Indiana Loss Mitigation, Motion and Notice (Combined) is a legal process used by homeowners in Indiana to resolve mortgage delinquencies and avoid foreclosure. The process involves the homeowner filing a motion with the court to request a loan modification, forbearance, or other loss mitigation option to help them keep their home. The homeowner must also serve a Notice of Motion on the mortgage service/lender, and the court, to inform them of the homeowner's intent to seek a loan modification, forbearance, or other loss mitigation option. If the motion is successful, the court will issue an Order granting the homeowner's request. There are several types of Indiana Loss Mitigation, Motion and Notice (Combined), including: 1. Motion for Loan Modification: This motion requests that the court order the mortgage service/lender to modify the terms of the loan, such as reducing the interest rate or extending the repayment period. 2. Motion for Forbearance: This motion requests that the court order the mortgage service/lender to temporarily suspend or reduce the homeowner's payments until the homeowner can get back on track with their payments. 3. Motion for Other Loss Mitigation Options: This motion requests that the court order the mortgage service/lender to explore other options for the homeowner, such as a short sale or deed in lieu of foreclosure.

Indiana Loss Mitigation, Motion and Notice (Combined)

Description

How to fill out Indiana Loss Mitigation, Motion And Notice (Combined)?

Completing official documentation can be quite challenging unless you have accessible ready-to-use fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the templates you receive, as all of them adhere to federal and state regulations and are validated by our experts.

Acquiring your Indiana Loss Mitigation, Motion and Notice (Combined) from our collection is straightforward. Previously registered users with an active subscription only need to Log In and click the Download button once they locate the correct template. Subsequently, if required, users can retrieve the same form from the My documents section of their account.

Haven't you explored US Legal Forms yet? Sign up for our service today to obtain any official document promptly and effortlessly whenever you require it, and keep your documentation organized!

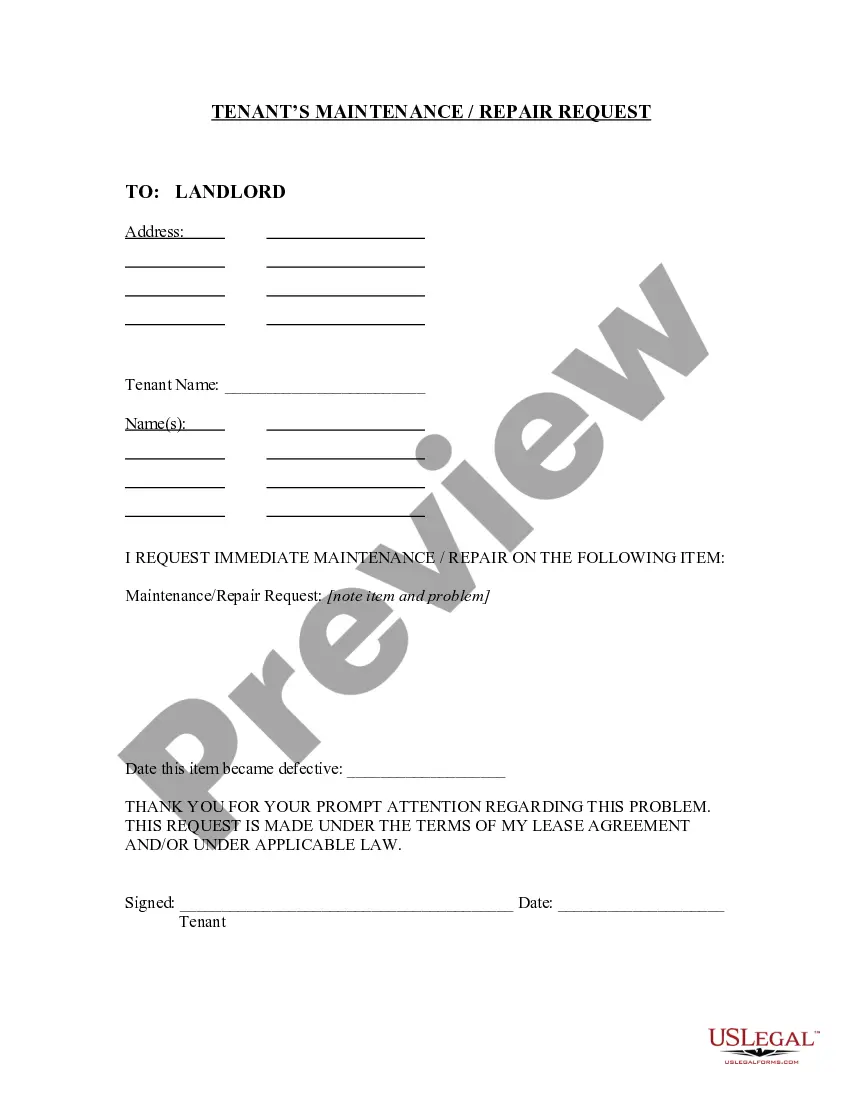

- Verification of document compliance. You should thoroughly evaluate the form you desire and ensure it meets your requirements and adheres to your state laws. Previewing your document and examining its general description will assist you in this process.

- Alternative search (optional). If there are any discrepancies, navigate through the library using the Search tab above until you discover an appropriate form, and click Buy Now once you identify the one you need.

- Account creation and form acquisition. Register for an account with US Legal Forms. Following account validation, Log In and choose your preferred subscription package. Make a payment to proceed (PayPal and credit card options are available).

- Template download and subsequent use. Select the file format for your Indiana Loss Mitigation, Motion and Notice (Combined) and click Download to save it to your device. Print it to manually fill out your documentation, or utilize a multi-featured online editor to create an electronic version more swiftly and efficiently.