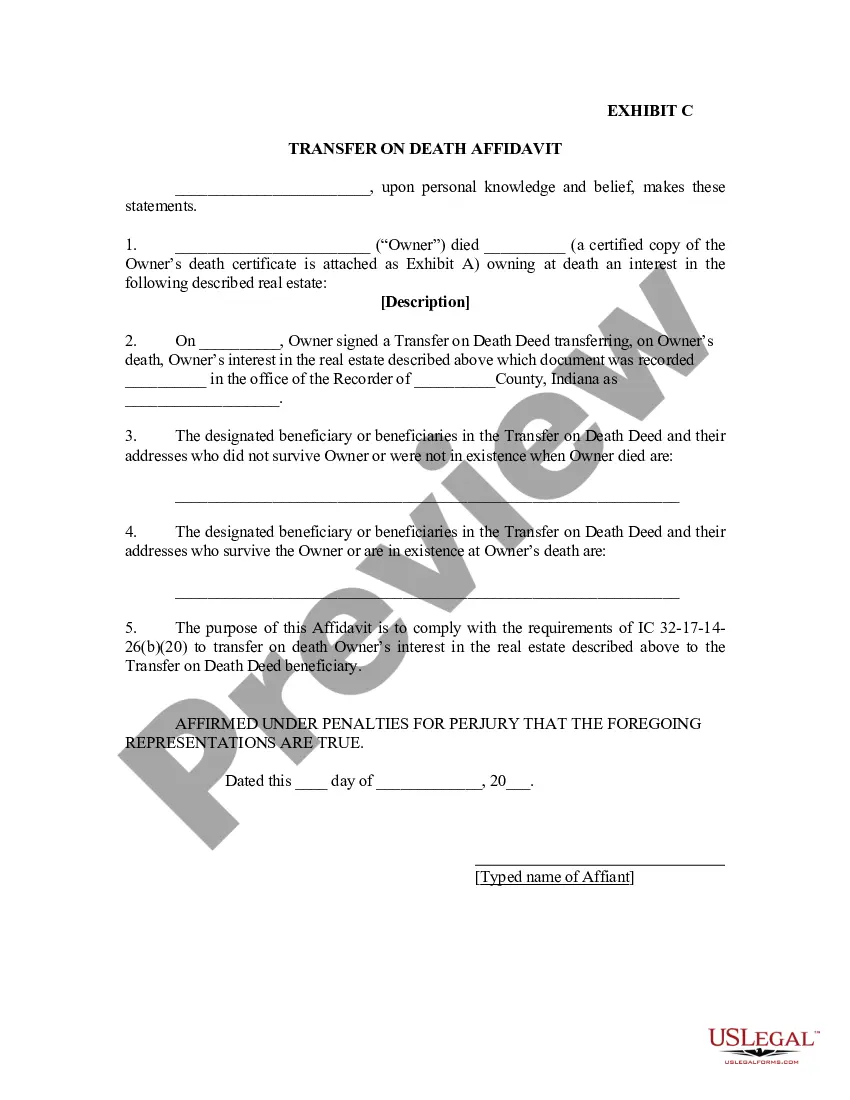

Indiana Transfer on Death Affidavit (ISDA) is a form of estate planning used in the state of Indiana, which allows individuals to transfer certain assets from one person to another upon their death. This form is also known as a “Transfer on Death” or ForsytheoISDAThe ITDA allows individuals to designate a beneficiary for their assets, such as real estate, bank accounts, stocks, bonds, and other securities, without having to go through the probate process. The ISDA also allows for the assets to be transferred without the need for a Last Will and Testament. There are two types of Indiana Transfer on Death Affidavit: an Individual Affidavit and a Joint Affidavit. The Individual Affidavit is used to designate a single beneficiary for the transfer of assets upon the death of the owner. The Joint Affidavit is used to designate two or more beneficiaries for the transfer of assets upon the death of the owner. Both forms must be properly completed, signed, and filed with the Indiana Secretary of State in order for the transfer to occur.

Indiana Transfer on Death Affidavit (ISDA) is a form of estate planning used in the state of Indiana, which allows individuals to transfer certain assets from one person to another upon their death. This form is also known as a “Transfer on Death” or ForsytheoISDAThe ITDA allows individuals to designate a beneficiary for their assets, such as real estate, bank accounts, stocks, bonds, and other securities, without having to go through the probate process. The ISDA also allows for the assets to be transferred without the need for a Last Will and Testament. There are two types of Indiana Transfer on Death Affidavit: an Individual Affidavit and a Joint Affidavit. The Individual Affidavit is used to designate a single beneficiary for the transfer of assets upon the death of the owner. The Joint Affidavit is used to designate two or more beneficiaries for the transfer of assets upon the death of the owner. Both forms must be properly completed, signed, and filed with the Indiana Secretary of State in order for the transfer to occur.