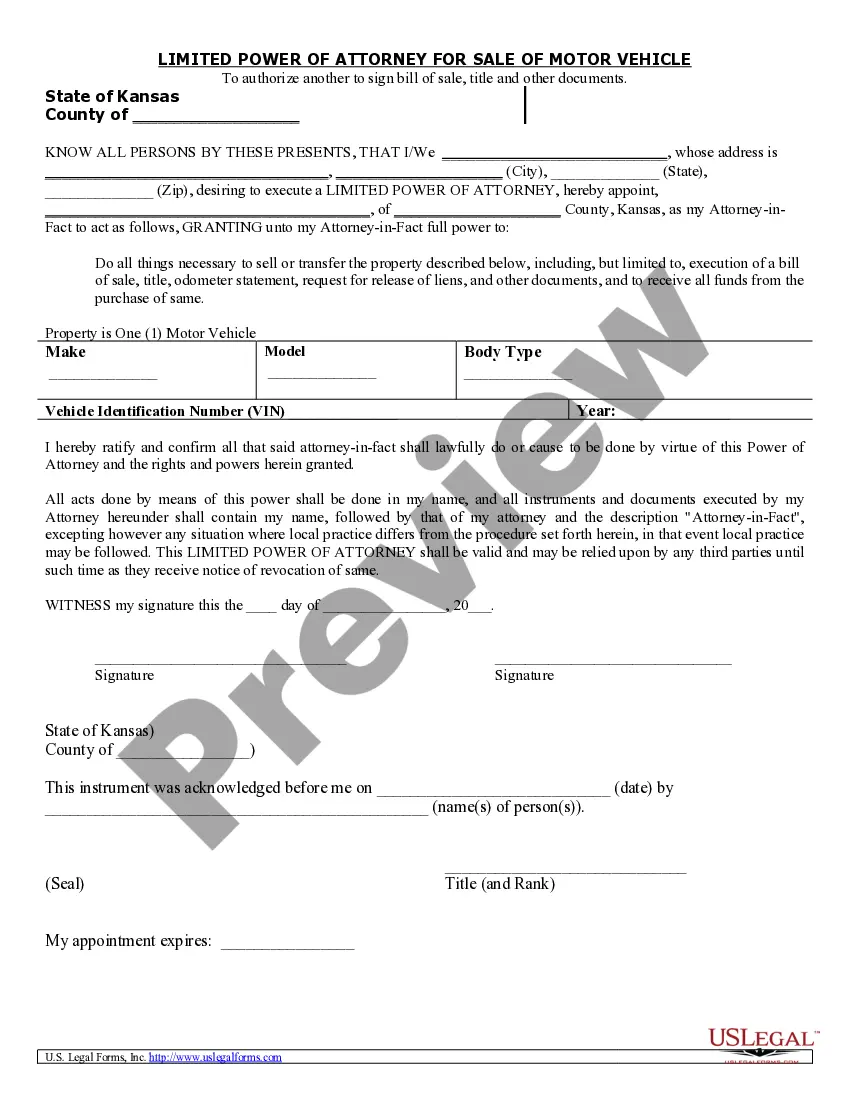

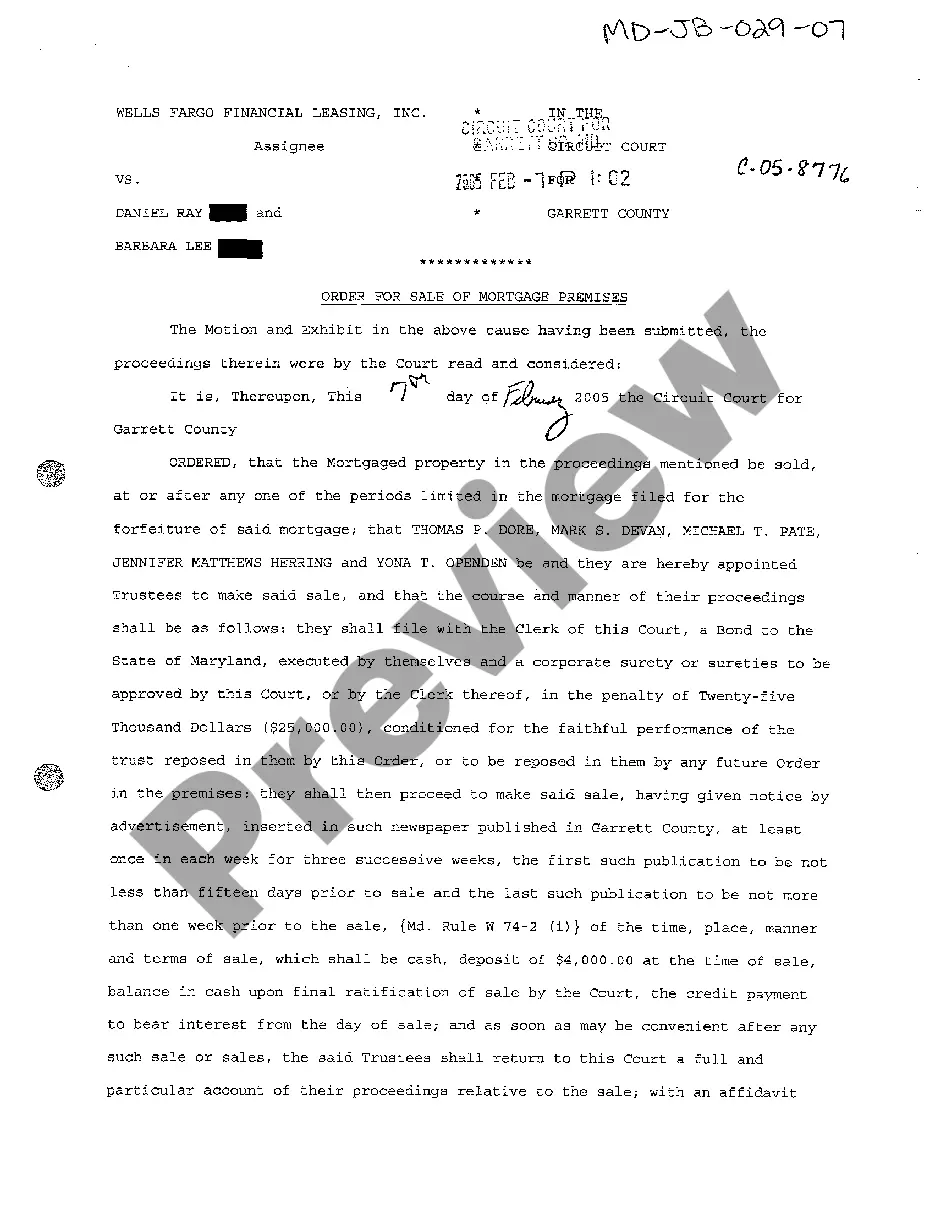

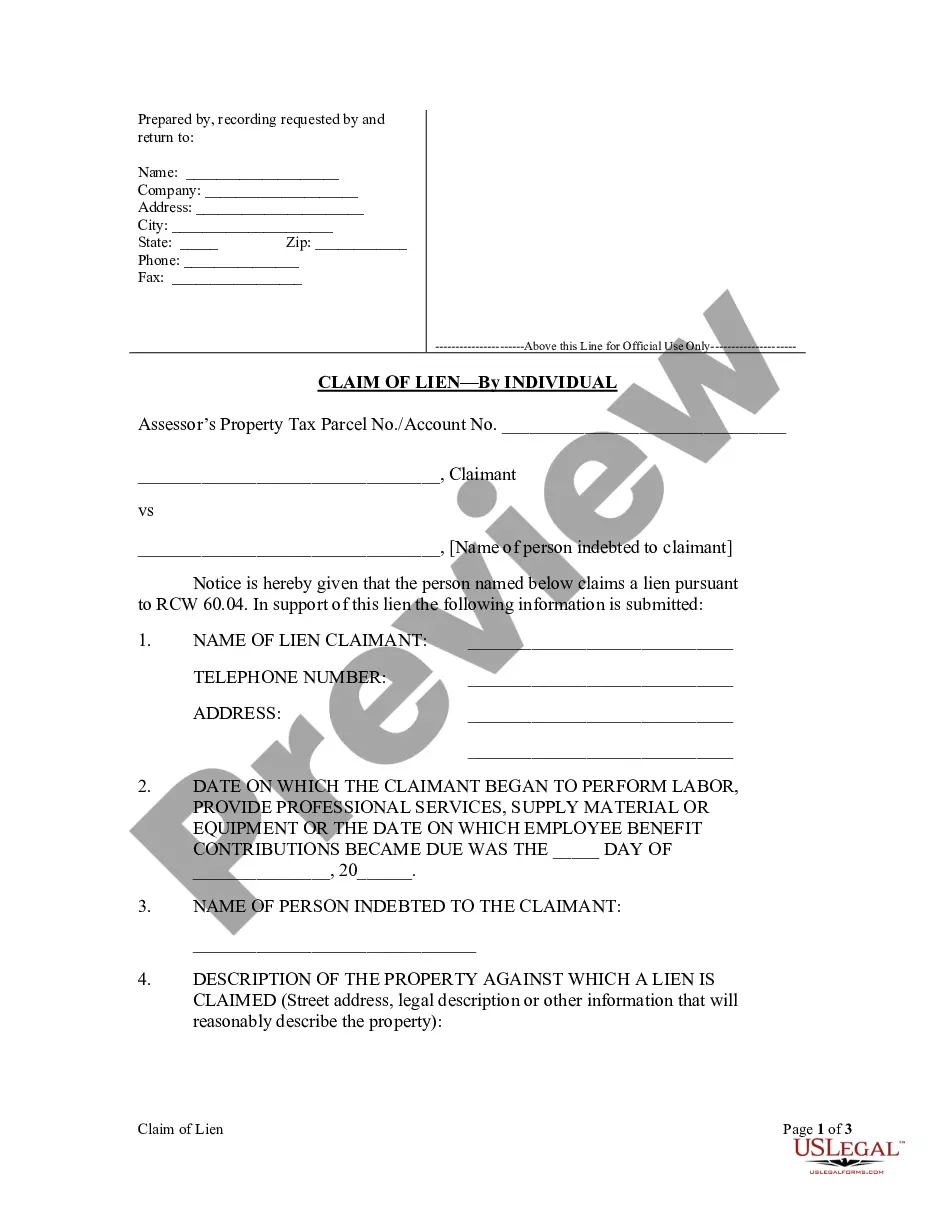

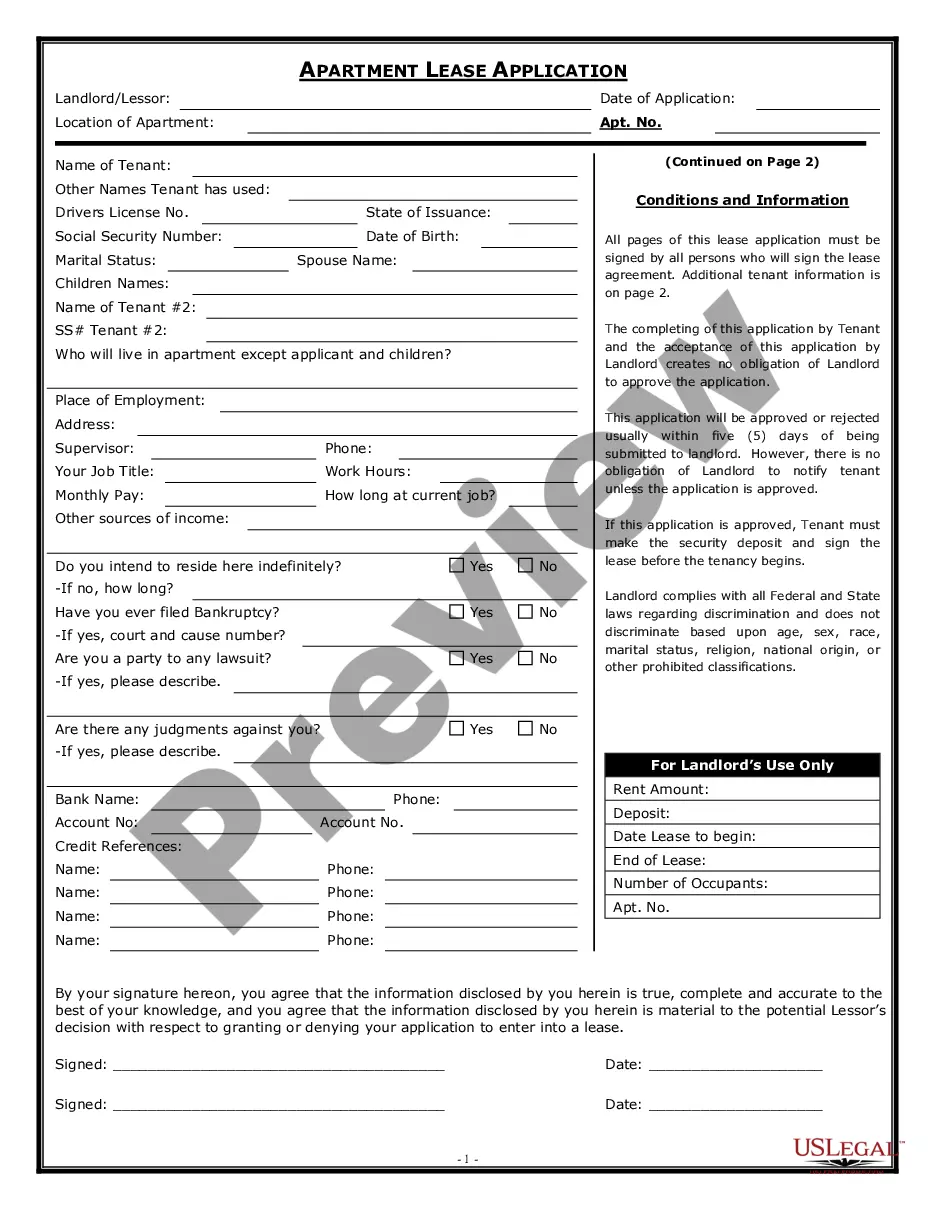

You are able to commit hours on-line attempting to find the authorized papers template which fits the federal and state specifications you will need. US Legal Forms supplies thousands of authorized forms which can be reviewed by pros. You can easily down load or produce the Illinois Underwriter Agreement - Self-Employed Independent Contractor from our services.

If you have a US Legal Forms profile, it is possible to log in and click on the Download key. Next, it is possible to comprehensive, edit, produce, or indication the Illinois Underwriter Agreement - Self-Employed Independent Contractor. Each authorized papers template you acquire is your own for a long time. To obtain an additional version of any obtained type, check out the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms site the very first time, follow the basic directions under:

- Very first, make certain you have chosen the right papers template for your region/area of your liking. Browse the type explanation to ensure you have picked the right type. If available, make use of the Review key to appear throughout the papers template at the same time.

- In order to get an additional variation in the type, make use of the Lookup area to obtain the template that meets your needs and specifications.

- After you have located the template you want, click Get now to move forward.

- Pick the rates strategy you want, enter your references, and sign up for an account on US Legal Forms.

- Total the financial transaction. You may use your Visa or Mastercard or PayPal profile to fund the authorized type.

- Pick the formatting in the papers and down load it in your product.

- Make alterations in your papers if necessary. You are able to comprehensive, edit and indication and produce Illinois Underwriter Agreement - Self-Employed Independent Contractor.

Download and produce thousands of papers templates using the US Legal Forms Internet site, that provides the largest assortment of authorized forms. Use expert and express-certain templates to tackle your small business or specific requires.

Form popularity

FAQ

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Notably, the new law does not apply to agreements covering an employer's confidential and proprietary information, protection of trade secrets, or inventions assignment agreements. The law also does not address covenants for independent contractors.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.