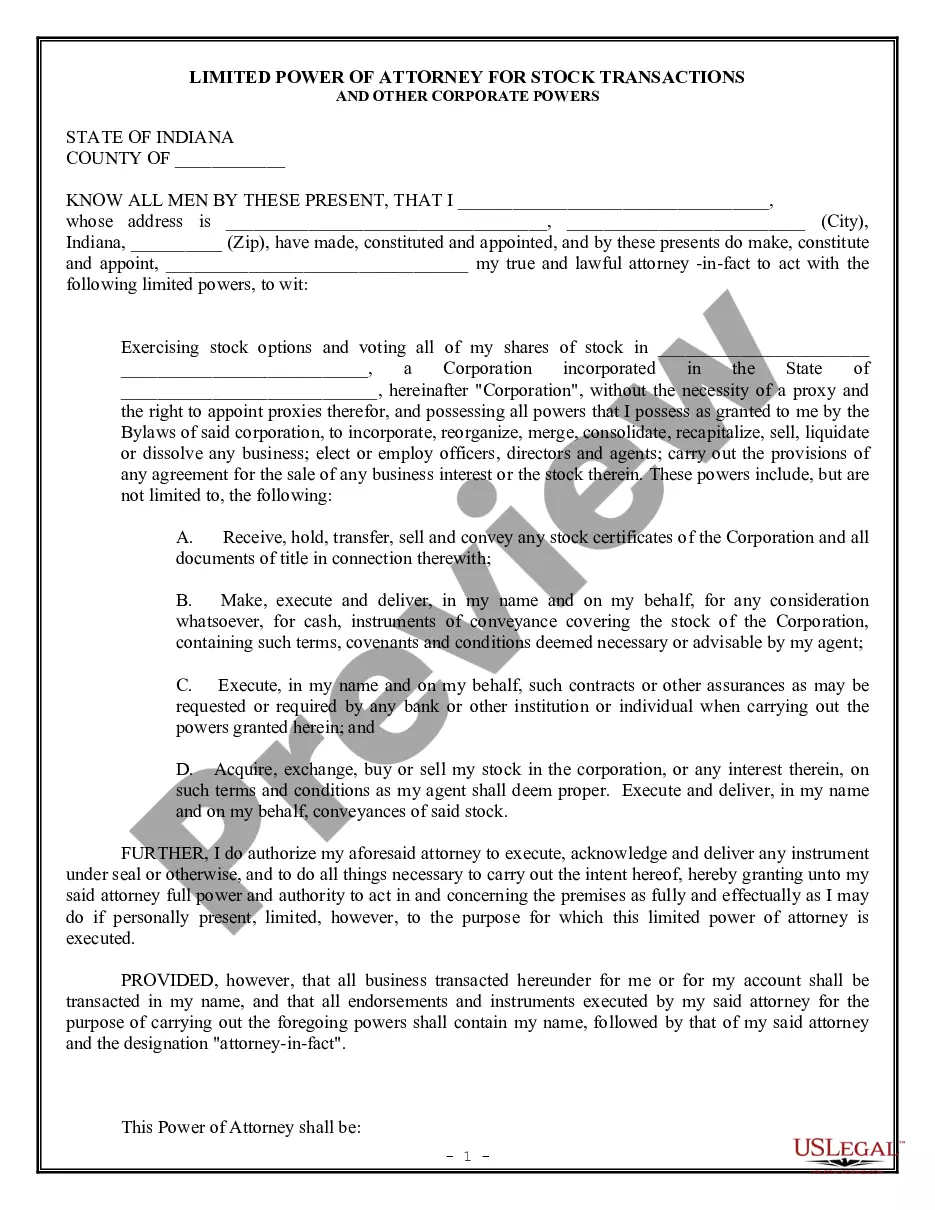

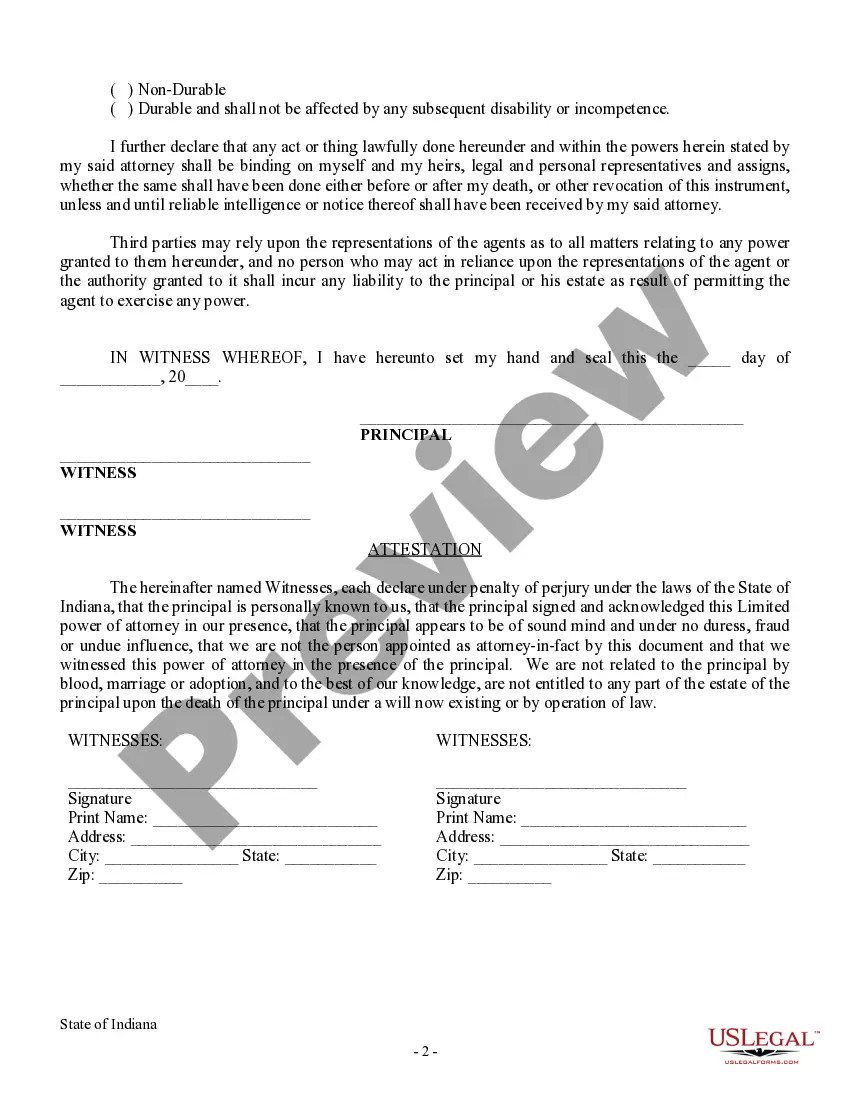

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

Indiana Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Indiana Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Searching for Indiana Limited Power of Attorney for Stock Transactions and Corporate Powers sample and completing them might be a challenge. To save lots of time, costs and effort, use US Legal Forms and choose the right example specially for your state in a few clicks. Our legal professionals draft all documents, so you simply need to fill them out. It is really that simple.

Log in to your account and return to the form's page and download the sample. All your downloaded samples are stored in My Forms and therefore are accessible at all times for further use later. If you haven’t subscribed yet, you have to register.

Check out our detailed recommendations on how to get the Indiana Limited Power of Attorney for Stock Transactions and Corporate Powers sample in a couple of minutes:

- To get an eligible sample, check out its applicability for your state.

- Check out the sample using the Preview function (if it’s accessible).

- If there's a description, read through it to know the important points.

- Click Buy Now if you identified what you're looking for.

- Choose your plan on the pricing page and create an account.

- Choose you would like to pay out with a card or by PayPal.

- Save the file in the preferred file format.

Now you can print the Indiana Limited Power of Attorney for Stock Transactions and Corporate Powers template or fill it out making use of any online editor. Don’t worry about making typos because your template may be used and sent, and printed out as often as you want. Try out US Legal Forms and access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

Limited. A limited power of attorney gives someone else the power to act in your stead for a very limited purpose. General. A general power of attorney is comprehensive and gives your attorney-in-fact all the powers and rights that you have yourself. Durable. Springing.

First, the legal answer is however long you set it up to last. If you set a date for a power of attorney to lapse, then it will last until that date. If you create a general power of attorney and set no date for which it will expire, it will last until you die or become incapacitated.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

What Is a Special Power of Attorney?Also known as a limited power of attorney (LPOA), a special power of attorney allows an individual to give another person the ability to make certain legal or financial decisions on their behalf.

In Indiana, if you wish to obtain power of attorney to assist a client, for example, with tax issues, you must use a particular form issued by the Indiana Department of Revenue. That form is available online at www.in.gov/dor.

Submit the POA-1 by fax to (317) 615-2605. Send the original POA-1 by mail to Indiana Department of Revenue, PO Box 7230, Indianapolis, IN 46207-7230.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

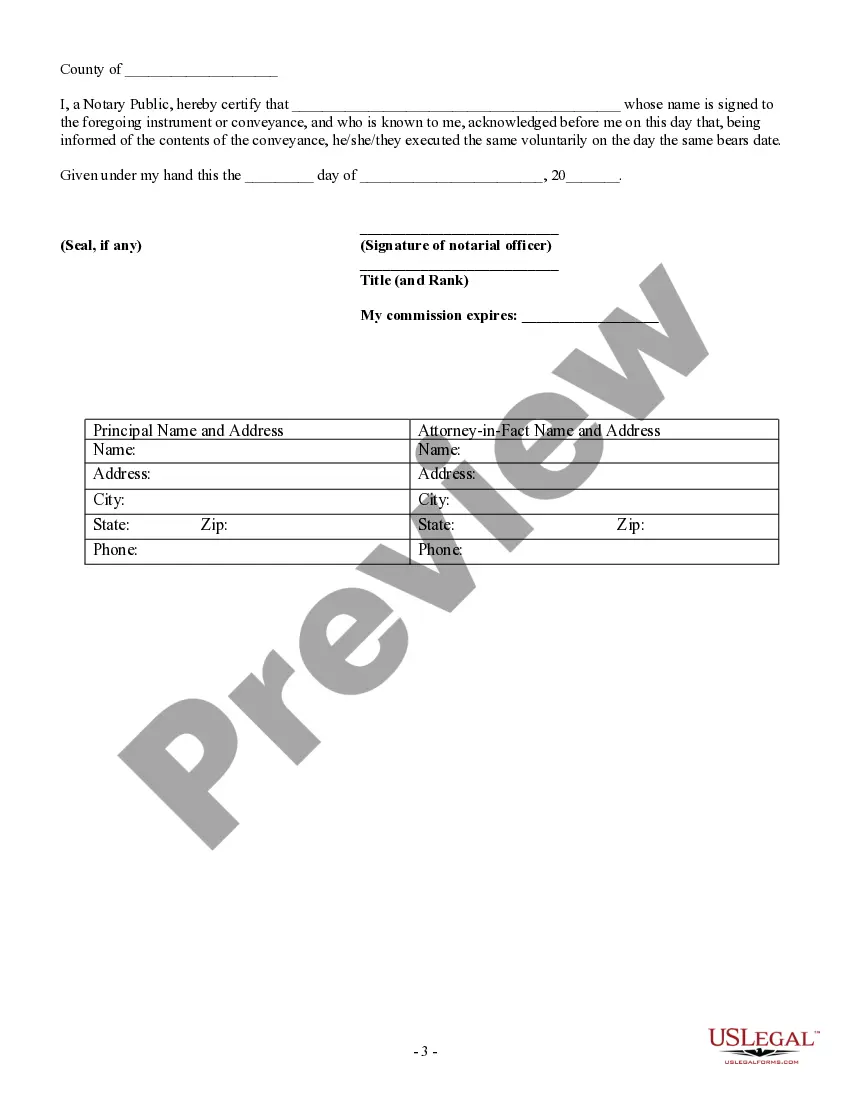

POWERS OF ATTORNEY. CHAPTER 3. General Provisions.(d) A document creating a power of attorney must comply with recording requirements, including notary and preparation statements, to be recorded under this section.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.