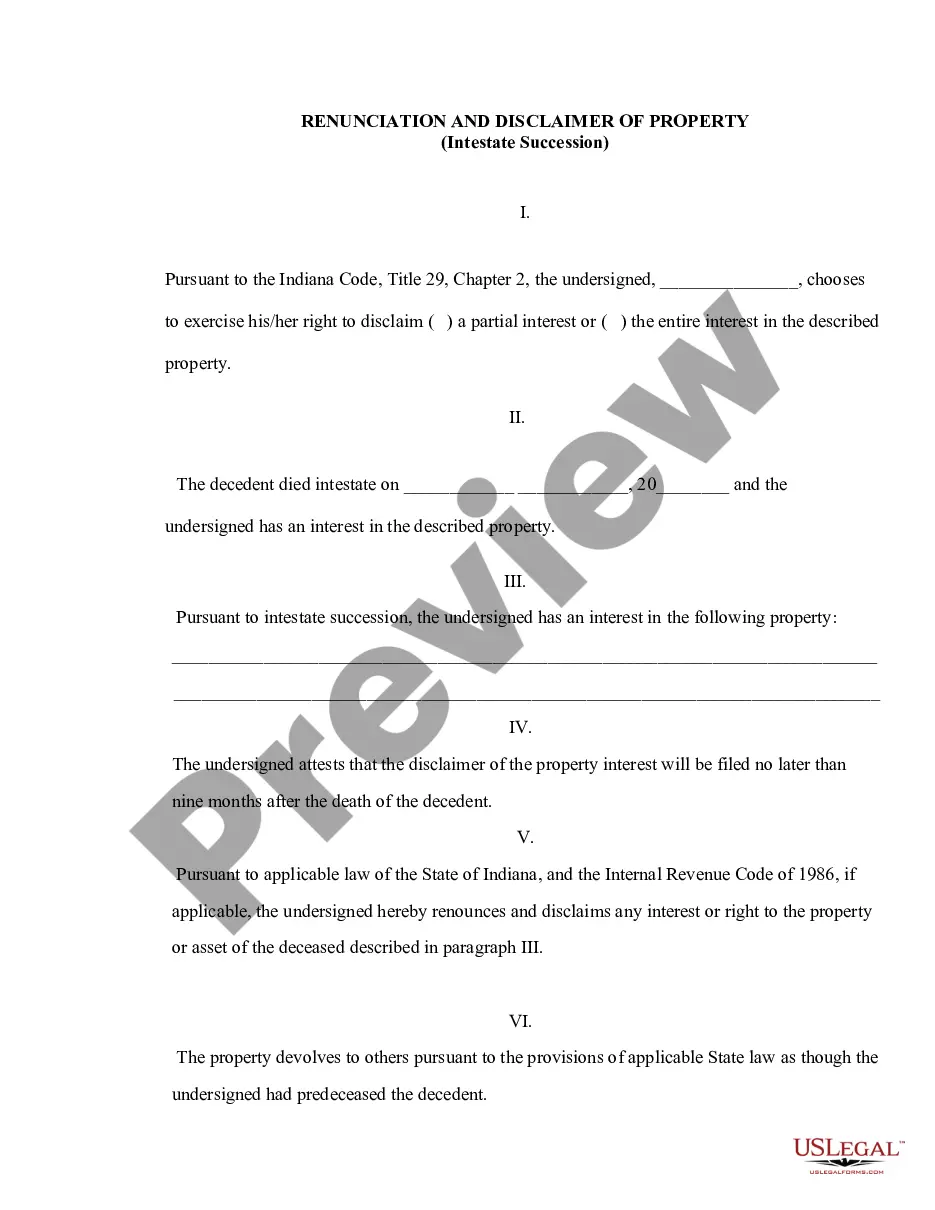

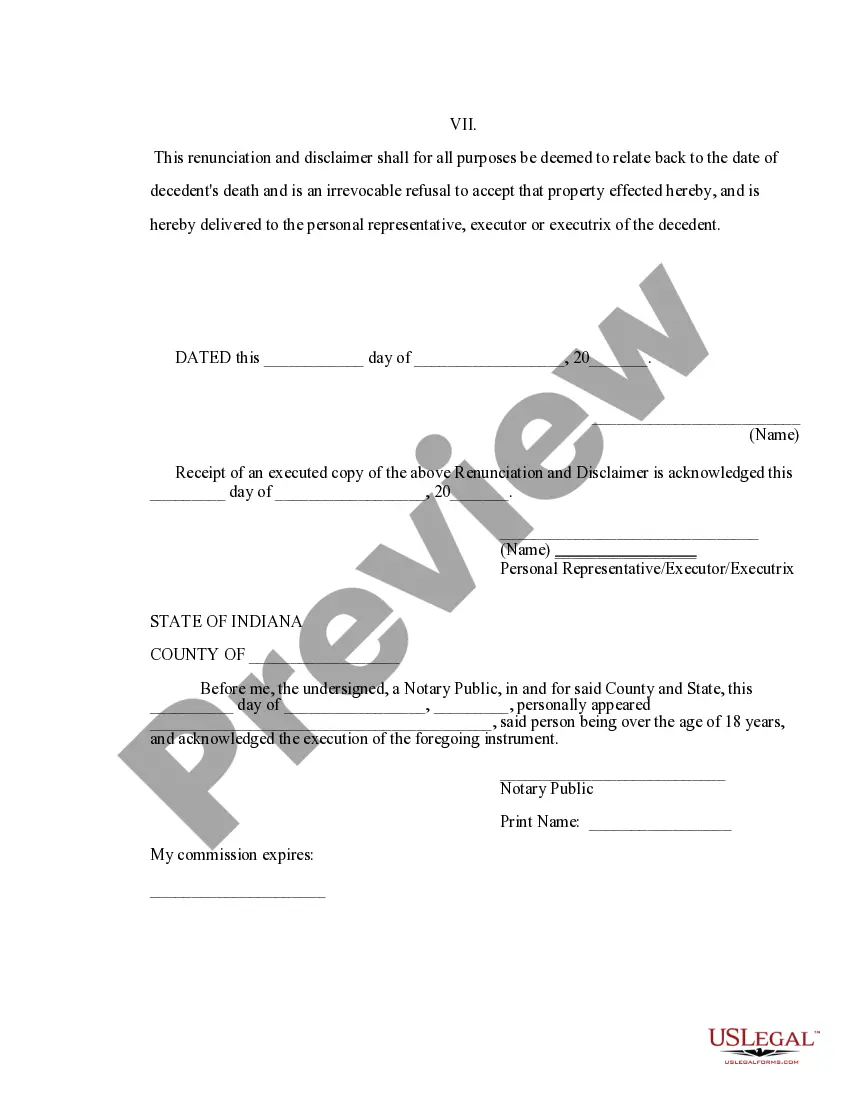

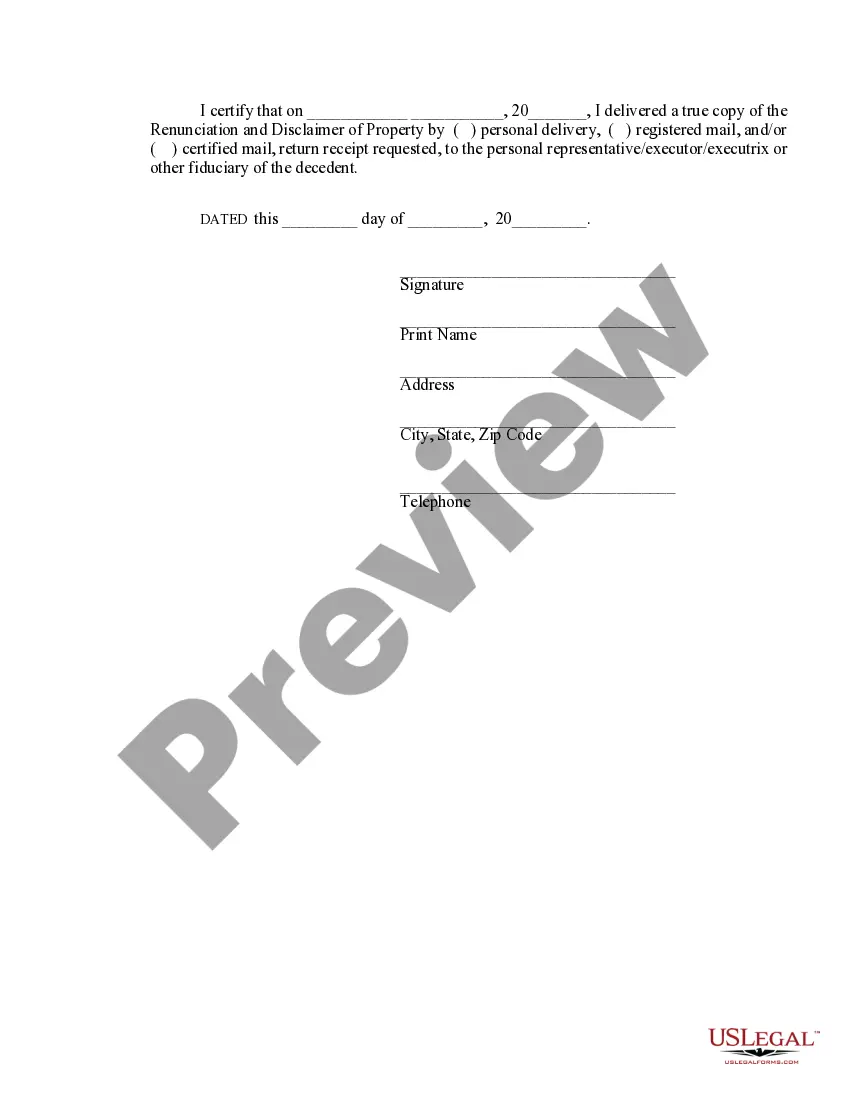

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property of the decedent. However, pursuant to the Indiana Code, Title 29, Chapter 2, the beneficiary wishes to disclaim a portion of or the entire interest in the property. The beneficiary attests that the disclaimer will be filed no later than nine months after the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Indiana Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession?

Looking for Indiana Renunciation and Disclaimer of Property received by Intestate Succession templates and completing them can be quite a challenge. To save time, costs and effort, use US Legal Forms and choose the right sample specifically for your state within a couple of clicks. Our lawyers draw up each and every document, so you just need to fill them out. It truly is that easy.

Log in to your account and return to the form's web page and save the sample. Your downloaded examples are stored in My Forms and they are accessible at all times for further use later. If you haven’t subscribed yet, you should sign up.

Take a look at our detailed instructions on how to get your Indiana Renunciation and Disclaimer of Property received by Intestate Succession template in a few minutes:

- To get an qualified form, check out its applicability for your state.

- Check out the form using the Preview option (if it’s offered).

- If there's a description, go through it to learn the important points.

- Click on Buy Now button if you identified what you're looking for.

- Choose your plan on the pricing page and make your account.

- Select you want to pay by way of a card or by PayPal.

- Download the form in the favored file format.

You can print the Indiana Renunciation and Disclaimer of Property received by Intestate Succession template or fill it out making use of any online editor. Don’t concern yourself with making typos because your form can be utilized and sent, and printed as often as you wish. Check out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The beneficiary can disclaim only a portion of an inherited IRA or asset, allowing some to flow to the contingent beneficiary(s). Partial disclaiming is either a specific dollar or percentage amount as of the date of death.The balance will go to the next beneficiary(s).