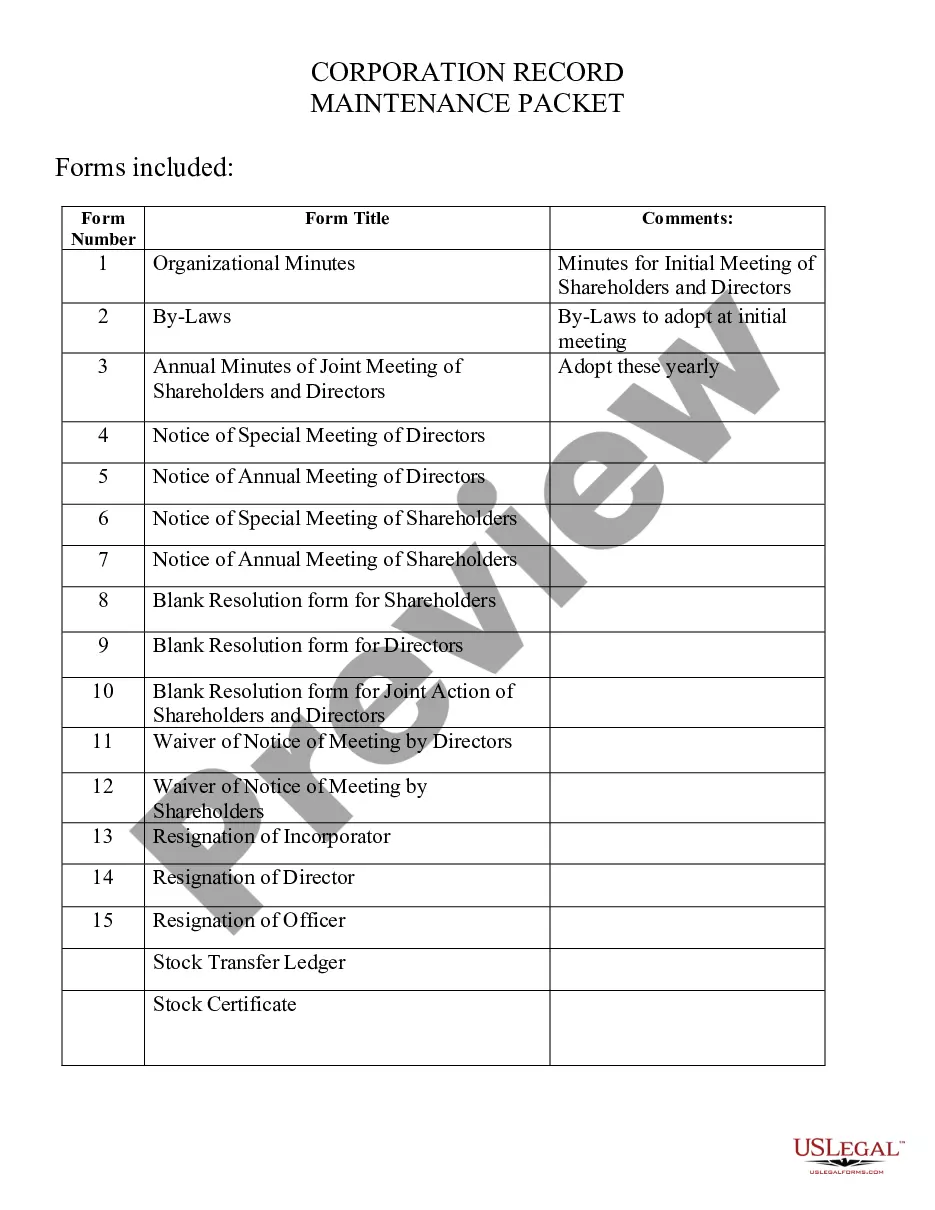

This Professional Corporations Package contains all forms and directions for filing needed in order to incorporate a Professional Corporation in your particular state. The forms included are as follows: articles on incorporation, by-laws, any other forms needed for creation and maintenance of the corporation.

Professional Corporation Package for Indiana

Description

How to fill out Professional Corporation Package For Indiana?

Among numerous free and paid examples that you’re able to find on the web, you can't be certain about their accuracy and reliability. For example, who created them or if they are qualified enough to deal with the thing you need these people to. Keep relaxed and utilize US Legal Forms! Locate Professional Corporation Package for Indiana templates made by professional legal representatives and get away from the high-priced and time-consuming process of looking for an attorney and then paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access your previously downloaded examples in the My Forms menu.

If you are using our service for the first time, follow the guidelines listed below to get your Professional Corporation Package for Indiana quick:

- Make certain that the file you discover is valid in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another template utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and bought your subscription, you can utilize your Professional Corporation Package for Indiana as many times as you need or for as long as it remains valid in your state. Edit it with your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Step 1: File the Articles of Incorporation with the California Secretary of State (required) Step 2: Register with the Appropriate Government Agency (required) Step 3: Prepare Corporate Bylaws. Step 4: Appoint the Professional Corporation's Directors (required)

Professional corporationslike traditional corporationscan take two forms: S Corps or C Corps.However, owners typically have the option to elect for S Corp status by completing and submitting IRS form 2553: Election by a Small Business Corporation.

An Indiana Professional Corporation may render Professional Services in the state of Indiana only through individuals licensed or otherwise authorized in Indiana to render the specific Professional Service.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized according to the laws of the state where the professional is licensed to practice.

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

Most importantly, a professional corporation is classified as a regular or "C" corporation by the Internal Revenue Service. The corporation is considered a taxpayer under Subchapter C of the tax code and must file an annual federal income tax return and pay taxes on net income at a corporate tax rate.