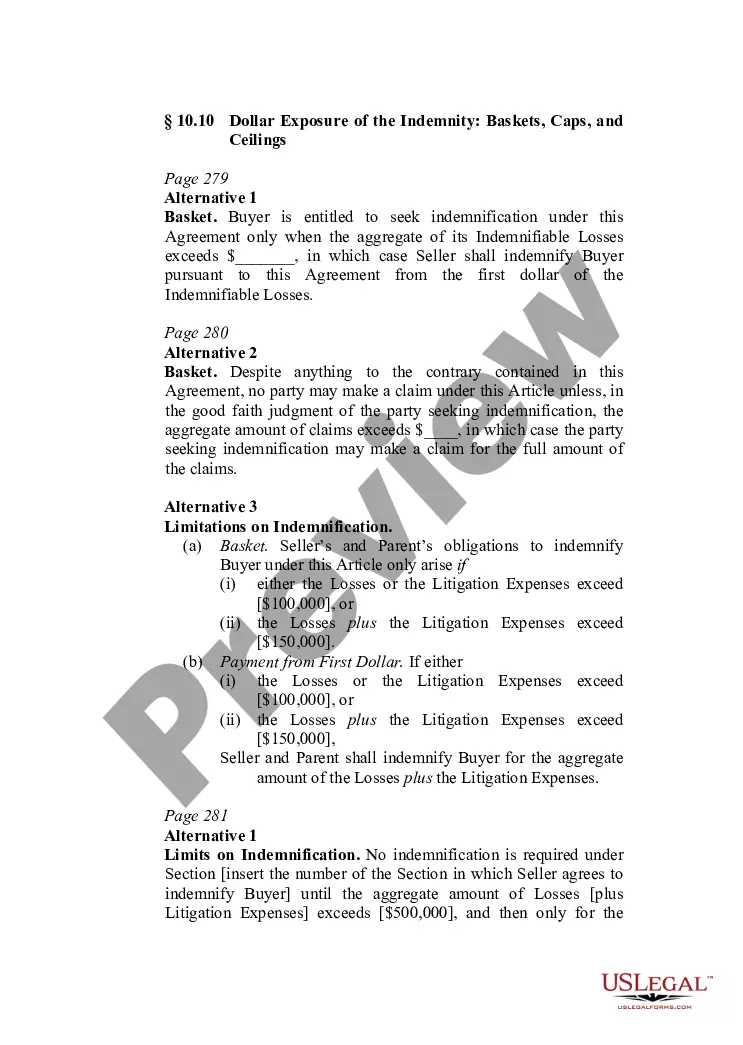

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

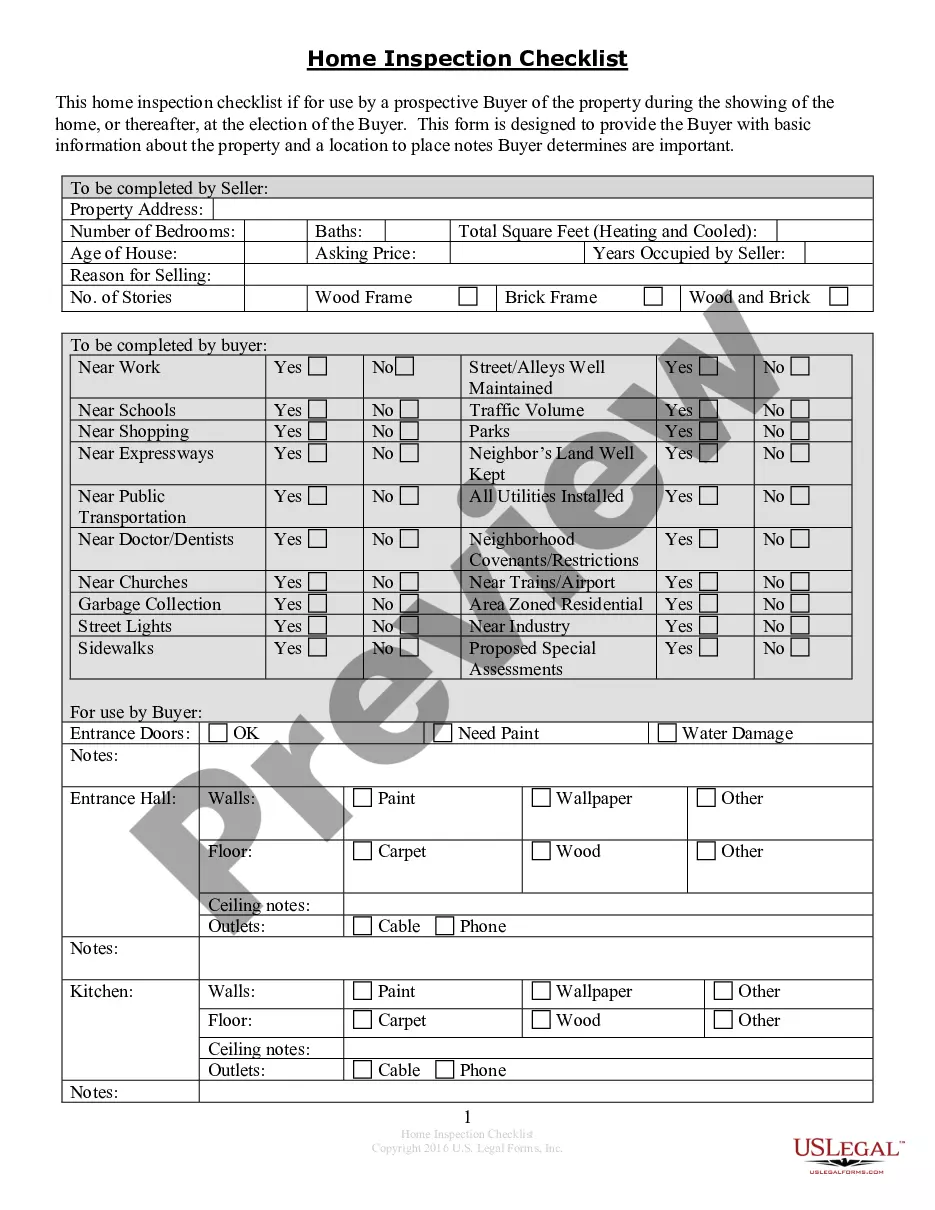

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

You are able to devote several hours on the Internet trying to find the legal record format which fits the state and federal needs you want. US Legal Forms provides a huge number of legal types which are reviewed by pros. It is possible to download or printing the Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations from my services.

If you have a US Legal Forms bank account, it is possible to log in and click the Download switch. Afterward, it is possible to complete, change, printing, or indicator the Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations. Every legal record format you get is your own eternally. To obtain an additional duplicate for any bought type, proceed to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms website initially, keep to the simple directions under:

- Initial, make certain you have selected the right record format for that area/city of your choice. Look at the type description to make sure you have picked out the correct type. If readily available, make use of the Preview switch to appear throughout the record format as well.

- If you wish to discover an additional model of the type, make use of the Research discipline to find the format that meets your needs and needs.

- Upon having located the format you would like, click Acquire now to carry on.

- Select the costs program you would like, type in your references, and register for your account on US Legal Forms.

- Full the deal. You can utilize your charge card or PayPal bank account to fund the legal type.

- Select the structure of the record and download it for your product.

- Make modifications for your record if needed. You are able to complete, change and indicator and printing Illinois Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations.

Download and printing a huge number of record layouts while using US Legal Forms web site, that offers the biggest collection of legal types. Use professional and state-particular layouts to handle your company or specific requirements.

Form popularity

FAQ

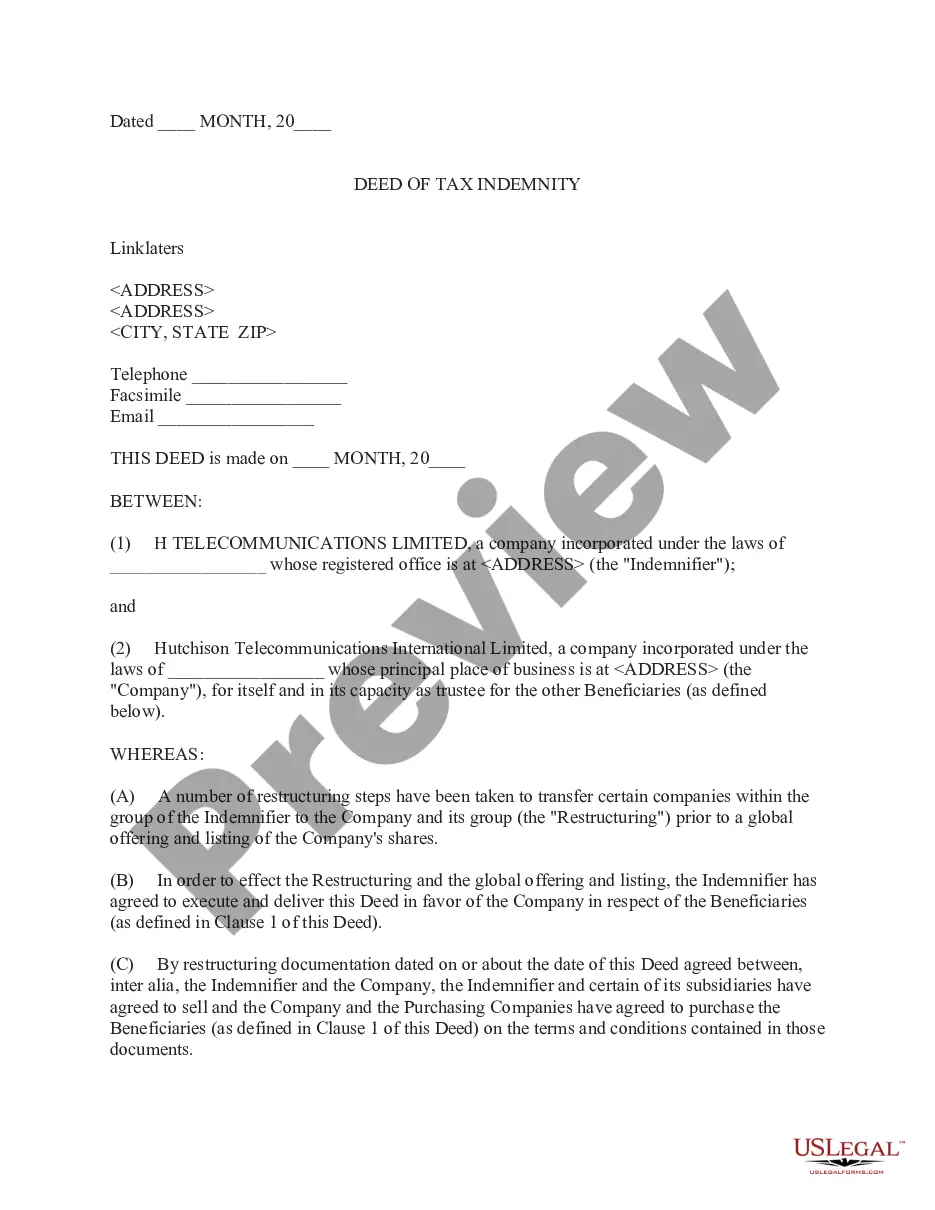

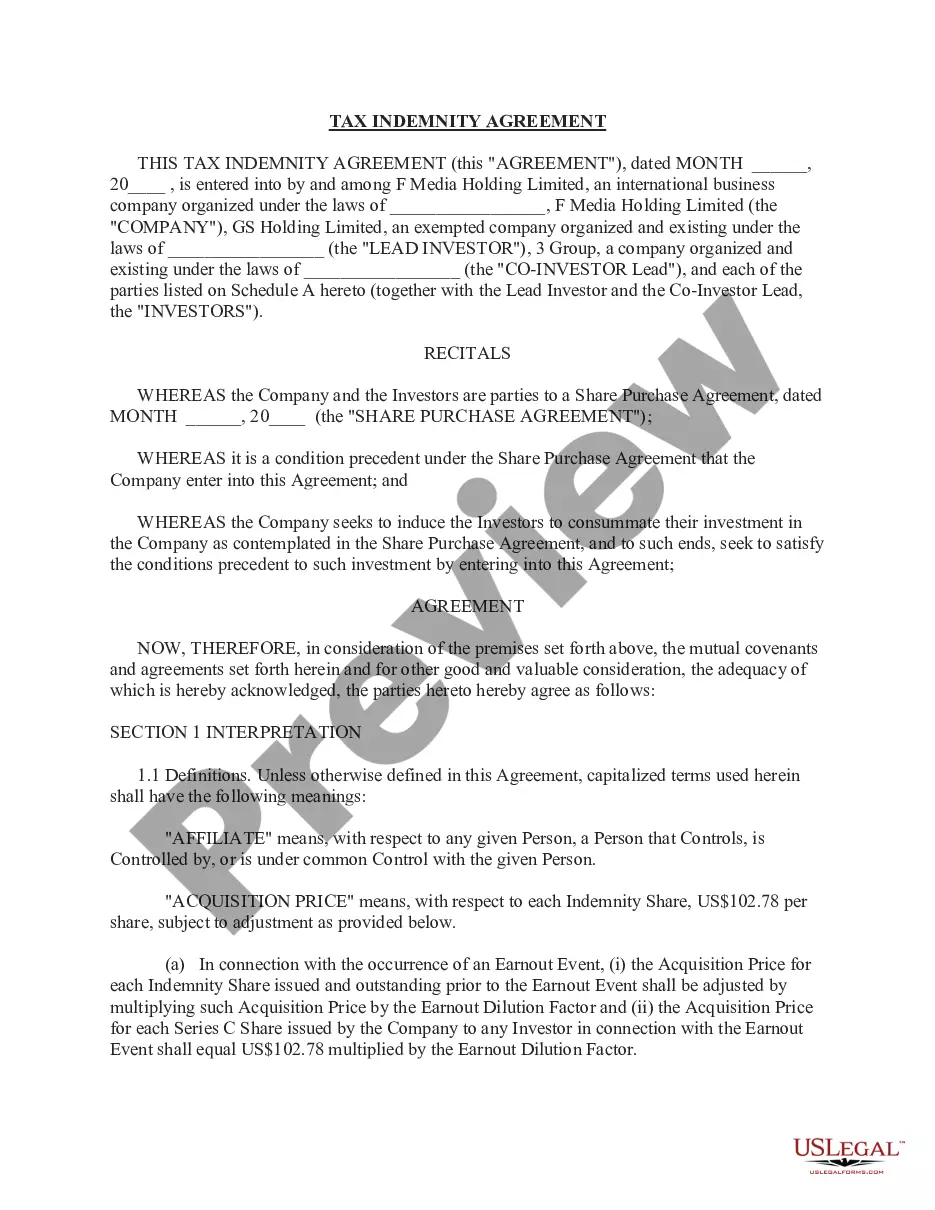

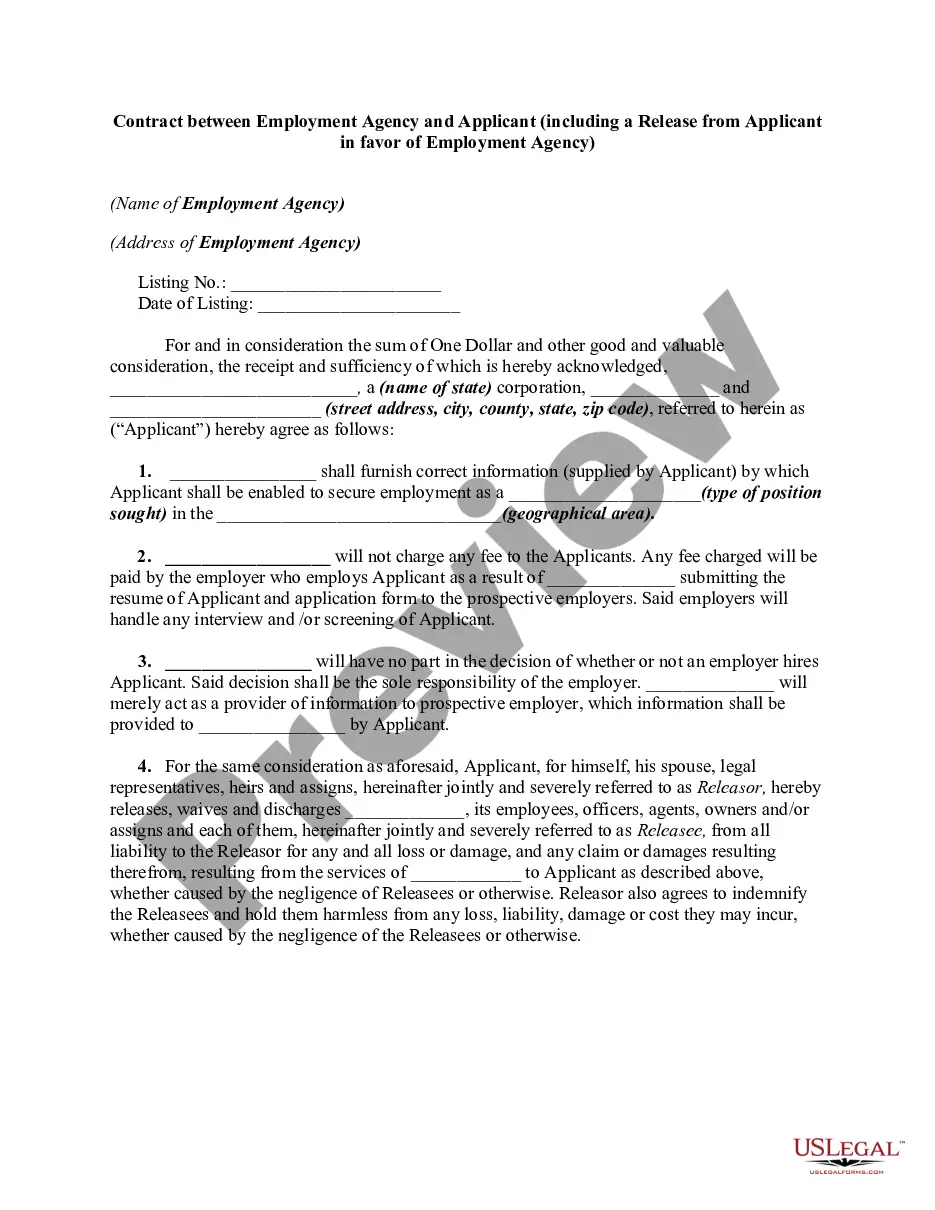

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

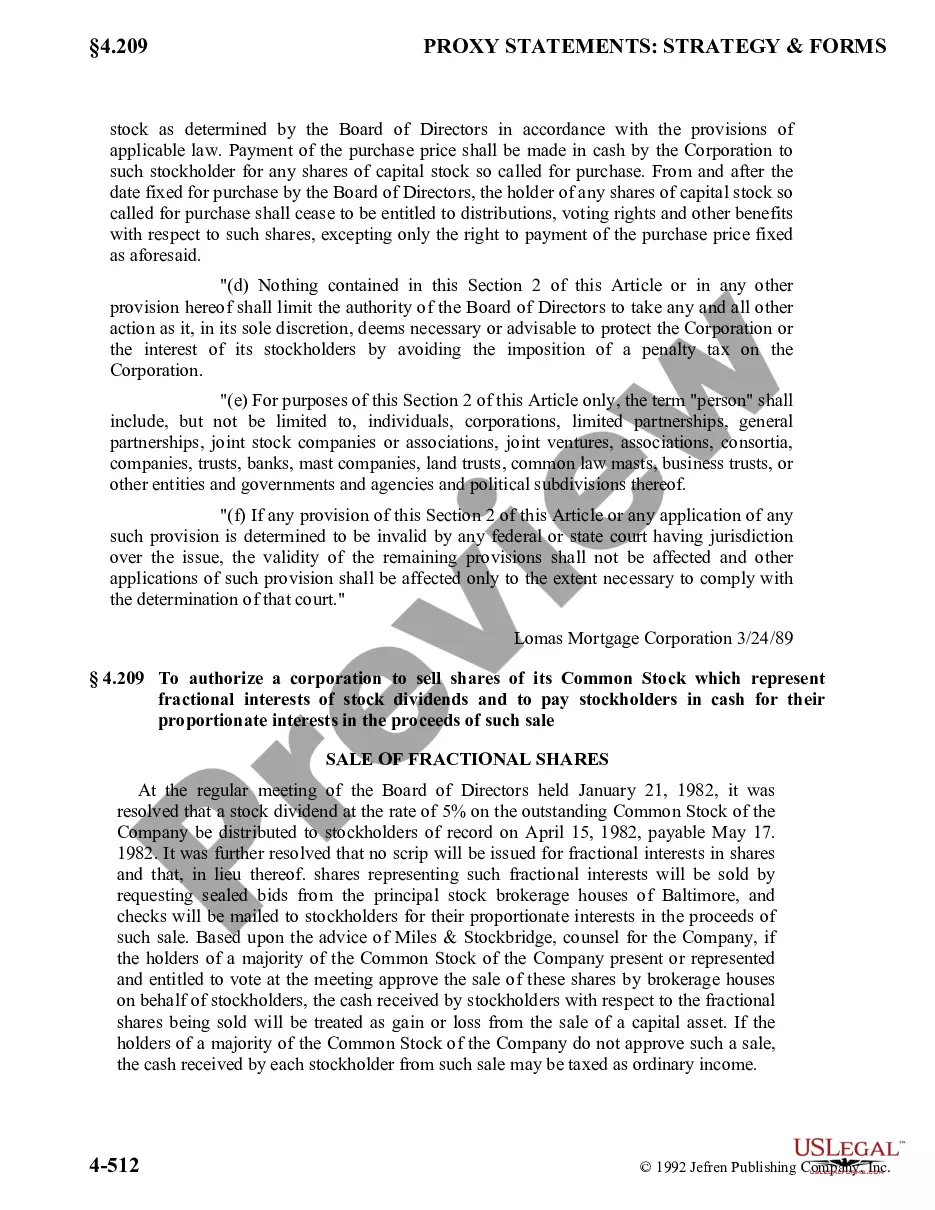

If an indemnity is considered appropriate, when negotiating the indemnity, parties should take into consideration the potential impact of the indemnity on their insurance coverage, their risk of exposure to liability under the contract, and whether any limitations or restrictions should be imposed on the indemnity to ...

Upon the occurrence of any Event for which you may become entitled to indemnity in ance with the above, the Company shall make available to you, from time to time, the amounts of money required to cover the various expenses and other payments involved in the handling of any legal proceedings against you in ...

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal.

The Company shall indemnify and hold Employee harmless to the fullest extent permitted by the laws of the Company's state of incorporation in effect at the time against and in respect of any and all actions, suits, proceedings, claims, demands, judgments, costs, expenses (including advancement of reasonable attorney's ...