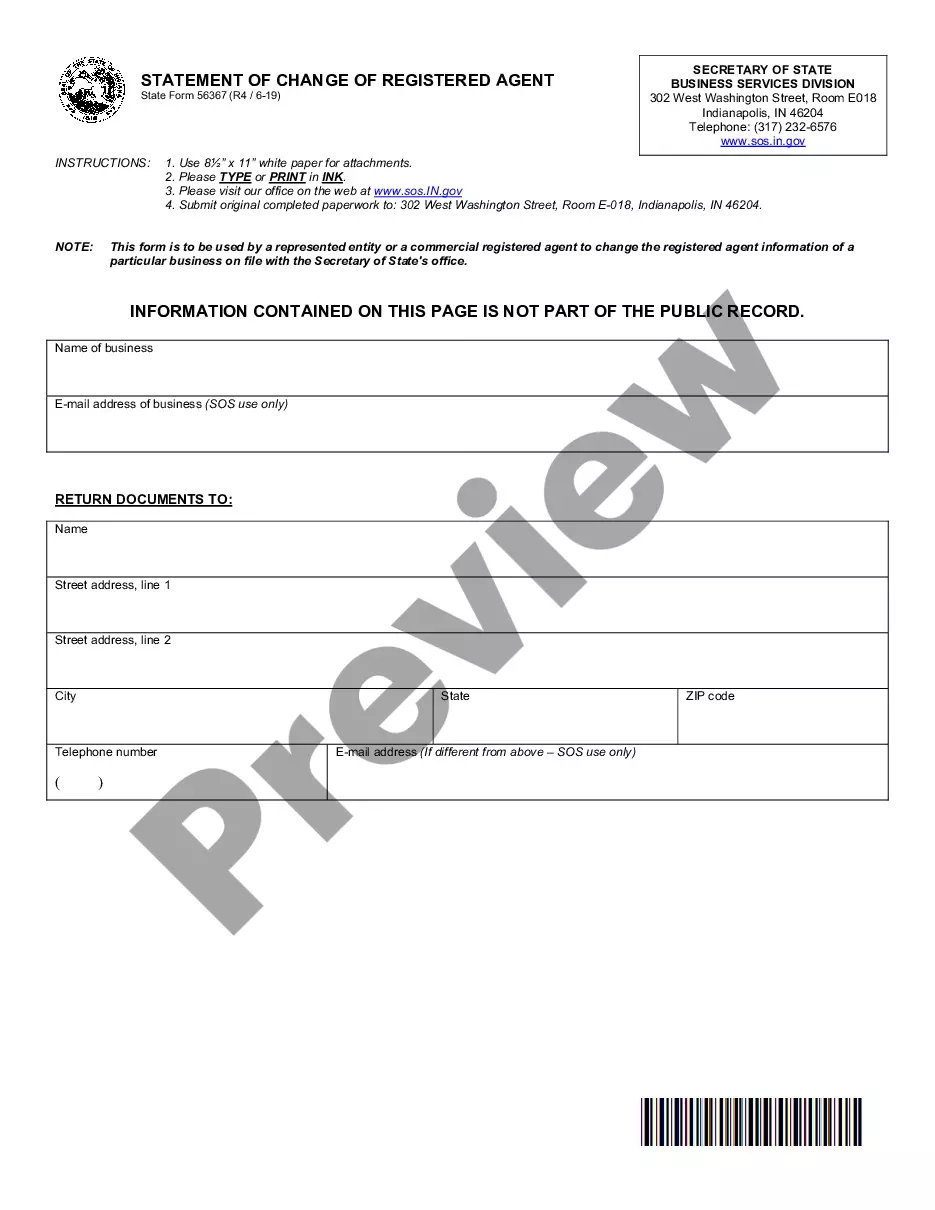

Indiana 51574- Articles of Entity Conversion: Conversion of A Corporation Into A Limited Liability is a process by which a corporation is converted into a limited liability company or LLC. This process is used in Indiana under Indiana Code Title 23, Chapter 1, Article 15, Section 51574. The process involves filing Articles of Entity Conversion with the Indiana Secretary of State, which contains basic information about the corporation and the LLC, such as the names, addresses, and purpose of the entity. This process is beneficial for businesses that want to take advantage of the advantages of the LLC structure such as limited liability, tax benefits, and flexible management options. There are two types of Indiana 51574- Articles of Entity Conversion: conversion of a Domestic Corporation into a Domestic LLC and conversion of a Foreign Corporation into a Domestic LLC.

Indiana 51574- Articles of Entity Conversion: Conversion of A Corporation Into A Limited Liability is a process by which a corporation is converted into a limited liability company or LLC. This process is used in Indiana under Indiana Code Title 23, Chapter 1, Article 15, Section 51574. The process involves filing Articles of Entity Conversion with the Indiana Secretary of State, which contains basic information about the corporation and the LLC, such as the names, addresses, and purpose of the entity. This process is beneficial for businesses that want to take advantage of the advantages of the LLC structure such as limited liability, tax benefits, and flexible management options. There are two types of Indiana 51574- Articles of Entity Conversion: conversion of a Domestic Corporation into a Domestic LLC and conversion of a Foreign Corporation into a Domestic LLC.