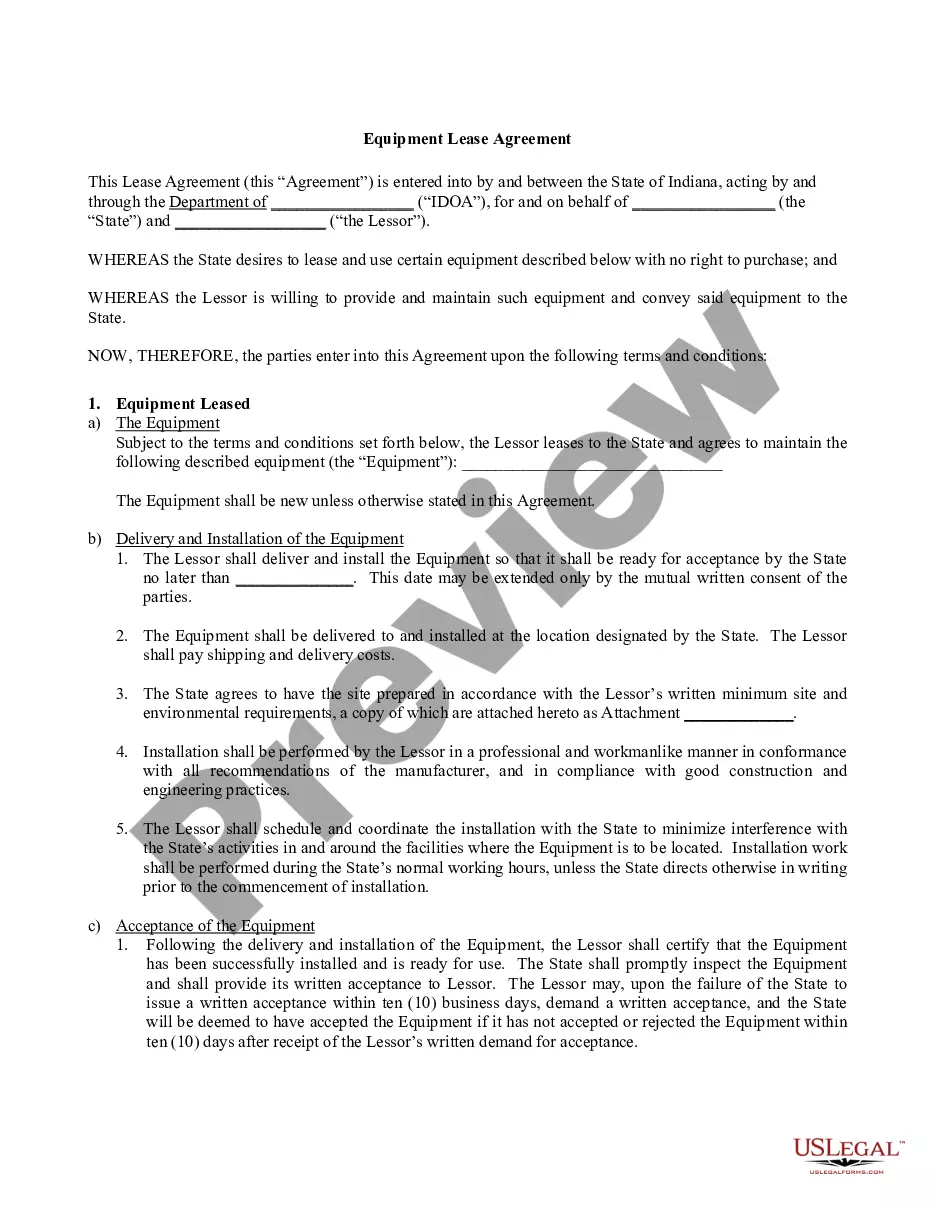

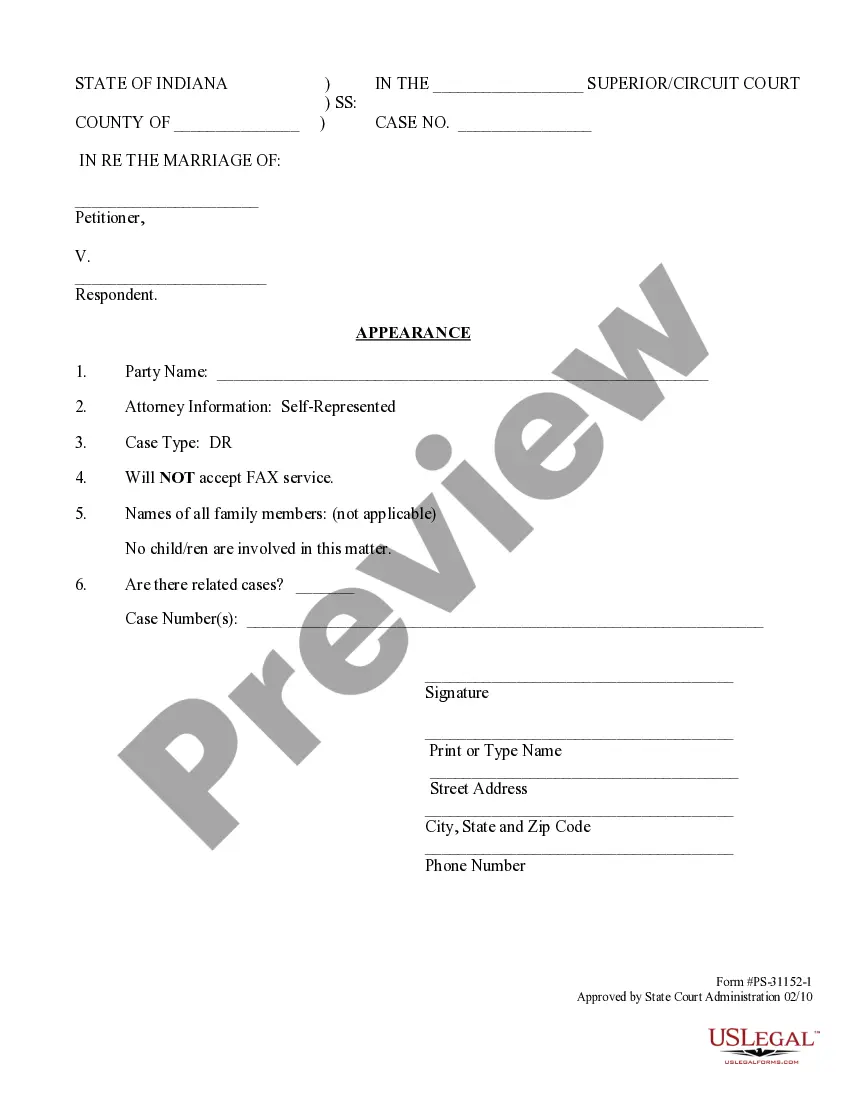

This form is a Renunciation and Disclaimer of a Joint Tenant Interest. Upon the death of the decedent, the beneficiary became the surviving joint tenant and gained an interest in the decedent's portion of the property. However, according to the Indiana Code, Title 29, Chapter 2, the surviving joint tenant has decided to disclaim his/her entire interest in the property. The property will devolve to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Indiana Renunciation and Disclaimer of Joint Tenant or Tenancy Interest

Description In Tenant Tenancy

How to fill out In Tenancy Interest?

Searching for Indiana Renunciation and Disclaimer of Joint Tenant or Tenancy Interest templates and filling out them might be a problem. To save lots of time, costs and effort, use US Legal Forms and choose the right template specially for your state in just a couple of clicks. Our legal professionals draw up all documents, so you simply need to fill them out. It really is that easy.

Log in to your account and return to the form's web page and save the document. All of your downloaded templates are saved in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you should register.

Look at our comprehensive instructions concerning how to get your Indiana Renunciation and Disclaimer of Joint Tenant or Tenancy Interest template in a few minutes:

- To get an qualified example, check its validity for your state.

- Look at the sample using the Preview option (if it’s offered).

- If there's a description, read through it to learn the important points.

- Click Buy Now if you found what you're seeking.

- Pick your plan on the pricing page and create an account.

- Choose you want to pay out by way of a card or by PayPal.

- Download the form in the preferred format.

You can print the Indiana Renunciation and Disclaimer of Joint Tenant or Tenancy Interest template or fill it out making use of any online editor. Don’t concern yourself with making typos because your sample can be utilized and sent, and published as often as you wish. Try out US Legal Forms and access to around 85,000 state-specific legal and tax files.

In Joint Tenant Form popularity

Joint Tenant Interest Other Form Names

Tenant Tenancy Interest FAQ

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

Must be in writing. Must be within nine months of the gift. No acceptance of the gifted interest or any benefits. Interest passes without any direction on the part of the person making the disclaimer.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

A qualified disclaimer is a refusal to accept property that meets the provisions set forth in the Internal Revenue Code (IRC) Tax Reform Act of 1976, allowing for the property or interest in property to be treated as an entity that has never been received.