The Indiana Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period is a form required for filing a Chapter 13 bankruptcy in Indiana. It is used to determine the debtor’s monthly income, calculate the repayment plan, and set the length of the repayment period. The form consists of two parts: the Statement of Your Current Monthly Income and the Calculation of Commitment Period. In the Statement of Your Current Monthly Income, the debtor must provide information about their monthly income from all sources, such as wages, self-employment, disability, and other income. The form also requires the debtor to list their monthly expenses, such as rent, food, clothing, utilities, and other necessary expenses. In the Calculation of Commitment Period, the debtor must calculate the total amount of their monthly disposable income. This is determined by subtracting the total monthly expenses from total monthly income. The court then uses this figure to determine the debtor’s repayment period, which is usually between three and five years. There are two types of Indiana Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period: the standard form and the simplified form. The standard form requires detailed information about income and expenses, while the simplified form only requires basic information.

Indiana Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period

Description

How to fill out Indiana Chapter 13 Statement Of Your Current Monthly Income And Calculation Of Commitment Period?

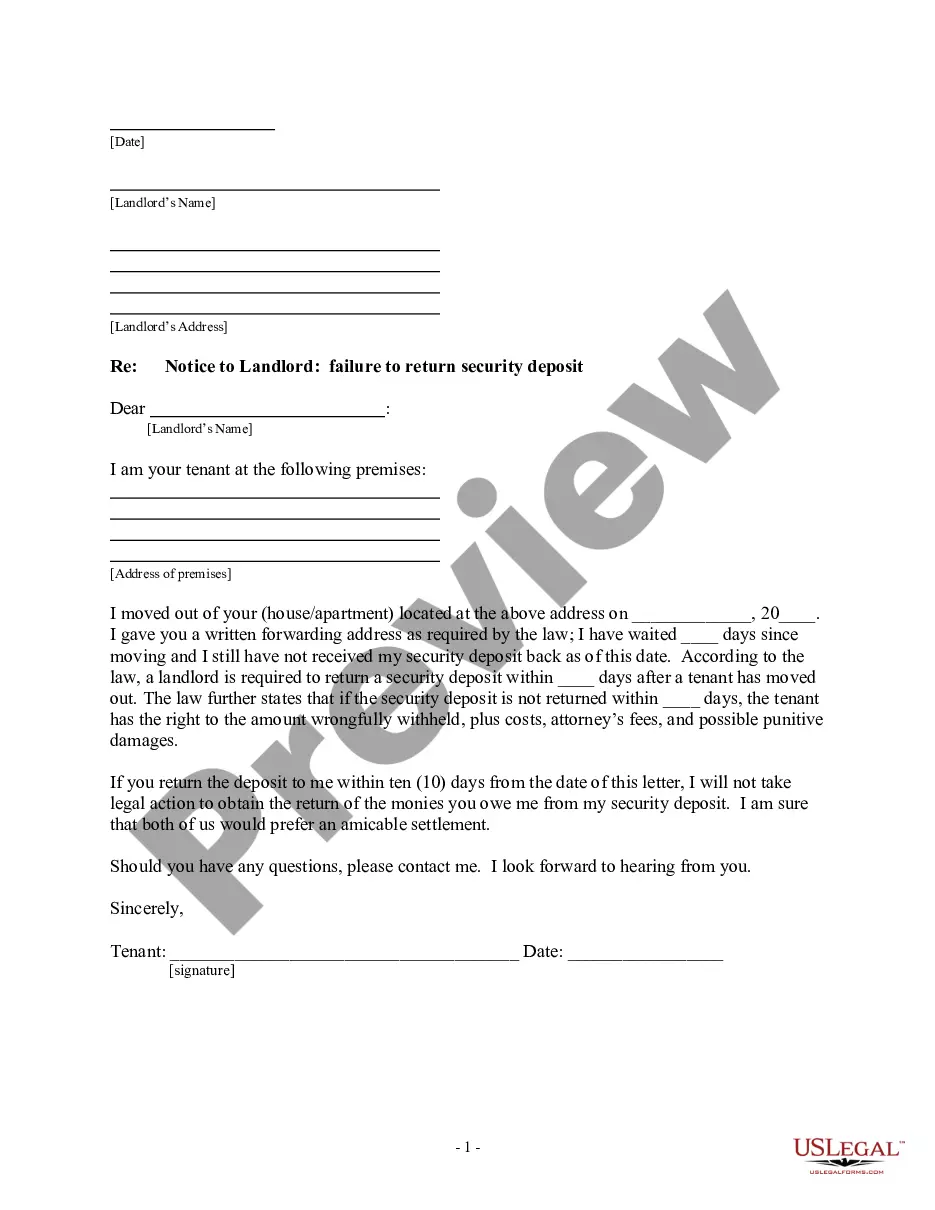

Drafting official documentation can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online library of formal documents, you can be assured about the blanks you encounter, as all of them adhere to federal and state regulations and are verified by our specialists.

So if you require to complete the Indiana Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period, our service is the ideal source to obtain it.

Here’s a concise guide for you: Document compliance review. You should carefully examine the content of the form you desire and ascertain whether it meets your requirements and complies with your state regulations. Previewing your document and reviewing its general description will assist you in accomplishing just that.

- Acquiring your Indiana Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period from our library is as easy as 1-2-3.

- Previously approved users with a valid subscription only need to Log In and click the Download button once they locate the relevant template.

- Later, if needed, users can access the same document from the My documents section of their account.

- Nonetheless, even if you are unfamiliar with our service, registering with a valid subscription will take merely a few moments.

Form popularity

FAQ

Chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years.

Take your monthly income and deduct living expenses, priority debt payments, and secured payments. The remaining amount is your disposable income. You'd are responsible to pay this amount to creditors each month.

It takes into account your income, expenses and family size to determine whether you have enough disposable income to repay your debts. Although it was designed to restrict the number of debtors who can get their debts forgiven through a Chapter 7 bankruptcy, most people who take the means test pass it easily.

The Means Test This test uses a complex formula that takes the gross income for the 6 month period above, and then subtracts out only certain allowed IRS-budgeted expenses items, and ongoing secured debt obligations.

That means both taxed and untaxed income, including wages, salary, tips, bonuses, interest, dividends, royalties, retirement income, unemployment and workers' compensation, and others.

The Means Test This test uses a complex formula that takes the gross income for the 6 month period above, and then subtracts out only certain allowed IRS-budgeted expenses items, and ongoing secured debt obligations.

You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.