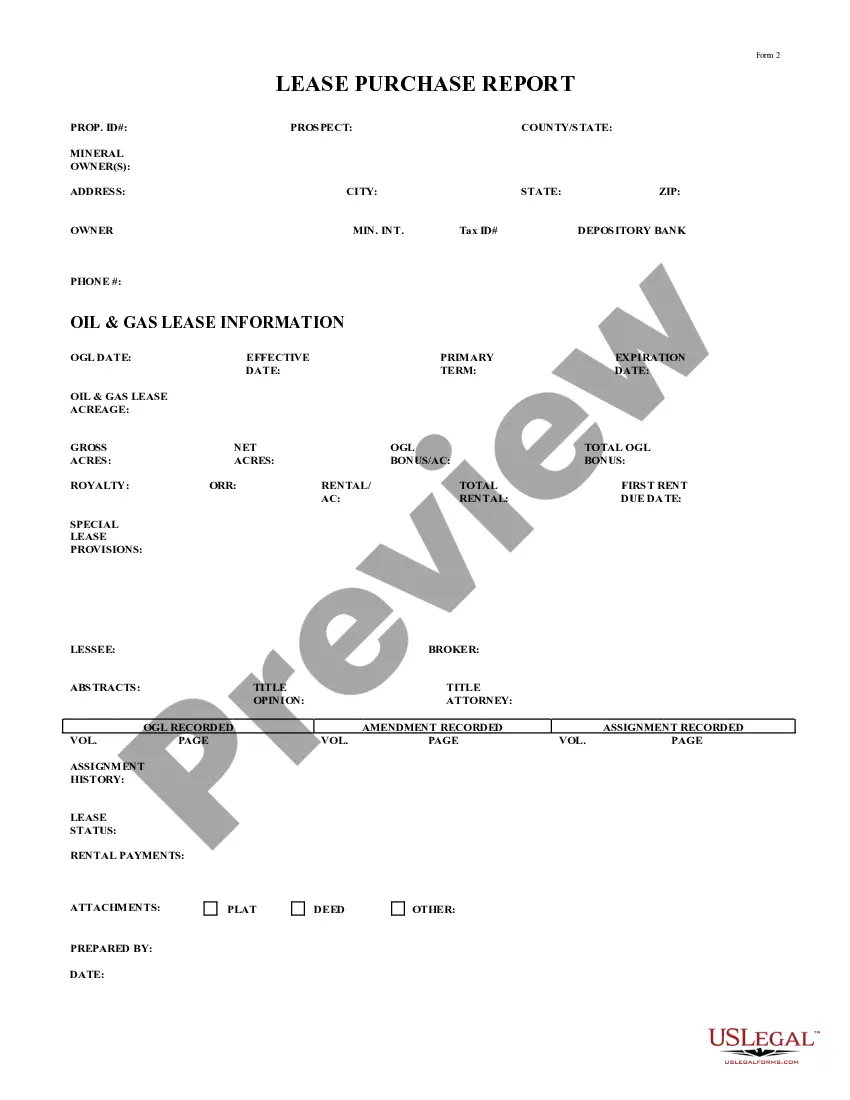

A Release of Mortgage or Deed of Trust, commonly known as a Full Release in Illinois, is a legal document that signifies the termination of a mortgage or a deed of trust on a property. This document is crucial as it releases the lien or encumbrance on the property, allowing the owner to have full ownership and control over it. The Illinois Release of Mortgage / Deed of Trust — Full Release document outlines the details of the mortgage or deed of trust, including the names of the parties involved, the property address, and the legal description of the property. It also states the amount of the original loan, the date of the loan, and any interest or fees associated with it. Keywords: Illinois, Release of Mortgage, Deed of Trust, Full Release, legal document, termination, lien, encumbrance, property, ownership, control, details, parties involved, property address, legal description, original loan, date of the loan, interest, fees. There are different types of Illinois Release of Mortgage / Deed of Trust — Full Release documents that may be relevant, depending on the specific circumstances: 1. Voluntary Release: This type of release occurs when the borrower has fully repaid the mortgage or fulfilled the terms of the deed of trust, allowing the lender to release their interest in the property willingly. 2. Satisfaction and Release: This release is executed when the borrower has fully satisfied their obligations under the loan agreement, including the repayment of the principal amount, interest, and any associated fees. The lender acknowledges the borrower's fulfillment of their obligations and releases the mortgage or deed of trust, providing legal documentation of the transaction. 3. Foreclosure Release: In cases where a foreclosure proceeding has been initiated, the Full Release document acknowledges the completion of the foreclosure process and releases the lien or encumbrance on the property, allowing the borrower to regain full ownership. 4. Partial Release: This type of release may occur when a property that is subject to a mortgage or deed of trust is divided into smaller parcels or sold in parts. The lender releases their interest in the portion that is being separated or sold, allowing the borrower to retain ownership or transfer the property to another party. In conclusion, the Illinois Release of Mortgage / Deed of Trust — Full Release is a crucial legal document that signifies the termination of a mortgage or deed of trust. It releases the lien or encumbrance on the property, granting the owner complete ownership and control. Different types of releases exist, such as voluntary release, satisfaction and release, foreclosure release, and partial release, depending on the circumstances of the property and the loan agreement.

Illinois Release of Mortgage / Deed of Trust - Full Release

Description

How to fill out Illinois Release Of Mortgage / Deed Of Trust - Full Release?

You are able to spend hours on the web trying to find the legal file design which fits the state and federal requirements you require. US Legal Forms offers 1000s of legal kinds that are analyzed by pros. It is simple to down load or print out the Illinois Release of Mortgage / Deed of Trust - Full Release from the services.

If you currently have a US Legal Forms bank account, you may log in and click on the Acquire key. Following that, you may comprehensive, revise, print out, or indication the Illinois Release of Mortgage / Deed of Trust - Full Release. Each and every legal file design you get is the one you have for a long time. To get an additional version for any purchased develop, go to the My Forms tab and click on the related key.

Should you use the US Legal Forms web site initially, follow the simple directions below:

- First, make certain you have selected the correct file design for the area/town of your liking. Read the develop outline to ensure you have chosen the proper develop. If accessible, take advantage of the Preview key to check from the file design as well.

- If you would like get an additional edition of your develop, take advantage of the Lookup field to discover the design that fits your needs and requirements.

- When you have identified the design you desire, click Purchase now to move forward.

- Pick the prices strategy you desire, type in your credentials, and sign up for an account on US Legal Forms.

- Full the transaction. You may use your Visa or Mastercard or PayPal bank account to cover the legal develop.

- Pick the format of your file and down load it in your gadget.

- Make adjustments in your file if necessary. You are able to comprehensive, revise and indication and print out Illinois Release of Mortgage / Deed of Trust - Full Release.

Acquire and print out 1000s of file layouts using the US Legal Forms site, that offers the largest assortment of legal kinds. Use specialist and condition-particular layouts to take on your company or personal requirements.

Form popularity

FAQ

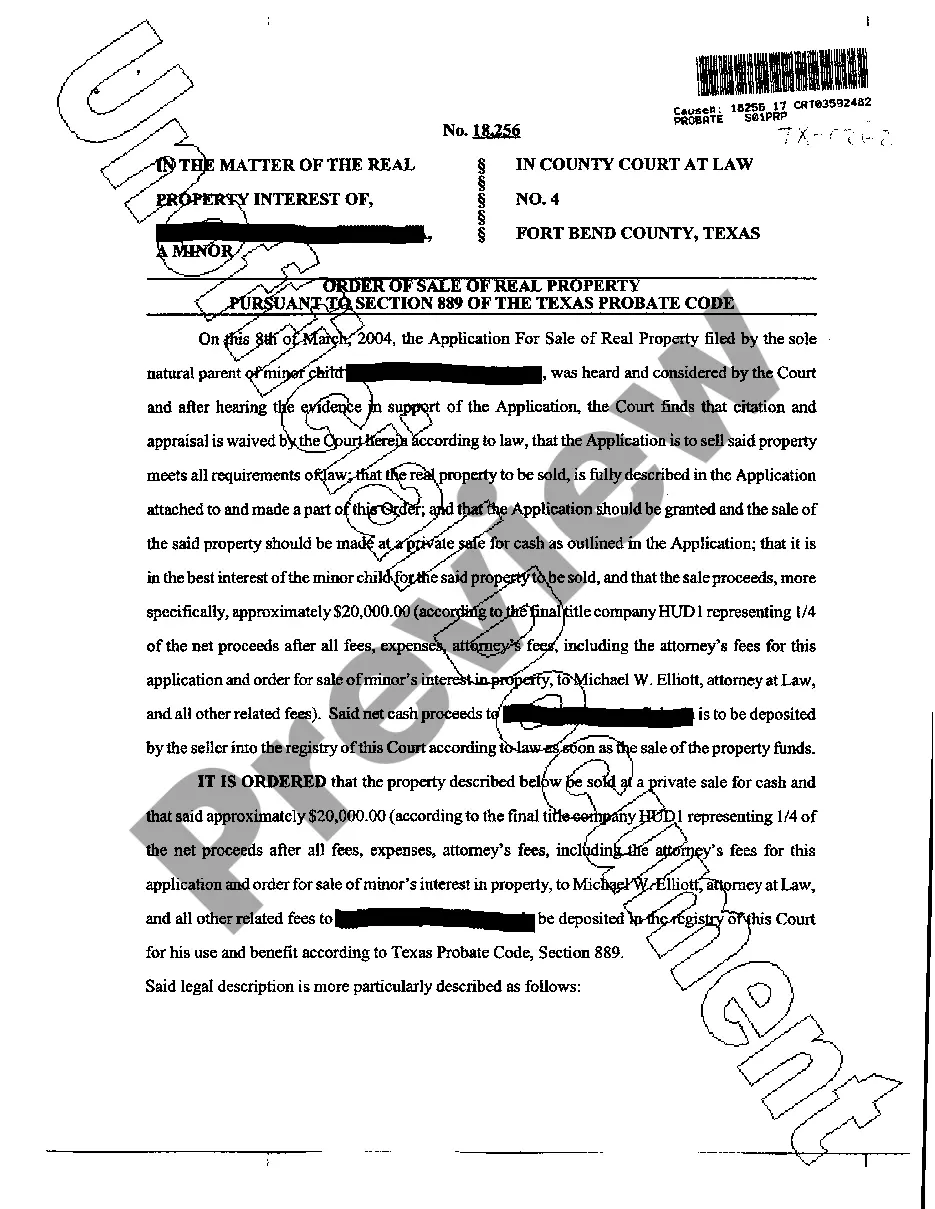

The deed also must be accepted by the grantee. This acceptance does not need to be shown in any formal way, but rather may be by any act, conduct or words showing an intention to accept. Finally, deeds should be recorded in the county in which the real estate is located. 765 ILCS 5/28.

One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

Office of the Will County Recorder of Deeds Address. 158 N. Scott Street. Joliet, IL 60432-4143. Office Hours. Monday?Friday. AM to PM. Phone Numbers. Phone: (815) 740-4637. Main Fax: (815) 740-4638. Archive Fax: (815) 740-4697. Location.

If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed. Make sure to fill in your name and address, and the name and address of the other party involved in the transfer.

Hear this out loud PauseIn Illinois, the property records are located at the county recorder. You can go there in person to conduct a search or you can check the county recorder's website to see if they offer online searching.

Hear this out loud PauseA deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

Hear this out loud PauseA release of mortgage, commonly known as a discharge of mortgage, is a legal document issued by the lender acknowledging that the mortgage debt is settled. It effectively releases the property from the lien, allowing homeowners clear ownership.

Hear this out loud PauseIllinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state. Mortgages are considered to be liens against the property and the vast majority of the liens in Illinois are mortgages.