Illinois Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out Illinois Bookkeeping Agreement - Self-Employed Independent Contractor?

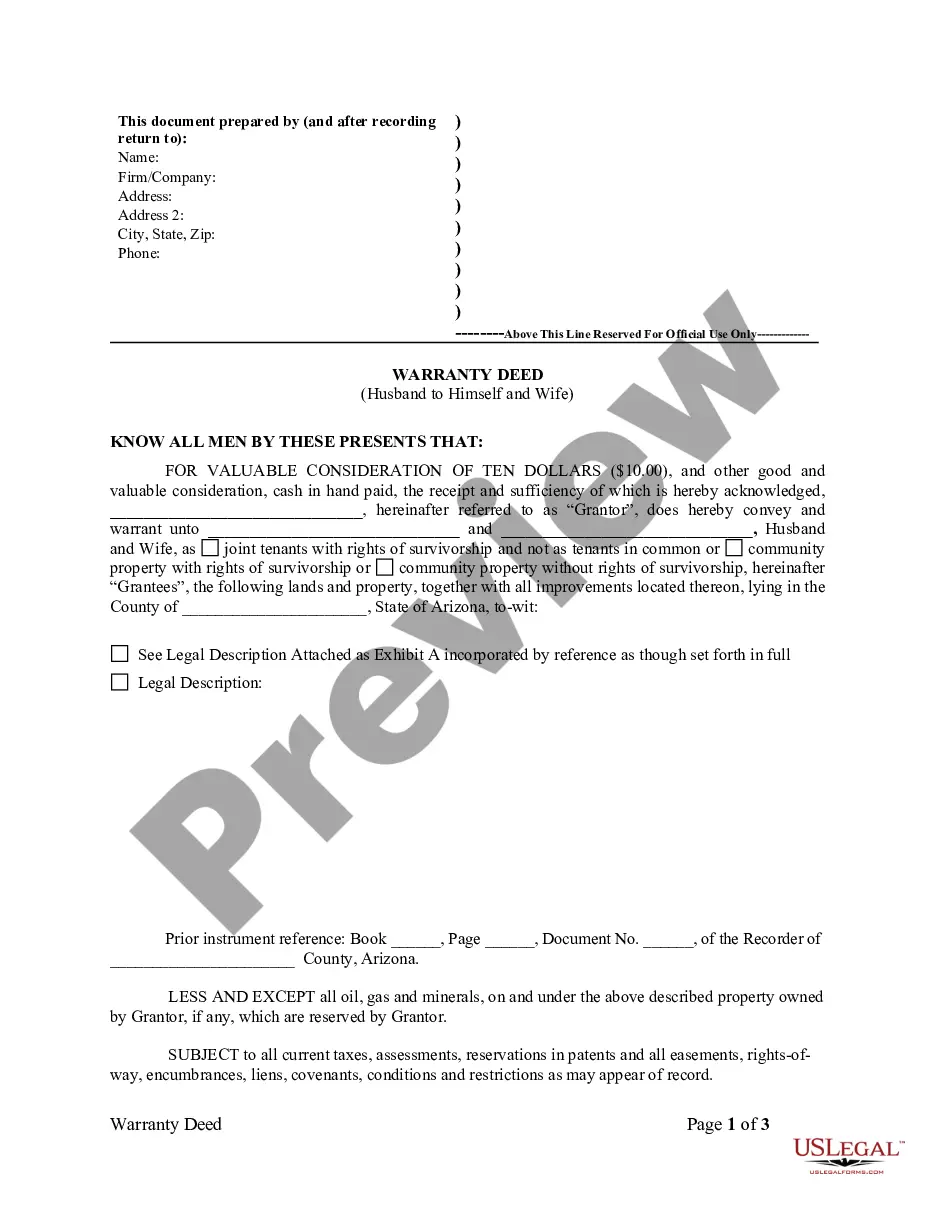

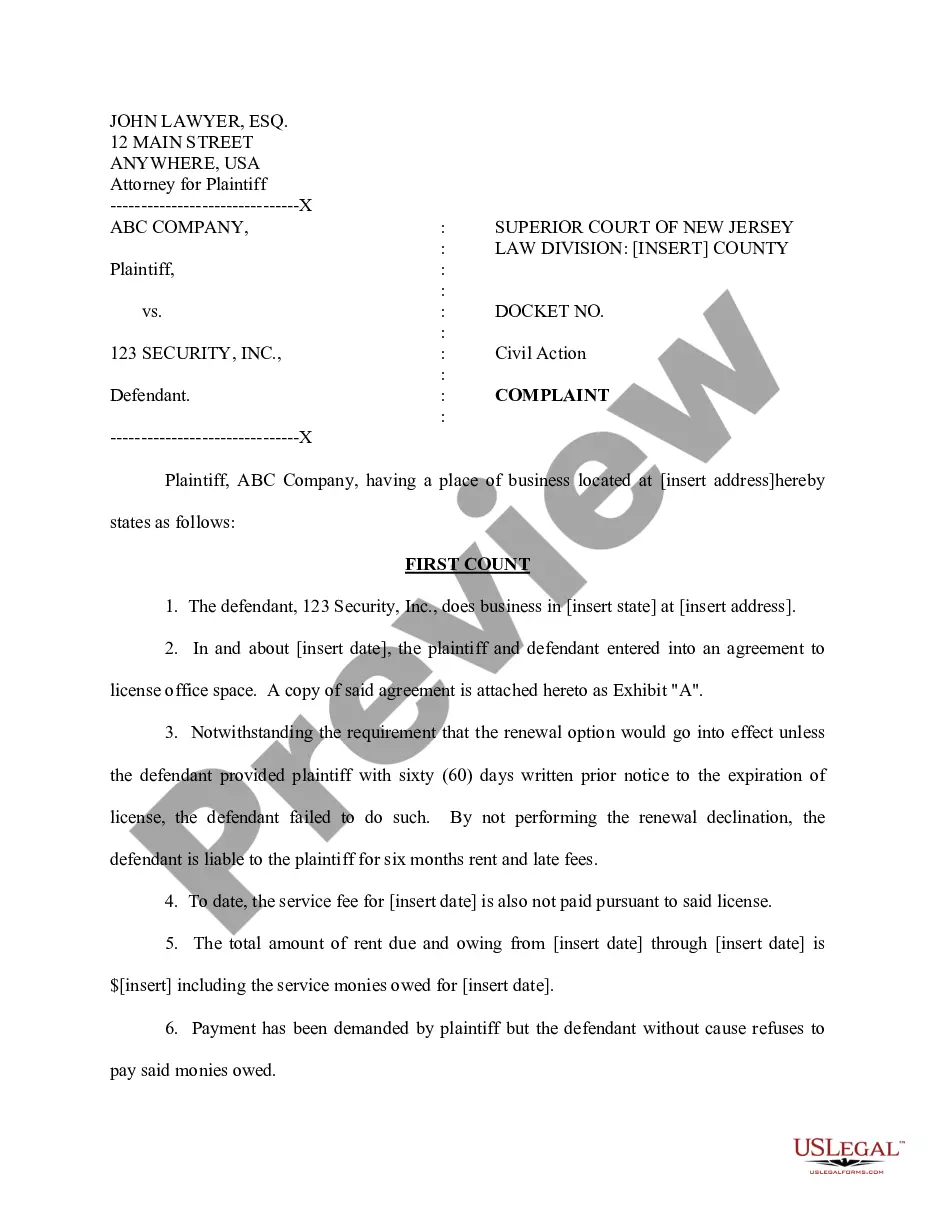

Are you presently in the position in which you require paperwork for possibly enterprise or personal functions just about every day? There are a lot of legal papers layouts available on the Internet, but discovering versions you can depend on is not simple. US Legal Forms offers thousands of develop layouts, such as the Illinois Bookkeeping Agreement - Self-Employed Independent Contractor, which are published to fulfill federal and state demands.

Should you be already informed about US Legal Forms internet site and possess a merchant account, simply log in. Afterward, you may download the Illinois Bookkeeping Agreement - Self-Employed Independent Contractor format.

If you do not provide an account and need to begin using US Legal Forms, adopt these measures:

- Discover the develop you will need and make sure it is to the correct metropolis/area.

- Use the Review switch to examine the form.

- Look at the outline to actually have chosen the proper develop.

- In case the develop is not what you are trying to find, take advantage of the Research industry to find the develop that suits you and demands.

- When you get the correct develop, just click Buy now.

- Opt for the rates strategy you desire, complete the desired information to make your bank account, and buy the transaction utilizing your PayPal or charge card.

- Select a practical data file format and download your backup.

Locate each of the papers layouts you possess bought in the My Forms food selection. You can aquire a extra backup of Illinois Bookkeeping Agreement - Self-Employed Independent Contractor at any time, if possible. Just click on the needed develop to download or print the papers format.

Use US Legal Forms, the most comprehensive assortment of legal varieties, to save lots of some time and avoid faults. The services offers appropriately produced legal papers layouts that can be used for a selection of functions. Make a merchant account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

There are no legal requirements for a self-employed bookkeeper to have any formal qualifications. However, if you are planning to start a bookkeeping business, it is essential you have bookkeeping experience.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How to become a bookkeeperPursue a high school degree. Unlike accountants, many bookkeepers have associate's or bachelor's degrees.Acquire training. Bookkeeping training can come from a variety of sources.Apply for positions.Become a freelancer.Consider certification.

Yes, the company should send you a 1099. Its easy to forget to include yourself when you're doing the books! All you need to do is print out a blank form 1099 (from IRS.gov), fill it out, check the "Corrected" box, and mail to the IRS.....and keep your copy of course!

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.

So, it's hard to say exactly what you can earn as a freelance bookkeeper in the UK. But a typical hourly rate would be between £10-A£25 depending on experience. The average hourly pay for a bookkeeper in the UK is calculated at A£11.89 by Payscale, with annual salaries between A£18,000 and A£36,000.