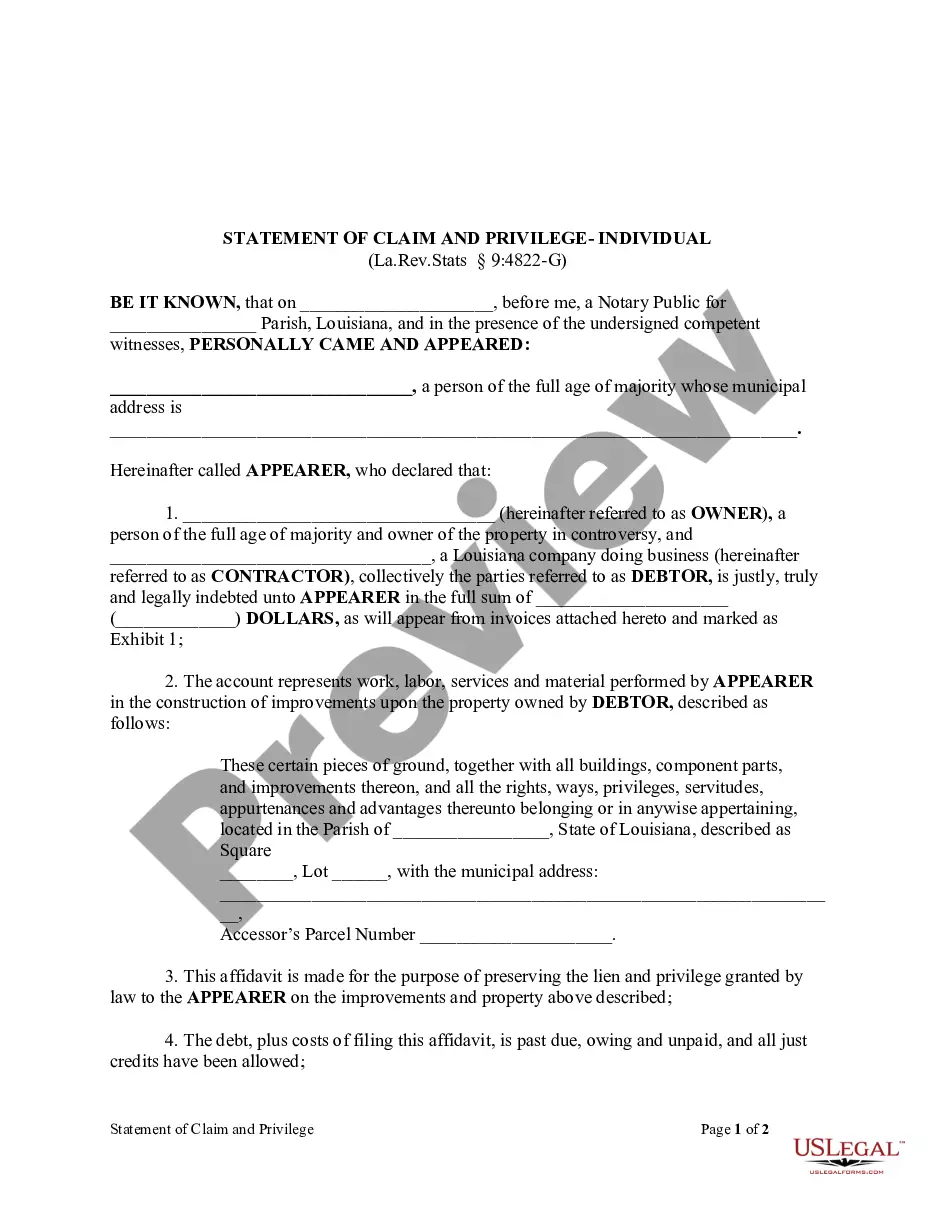

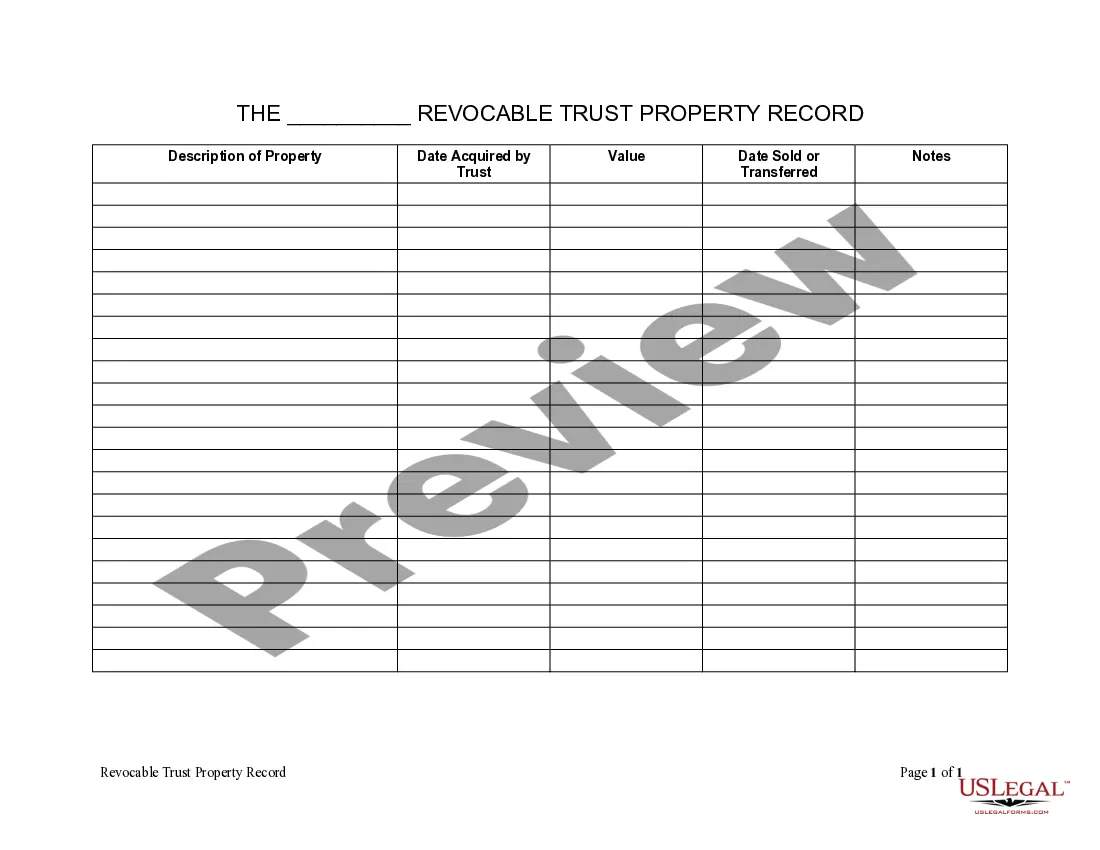

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Indiana Living Trust Property Record

Description

How to fill out Indiana Living Trust Property Record?

Searching for Indiana Living Trust Property Record templates and completing them could be a problem. In order to save time, costs and effort, use US Legal Forms and choose the right template specifically for your state in a few clicks. Our lawyers draft all documents, so you simply need to fill them out. It truly is that easy.

Log in to your account and come back to the form's web page and save the sample. All of your saved examples are kept in My Forms and therefore are available at all times for further use later. If you haven’t subscribed yet, you have to register.

Have a look at our comprehensive instructions regarding how to get the Indiana Living Trust Property Record form in a few minutes:

- To get an qualified form, check its applicability for your state.

- Check out the example utilizing the Preview function (if it’s available).

- If there's a description, go through it to learn the details.

- Click Buy Now if you found what you're searching for.

- Pick your plan on the pricing page and create an account.

- Select you wish to pay by a card or by PayPal.

- Save the file in the favored format.

Now you can print the Indiana Living Trust Property Record form or fill it out using any web-based editor. No need to worry about making typos because your sample may be applied and sent away, and printed out as often as you want. Try out US Legal Forms and access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Trusts Are Not Public Record.However, trusts aren't recorded. Not having to file the trust with the court is one of the biggest benefits of a trust because it keeps the settlement a private matter between the successor trustees and trust beneficiaries.

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Assets Held in the Trustee's Name Kahane Revocable Living Trust or the Nessler Family Trust. In particular, look for a list of assets at the end of the document. It will likely be labeled Schedule A or something similar, and should list the items the person who set up the trust intended to hold in the trust.

Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.