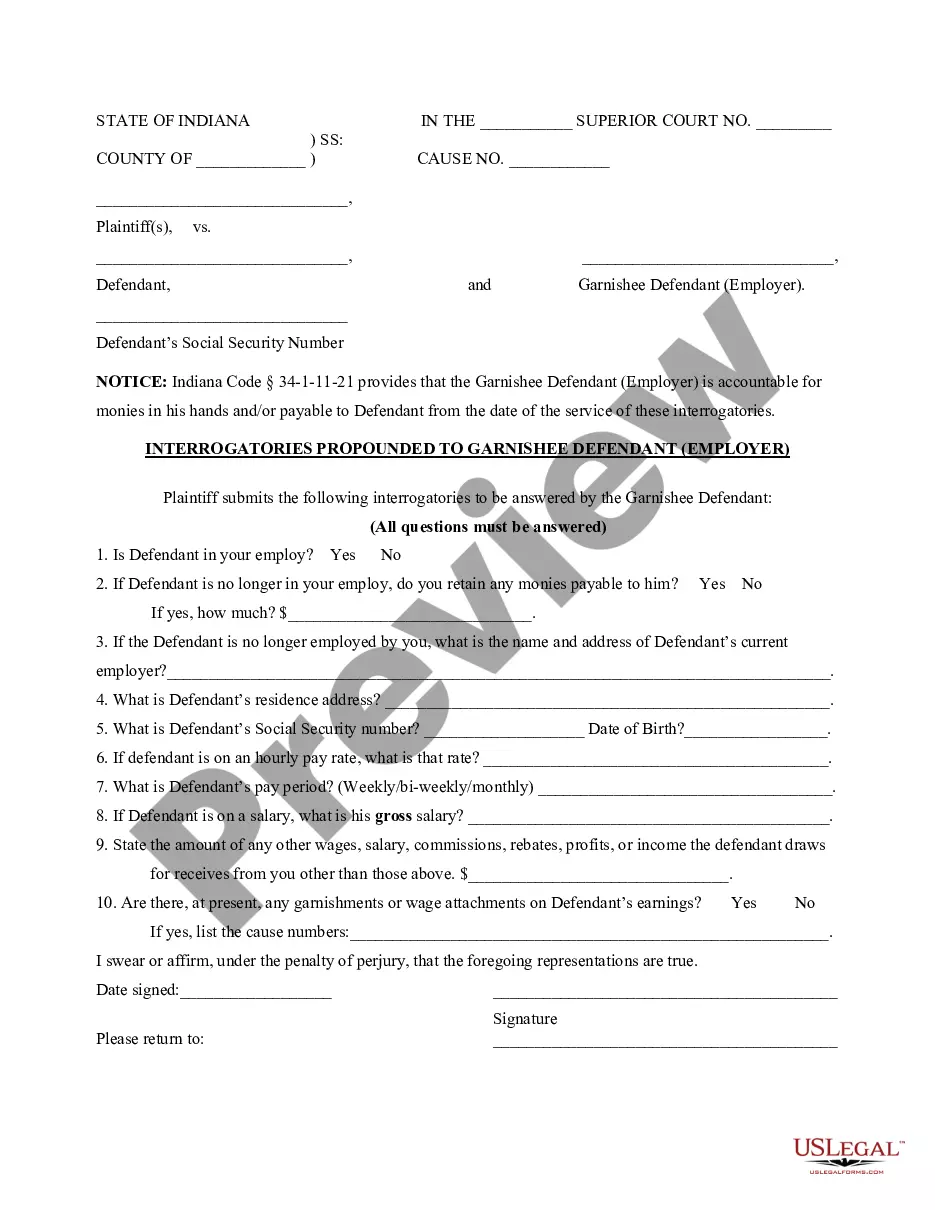

These are sample interrogatories given to a Garnishee Defendant's Employer. The Plaintiff demands information from the Employer concerning the Judgment Debtor. They are to be used simply as a model and should be modified to fit your particular cause of action.

Indiana Interrogatories Propounded to Garnishee Defendant - Employer

Description Indiana Interrogatories To Be Answered Form

How to fill out Indiana Interrogatories Propounded To Garnishee Defendant - Employer?

In search of Indiana Interrogatories Propounded to Garnishee Defendant - Employer templates and completing them might be a problem. In order to save time, costs and energy, use US Legal Forms and choose the right template specially for your state in a couple of clicks. Our attorneys draft all documents, so you just need to fill them out. It truly is that simple.

Log in to your account and return to the form's page and save the sample. All your saved examples are saved in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you should sign up.

Have a look at our detailed guidelines regarding how to get the Indiana Interrogatories Propounded to Garnishee Defendant - Employer form in a few minutes:

- To get an entitled sample, check out its applicability for your state.

- Have a look at the sample using the Preview option (if it’s available).

- If there's a description, go through it to understand the specifics.

- Click Buy Now if you found what you're searching for.

- Choose your plan on the pricing page and create an account.

- Pick how you wish to pay out by a card or by PayPal.

- Save the file in the preferred format.

You can print the Indiana Interrogatories Propounded to Garnishee Defendant - Employer form or fill it out utilizing any web-based editor. No need to worry about making typos because your sample may be used and sent away, and printed as often as you wish. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

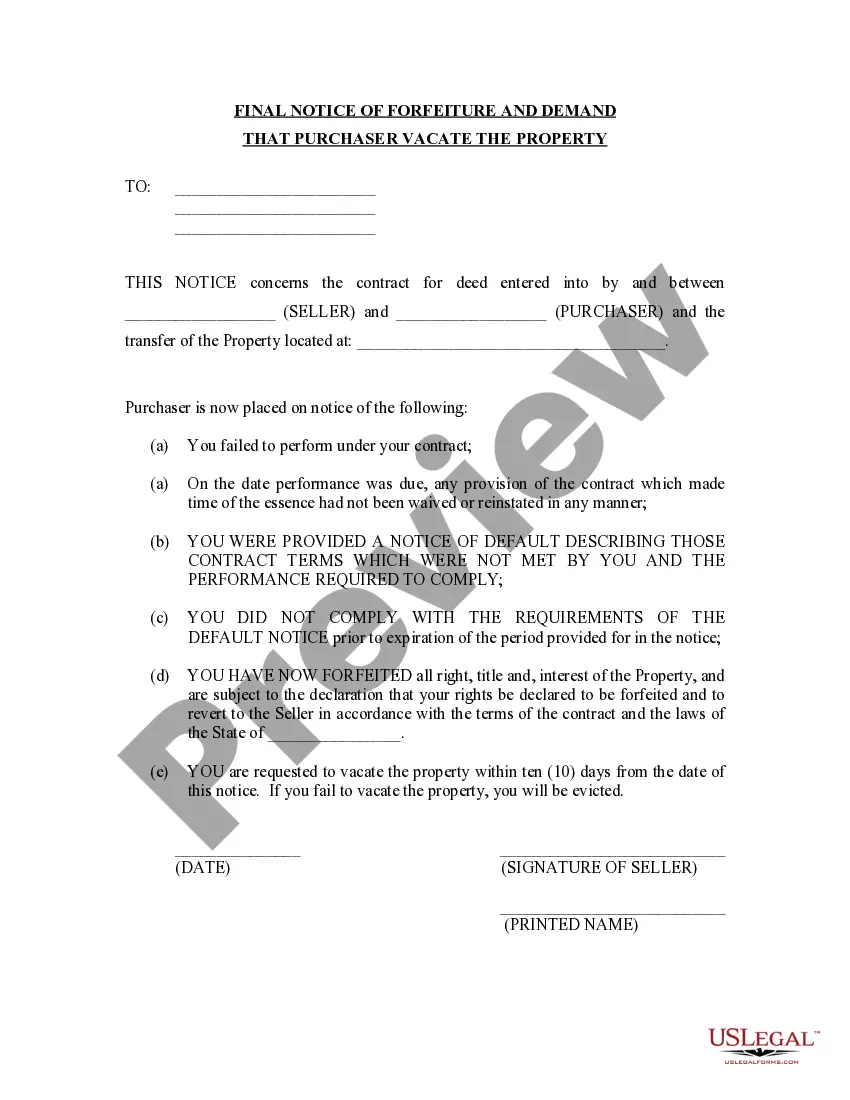

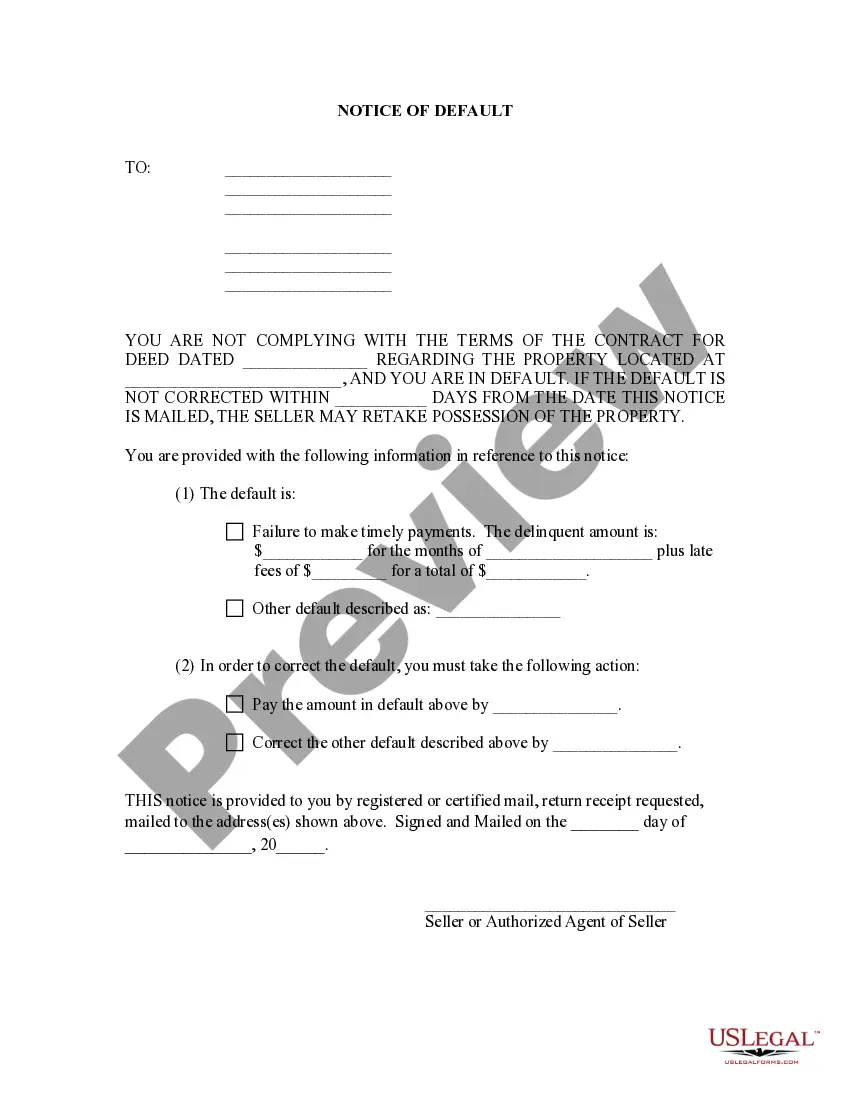

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.

When there is a court judgment against you, the creditor has the right to garnish your wages.With the exception of a student loan debt or a debt owed the government, garnishment can take place only after the creditor obtains a court judgment against you.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

A Proceedings Supplemental is a court-ordered meeting between you and the creditor (the person you owe) to determine what your income, savings and property are. Your bank or employer may also have to give information to the creditor and the court.

Pay off the debt. settle the debt. discharge the debt in Chapter 7 bankruptcy. pay some or all of the debt through a Chapter 13 repayment plan, or. successfully ask the state court to stop the garnishment.

When a creditor obtains a writ of garnishment, the employer is the garnishee and the creditor is the garnishor.In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

If your wages are being garnished for tax debt, Bankruptcy will stop the garnishment and in some cases you may not have to pay the tax debt. Filing Bankruptcy on tax debt will allow you to receive future tax refunds. If your wages are being garnished for student loans, filing Bankruptcy will stop the garnishment.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

In general terms, to attempt to have a wage garnishment ended, modified or reversed, you have the following options. First, you could attempt to negotiate a monthly payment agreement with the creditor/collector.Third, you could file an appeal with the court if you do not agree with the garnishment.