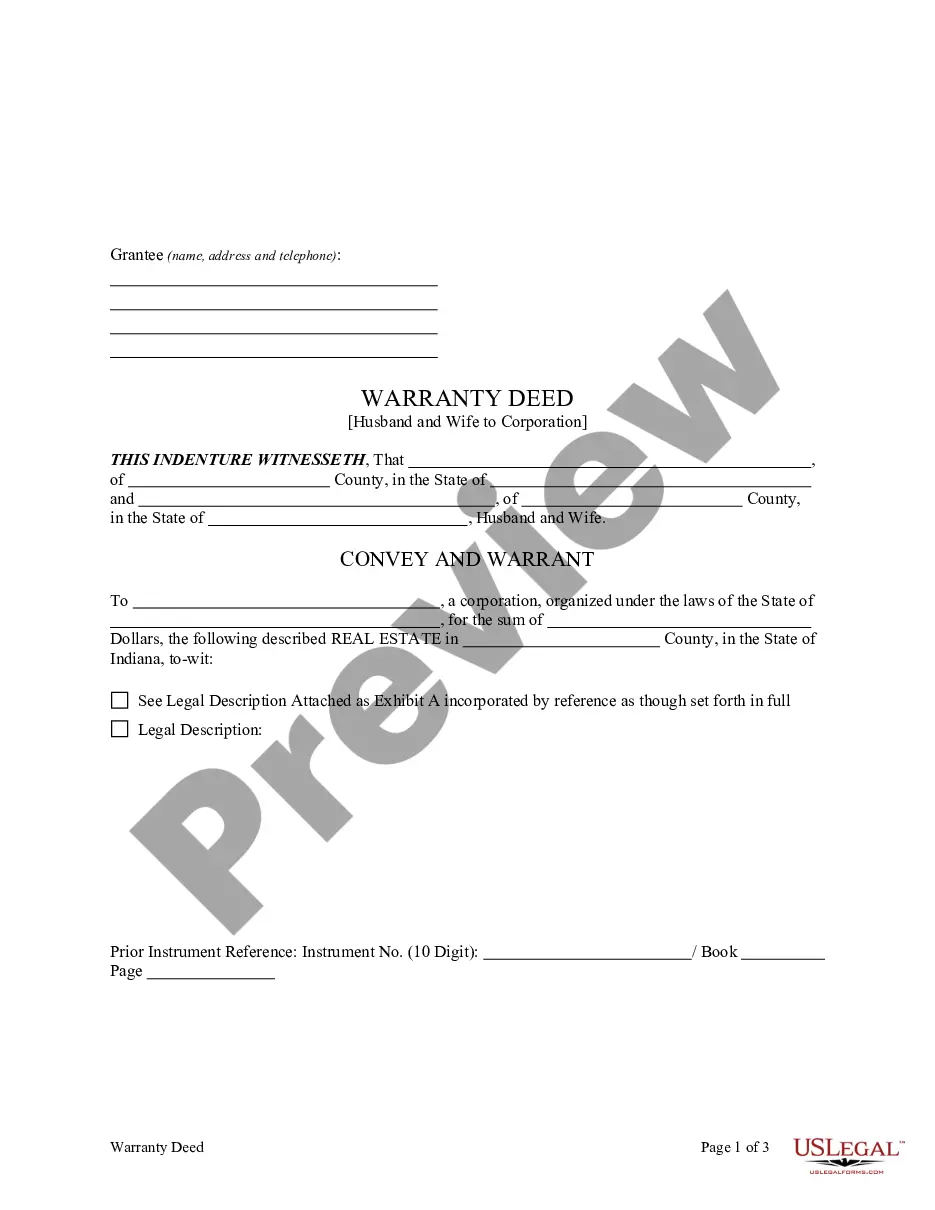

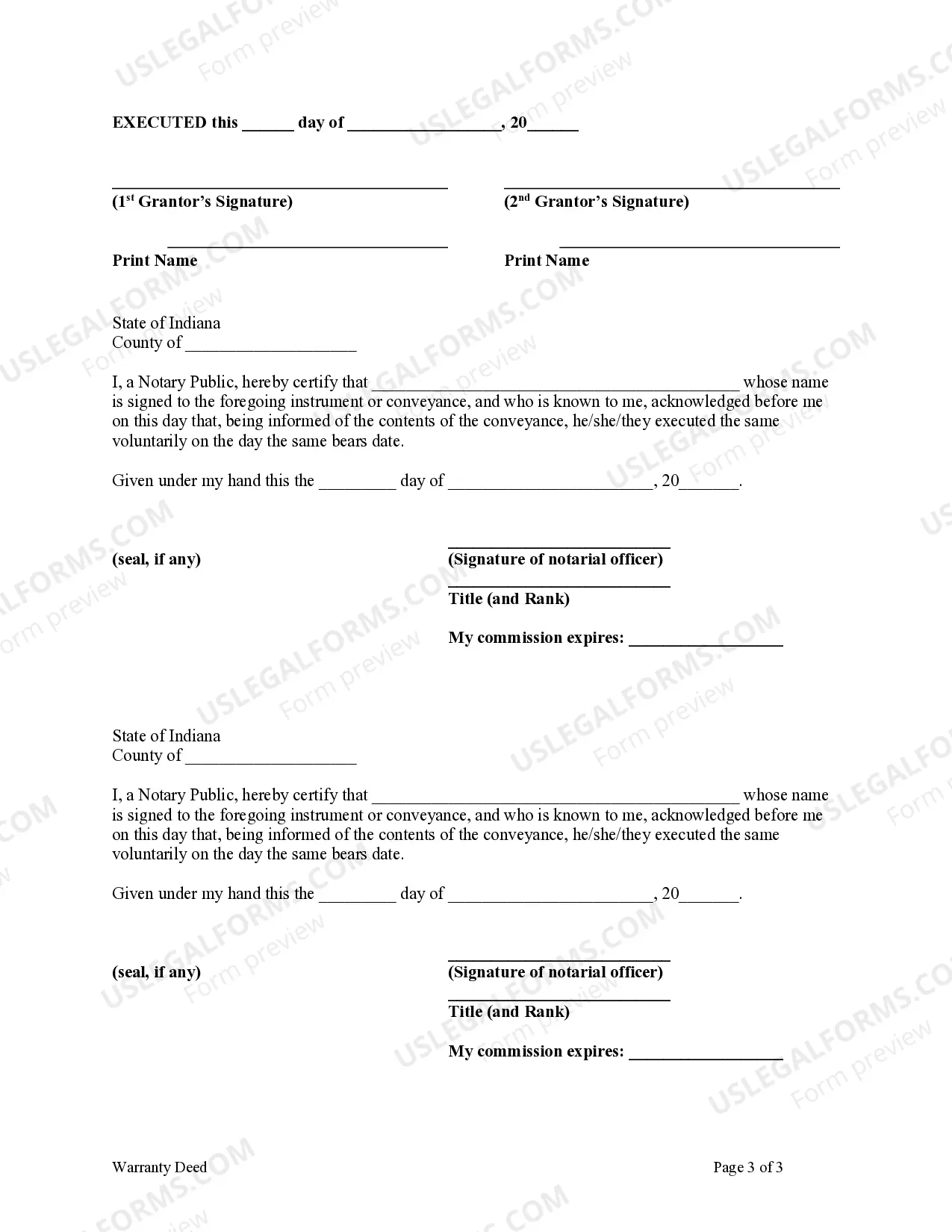

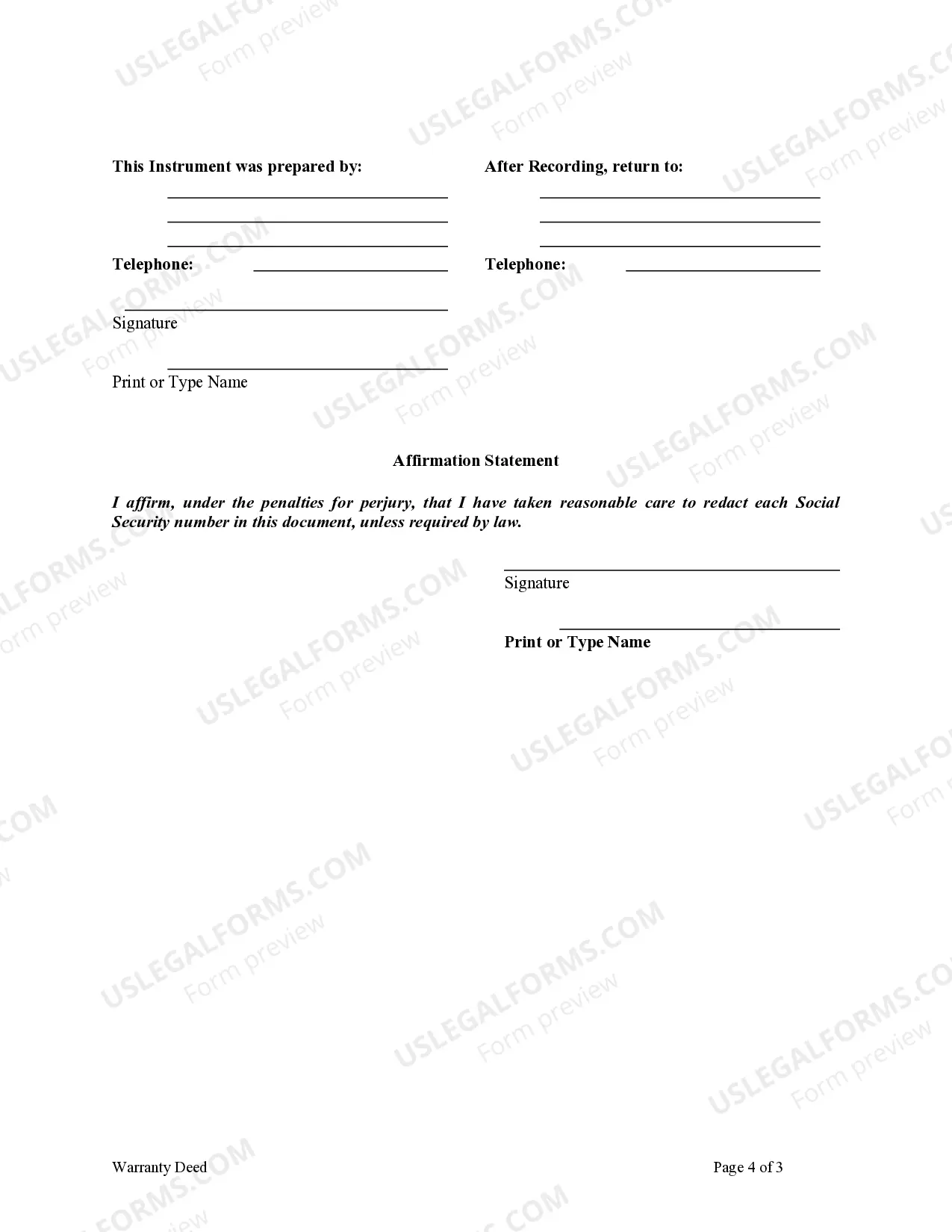

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indiana Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Indiana Warranty Deed From Husband And Wife To Corporation?

Trying to find Indiana Warranty Deed from Husband and Wife to Corporation sample and completing them can be quite a problem. In order to save time, costs and energy, use US Legal Forms and choose the right template specifically for your state in a couple of clicks. Our lawyers draft every document, so you simply need to fill them out. It really is that easy.

Log in to your account and come back to the form's web page and download the document. Your saved templates are saved in My Forms and they are available at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Take a look at our detailed guidelines regarding how to get the Indiana Warranty Deed from Husband and Wife to Corporation form in a few minutes:

- To get an qualified example, check its validity for your state.

- Have a look at the sample utilizing the Preview option (if it’s available).

- If there's a description, read through it to learn the important points.

- Click Buy Now if you found what you're looking for.

- Select your plan on the pricing page and make your account.

- Pick how you would like to pay by way of a card or by PayPal.

- Save the sample in the favored format.

You can print out the Indiana Warranty Deed from Husband and Wife to Corporation template or fill it out making use of any web-based editor. No need to worry about making typos because your template may be utilized and sent away, and printed out as many times as you want. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

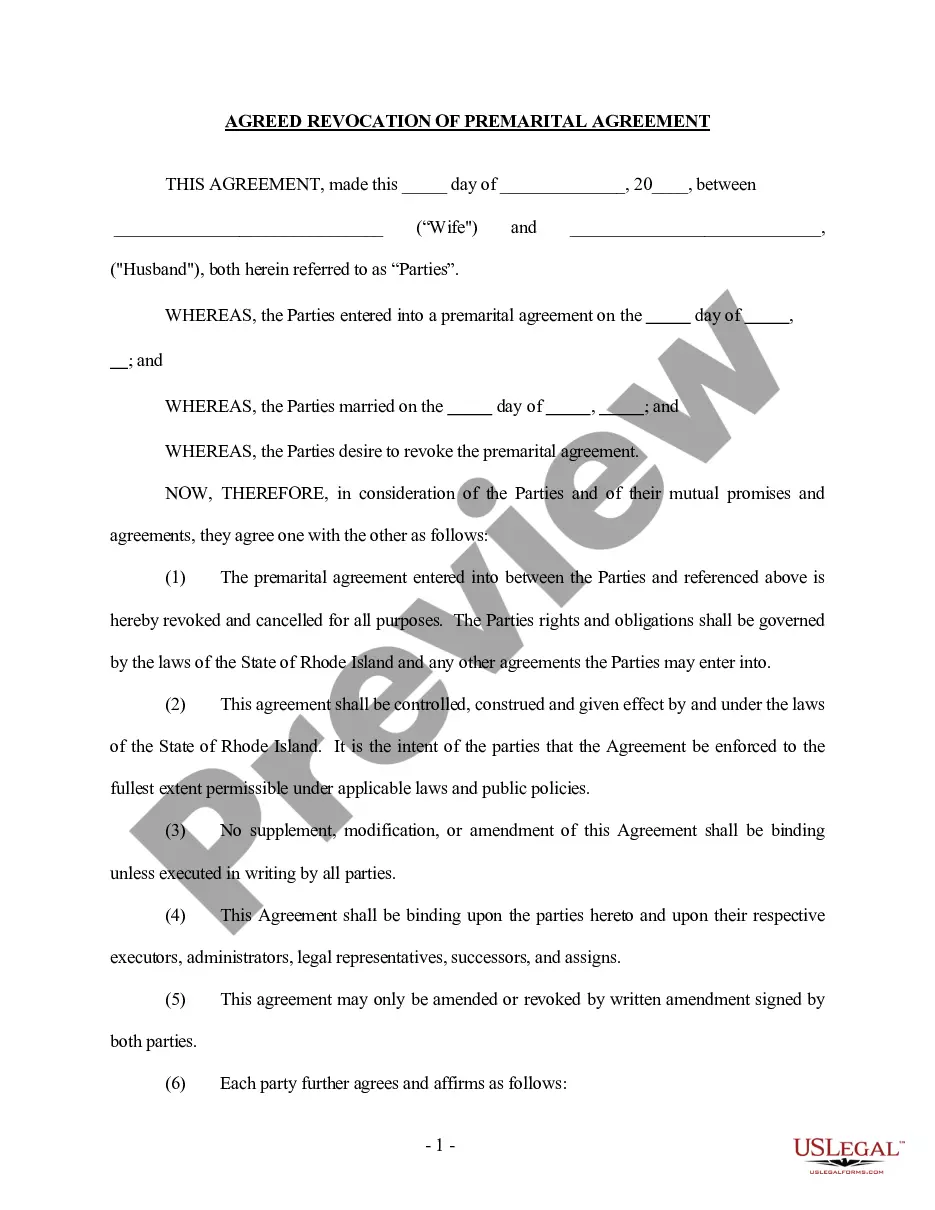

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

Locate the prior deed to the property. Create the new deed. Sign the new deed. Record the original deed.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.