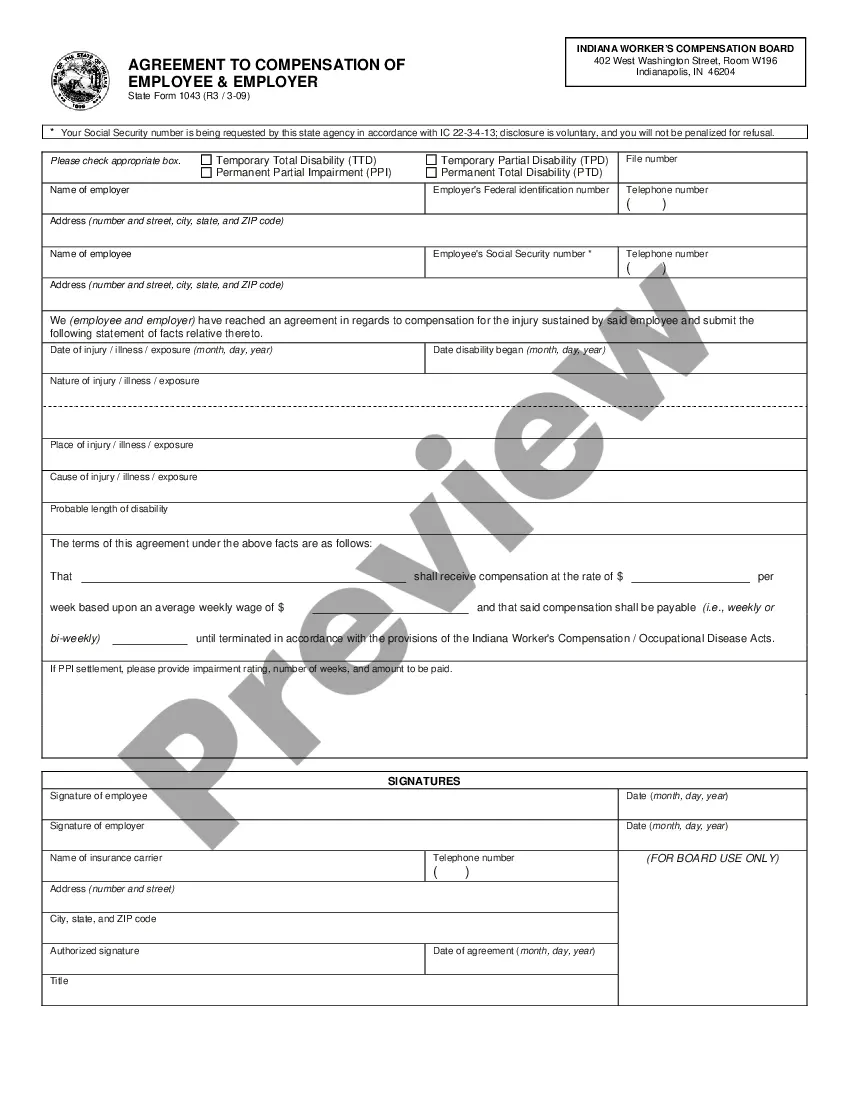

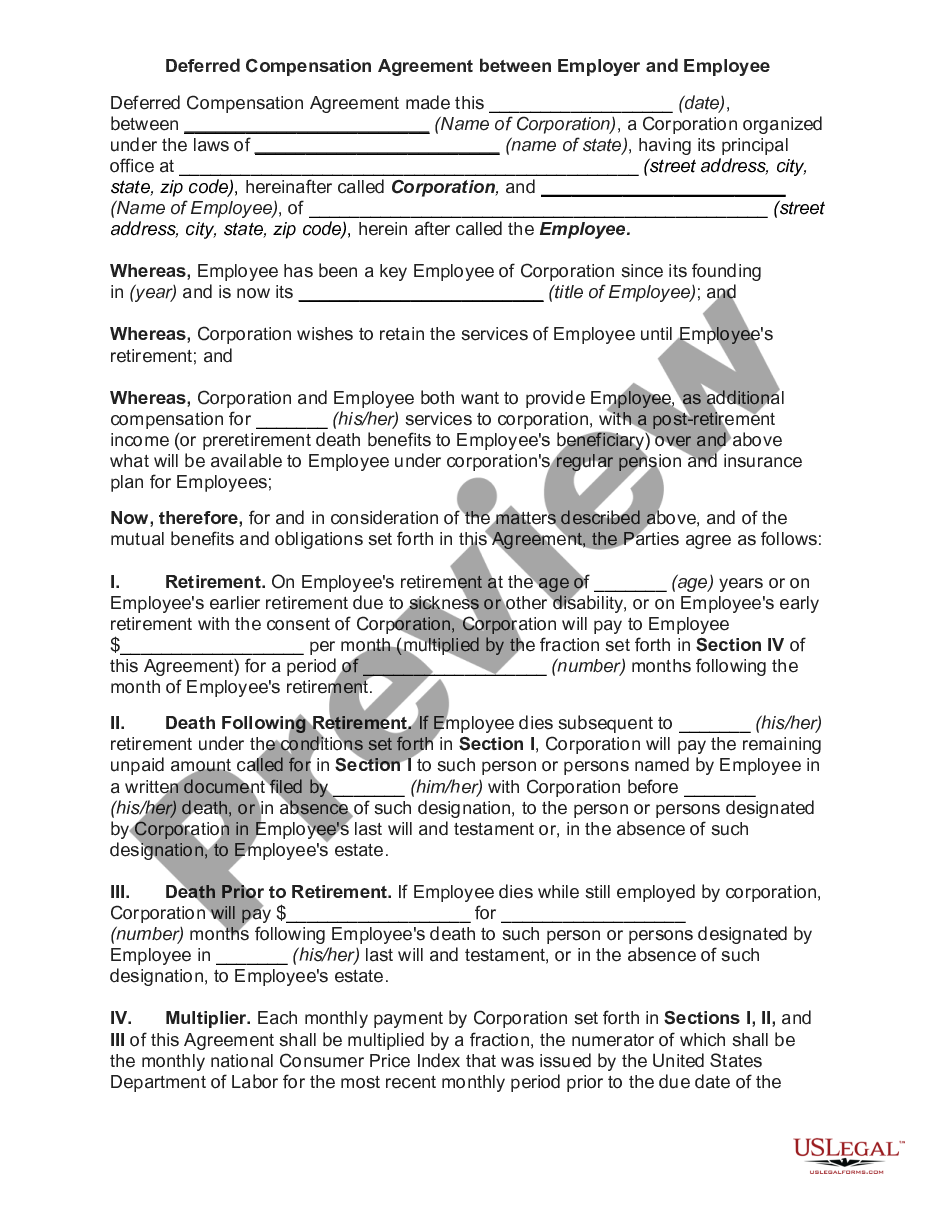

Indiana Agreement to Compensation Between the Dependents of Deceased Employee and Employer — SF 18875 is an agreement between the employer and the dependents of a deceased employee that establishes the terms of compensation for the employee's death. This agreement is used when an employee dies while in the employ of an Indiana business. It outlines the employee's death benefits, such as wage and salary continuation, health insurance coverage, death benefits, and other financial considerations. It also establishes the rights and responsibilities of both the employer and the dependents of the deceased employee. There are two types of Indiana Agreement to Compensation Between the Dependents of Deceased Employee and Employer — SF 18875: one for employers and one for dependents. The employer's agreement outlines the employer's obligations to the dependents of the deceased employee and the dependents' rights to the death benefits due to them. The dependents' agreement outlines the rights of the dependents to any death benefits due to them from the employer. Both agreements must be signed by both parties in order for them to be legally binding.

Indiana Agreement to Compensation Between the Dependents of Deceased Employee and Employer - SF 18875

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Agreement To Compensation Between The Dependents Of Deceased Employee And Employer - SF 18875?

Handling official documentation necessitates focus, precision, and utilizing correctly-prepared forms.

US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Indiana Agreement to Compensation Between the Dependents of Deceased Employee and Employer - SF 18875 template from our collection, you can be assured it complies with federal and state regulations.

All documents are crafted for multiple uses, like the Indiana Agreement to Compensation Between the Dependents of Deceased Employee and Employer - SF 18875 you see on this page. If you require them again, you can fill them out without an additional fee - just access the My documents tab in your profile and complete your document whenever necessary. Experience US Legal Forms and achieve your business and personal documentation quickly and in complete legal compliance!

- Keep in mind to thoroughly review the form details and its alignment with general and legal criteria by previewing it or reading its description.

- Look for another official document if the one you opened doesn’t fit your circumstances or state laws (the option for that is located at the top page corner).

- Log in to your account and save the Indiana Agreement to Compensation Between the Dependents of Deceased Employee and Employer - SF 18875 in your desired format. If it’s your first time using our service, click Buy now to proceed.

- Create an account, choose your subscription package, and pay with your credit card or PayPal account.

- Select the format you would like to receive your form in and click Download. Print the document or integrate it into a professional PDF editor for hassle-free submission.

Form popularity

FAQ

It means that an employee is in the course of his employment when he is engaged in doing something in the discharge of his duties to his employer and also when he is engaged in an action arising out of it.

?Arising out of employment? and ?in the course of employment? are separate elements. The former refers to injury causation. There must be a causal connection between the injury and an employment-related risk. The latter refers to the time, place, and circumstance of the injury.

If the accident took place during the course of his employment, then the employer is liable to pay full wages till he resumes duty. In such case the leave is called accident leave. No need to avail SL or any other leave.

As a general rule, an uncashed paycheck issued prior to the employee's death should be canceled, and a new check should be issued in the name of the employee's estate or beneficiary. The new check should have the same amount withheld for tax purposes as the old check.

?In the course of employment? refers to the time, place, and circumstances under which an accident occurred. An accident occurs ?in the course of employment? when it occurs. Within the period of employment, At a place where the employee reasonably may be in the performance of the employee's duties, and.

Factors that determine amount of compensation The benefit depends upon the monthly wages earned by the worker, the nature of the injury, and a relevant factor defined in the Act. These factors help to calculate the amount of workmen's compensation. The compensation also depends on the age of the injured employee.

Contracting an occupational disease is deemed to be an injury by accident and is deemed to have arisen out of and in the course of employment. So, the employer is liable to pay compensation for such diseases which can be directly attributed to specific injuries by accident.