This provision provides for the assignor to except from this assignment and reserve an overriding royalty interest of all oil, gas, casinghead gas, and other minerals that may be produced from the lands under the terms of the Leases that are the subject of this assignment.

Illinois Reservation of Overriding Royalty Interest

Description

How to fill out Reservation Of Overriding Royalty Interest?

Choosing the best authorized record format can be quite a have a problem. Of course, there are plenty of templates available online, but how will you obtain the authorized form you need? Make use of the US Legal Forms web site. The services offers 1000s of templates, like the Illinois Reservation of Overriding Royalty Interest, that can be used for business and private requires. Each of the varieties are inspected by specialists and meet up with state and federal demands.

When you are previously listed, log in in your accounts and then click the Acquire key to find the Illinois Reservation of Overriding Royalty Interest. Make use of your accounts to check through the authorized varieties you might have ordered in the past. Visit the My Forms tab of your own accounts and acquire yet another version of the record you need.

When you are a fresh end user of US Legal Forms, listed below are easy directions for you to stick to:

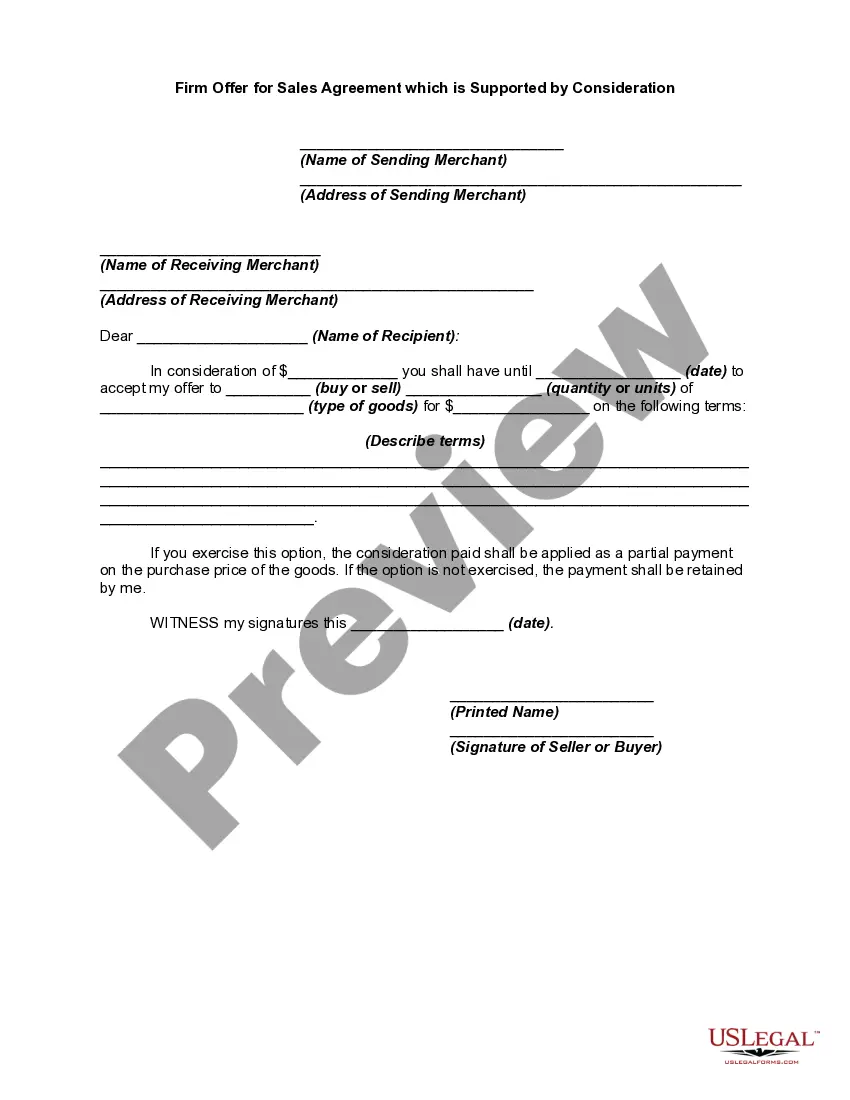

- Initial, be sure you have chosen the proper form for your personal city/region. You are able to look through the shape making use of the Review key and look at the shape information to make sure it is the right one for you.

- In case the form is not going to meet up with your preferences, make use of the Seach field to get the appropriate form.

- When you are certain that the shape would work, go through the Purchase now key to find the form.

- Pick the costs strategy you desire and enter the required information and facts. Make your accounts and pay money for an order making use of your PayPal accounts or bank card.

- Select the submit formatting and obtain the authorized record format in your device.

- Complete, edit and produce and indicator the attained Illinois Reservation of Overriding Royalty Interest.

US Legal Forms is the largest catalogue of authorized varieties for which you can find a variety of record templates. Make use of the service to obtain expertly-produced files that stick to state demands.

Form popularity

FAQ

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons. The exact details of an override are dependent on the language. ORRIs can be interpreted literally or may have proportionate reduction language.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.

Unlike a working or royalty interest, an ORRI cannot be fractionalized. It is an undivided, non-possessory right to a share of the production, excluding the mineral lease's production costs.