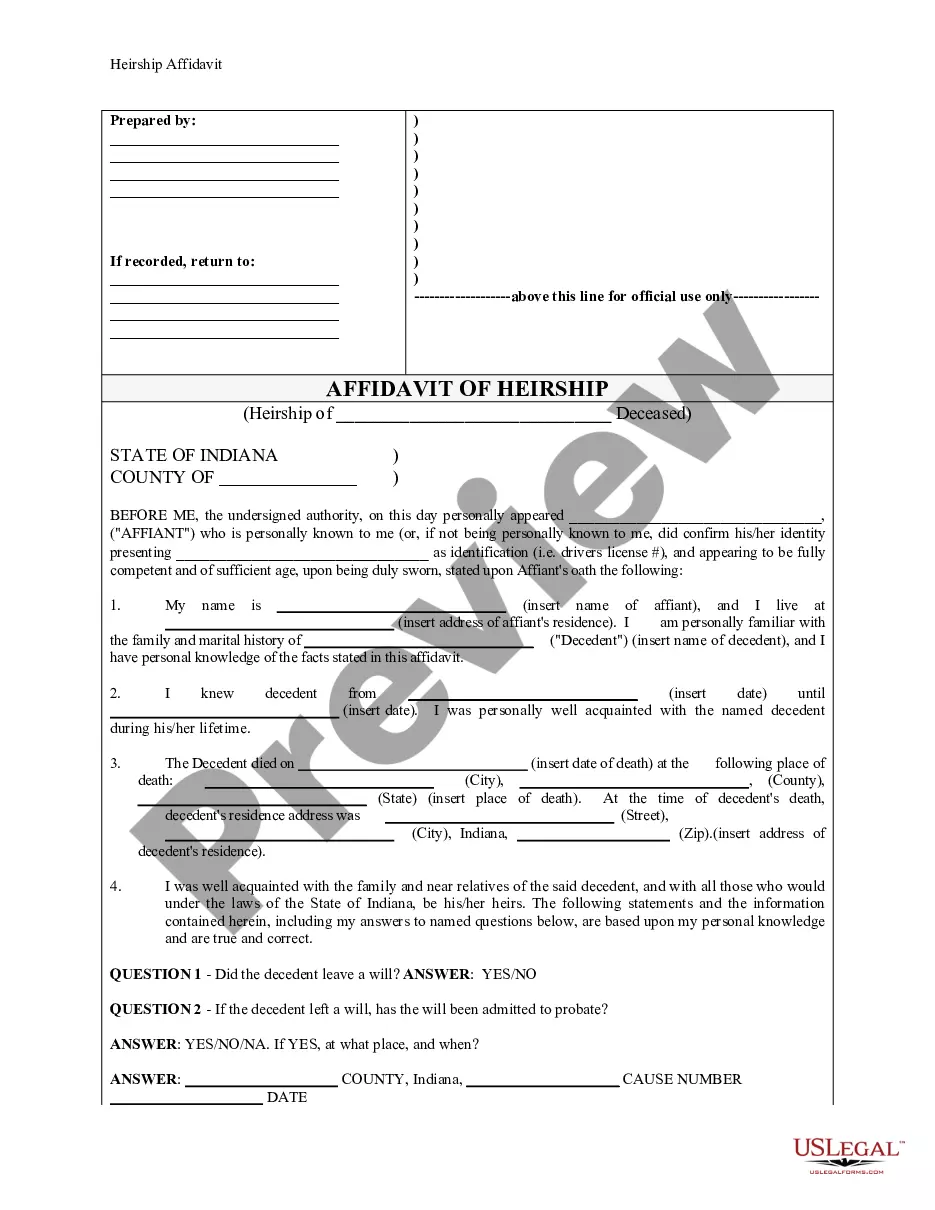

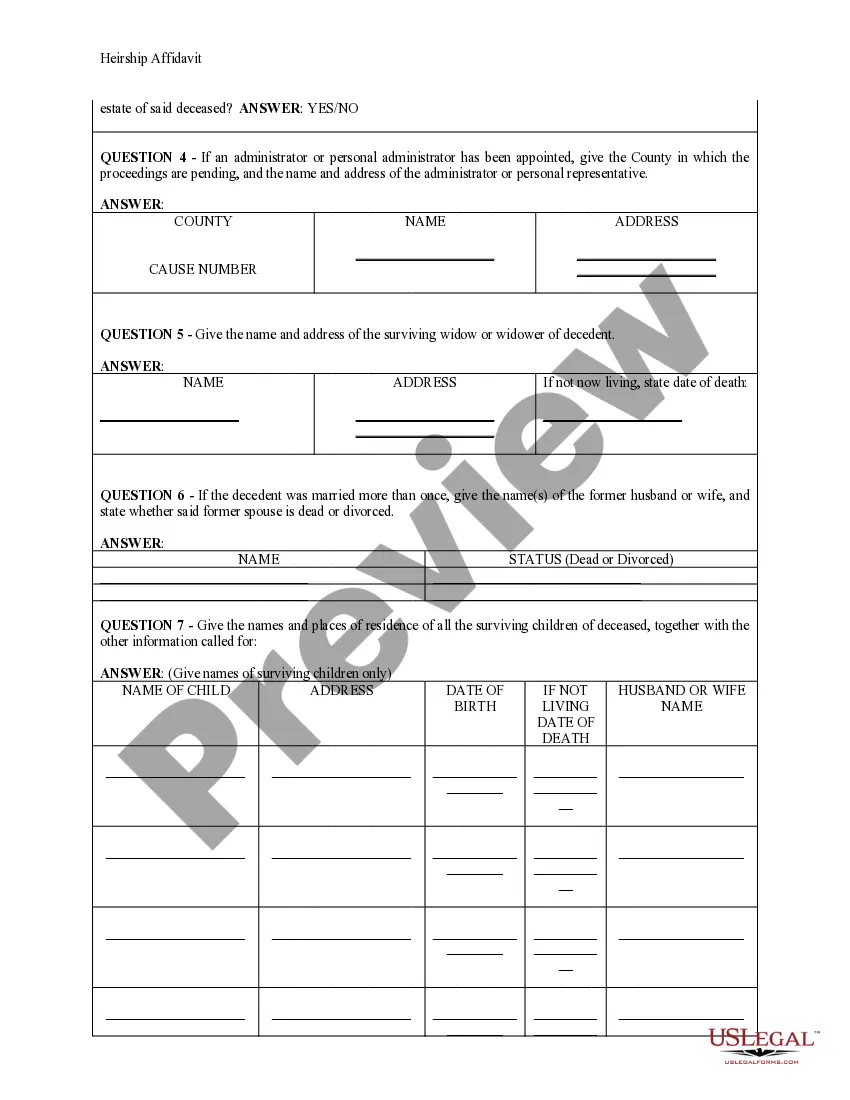

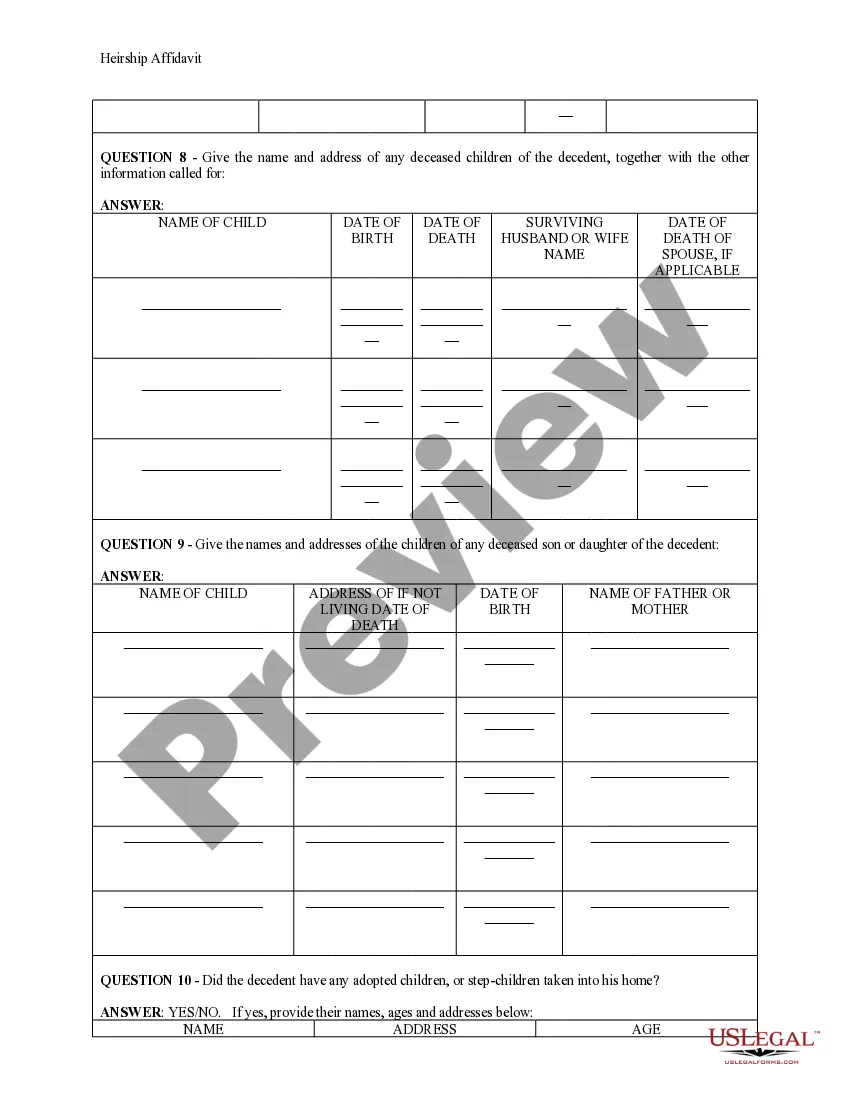

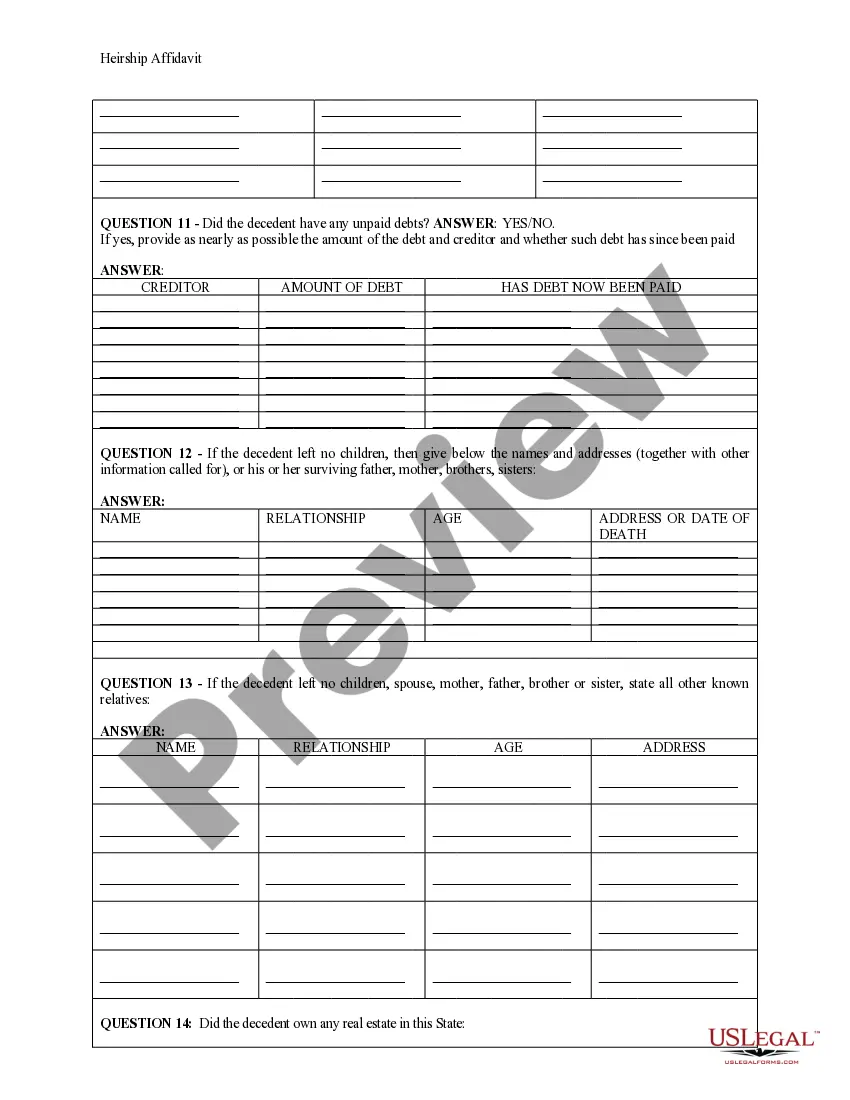

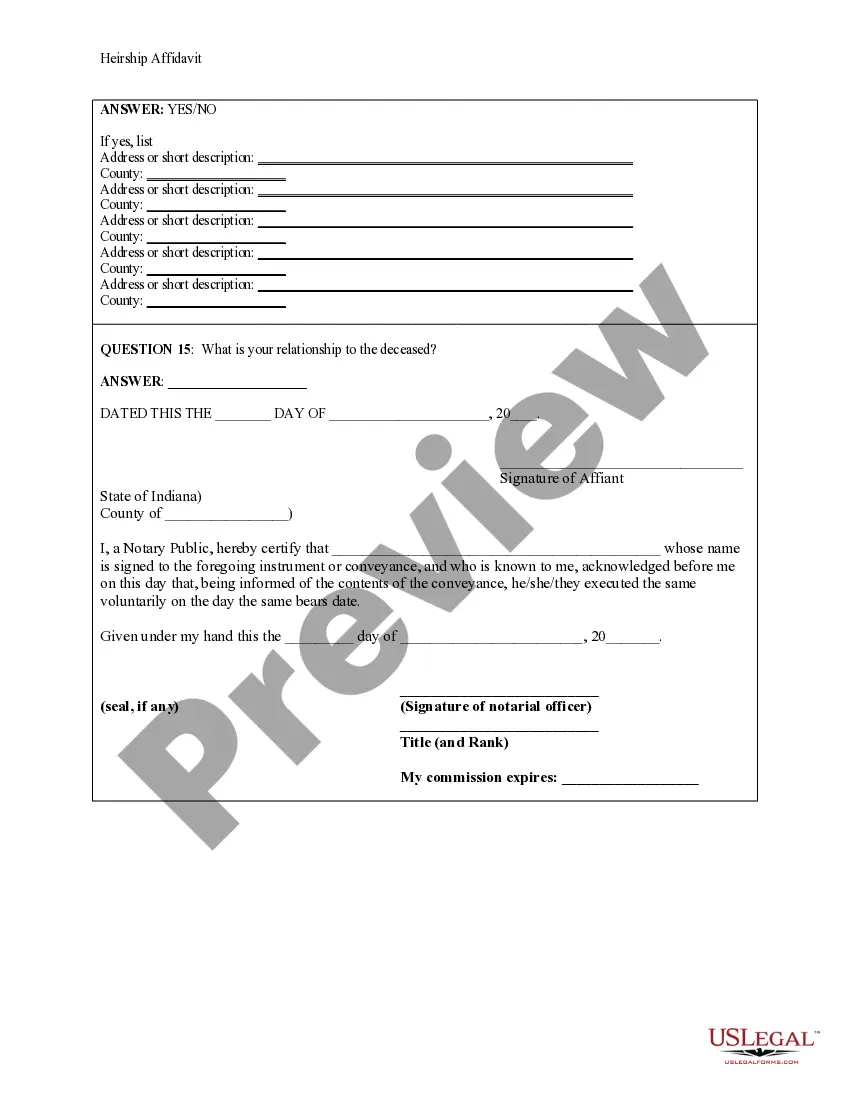

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Indiana Heirship Affidavit - Descent

Description Heirship Affidavit Application

How to fill out In Heirship Document?

Searching for Indiana Heirship Affidavit - Descent forms and completing them could be a challenge. To save time, costs and effort, use US Legal Forms and find the correct sample specifically for your state in a few clicks. Our lawyers draw up all documents, so you just need to fill them out. It is really so easy.

Log in to your account and come back to the form's page and download the document. All your saved templates are kept in My Forms and are accessible at all times for further use later. If you haven’t subscribed yet, you have to register.

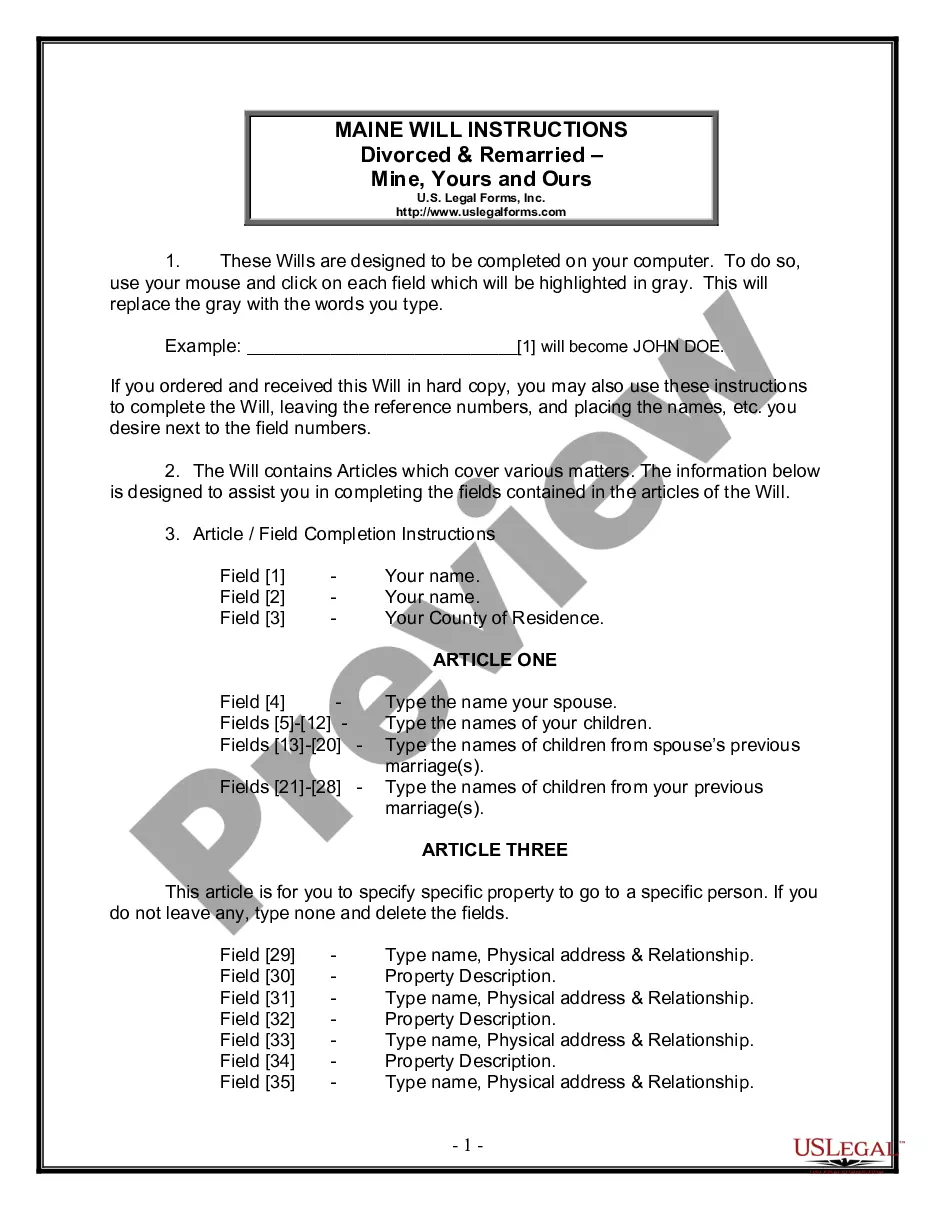

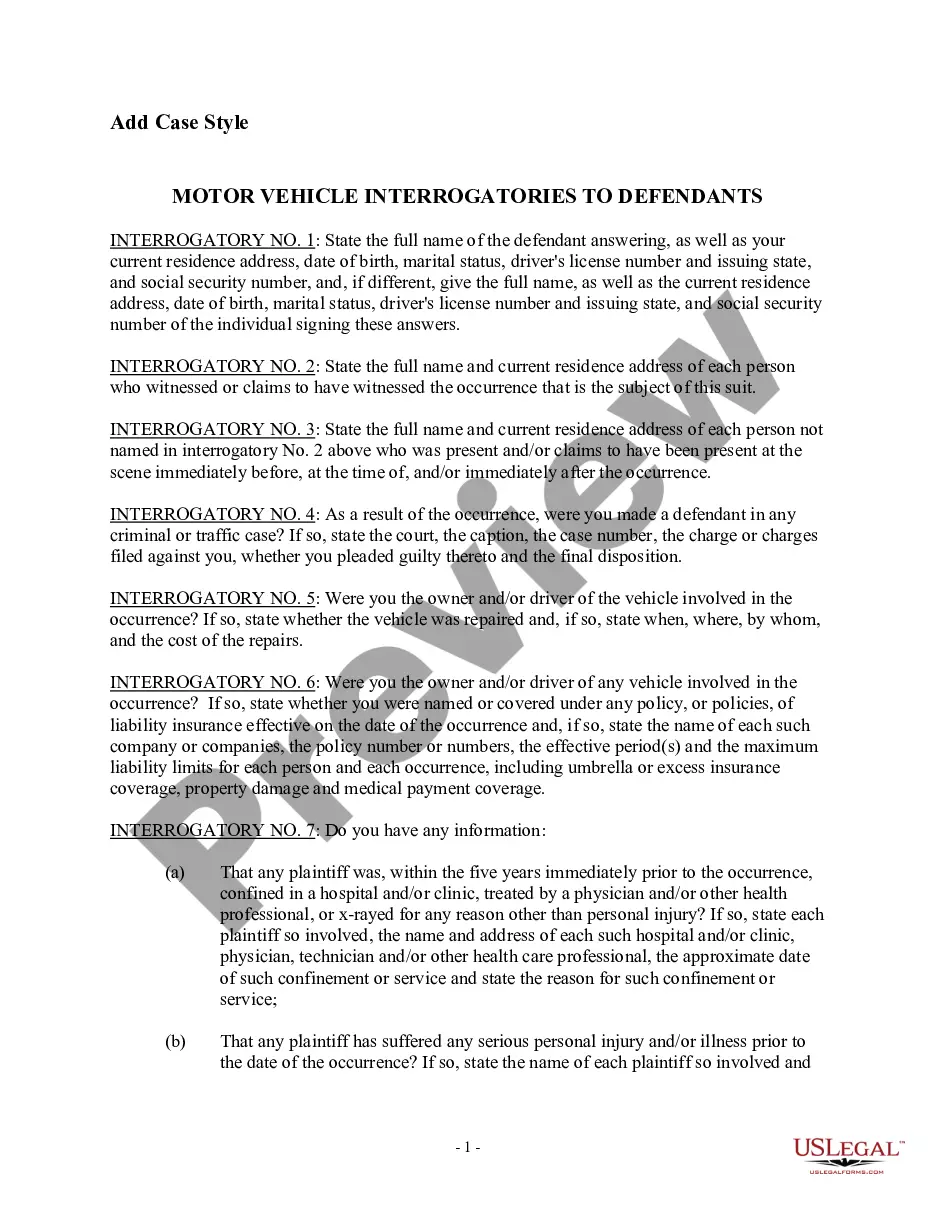

Take a look at our detailed instructions regarding how to get the Indiana Heirship Affidavit - Descent template in a couple of minutes:

- To get an entitled sample, check out its applicability for your state.

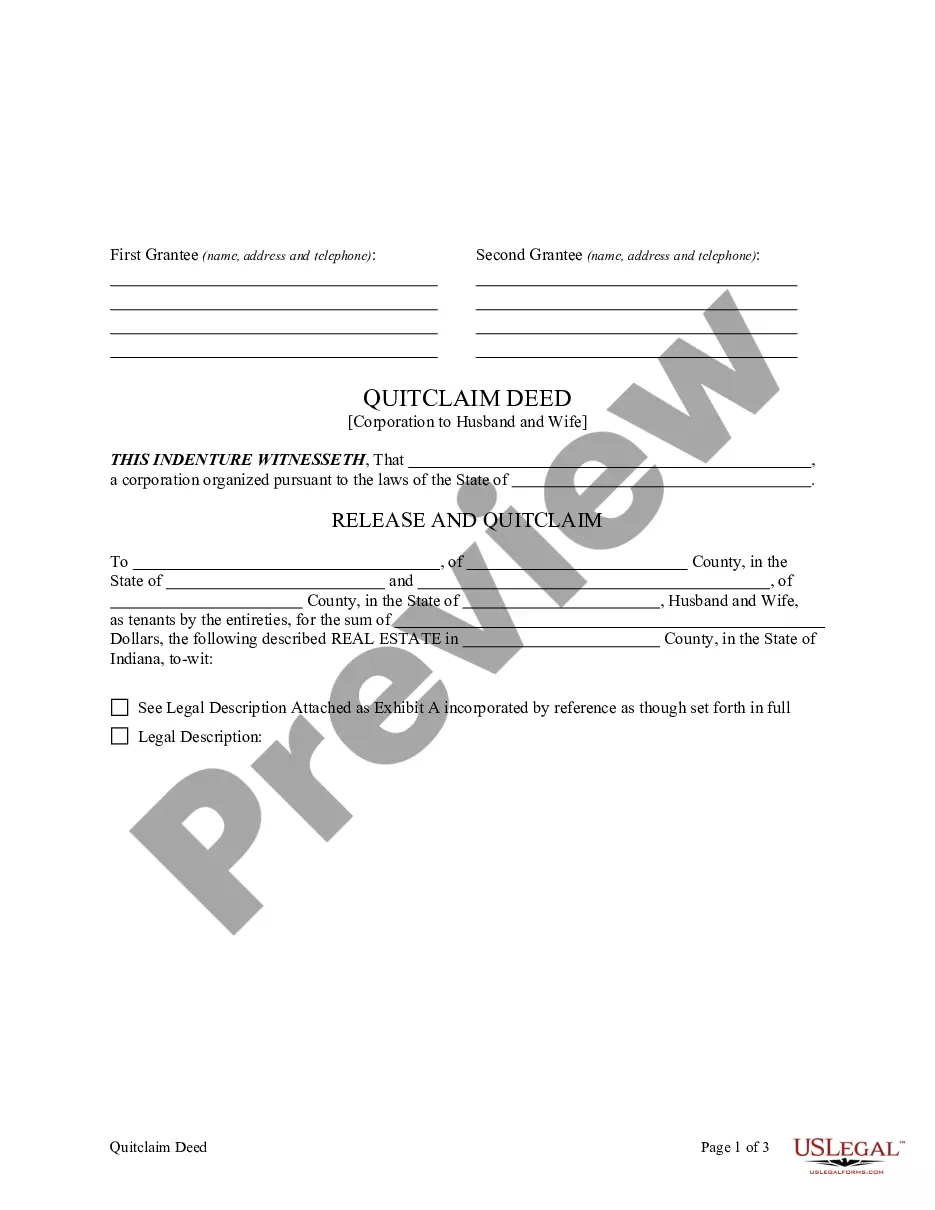

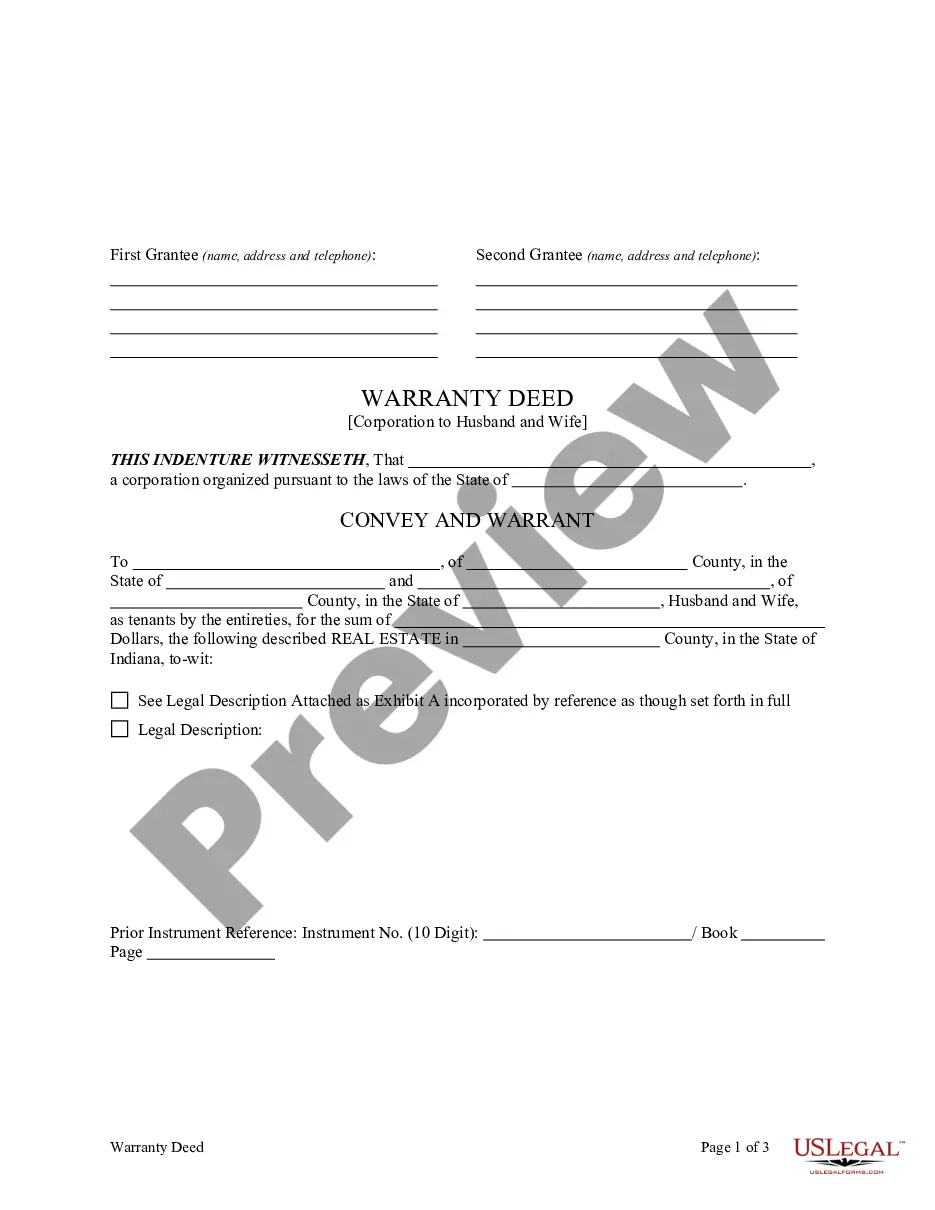

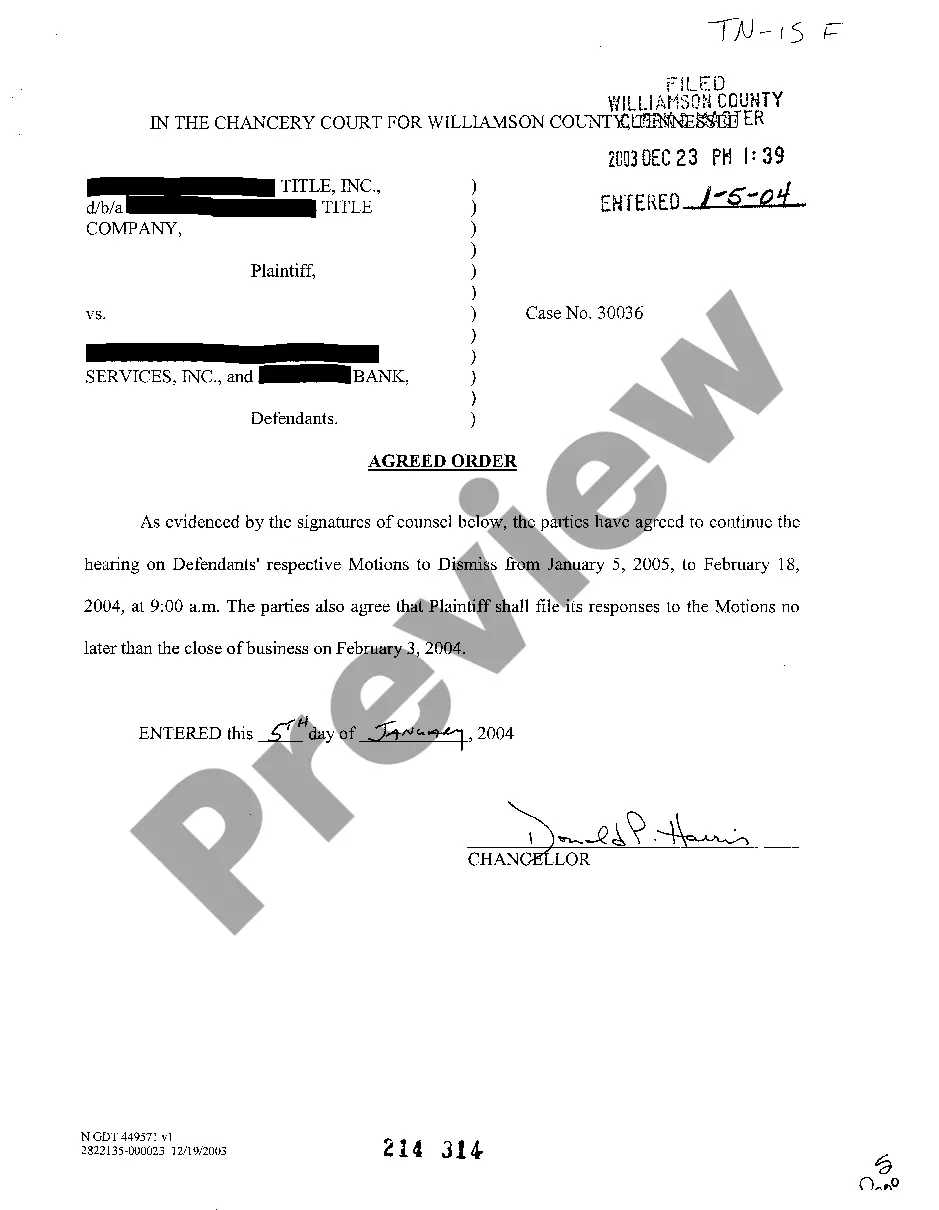

- Take a look at the example utilizing the Preview function (if it’s accessible).

- If there's a description, go through it to learn the specifics.

- Click on Buy Now button if you identified what you're searching for.

- Pick your plan on the pricing page and create an account.

- Pick how you wish to pay with a card or by PayPal.

- Download the sample in the favored format.

Now you can print out the Indiana Heirship Affidavit - Descent form or fill it out using any online editor. Don’t worry about making typos because your form can be applied and sent away, and published as often as you would like. Check out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Affidavit Of Heirship Indiana Form popularity

Heirship In Other Form Names

Indiana Small Estate Affidavit For Bank Account FAQ

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

No. This form should not be filed in court. This form should be filled out and given to the person or company that has the property that you have a right to. For example, if you are trying to get the funds out of your deceased spouse's bank account, you would give the form to the bank.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Harris County Civil Courthouse. 201 Caroline, Suite 800. (713) 274-8585.

In my experience, the Court will typically grant a reasonable hourly rate. I typically see somewhere around $15-$25 an hour based on the complexity of the work performed by the executor.

Probate and its alternatives in Indiana. Conducting a probate in Indiana commonly takes six months to a year, depending on the situation. It can take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

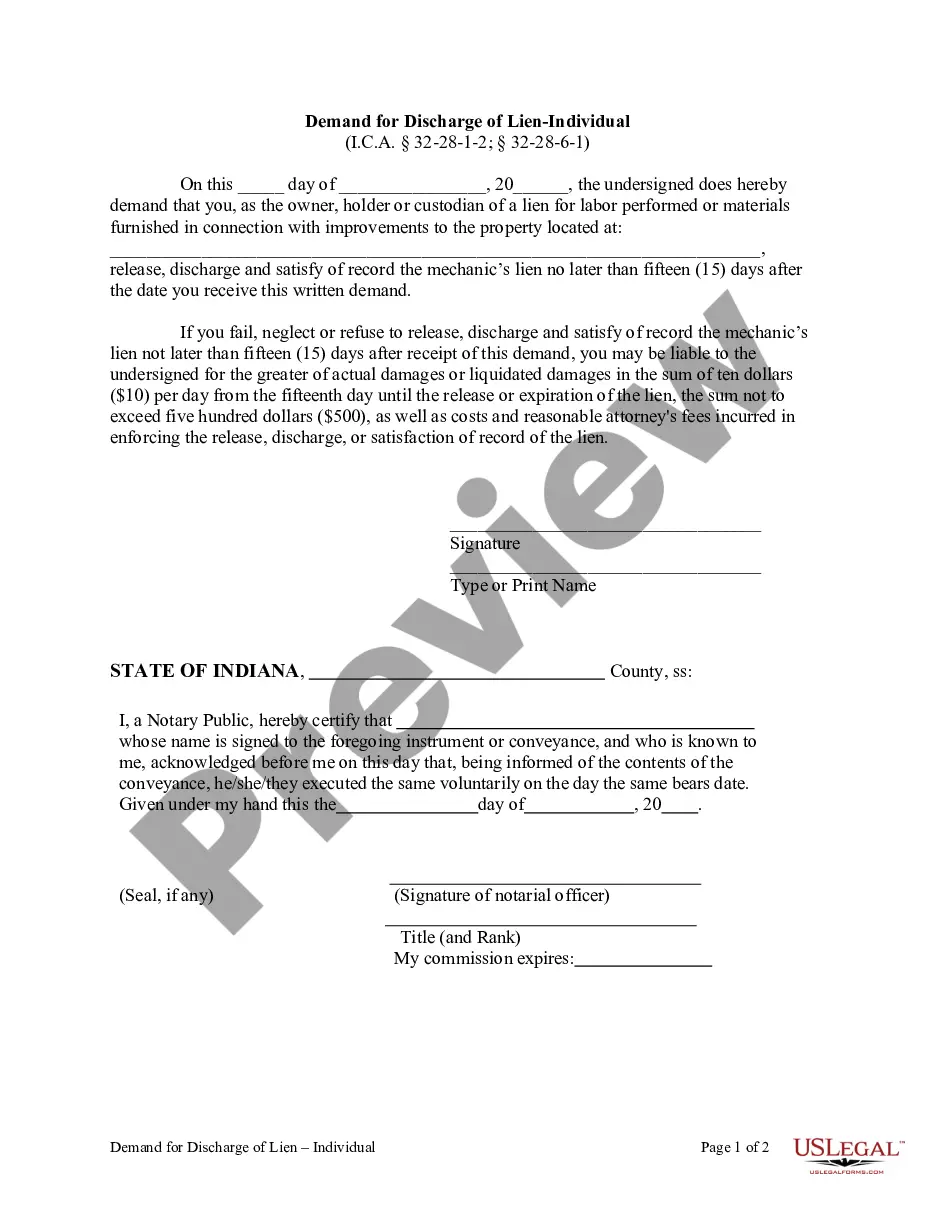

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.