Illinois Term Mineral Deed of Undivided Interest

Description

How to fill out Term Mineral Deed Of Undivided Interest?

If you have to complete, down load, or produce authorized record web templates, use US Legal Forms, the biggest variety of authorized types, which can be found on-line. Utilize the site`s easy and convenient lookup to find the files you will need. Numerous web templates for business and personal purposes are categorized by types and states, or search phrases. Use US Legal Forms to find the Illinois Term Mineral Deed of Undivided Interest within a couple of clicks.

Should you be previously a US Legal Forms client, log in to the accounts and click on the Down load option to have the Illinois Term Mineral Deed of Undivided Interest. Also you can gain access to types you in the past downloaded in the My Forms tab of your own accounts.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the right town/nation.

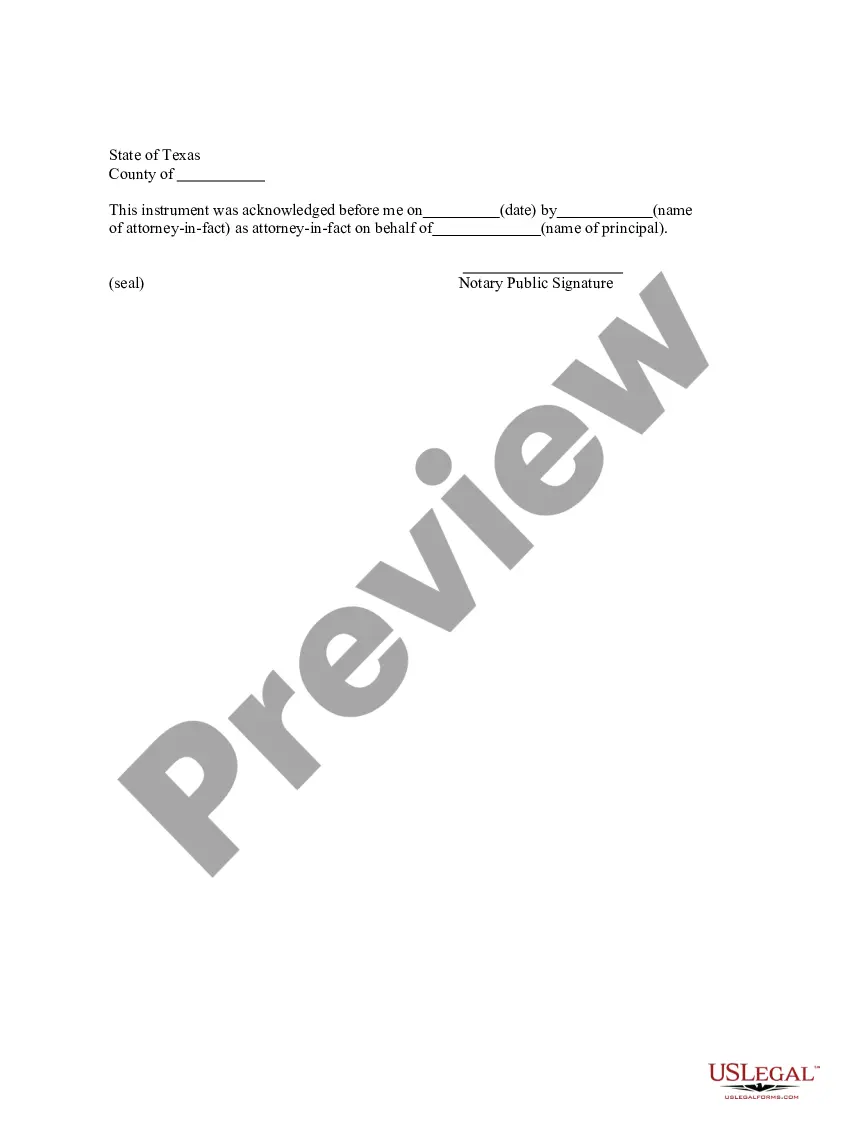

- Step 2. Make use of the Preview choice to check out the form`s information. Do not forget about to read through the information.

- Step 3. Should you be not happy with all the form, utilize the Research area at the top of the display to get other variations of the authorized form design.

- Step 4. Upon having found the shape you will need, click on the Buy now option. Choose the rates program you like and add your references to sign up for an accounts.

- Step 5. Procedure the deal. You may use your charge card or PayPal accounts to perform the deal.

- Step 6. Find the formatting of the authorized form and down load it on your own product.

- Step 7. Comprehensive, change and produce or indicator the Illinois Term Mineral Deed of Undivided Interest.

Each authorized record design you buy is your own property eternally. You possess acces to every form you downloaded within your acccount. Select the My Forms area and select a form to produce or down load yet again.

Be competitive and down load, and produce the Illinois Term Mineral Deed of Undivided Interest with US Legal Forms. There are millions of specialist and condition-specific types you can utilize for your personal business or personal demands.

Form popularity

FAQ

Inheriting Oil and Gas Royalties: The Transfer Process This process is somewhat similar to inheriting real estate, but with some specific nuances. Will and Probate Process: If the deceased left a will, the mineral rights will be transferred ing to their wishes.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.

Hear this out loud PauseThe term ?undivided interest? refers to a type of ownership in which multiple parties share ownership of a single asset without the property being physically divided among them. This is commonly seen in real estate, natural resource holdings, and certain types of financial investments. What is an Undivided Interest? ? SuperfastCPA CPA Review superfastcpa.com ? what-is-an-undivided-int... superfastcpa.com ? what-is-an-undivided-int...

Hear this out loud PauseTraditionally, a tract of land where an oil or gas well is drilled and located. With the advent of horizontal drilling, it now includes any tract that is traversed by a horizontal well. Drillsite Tract (US) - Westlaw westlaw.com ? Glossary ? PracticalLaw westlaw.com ? Glossary ? PracticalLaw

Hear this out loud PauseTransfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir. How are Mineral Rights Passed Down? - Lovell, Isern & Farabough, LLP. lovell-law.net ? blog ? business-litigation lovell-law.net ? blog ? business-litigation

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that ?all minerals? are included.

Hear this out loud PauseThe ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate. mineral rights | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? mineral_rights cornell.edu ? wex ? mineral_rights