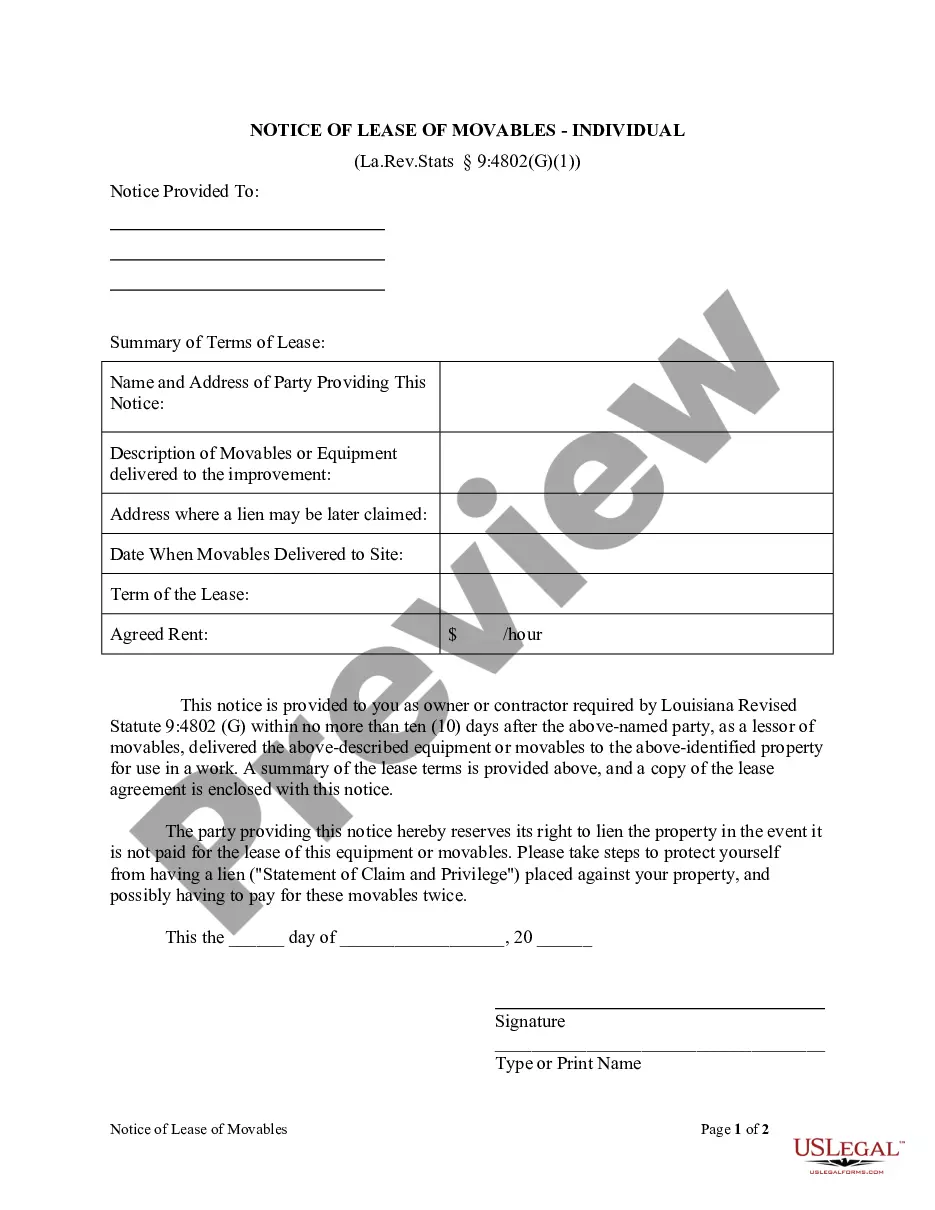

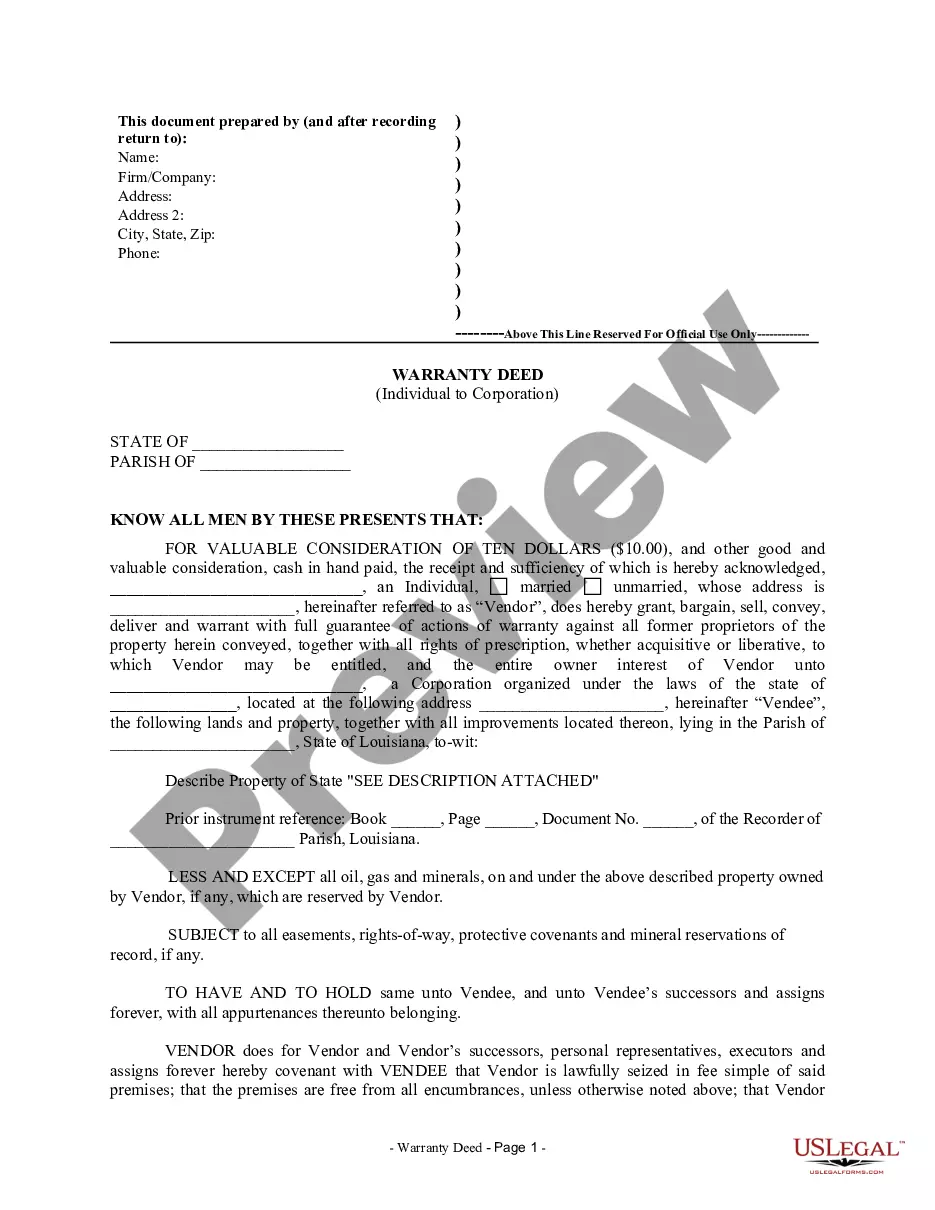

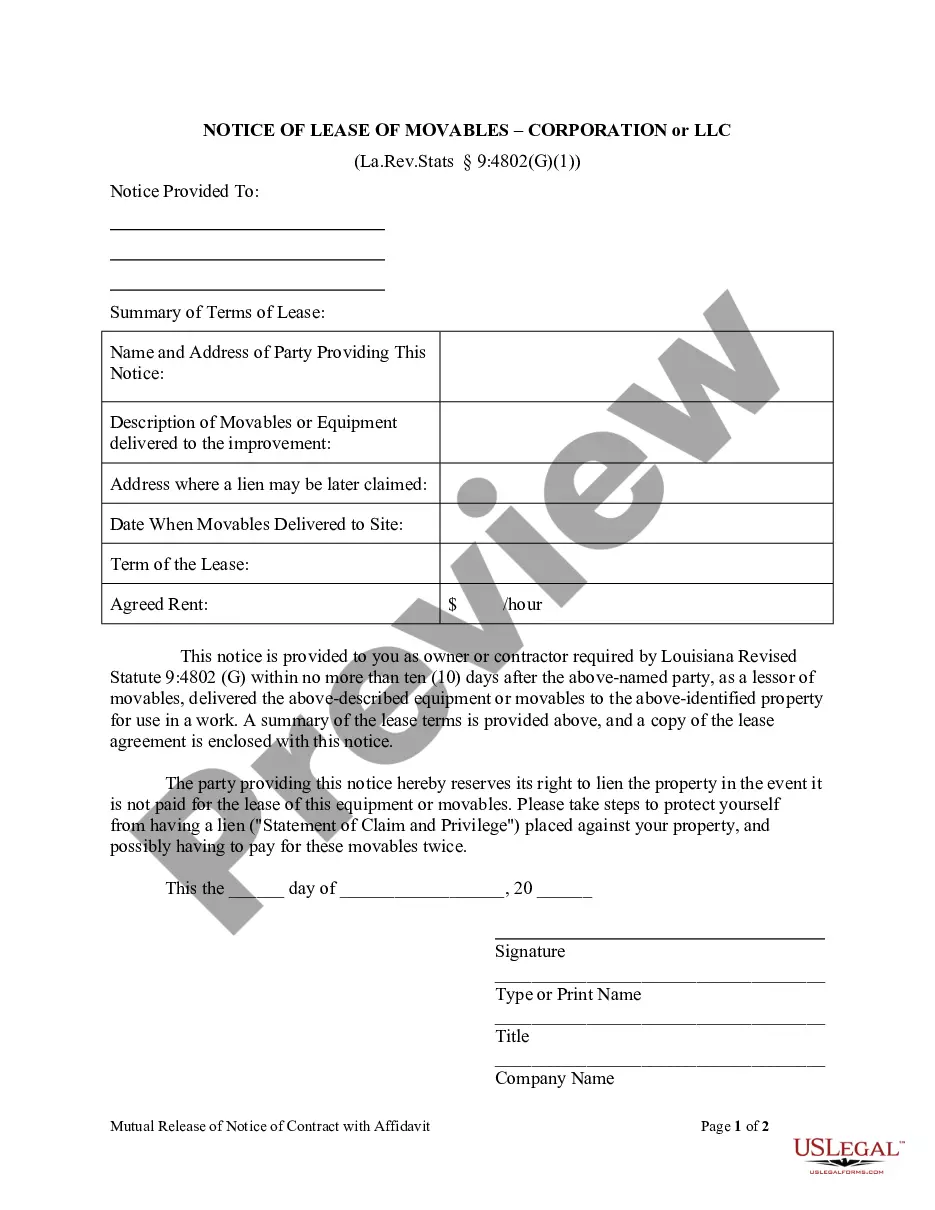

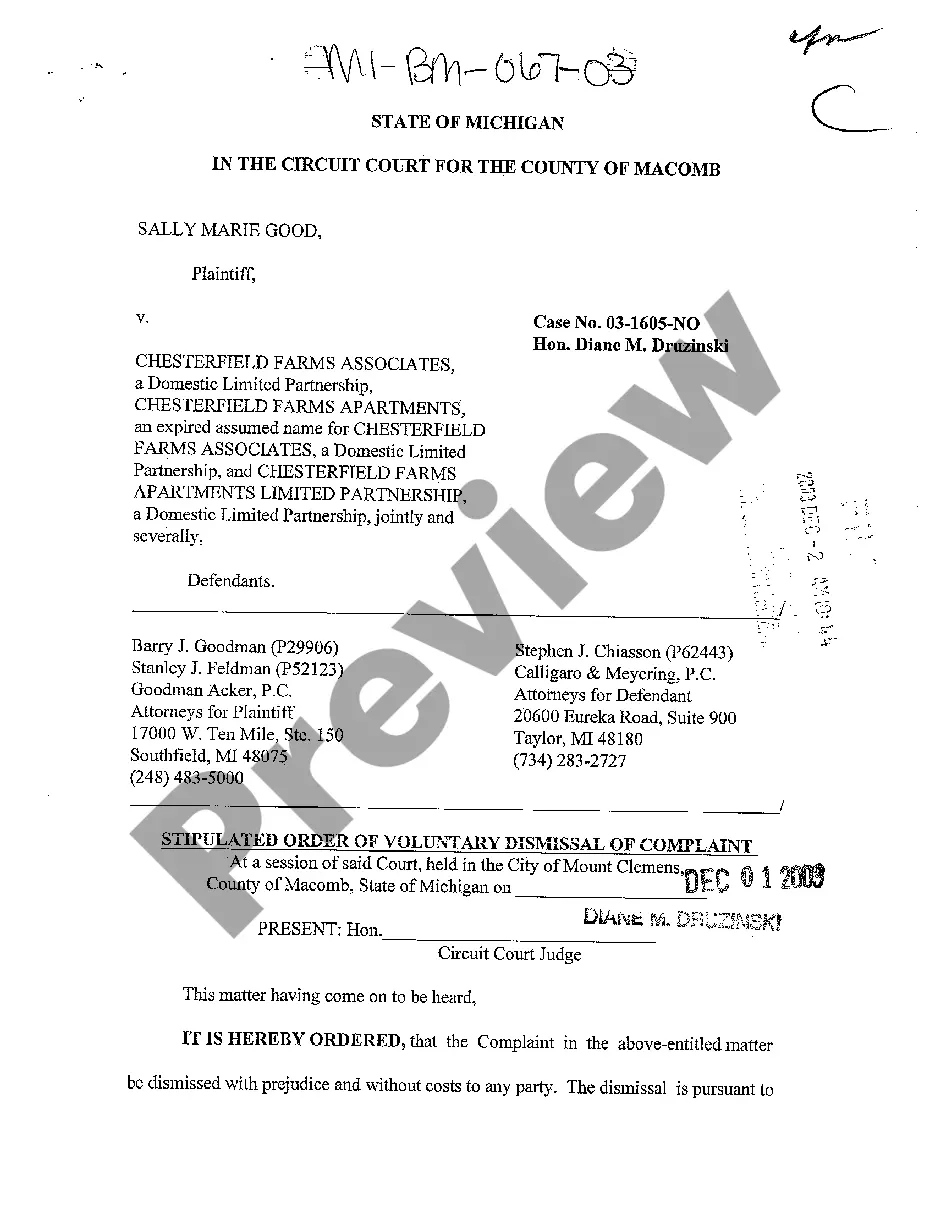

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Indiana Assignment to Living Trust

Description

How to fill out Indiana Assignment To Living Trust?

Looking for Indiana Assignment to Living Trust templates and completing them can be quite a problem. To save lots of time, costs and energy, use US Legal Forms and find the appropriate example specially for your state in just a few clicks. Our attorneys draft all documents, so you simply need to fill them out. It truly is that simple.

Log in to your account and come back to the form's page and save the document. All your saved templates are kept in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you should register.

Have a look at our detailed guidelines regarding how to get the Indiana Assignment to Living Trust sample in a couple of minutes:

- To get an entitled example, check its validity for your state.

- Have a look at the example utilizing the Preview option (if it’s available).

- If there's a description, go through it to understand the details.

- Click on Buy Now button if you identified what you're seeking.

- Pick your plan on the pricing page and create your account.

- Choose you would like to pay by way of a credit card or by PayPal.

- Download the file in the favored file format.

Now you can print the Indiana Assignment to Living Trust form or fill it out using any online editor. No need to concern yourself with making typos because your form can be employed and sent, and published as often as you wish. Check out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.