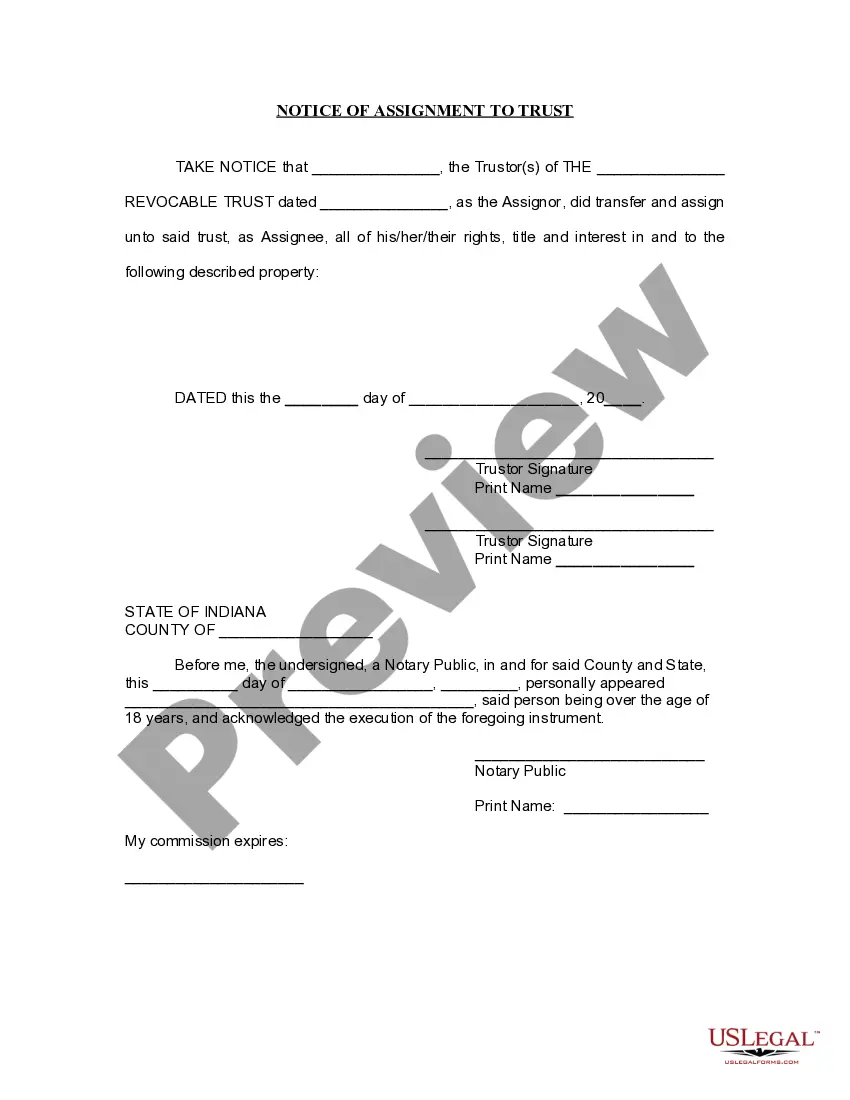

This is a Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form is a form of notification to the lienholders that certain property has been transferred to a living trust and serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust. Use one form per property transferred.

Indiana Notice of Assignment to Living Trust

Description

How to fill out Indiana Notice Of Assignment To Living Trust?

Searching for Indiana Notice of Assignment to Living Trust templates and filling out them might be a problem. To save lots of time, costs and energy, use US Legal Forms and find the correct example specifically for your state in a couple of clicks. Our legal professionals draft each and every document, so you just need to fill them out. It really is so easy.

Log in to your account and come back to the form's page and save the document. Your downloaded examples are kept in My Forms and therefore are available at all times for further use later. If you haven’t subscribed yet, you need to register.

Have a look at our comprehensive instructions concerning how to get the Indiana Notice of Assignment to Living Trust form in a couple of minutes:

- To get an qualified example, check out its applicability for your state.

- Check out the form making use of the Preview option (if it’s accessible).

- If there's a description, read it to know the details.

- Click on Buy Now button if you identified what you're trying to find.

- Choose your plan on the pricing page and make an account.

- Select you want to pay with a card or by PayPal.

- Download the form in the favored file format.

Now you can print out the Indiana Notice of Assignment to Living Trust template or fill it out utilizing any web-based editor. No need to concern yourself with making typos because your template can be used and sent away, and printed out as often as you want. Check out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

Under Declaration of Trust Most personal trusts are trusts under agreement, or "UA," in which the grantor and the trustee are different parties.

UDT is an abbreviation for under declaration of trust, which is the legal language used in some trust instruments to indicate that the grantor is both creating the trust and controlling its assets.Most personal trusts are trusts under agreement, or "UA," in which the grantor and the trustee are different parties.

DTD is just an abbreviation for "dated," meaning the date the trust was signed. When referring to a trust, one should always use the date of the trust.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Ownership in a business can also be transferred through a living trust. To do this, the business owner must first transfer the business to the trust, then name the intended successor as successor trustee to the trust. The business owner, while living, would serve as both trustee and beneficiary of the trust.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.