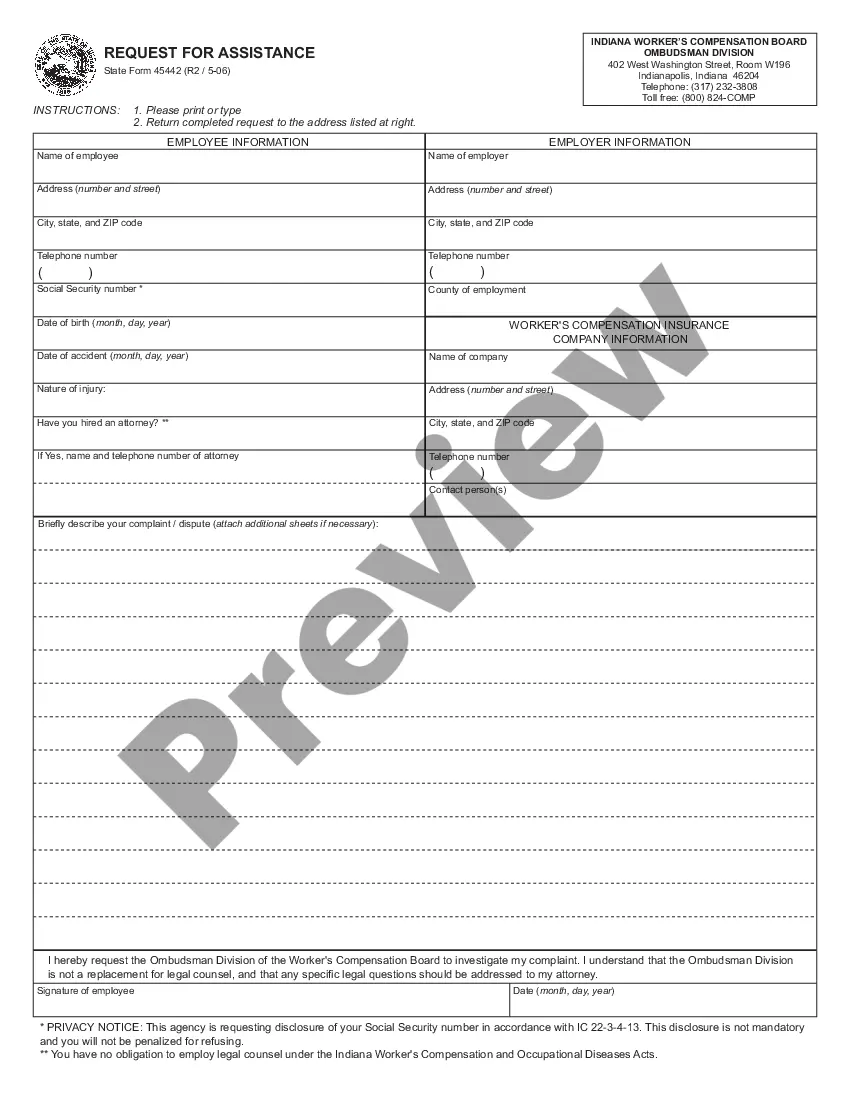

Indiana Notice of Inability to Determine Liability / Request for Additional Time — SF 48557 is a form used by the state of Indiana when an individual or business needs more time to determine their tax liability. This form is typically used when a taxpayer’s records are incomplete or require additional review. The form provides information on the taxpayer’s current status, including the taxpayer’s name, address, and taxpayer identification number (TIN). The form includes two types of requests: a request for an extension of time to file a return and a request for additional time to determine the amount of tax due. The taxpayer must provide an explanation of why they are unable to determine their liability and must also provide evidence of their efforts to comply with the state’s tax laws. The form must be completed and signed by the taxpayer or their appointed representative. It must be sent to the Indiana Department of Revenue (FOR) within 30 days of the original due date. The FOR will review the request and may grant an extension of time to file or may require additional information before determining the taxpayer’s liability.

Indiana Notice of Inability to Determine Liability / Request for Additional Time - SF 48557**

Description

How to fill out Indiana Notice Of Inability To Determine Liability / Request For Additional Time - SF 48557**?

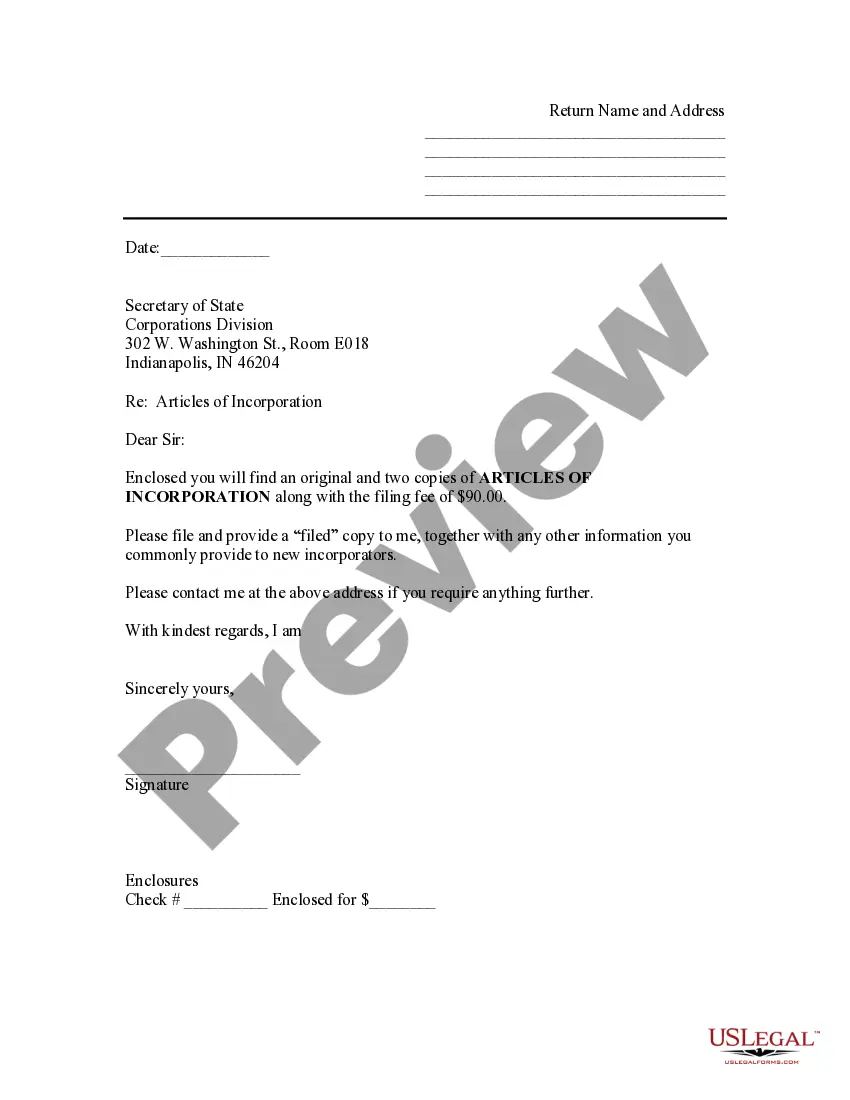

US Legal Forms is the most uncomplicated and economical method to discover suitable official templates.

It boasts the largest online collection of business and personal legal documents prepared and authenticated by legal experts.

Here, you can locate printable and fillable templates that adhere to national and local regulations - just like your Indiana Notice of Inability to Determine Liability / Request for Additional Time - SF 48557**.

Review the form description or preview the document to confirm you’ve chosen the one that fulfills your needs, or find another using the search feature above.

Click Buy now when you’re confident about its compliance with all the requirements, and select the subscription plan that suits you best.

- Acquiring your template involves just a few easy steps.

- Users with an existing account and an active subscription only need to sign in to the site and download the document onto their device.

- Later, they can find it in their profile under the My documents section.

- And here’s how to obtain a professionally crafted Indiana Notice of Inability to Determine Liability / Request for Additional Time - SF 48557** if you are experiencing US Legal Forms for the first time.

Form popularity

FAQ

Temporary Total Disability In Indiana, these benefits are calculated as two-thirds of your average weekly wage during the year before your injury, up to a legal maximum.

Fine up to $10,000. Compensation not to exceed double the compensation provided by this Act; Medical expenses, and. Reasonable attorney fees.

The failure to report an injury could result in fines or even jail time. Once you submit the form, the insurer must submit a copy to the Workers' Compensation Board and accept or deny the claim within 29 days.

PTD, also known as permanent total disability, are those benefits awarded to employees who are permanently or completely disabled from a work related injury. If an employee is unable to work due to injuries, Indiana law states that an employer's workers' compensation pays those benefits.

The rule in temporary partial disability (TPD) is that if the person earns less than they did at the time of their injury during the period of light duty, they are entitled to two-thirds of the difference.

TPD benefits last for a maximum of 300 weeks. Once the doctor determines that the injured worker has reached maximum medical improvement, the worker will be evaluated to determine whether he or she has any permanent impairment.

TTD benefits are calculated as two-thirds of the worker's average weekly wage during the year before the injury occurred. In Indiana, the maximum average weekly wage for determining benefits is $1,170 (as of 2020). That equates to a maximum TTD benefit of $780 per week.

Calculate the worker's Average Weekly Wage (AWW) from the past 52 weeks. The Permanent Total Disability (TTD) rate is calculated at two-thirds (2/3) of the AWW. In 2021, the maximum PTD benefit is $711.00 per week.