Illinois Appraisal Agreement - Self-Employed Independent Contractor

Description

How to fill out Illinois Appraisal Agreement - Self-Employed Independent Contractor?

Have you been in a position that you will need documents for possibly business or personal functions almost every day? There are plenty of lawful record themes available online, but locating ones you can trust isn`t effortless. US Legal Forms delivers 1000s of type themes, such as the Illinois Appraisal Agreement - Self-Employed Independent Contractor, which are created in order to meet state and federal needs.

If you are currently acquainted with US Legal Forms site and possess a free account, simply log in. Next, you may obtain the Illinois Appraisal Agreement - Self-Employed Independent Contractor design.

If you do not come with an profile and wish to start using US Legal Forms, follow these steps:

- Discover the type you need and ensure it is for the appropriate town/county.

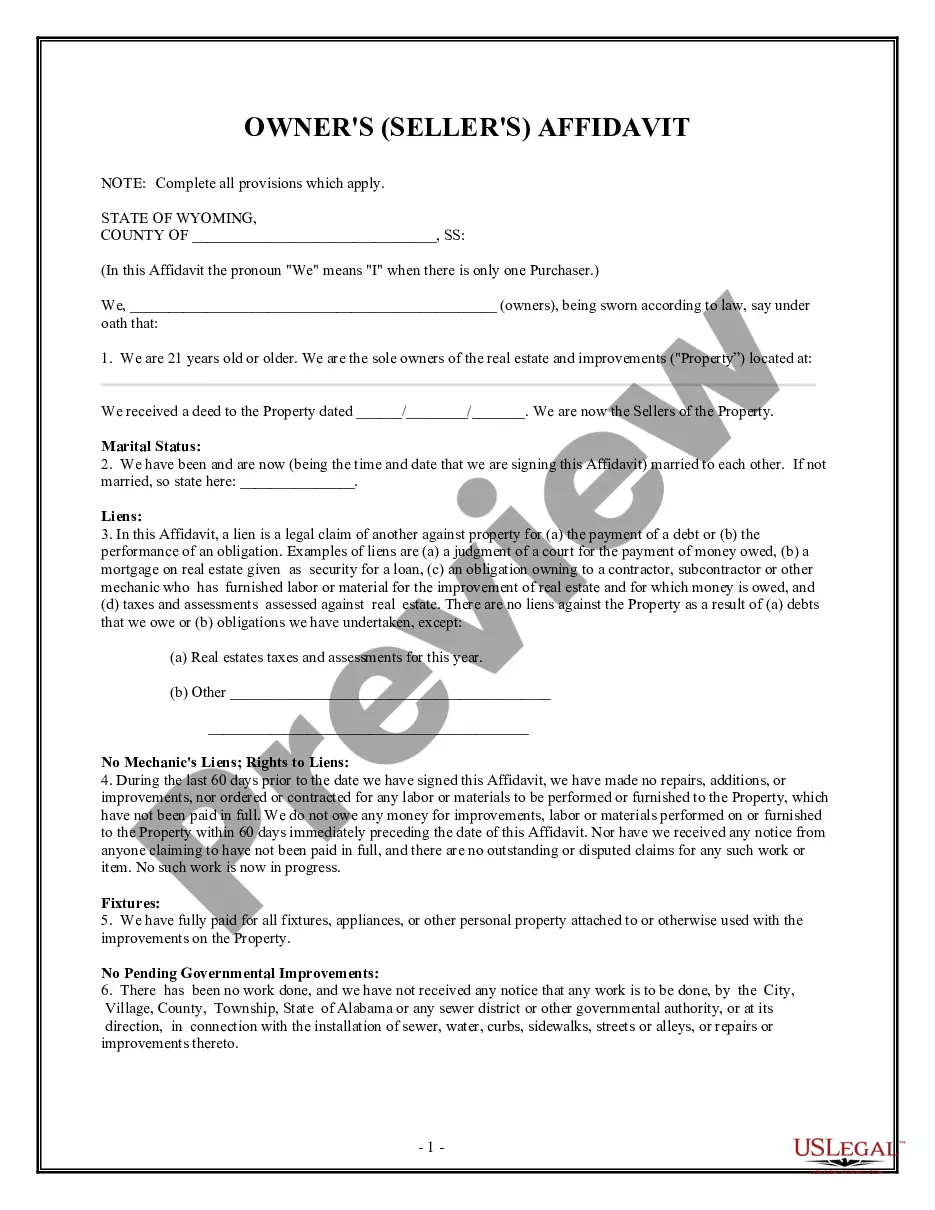

- Take advantage of the Review switch to examine the form.

- Read the explanation to ensure that you have selected the correct type.

- If the type isn`t what you`re searching for, make use of the Search discipline to discover the type that meets your needs and needs.

- Whenever you get the appropriate type, click on Buy now.

- Opt for the rates prepare you want, fill in the required information and facts to generate your money, and pay money for the transaction making use of your PayPal or bank card.

- Select a handy file file format and obtain your backup.

Find each of the record themes you possess purchased in the My Forms food list. You can get a additional backup of Illinois Appraisal Agreement - Self-Employed Independent Contractor whenever, if possible. Just click on the needed type to obtain or produce the record design.

Use US Legal Forms, one of the most comprehensive variety of lawful varieties, in order to save some time and prevent faults. The support delivers expertly manufactured lawful record themes that can be used for a variety of functions. Create a free account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Here are five tips for accurately reviewing, understanding, and negotiating your next independent contractor agreement.Define Details, Deliverables, and Deadlines.Know Your Bill Rate and Stick to it.Beware of Confidentiality or Non-compete Clauses.Recognize When to Walk Away.Involve a Professional.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.