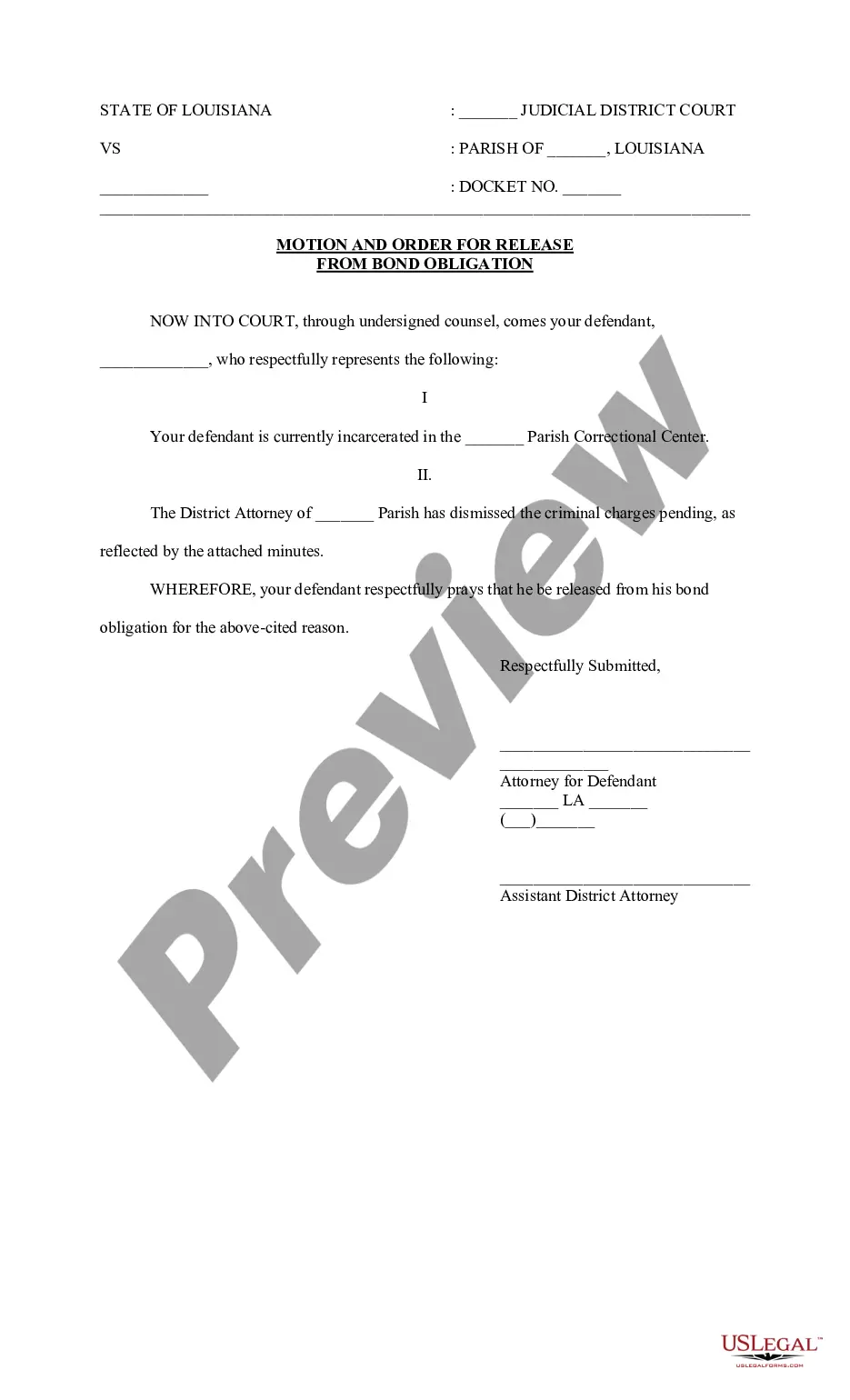

The Indiana Exemption Claim and Request for Hearing form (PDF) is a document used to apply for an exemption from Indiana state taxes. The form is broken down into two sections. The first section is the Exemption Claim which must be completed by the taxpayer and submitted to the Indiana Department of Revenue. This section requires the taxpayer to provide information such as their name, address, Social Security number, and the type of exemption they are claiming. The second section of the form is the Request for Hearing which must be completed if the taxpayer wishes to challenge the Department’s decision on their exemption claim. This section requires the taxpayer to provide information such as the reason for the appeal, the contact information of the taxpayer’s representative (if applicable), and any additional documents or evidence they wish to submit in support of their appeal. There are three types of Indiana Exemption Claim and Request for Hearing form (PDF) available. These include: Indiana Tax Exemption Claim, Indiana Property Tax Exemption Claim, and Indiana Sales Tax Exemption Claim.

Indiana Exemption claim and request for hearing form (PDF)Opens a New Window.

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Exemption Claim And Request For Hearing Form (PDF)Opens A New Window.?

Drafting legal documents can be quite a hassle unless you have accessible fillable templates.

With the US Legal Forms online repository of official paperwork, you can trust the forms you receive, as they all align with federal and state laws and are validated by our experts.

Nevertheless, if you are new to our service, signing up with a valid subscription will only take a few minutes. Here’s a brief guide for you: Document compliance check. It is essential to thoroughly review the content of the form you desire and confirm it meets your requirements and adheres to your state laws. Previewing your document and examining its general overview will assist you in doing just that.

- So if you require to complete the Indiana Exemption claim and request for hearing form (PDF)Opens a New Window., our platform is the optimal choice to download it.

- Acquiring your Indiana Exemption claim and request for hearing form (PDF)Opens a New Window. from our collection is as straightforward as ABC.

- Registered users with an active subscription simply need to Log In and hit the Download button once they locate the right template.

- Furthermore, if needed, users can access the same blank from the My documents section of their account.

Form popularity

FAQ

If you do not have any income or property that can be taken, your income and property are considered to be ?exempt? from the claims of your creditors. If your income and property are exempt, you cannot be forced to pay on the judgment by the Court or by the creditor.

Under Indiana law, there are three main exemptions: Homestead exemption. Personal property exemption. And general intangible exemption.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

UNDER FEDERAL AND STATE LAW, CERTAIN FUNDS ARE EXEMPT FROM GARNISHMENT. THIS MEANS THAT THESE FUNDS MAY NOT BE TAKEN BY CREDITORS EVEN IF THEY HAVE BEEN DEPOSITED INTO YOUR ACCOUNTS. SOCIAL SECURITY, SUPPLEMENTAL SECURITY INCOME, VETERANS BENEFITS, AND CERTAIN DISABILITY PENSION BENEFITS CANNOT BE TAKEN.

Limits on Wage Garnishment in Indiana For any given workweek, creditors are allowed to garnish the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

Limits on Wage Garnishment in Indiana For any given workweek, creditors are allowed to garnish the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

Creditors cannot garnish exempt income, such as Social Security benefits, veteran's benefits, unemployment compensation, and workers' compensation.