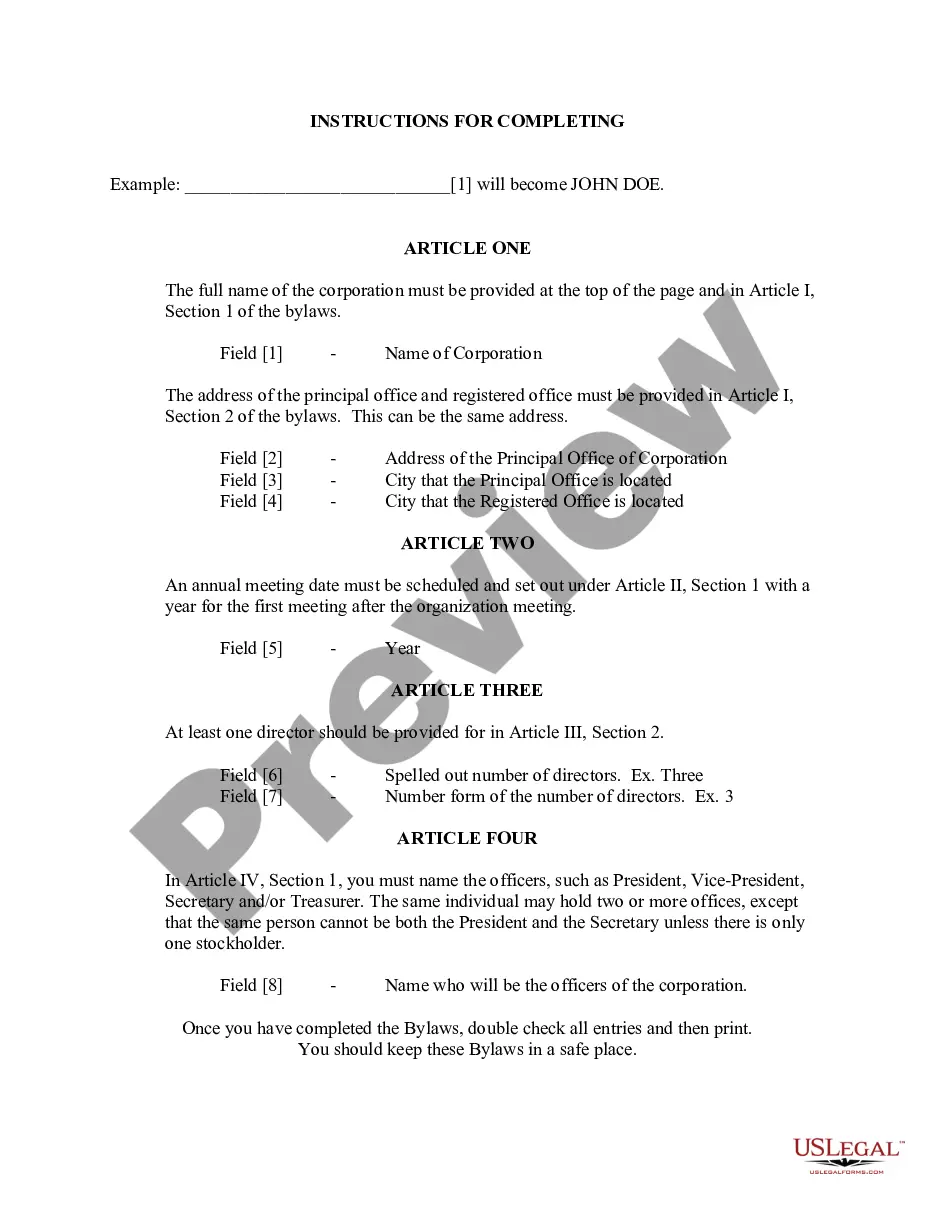

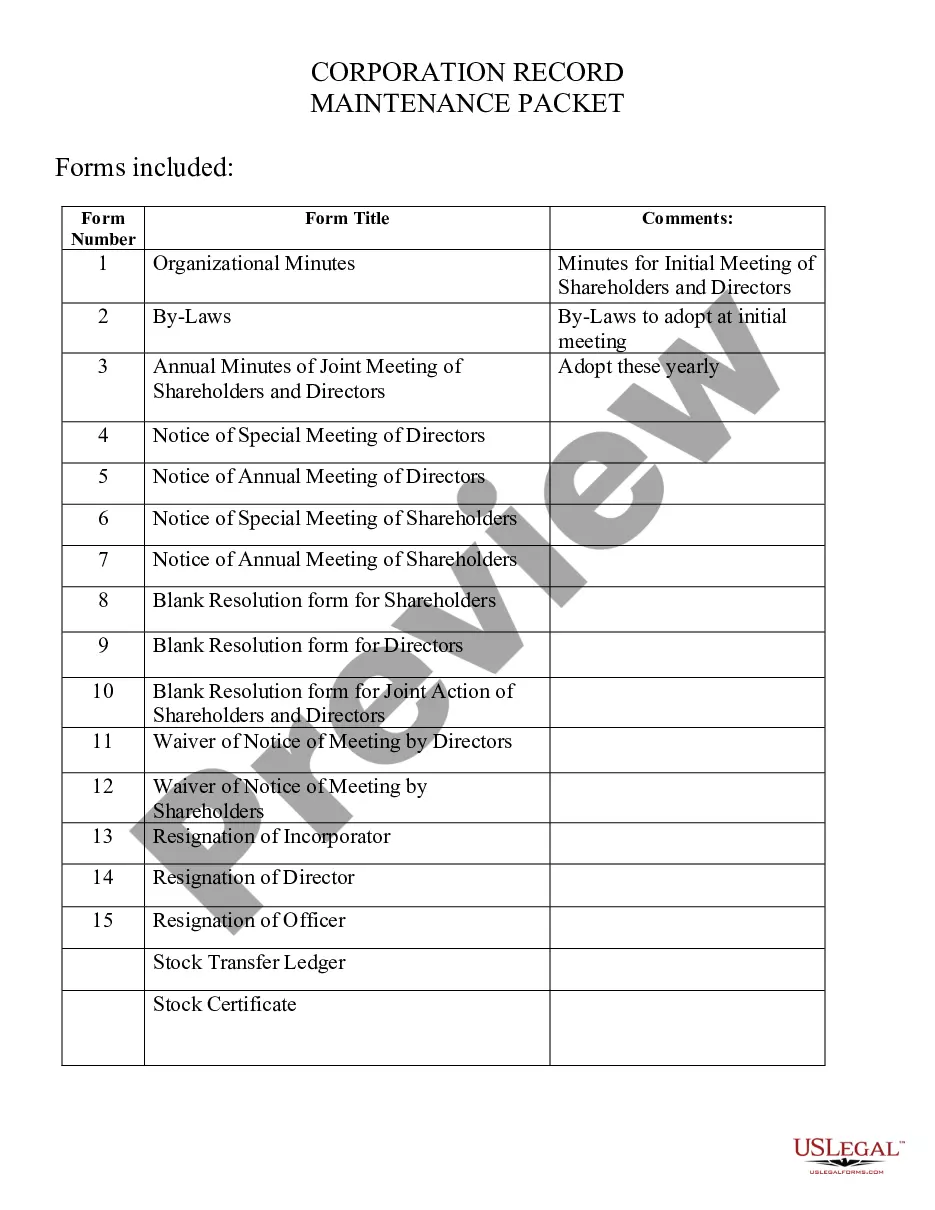

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Indiana Articles of Incorporation for Domestic For-Profit Corporation

Description State Of Indiana Articles Of Incorporation

How to fill out Indiana Articles Of Incorporation For Domestic For-Profit Corporation?

Trying to find Indiana Articles of Incorporation for Domestic For-Profit Corporation sample and completing them can be a challenge. To save time, costs and effort, use US Legal Forms and find the appropriate template specifically for your state in just a few clicks. Our attorneys draft every document, so you just need to fill them out. It really is that simple.

Log in to your account and come back to the form's web page and save the document. Your saved examples are stored in My Forms and are accessible at all times for further use later. If you haven’t subscribed yet, you have to register.

Check out our comprehensive recommendations on how to get your Indiana Articles of Incorporation for Domestic For-Profit Corporation template in a couple of minutes:

- To get an eligible sample, check out its applicability for your state.

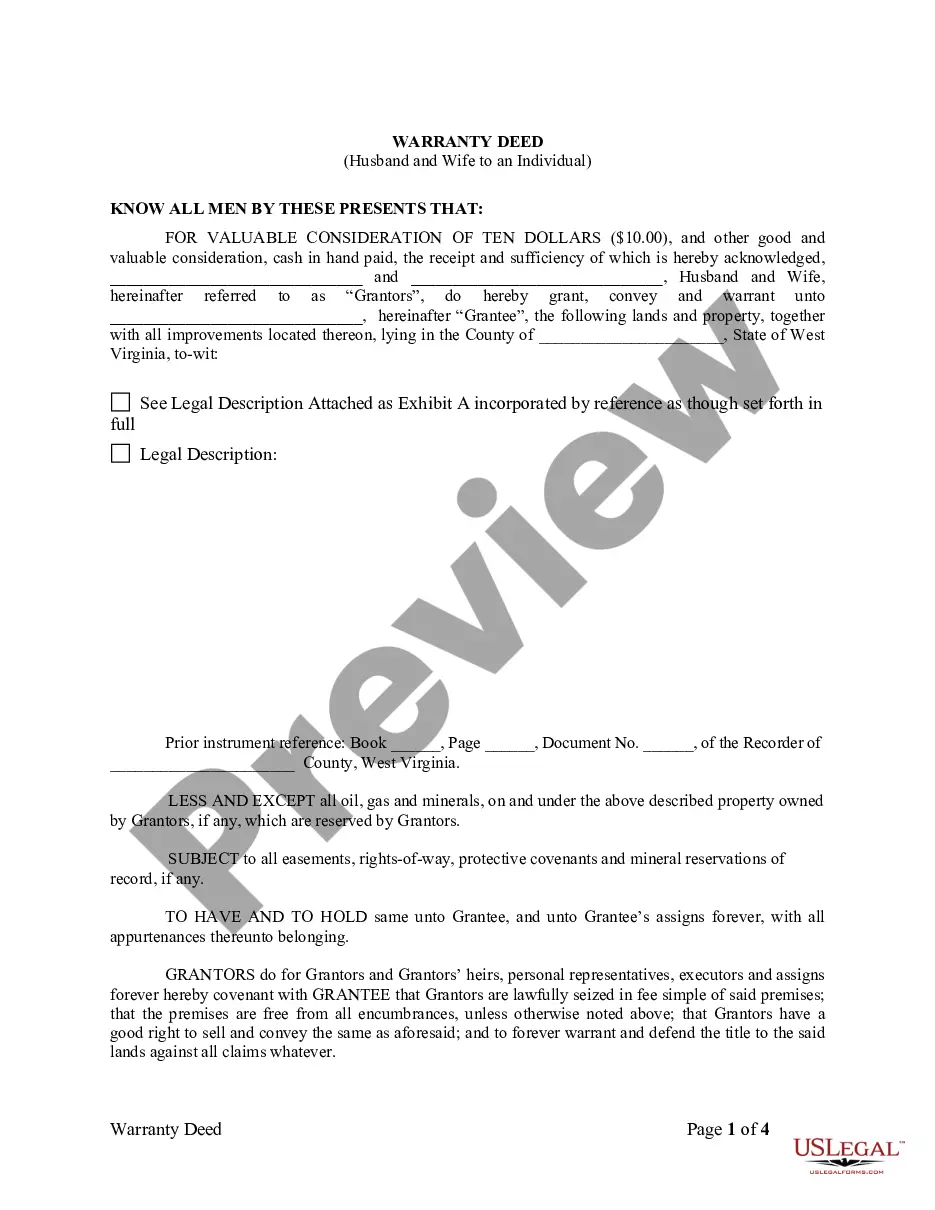

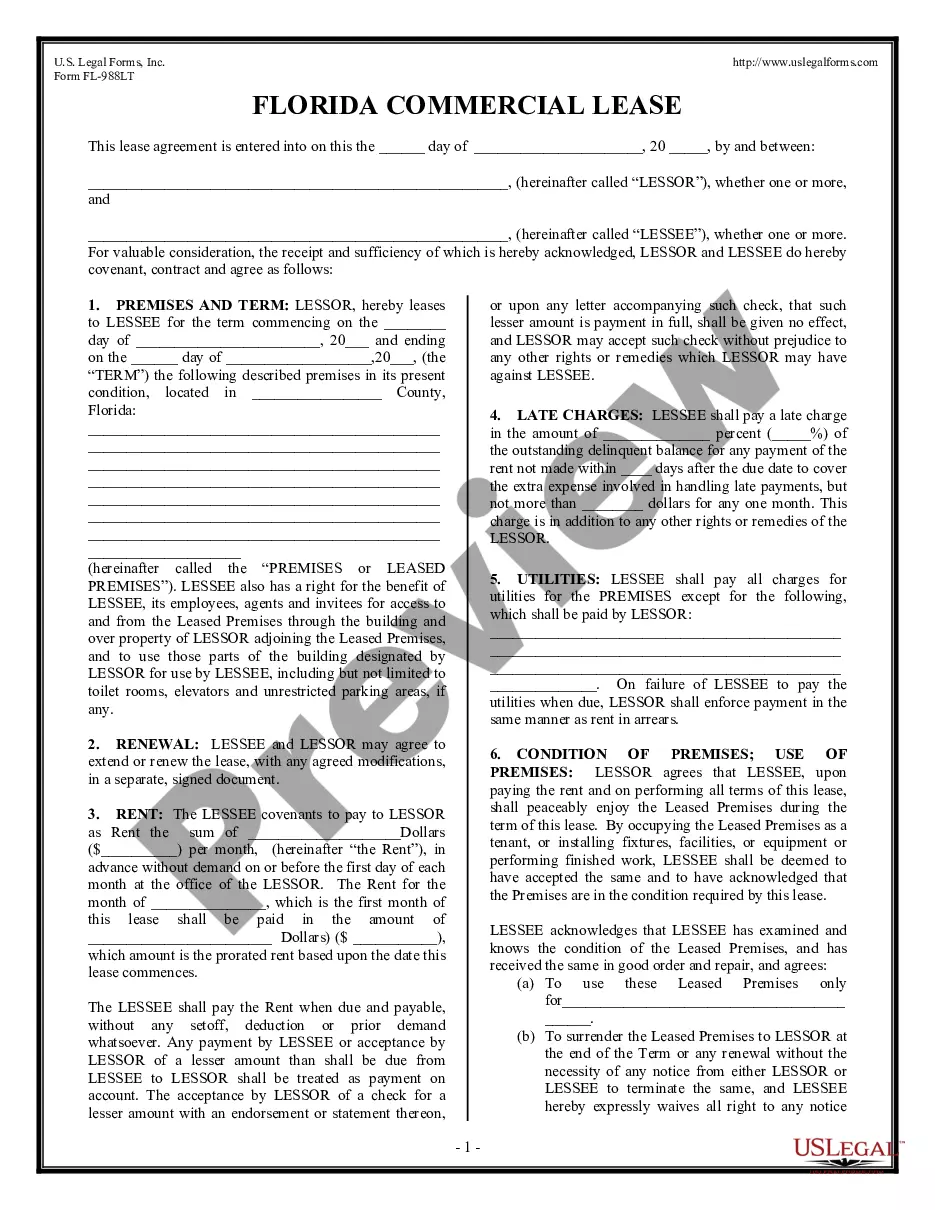

- Look at the sample making use of the Preview option (if it’s offered).

- If there's a description, read it to learn the important points.

- Click Buy Now if you identified what you're trying to find.

- Pick your plan on the pricing page and create your account.

- Pick how you want to pay by a card or by PayPal.

- Save the form in the preferred format.

Now you can print out the Indiana Articles of Incorporation for Domestic For-Profit Corporation template or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your template may be used and sent away, and printed out as many times as you want. Try out US Legal Forms and get access to around 85,000 state-specific legal and tax documents.

What Is A Domestic Profit Corporation Form popularity

Indiana Incorporation Other Form Names

FAQ

Related. Corporations are generally categorized as S or C corporations. A corporation must file articles of incorporation in the state in which it is located. Sometimes articles of incorporation are referred to as certificates of incorporation or charter documents.

Every state has a form for the articles of incorporation. You can find your state's form on the website of the state agency that handles business filings. In most states, that's the secretary of state, but some states have a different business filing agency.

You can form your Indiana LLC by filing Articles of Organization online or by mail. Form an Indiana LLC online: The state filing fee is $95 and the processing time is 24 hours.

Any company registered in Indiana can order certified copies of its official formation documents from the Indiana Secretary of State. Processing time is typically 3-5 business days plus mailing time.

In the U.S., articles of incorporation are filed with the Office of the Secretary of State where the business chooses to incorporate. Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares.

Obtaining a copy of a company's Articles of Incorporation is a relatively simple process. In most states, a certified copy can be requested by visiting the office of the Secretary of State in person or by phone, mail, or the state's online system.

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

If you want to structure your business as a corporation, one of the first formal steps you'll need to take is to file a special document with a particular state office. In most states, the document is known as the articles of incorporation, and in most states it needs to be filed with the Secretary of State.

File the documents with the Secretary of State's office. Include the fee of incorporation, as well as the names and addresses of the incorporating business partners.