This form is a weekly expense report listing name, period, position, client, project number, project code, the expense items and the daily totals.

Illinois Weekly Expense Report

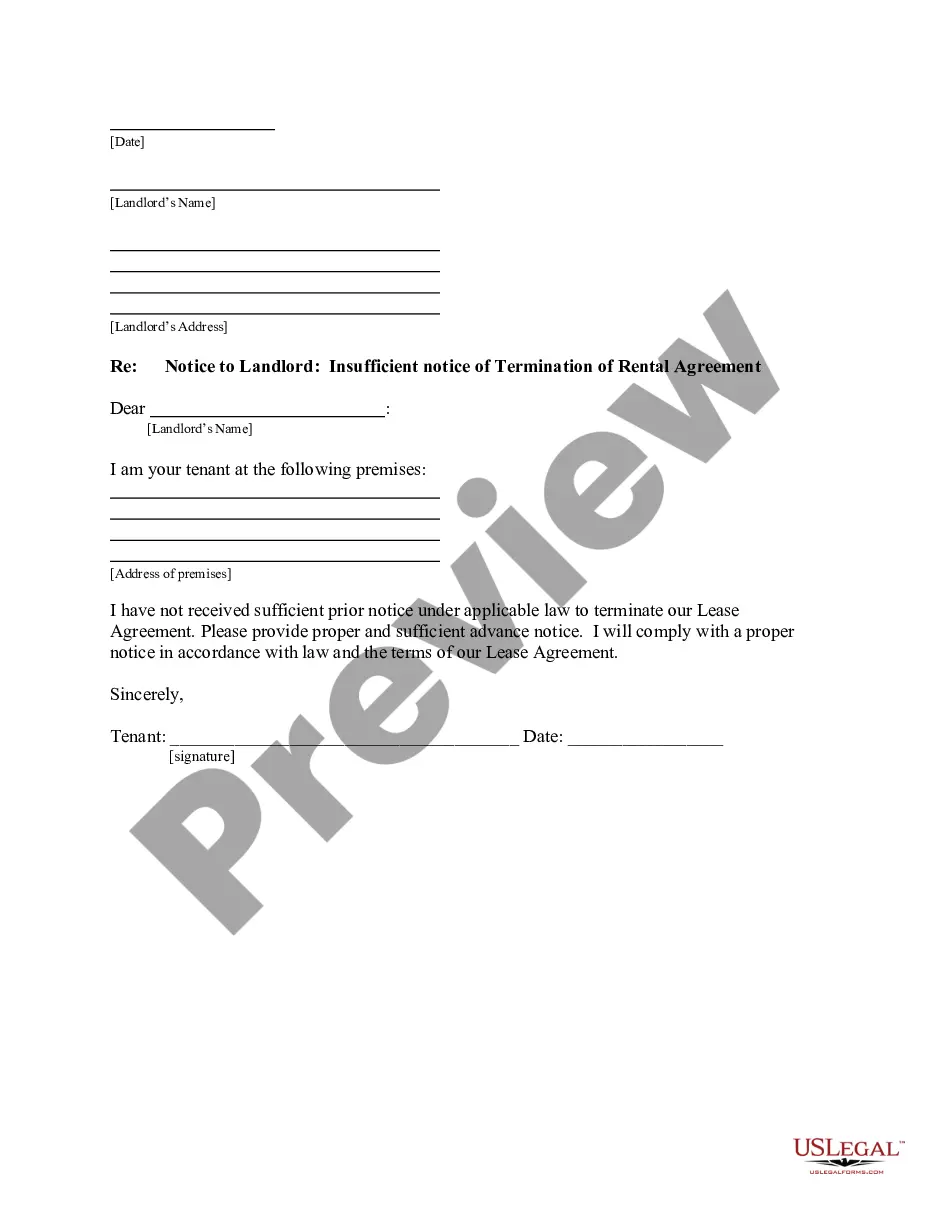

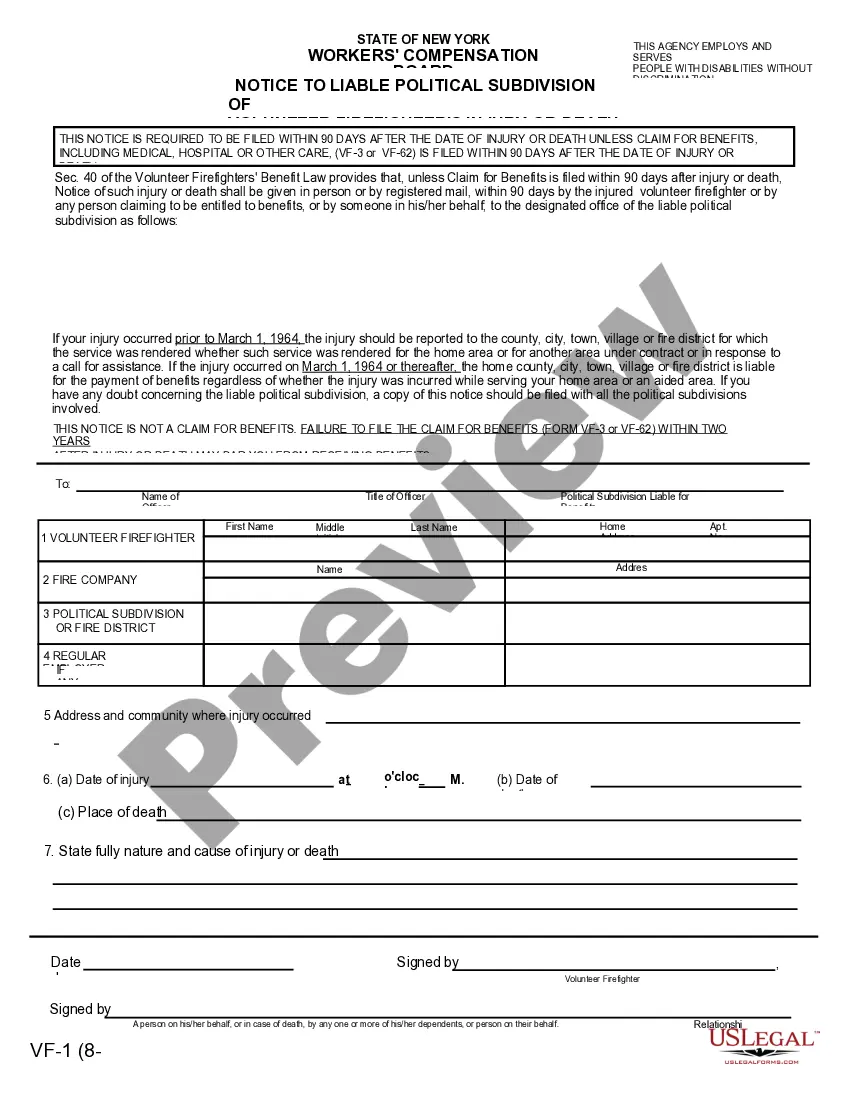

Description

How to fill out Illinois Weekly Expense Report?

If you want to complete, obtain, or produce lawful file layouts, use US Legal Forms, the most important selection of lawful types, which can be found on-line. Utilize the site`s simple and easy handy research to obtain the files you will need. Numerous layouts for company and individual reasons are sorted by categories and says, or keywords and phrases. Use US Legal Forms to obtain the Illinois Weekly Expense Report with a handful of click throughs.

Should you be previously a US Legal Forms consumer, log in for your profile and click the Down load switch to have the Illinois Weekly Expense Report. You may also entry types you in the past acquired within the My Forms tab of your profile.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that proper town/land.

- Step 2. Make use of the Review option to check out the form`s articles. Do not neglect to learn the information.

- Step 3. Should you be unsatisfied with all the type, take advantage of the Research discipline near the top of the screen to locate other types from the lawful type template.

- Step 4. When you have identified the form you will need, click on the Buy now switch. Choose the rates program you prefer and include your accreditations to register on an profile.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Find the format from the lawful type and obtain it on your own system.

- Step 7. Full, modify and produce or sign the Illinois Weekly Expense Report.

Each and every lawful file template you get is yours forever. You have acces to each type you acquired within your acccount. Select the My Forms area and choose a type to produce or obtain once again.

Be competitive and obtain, and produce the Illinois Weekly Expense Report with US Legal Forms. There are many professional and express-distinct types you can use for the company or individual requirements.

Form popularity

FAQ

7 Steps to Track Small Business ExpensesOpen a business bank account.Use a dedicated business credit card.Choose cash or accrual accounting.Choose accounting software to automate record keeping and track expenses in one spot.Digitize receipts with a receipt scanner.More items...?

ST-1 Sales and Use Tax and E911 Surcharge Return For Reporting Periods January 2019 and After - Sales & Use Tax Forms.

Find your Gross Sales in Illinois this number is at the top of your TaxJar Illinois state report. Enter your Gross Sales on your Illinois form ST-1 on line 1 Total Receipts under Step 2: Taxable Receipts. The Illinois filing system will automatically round this number to the closest dollar amount.

If you are a sole proprietor, you report your business income and claim your business deductions by filing IRS Schedule C, Profit or Loss From Business with our personal tax return. To make this task easy, Schedule C lists common expense categoriesyou just need to fill in the amount for each category.

If you are a sole proprietor, you report your business income and claim your business deductions by filing IRS Schedule C, Profit or Loss From Business with our personal tax return. To make this task easy, Schedule C lists common expense categoriesyou just need to fill in the amount for each category.

You have three options for filing and paying your Illinois sales tax: File online File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail You can use Form ST-1 and file and pay through the mail.

IRS Form 1065 InstructionsFill in Boxes A Through J. Once you have all the documents handy, it'll be time to fill out boxes A through J, which are located on the very top of 1065 Form.Complete the Remainder of Page 1.Fill Out Schedule B.Complete Schedule K.Fill Out the Remaining Sections.Review and File with the IRS.

The ITAC Assessment allows the Commission to administer its program to assist persons having a hearing or speech disability to communicate with persons with normal hearing. NOTE: The E911 Surcharge and ITAC Assessment do not change previously established sales tax obligations on prepaid services.

Form ST-1, Step 2: Taxable ReceiptsEnter your Gross Sales on your Illinois form ST-1 on line 1 Total Receipts under Step 2: Taxable Receipts. The Illinois filing system will automatically round this number to the closest dollar amount.

Are taxpayers required by law to claim all expenses pertaining to their business? Yes. A self-employed individual is required to report all income and deduct all expenses.

More info

Illinois About This Site The Illinois State Reports Online is an interactive website containing an extensive list of production cost reports covering more than 40 states. The online report is available at no cost and is regularly updated with production cost reports for all states except for Louisiana, which currently has no cost reports available. The reports provide cost reports on production costs paid or incurred during the most recent (quarterly) calendar year, as well as a historical summary of previous reporting year cost reports. The report can only be accessed over TCP/IP, and will require access to your computer's home Internet connection, which is recommended for optimum security and ease of use. We recommend that most users use their desktop or laptop computers.