This office lease clause is used to respond to various changes that might occur within the tenant's office building or shopping center.

Illinois Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

How to fill out Measurement Representations And Proportionate Share Adjustment Of Tenants Proportionate Tax Share?

Are you presently in a situation the place you will need paperwork for possibly company or personal purposes just about every time? There are a lot of lawful record layouts available on the Internet, but finding types you can rely isn`t straightforward. US Legal Forms provides a large number of type layouts, much like the Illinois Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share, that happen to be published to satisfy state and federal requirements.

If you are previously knowledgeable about US Legal Forms internet site and have a free account, just log in. Afterward, you are able to acquire the Illinois Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share format.

Should you not have an profile and need to start using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for your proper city/region.

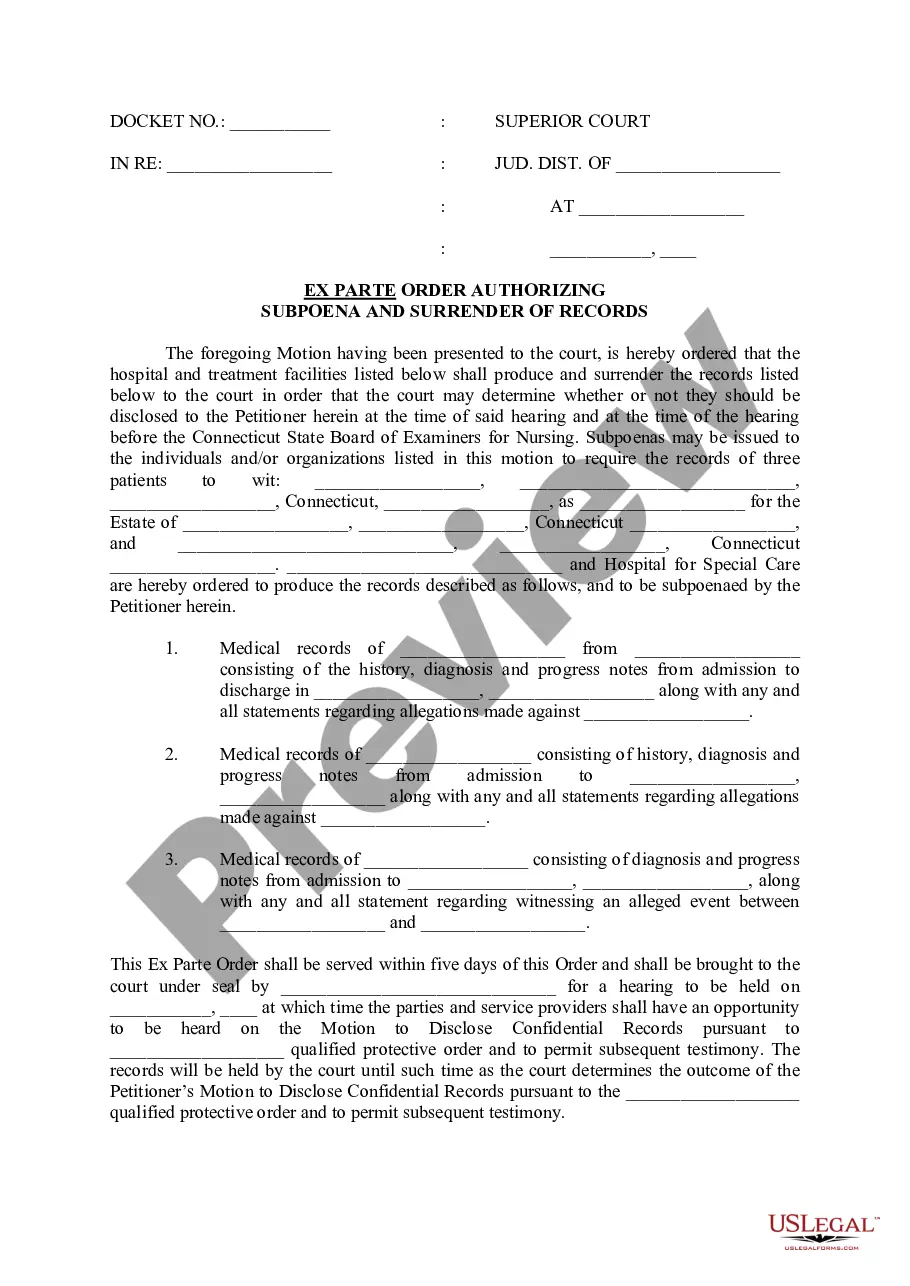

- Utilize the Review button to review the shape.

- Look at the description to ensure that you have chosen the right type.

- In the event the type isn`t what you are looking for, take advantage of the Research field to find the type that suits you and requirements.

- Whenever you get the proper type, just click Get now.

- Opt for the costs plan you need, complete the necessary information and facts to create your account, and pay money for the transaction using your PayPal or charge card.

- Select a convenient file file format and acquire your version.

Locate each of the record layouts you may have bought in the My Forms menus. You may get a more version of Illinois Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share anytime, if required. Just go through the necessary type to acquire or printing the record format.

Use US Legal Forms, one of the most extensive collection of lawful varieties, to save lots of time as well as prevent blunders. The support provides skillfully produced lawful record layouts which you can use for a selection of purposes. Create a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Your pro rata share of household operating expenses is the average monthly household operating expenses (based on a reasonable estimate if exact figures are not available) divided by the number of people in the household, regardless of age.

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.

The amount due to each shareholder is their pro rata share. This is calculated by dividing the ownership of each person by the total number of shares and then multiplying the resulting fraction by the total amount of the dividend payment.

Pro rata is a calculation that determines the fair distribution of a fixed amount. These calculations are common for issuing dividends and determining part-time salaries. You can calculate pro rata by determining the payee's portion and multiplying it by the total fixed amount.

The easiest way to work out pro rate salary is by dividing the total annual salary by the number of full-time hours. You can then multiply the result by the pro rata hours worked.

Pro-rata share is defined as an equal proportion of a whole. If 5 people want to split a $50 dinner bill using pro-rata share, each person will pay $10. We will focus on subparts (a) and (c) as it relates to aviation: 14 CFR § 61.113 - Private pilot privileges and limitations: Pilot in command.

In general, the tenant's proportionate share is determined by taking the building's rentable square footage and dividing it by the tenant's rentable square footage. Local industry customs usually provide the landlord with the guiding principles for: Measuring the building.