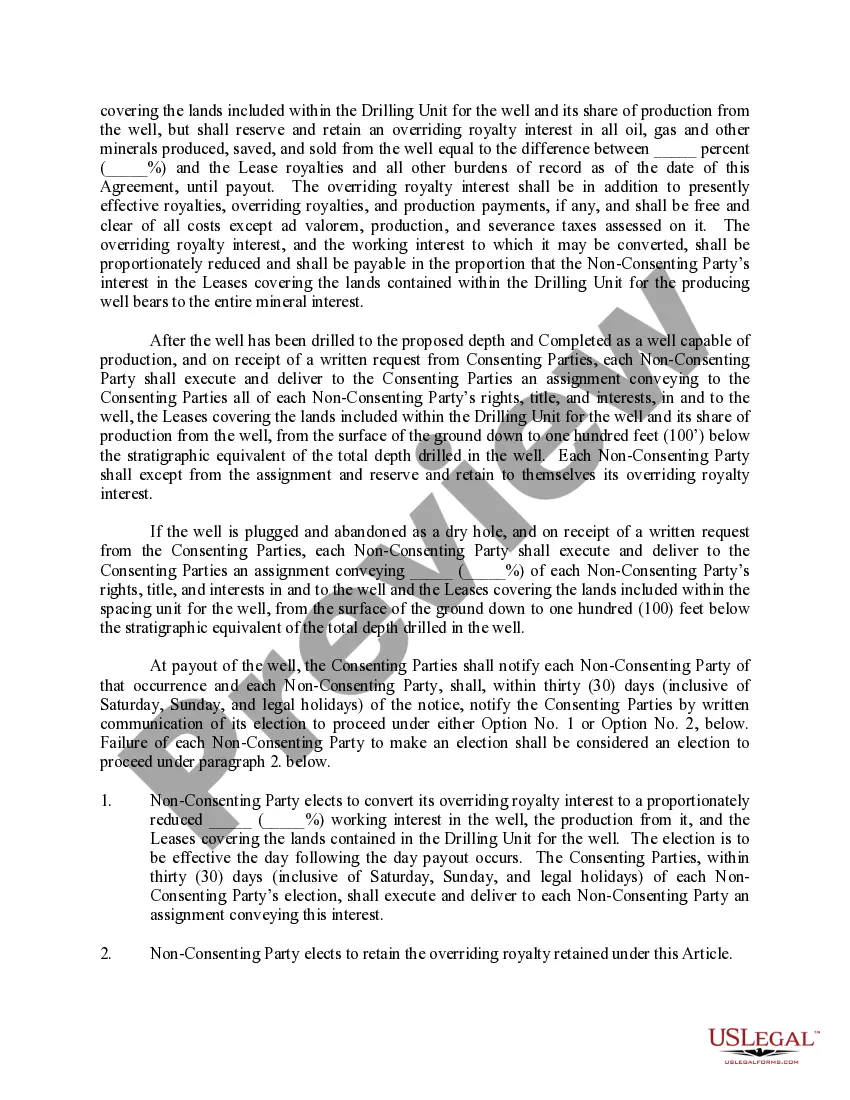

This ia a provision that states that any Party receiving a notice proposing to drill a well as provided in Operating Agreement elects not to participate in the proposed operation, then in order to be entitled to the benefits of this Article, the Party or Parties electing not to participate must give notice. Drilling by the parties who choose to participate must begin within 90 days of the notice.

Illinois Farmout by Non-Consenting Party

Description

How to fill out Farmout By Non-Consenting Party?

If you want to comprehensive, acquire, or printing legal file web templates, use US Legal Forms, the largest selection of legal varieties, which can be found on the web. Use the site`s simple and easy hassle-free research to get the files you will need. Various web templates for enterprise and individual reasons are categorized by categories and says, or key phrases. Use US Legal Forms to get the Illinois Farmout by Non-Consenting Party within a few click throughs.

If you are presently a US Legal Forms customer, log in to the accounts and click the Download button to find the Illinois Farmout by Non-Consenting Party. You can even gain access to varieties you formerly downloaded from the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for that proper metropolis/land.

- Step 2. Make use of the Preview solution to look through the form`s content material. Don`t forget to learn the outline.

- Step 3. If you are not happy together with the develop, make use of the Lookup industry near the top of the monitor to get other versions of the legal develop format.

- Step 4. Upon having identified the shape you will need, go through the Purchase now button. Opt for the pricing strategy you prefer and add your qualifications to register for the accounts.

- Step 5. Procedure the deal. You can use your credit card or PayPal accounts to perform the deal.

- Step 6. Pick the format of the legal develop and acquire it on your own gadget.

- Step 7. Total, edit and printing or signal the Illinois Farmout by Non-Consenting Party.

Every legal file format you buy is your own eternally. You may have acces to each and every develop you downloaded in your acccount. Click on the My Forms portion and decide on a develop to printing or acquire again.

Remain competitive and acquire, and printing the Illinois Farmout by Non-Consenting Party with US Legal Forms. There are millions of skilled and condition-specific varieties you can utilize for your enterprise or individual demands.

Form popularity

FAQ

out agreement, the key agreement documenting a transaction whereby a third party agrees to acquire an interest in an upstream oil and gas asset (licence or other form of concession) from one or more of the current owners in return for performing certain work obligations, such as the acquisition of seismic, the ...

While the first is the entry of companies into O&G exploration, the farm-out takes place when a business with the current concession is willing to give up part or all of its available area. Making a simpler analogy about the process, the farm-in is the buyer and the farm-out is the seller.

A farm out is a type of agreement where a party that has a working interest to a gas and oil lease will grant that interest to another party. The other party will then be contractually obligated to meet specific conditions, such as setting up a drill in a specific location, drilling to an agreed upon depth, etc.

What Is a Farmout? A farmout is the assignment of part or all of an oil, natural gas, or mineral interest to a third party for development. The interest may be in any agreed-upon form, such as exploration blocks or drilling acreage. Farmout: What it Means, How it Works, Example - Investopedia investopedia.com ? terms ? farmout investopedia.com ? terms ? farmout

out agreement, the key agreement documenting a transaction whereby a third party agrees to acquire an interest in an upstream oil and gas asset (licence or other form of concession) from one or more of the current owners in return for performing certain work obligations, such as the acquisition of seismic, the ... Farmout agreement (oil and gas) Practical Law thomsonreuters.com ? ... thomsonreuters.com ? ...

One example is where it is projected that the farmee will pay for 75% of the drilling costs, the parties may agree that upon meeting the earning barrier, the farmee will obtain a 75% interest in the acreage committed to the well, or even the entire contract area. Farmout Agreements: Key Decisions and Negotiation Points oilandgaslawdigest.com ? primers-insights ? farm... oilandgaslawdigest.com ? primers-insights ? farm...