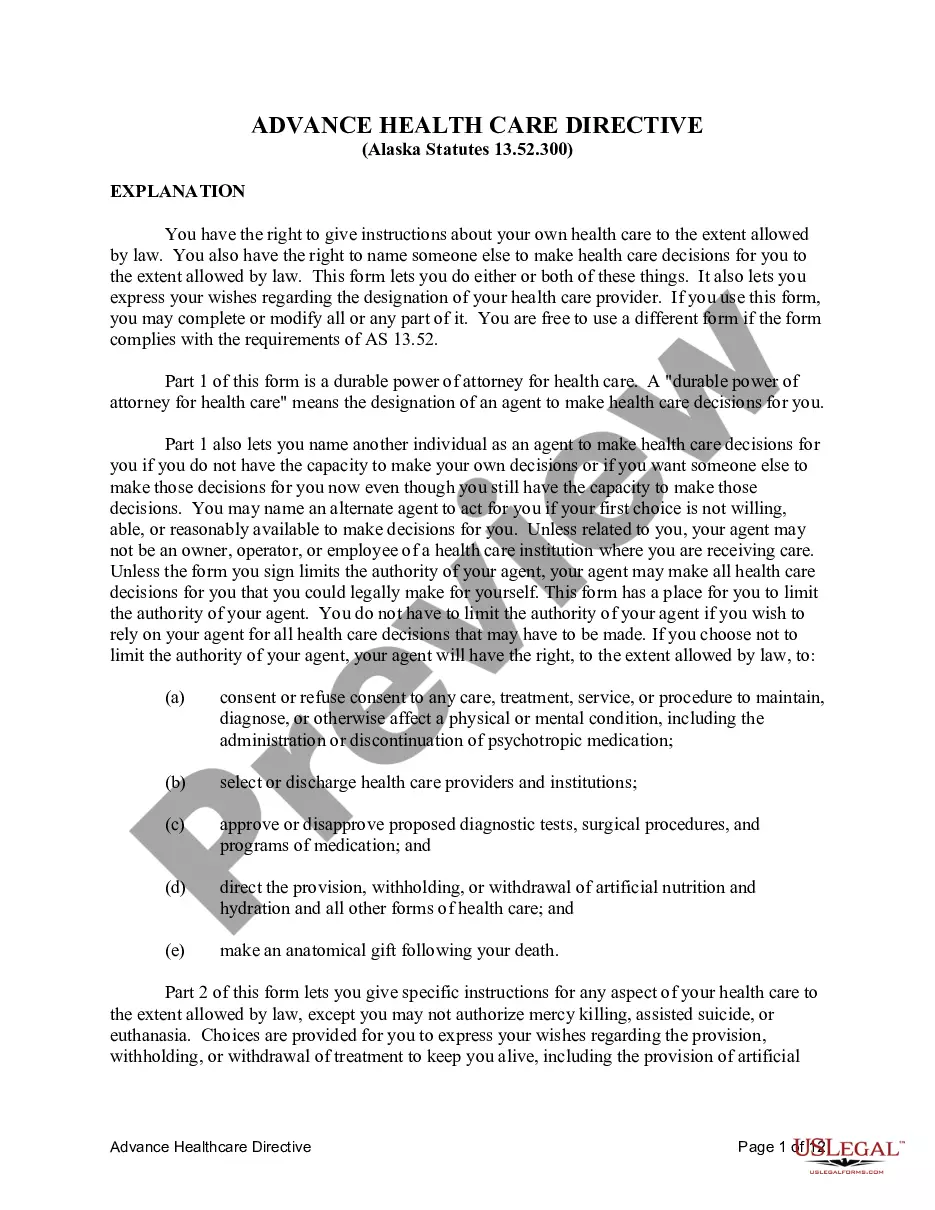

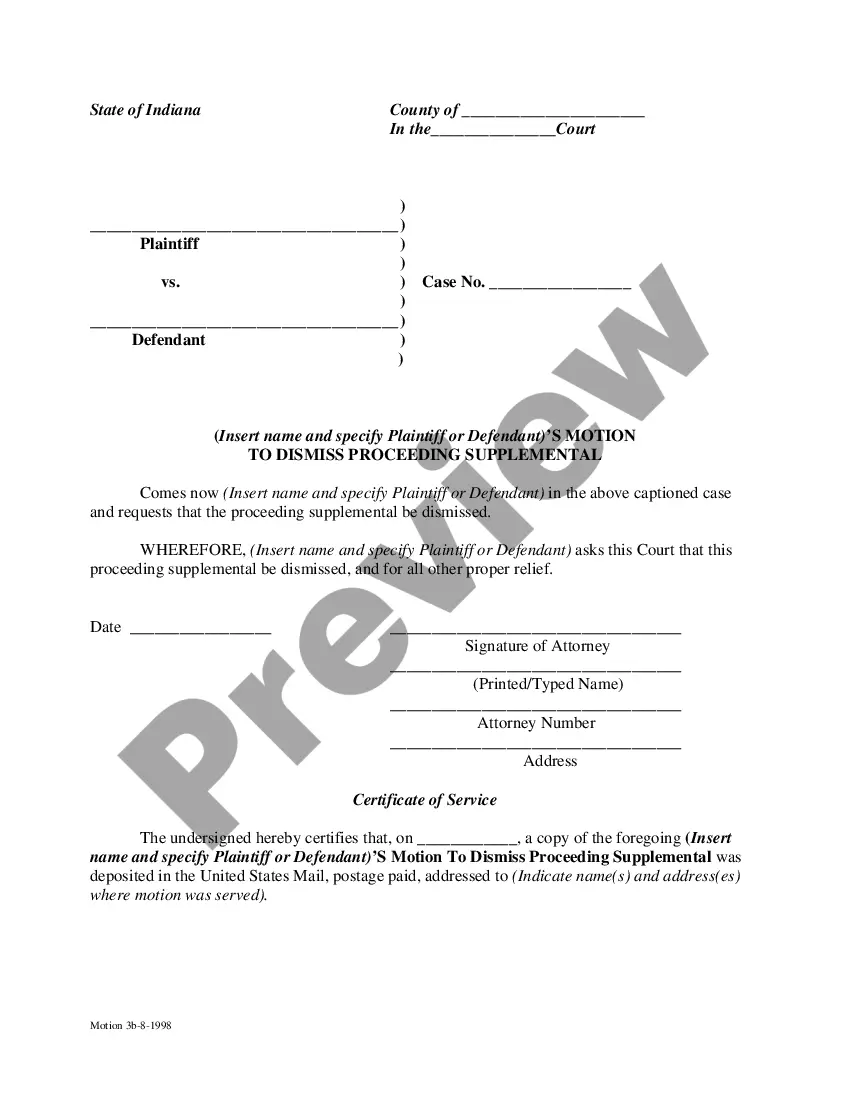

This form is an official form used in Indiana, and it complies with all applicable state and Federal codes and statutes. It is a Motion to Dismiss Proceeding Supplemental. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Indiana Motion to Dismiss Proceeding Supplemental

Description

How to fill out Indiana Motion To Dismiss Proceeding Supplemental?

In search of Indiana Motion to Dismiss Proceeding Supplemental sample and completing them could be a challenge. To save time, costs and energy, use US Legal Forms and choose the right sample specially for your state in a few clicks. Our legal professionals draft all documents, so you just have to fill them out. It truly is so easy.

Log in to your account and come back to the form's web page and save the sample. Your saved examples are kept in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Take a look at our thorough instructions concerning how to get your Indiana Motion to Dismiss Proceeding Supplemental form in a couple of minutes:

- To get an qualified form, check its validity for your state.

- Have a look at the example making use of the Preview function (if it’s available).

- If there's a description, read through it to understand the important points.

- Click Buy Now if you found what you're searching for.

- Select your plan on the pricing page and make an account.

- Choose you want to pay with a card or by PayPal.

- Download the form in the favored file format.

You can print the Indiana Motion to Dismiss Proceeding Supplemental form or fill it out making use of any online editor. No need to concern yourself with making typos because your form can be utilized and sent, and printed out as many times as you would like. Try out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

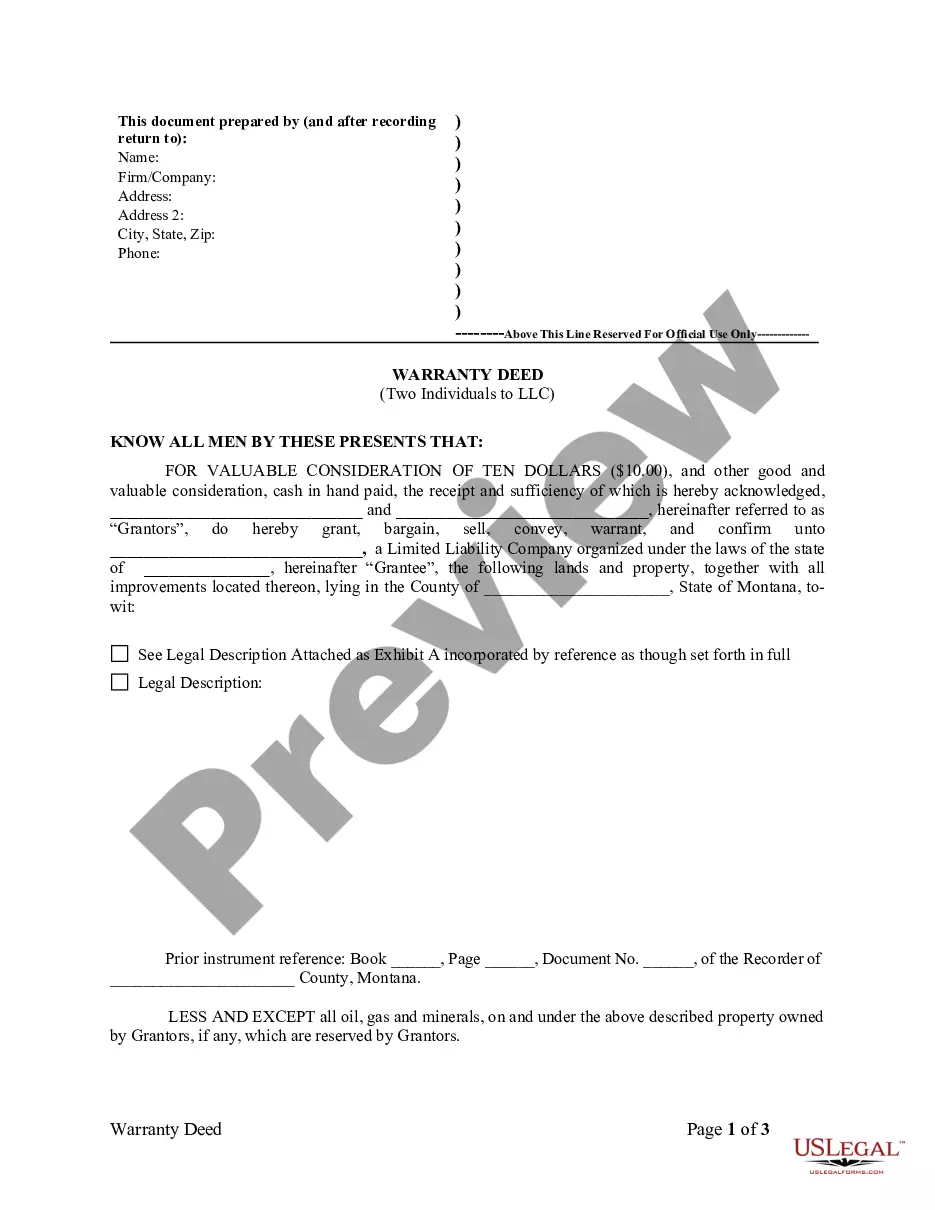

All states have designated certain types of property as exempt, or free from seizure, by judgment creditors. For example, clothing, basic household furnishings, your house, and your car are commonly exempt, as long as they're not worth too much.

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

A Proceedings Supplemental is a court-ordered meeting between you and the creditor (the person you owe) to determine what your income, savings and property are. Your bank or employer may also have to give information to the creditor and the court.

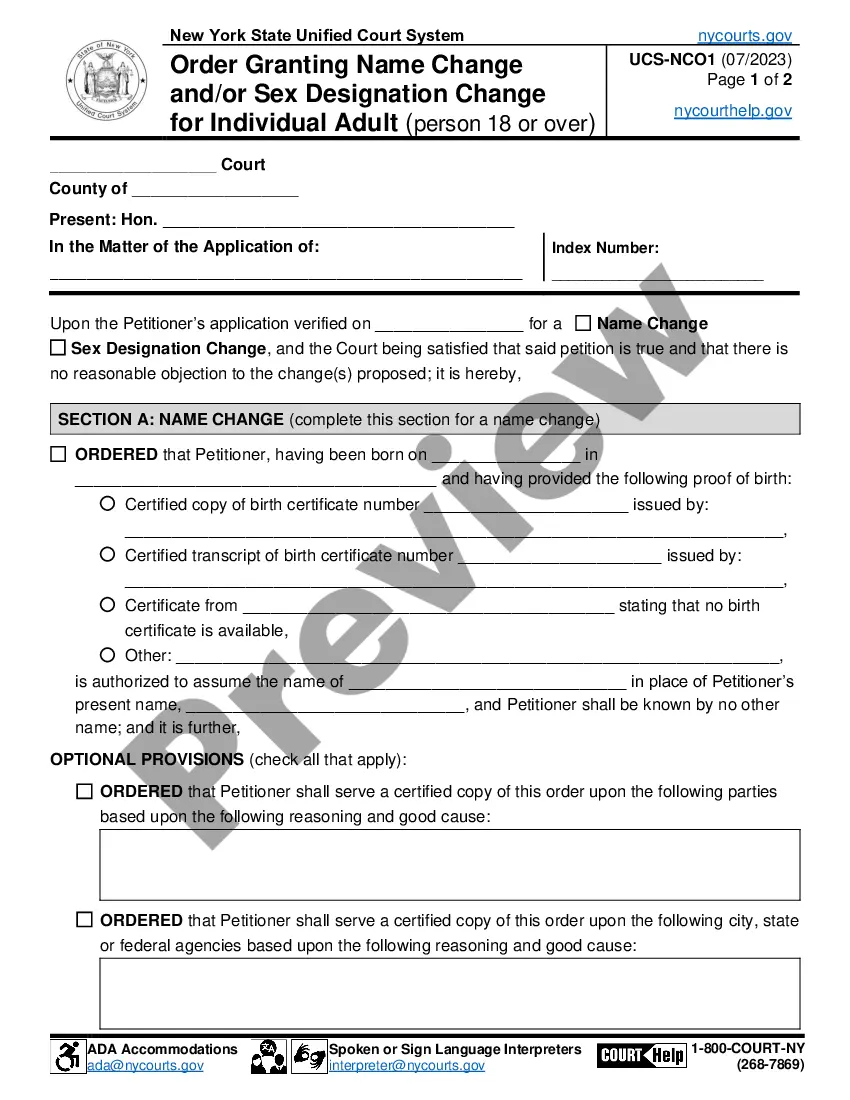

If a summons has already been issued by the Clerk of the Court but another summons is needed, perhaps because there was an error in the original one, it was served on the wrong party or to the wrong address or not served within the required time frame, the plaintiff may file a Request for Alias Summons to request that

If your wages are being garnished for tax debt, Bankruptcy will stop the garnishment and in some cases you may not have to pay the tax debt. Filing Bankruptcy on tax debt will allow you to receive future tax refunds. If your wages are being garnished for student loans, filing Bankruptcy will stop the garnishment.

Assuming you have the date of birth and social security number for the debtor, you can try to get a garnishment in place against the wages of the person who owes you money. If you don't have their employer information, you can submit a request filed by the court to find out where they work.

A responsive pleading required under these rules, shall be served within twenty 20 days after service of the prior pleading. Unless the court specifies otherwise, a reply shall be served within twenty 20 days after entry of an order requiring it.

What is a Supplemental Proceeding? A creditor (someone you owe money) has a judgment ordered by a court. They want. to collect the money from you. The creditor wants to know if you have property or income they can take.