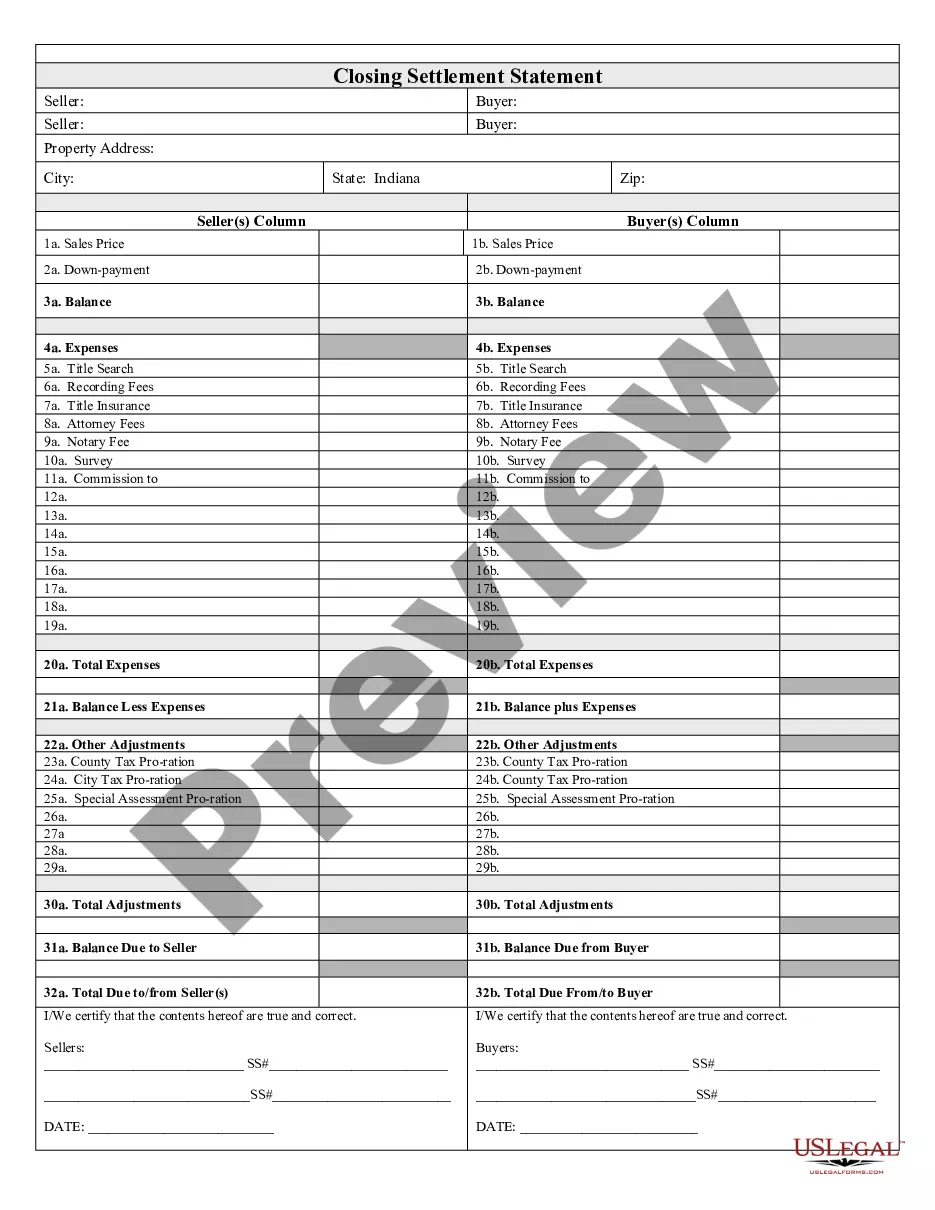

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Indiana Closing Statement

Description Indiana Closing Statement

How to fill out Indiana Closing Print?

In search of Indiana Closing Statement forms and completing them could be a challenge. To save lots of time, costs and effort, use US Legal Forms and find the appropriate sample specially for your state within a few clicks. Our legal professionals draw up all documents, so you just need to fill them out. It is really that easy.

Log in to your account and return to the form's web page and download the document. All your saved templates are kept in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you should register.

Look at our comprehensive recommendations concerning how to get the Indiana Closing Statement sample in a couple of minutes:

- To get an entitled sample, check its validity for your state.

- Look at the example utilizing the Preview option (if it’s available).

- If there's a description, read it to understand the important points.

- Click on Buy Now button if you found what you're looking for.

- Select your plan on the pricing page and make your account.

- Select you wish to pay out with a credit card or by PayPal.

- Save the form in the preferred format.

You can print the Indiana Closing Statement form or fill it out using any web-based editor. Don’t concern yourself with making typos because your template can be applied and sent away, and published as many times as you wish. Try out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Settlement Statement Form Form popularity

Indiana Closing File Other Form Names

Small Estate Affidavit Indiana FAQ

Small Estate Threshold The Indiana small estate procedures are available when the gross probate estate, less liens and encumbrances, does not exceed $50,000. The estate calculation includes all property owned by the decedent, including real estate.

Fill in the name of the Indiana county at the top of the small estate affidavit. It should be the county where the decedent resided when he died or a county where he owned real estate. Enter your full name in at the top of the affidavit, after "I." Write your postal and residence addresses on the provided lines.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Once all assets have been distributed, you must provide the court with the full details of the estate transactions so that the estate can be formally closed. This is accomplished by providing a final accounting of the actions you have taken, and filing a petition to settle the estate.

If real estate was transferred, an affidavit should be filed with the county recorder's office in the county where the real estate is situated and also filed with the closing statement. Ind. Code Ann. § A§ 29-1-8-3 and following.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

Probate and its alternatives in Indiana. Conducting a probate in Indiana commonly takes six months to a year, depending on the situation. It can take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

In Indiana, a small estate is an estate that has a value of $50,000 or less after liens, encumbrances, and reasonable funeral expenses are subtracted. All joint assets and beneficiary designations are not included in the $50,000 estate amount. Beneficiary designations include life insurance and joint assets.