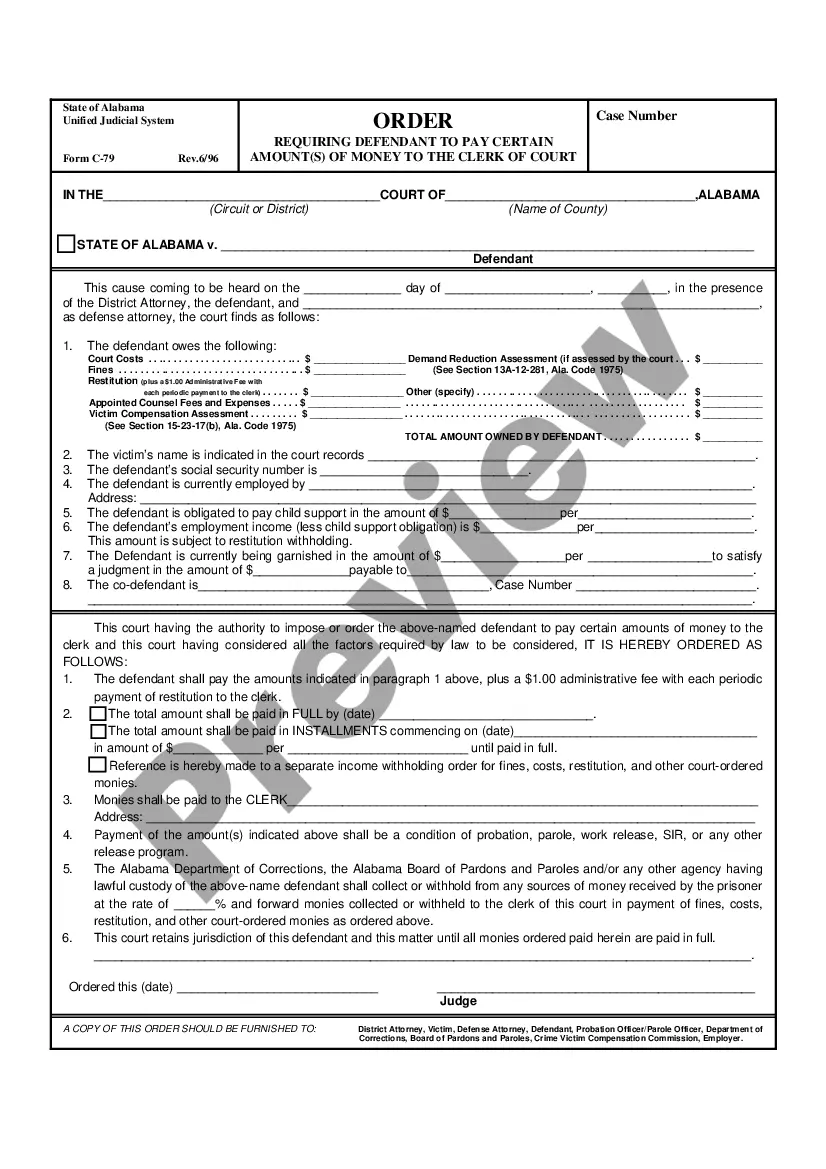

This is a Prior instruments and Obligations form, in addition to being made subject to all conveyances, reservations, and exceptions or other instruments of record, this assignment is made and assignee accepts this assignment subject to all terms, provisions, covenants, conditions, obligations, and agreements, including but not limited to the plugging responsibility for any well, surface restoration, or preferential purchase rights, contained in any contracts existing as of the effective date of this assignment and affecting the assigned property, whether or not recorded.

Illinois Prior Instruments and Obligations are financial commitments issued by the state of Illinois to cover its past and current financial obligations. These instruments are essentially debt instruments issued to fund various public projects, such as infrastructure improvements, construction projects, and public services. Illinois Prior instruments can include General Obligation (GO) bonds, revenue bonds, notes, and other debt instruments issued by the state. These instruments are typically secured by the state's taxing power and its ability to generate revenue from various sources, including sales tax, income tax, and tolls. GO bonds are one of the most common types of Illinois Prior instruments. These bonds are backed by the full faith and credit of the state, meaning that the state pledges its taxing power and general resources to repay the bondholders. GO bonds are typically issued to fund projects that provide a broad public benefit or meet important public needs. Revenue bonds are another type of Illinois Prior instrument. Unlike GO bonds, revenue bonds are backed by specific revenue streams or income sources. For example, revenue generated from toll roads or bridges may be used to repay revenue bonds issued for infrastructure improvements. In addition to GO bonds and revenue bonds, the state of Illinois may also issue short-term notes to bridge temporary funding gaps. These notes are typically repaid within one year and serve as a temporary financing solution until more long-term funding can be arranged. The purpose of Illinois Prior instruments and obligations is to provide the necessary capital to finance critical projects and address the state's financial commitments. These instruments allow the state to spread out the financial burden over time while providing essential services to its residents. It is important to note that these financial instruments carry inherent risks, including the potential for defaults or downgrades in credit ratings. The financial stability and creditworthiness of the state play a crucial role in determining the terms and interest rates associated with these instruments. In summary, Illinois Prior instruments and obligations encompass various types of debt instruments issued by the state to finance public projects and meet financial obligations. These instruments play a pivotal role in funding critical infrastructure improvements, public services, and other essential projects throughout the state.