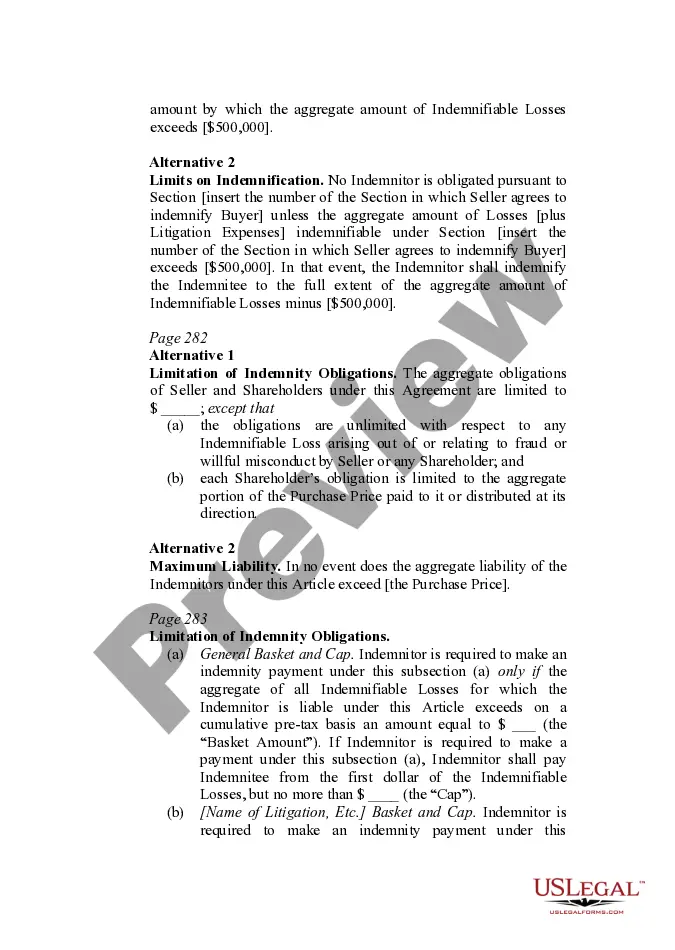

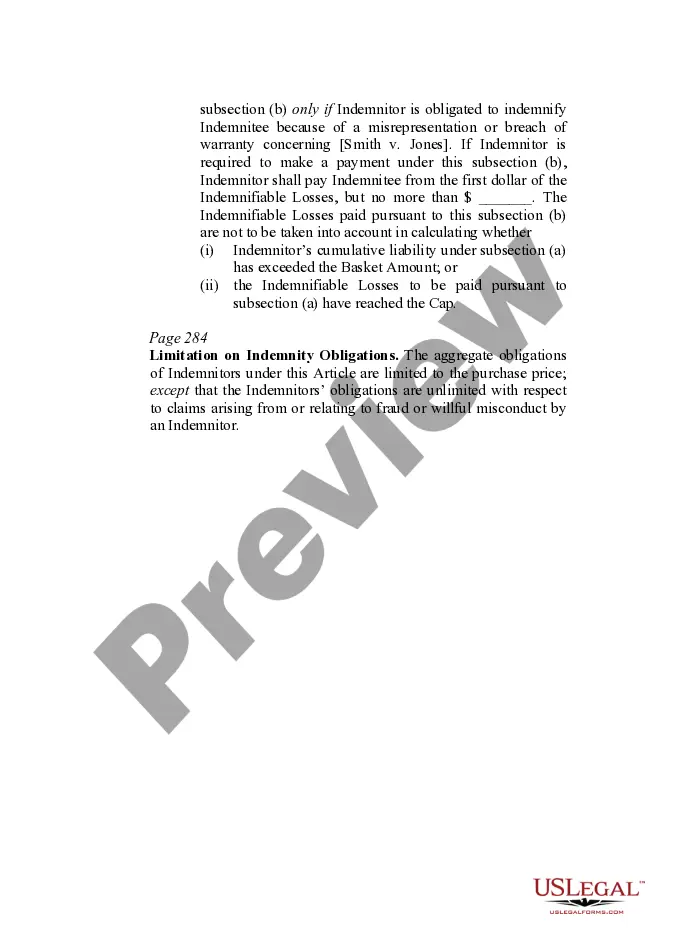

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement. Several different language options are included to suit individual needs and circumstances.

Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings

Description

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Baskets, Caps, And Ceilings?

Finding the right legitimate document template can be a struggle. Of course, there are a variety of web templates available online, but how will you find the legitimate develop you want? Take advantage of the US Legal Forms web site. The services gives 1000s of web templates, for example the Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings, which can be used for enterprise and personal requires. All the forms are checked out by pros and meet up with federal and state specifications.

If you are presently registered, log in for your accounts and then click the Obtain key to get the Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings. Make use of accounts to appear through the legitimate forms you possess purchased previously. Proceed to the My Forms tab of the accounts and acquire an additional copy of the document you want.

If you are a new customer of US Legal Forms, listed below are easy instructions for you to stick to:

- First, make sure you have chosen the right develop for your personal metropolis/county. It is possible to examine the shape using the Preview key and read the shape explanation to make sure it is the best for you.

- When the develop does not meet up with your requirements, use the Seach discipline to get the appropriate develop.

- Once you are positive that the shape would work, select the Purchase now key to get the develop.

- Choose the costs strategy you would like and enter the required information and facts. Make your accounts and buy the transaction with your PayPal accounts or credit card.

- Choose the document format and obtain the legitimate document template for your gadget.

- Full, change and printing and signal the attained Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings.

US Legal Forms is definitely the most significant collection of legitimate forms in which you will find numerous document web templates. Take advantage of the company to obtain professionally-produced documents that stick to express specifications.

Form popularity

FAQ

In the context of mergers and acquisitions, or a commercial transaction, a basket is a provision in a purchase and sale agreement that limits an indemnifying party's obligations to indemnify another party for small losses or claims. The basket establishes a monetary threshold.

A basket establishes a threshold under which the buyer cannot make a claim against the seller. In small market transactions, the basket amount is usually in the range of $25,000-$50,000, and is often determined as a percentage of the purchase price (around 0.5%).

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

An indemnification basket refers to the size of the damage incurred before a seller become liable to reimburse the purchaser for any losses. There are two types of ?baskets?: true deductibles and threshold/tipping baskets.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

In the context of mergers and acquisitions, or a commercial transaction, a basket is a provision in a purchase and sale agreement that limits an indemnifying party's obligations to indemnify another party for small losses or claims. The basket establishes a monetary threshold.

The indemnification clause is a crucial element in commercial contracts as it helps mitigate the risks and consequences associated with potential breaches of contracts. This clause also ensures that the parties are fairly compensated for their losses and helps maintain a stable and predictable business relationship.