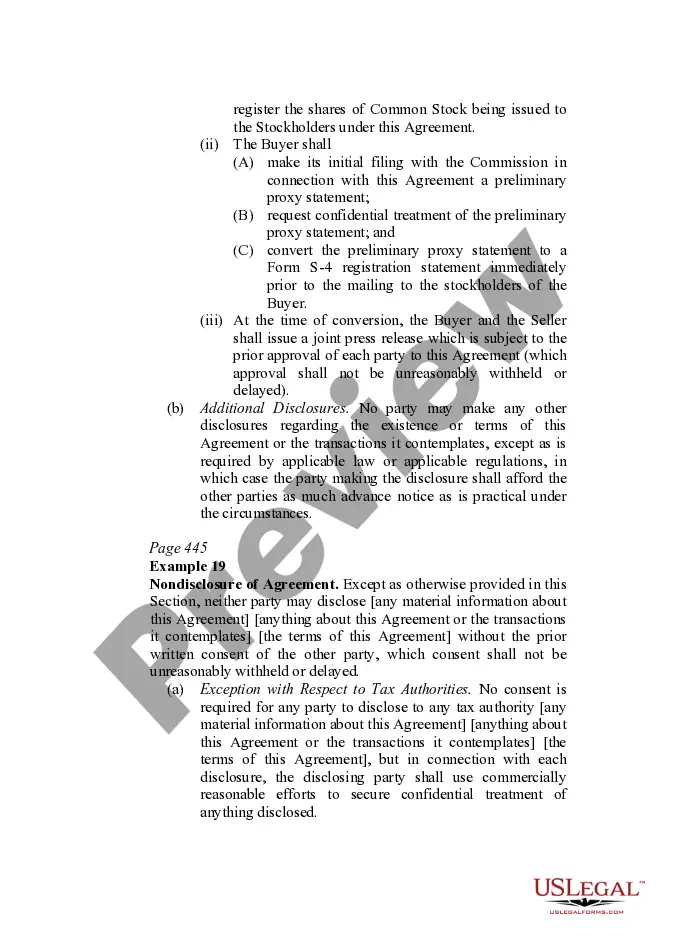

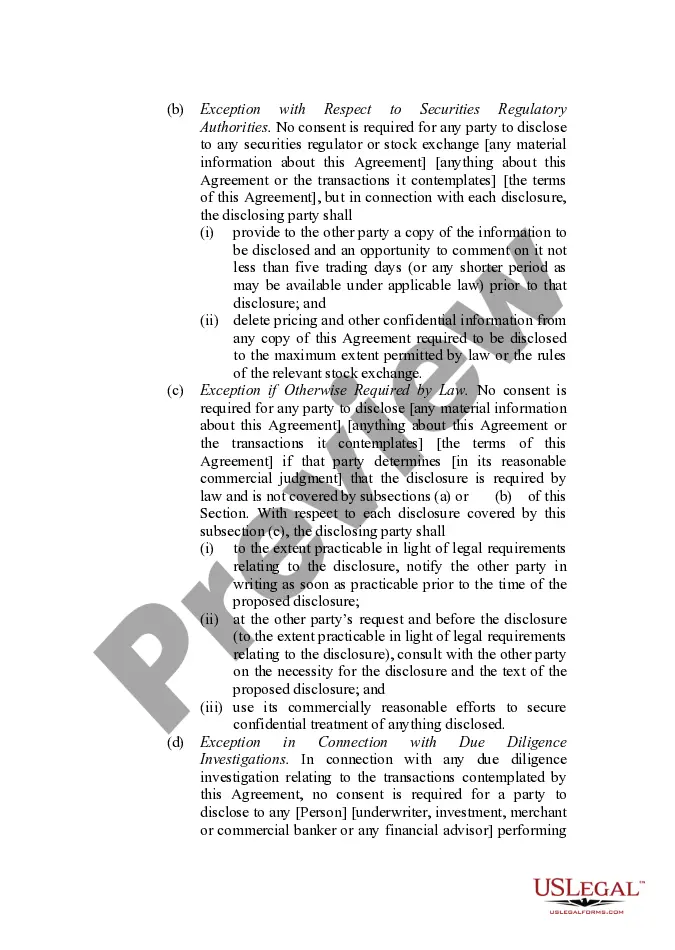

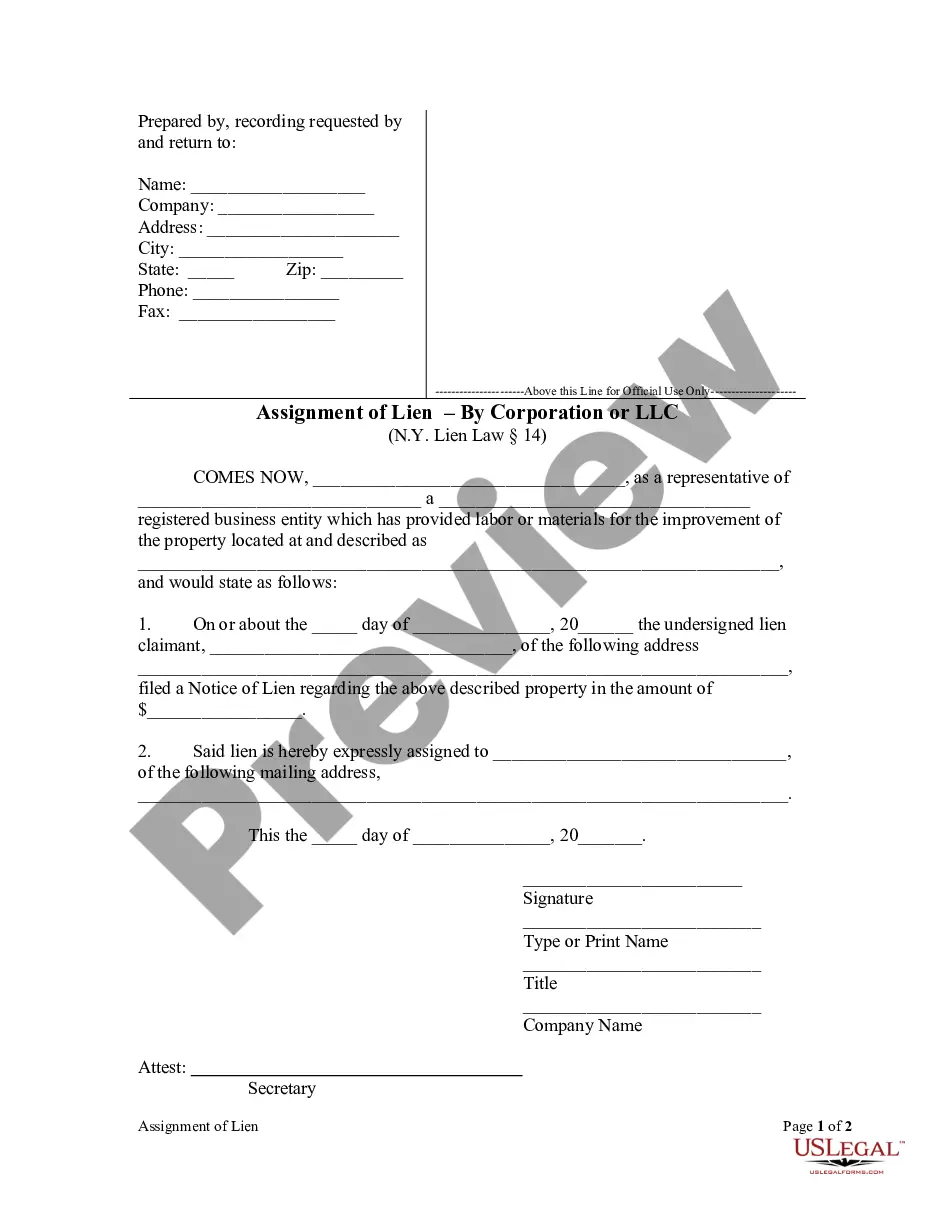

This form provides boilerplate contract clauses that outline the obligations of nondisclosure and the restrictions that apply to public announcements regarding the existence or terms of the contract agreement. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Illinois Announcement Provisions in the Transactional Context

Description

How to fill out Announcement Provisions In The Transactional Context?

US Legal Forms - one of several most significant libraries of lawful types in the United States - gives an array of lawful record web templates you may obtain or printing. Using the site, you will get 1000s of types for organization and person functions, categorized by classes, says, or keywords.You can find the most recent models of types just like the Illinois Announcement Provisions in the Transactional Context in seconds.

If you already possess a monthly subscription, log in and obtain Illinois Announcement Provisions in the Transactional Context in the US Legal Forms collection. The Obtain key can look on every single type you view. You gain access to all previously downloaded types from the My Forms tab of your accounts.

In order to use US Legal Forms the first time, allow me to share easy guidelines to help you get started:

- Be sure you have picked out the correct type for the metropolis/county. Select the Review key to check the form`s articles. Read the type outline to ensure that you have selected the proper type.

- In case the type doesn`t fit your needs, take advantage of the Search discipline on top of the display screen to get the one which does.

- In case you are content with the form, affirm your selection by clicking on the Get now key. Then, choose the prices prepare you favor and offer your qualifications to sign up on an accounts.

- Method the deal. Use your charge card or PayPal accounts to complete the deal.

- Select the file format and obtain the form on your device.

- Make changes. Complete, modify and printing and sign the downloaded Illinois Announcement Provisions in the Transactional Context.

Each design you put into your bank account lacks an expiry day and it is your own property permanently. So, if you want to obtain or printing an additional version, just visit the My Forms section and click on about the type you need.

Obtain access to the Illinois Announcement Provisions in the Transactional Context with US Legal Forms, one of the most considerable collection of lawful record web templates. Use 1000s of skilled and express-particular web templates that meet up with your small business or person requirements and needs.