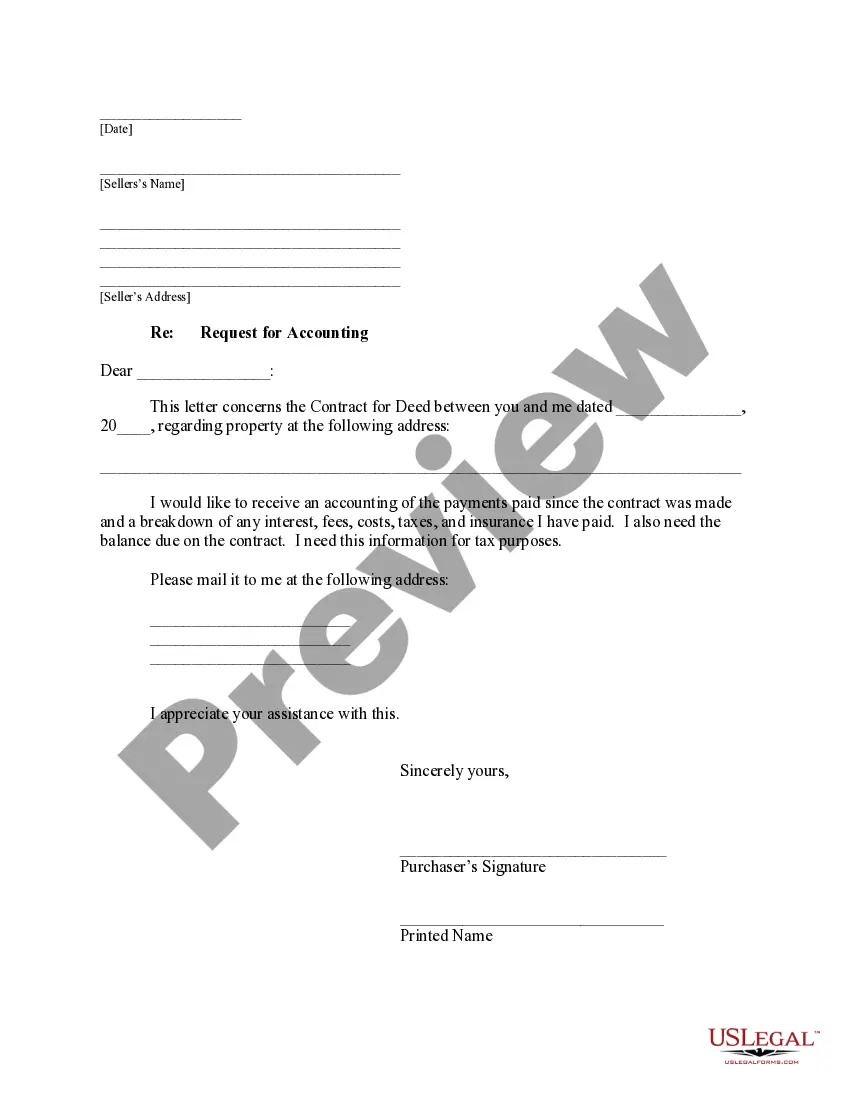

This is a request from the buyer to the seller for the seller to provide the buyer with an accounting of payments made. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indiana Buyer's Request for Accounting from Seller under Contract for Deed

Description

How to fill out Indiana Buyer's Request For Accounting From Seller Under Contract For Deed?

Use US Legal Forms to obtain a printable Indiana Buyer's Request for Accounting from Seller under Contract for Deed. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue online and provides affordable and accurate samples for customers and lawyers, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Indiana Buyer's Request for Accounting from Seller under Contract for Deed:

- Check to make sure you get the correct template in relation to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Indiana Buyer's Request for Accounting from Seller under Contract for Deed. Above three million users already have used our platform successfully. Choose your subscription plan and get high-quality forms within a few clicks.

Form popularity

FAQ

While a buyer can legally back out of a home contract, there can be consequences for doing so. For example, you can lose your earnest money, which could amount to thousands of dollars or more. That is unless your reason for pulling out of the deal is stipulated in your contract.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Contact the other party and ask whether they are willing to negotiate the cancellation of the contract. Offer the other party an incentive to cancel the contract for deed.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

If you want out of a real estate contract and don't have any contingencies available, you can breach the contract.The seller could also decide to sue you for breach of contract. Some real estate contracts have a liquidated damages clause that states the maximum the seller can keep if the buyers breach the contract.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement. The biggest risk when buying a home contract for deed is that you really don?t have a legal claim to the property until you have paid off the entire purchase price.