This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

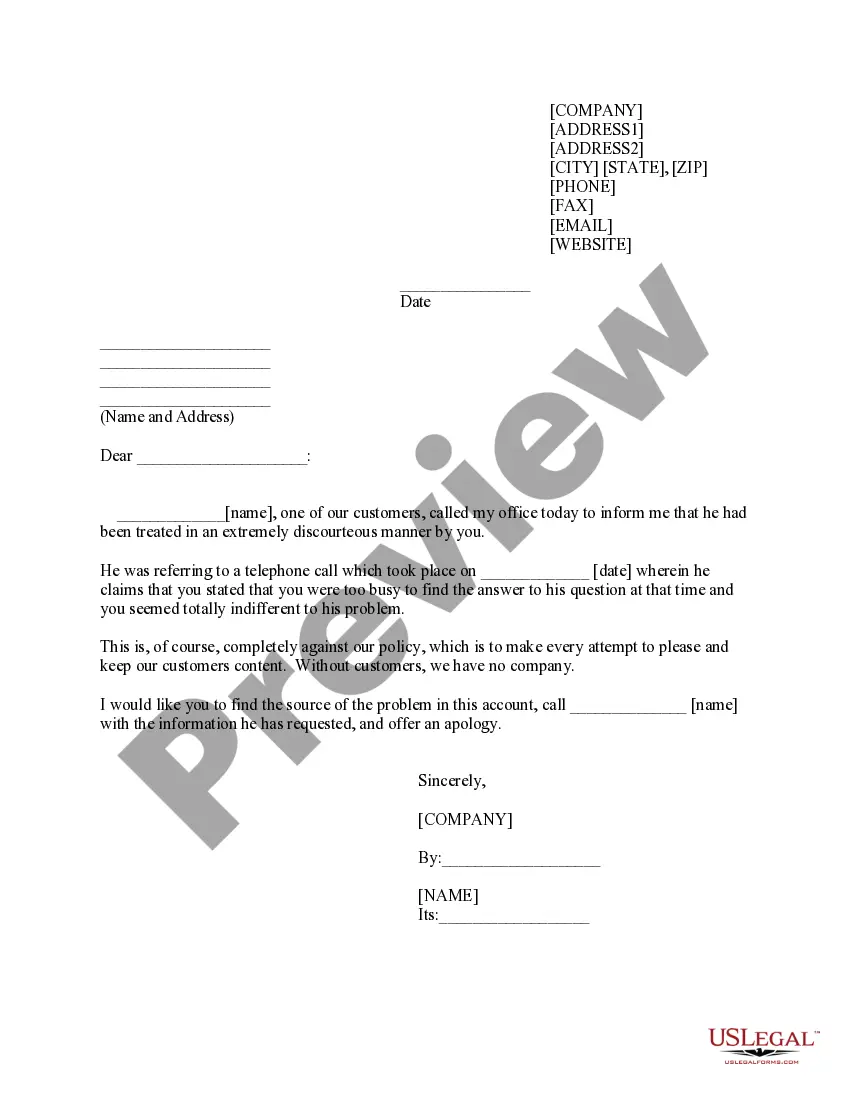

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

You might invest numerous hours online attempting to locate the legal document template that meets the federal and state requirements you will need.

US Legal Forms provides a vast array of legal templates that are evaluated by professionals.

You can download or print the Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage from the platform.

If available, utilize the Review button to examine the document template as well. If you wish to find another version of the form, use the Lookup field to locate the template that suits your needs and requirements. Once you have found the template you desire, simply click Get now to proceed. Select the pricing plan you wish, enter your information, and register for your account on US Legal Forms. Complete the payment process. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Obtain and print numerous document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and hit the Obtain button.

- Then, you can fill out, modify, print, or sign the Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

To file a complaint against an insurance company in Indiana, you should contact the Indiana Department of Insurance directly. You can submit your complaint online, by mail, or by phone, detailing your issues with the insurer. If your situation involves an Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, the Department can assist you in understanding your rights and the next steps. For additional support, consider using resources like USLegalForms to help guide you through the process.

In Indiana, the Department of Insurance regulates insurance companies. This state agency ensures that these companies adhere to laws and regulations designed to protect consumers. If you have concerns regarding your insurance coverage, such as those related to an Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, the Department can provide guidance. They help maintain fair practices within the insurance market.

Proving that an insurance company acted in bad faith involves showing that the company failed to uphold its contractual obligations. You should gather evidence such as correspondence with the insurer, policy documents, and any notes from interactions. Documentation demonstrating delayed payments or unreasonable denial of claims is crucial. If you're facing issues with your credit life policy, consider filing an Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to help establish your case.

The insurance company with the most complaints can vary over time and by specific metrics. However, you can find up-to-date information on consumer complaints by checking reports from organizations like the National Association of Insurance Commissioners (NAIC). When evaluating insurance providers, it's essential to consider both the volume of complaints and the nature of those complaints. For any disputes regarding policy coverage, filing an Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage may help you address your concerns effectively.

To file a complaint against an insurance company in Indiana, you first need to gather all relevant documentation related to your case. This includes your policy details, correspondence with the insurer, and any other supporting evidence. Next, you can submit your complaint through the Indiana Department of Insurance's website or by mail. If your situation involves a dispute about coverage, consider filing an Indiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to clarify your rights.

For example, one party may claim that it performed under a commission agreement and is entitled to payment of his or her commission. The other party may file a declaratory judgment action seeking a declaration that there has not been performance under the agreement and that no commission is owed.

A plaintiff seeking declaratory relief must show that there is an actual controversy even though declaratory relief will not order enforceable action against the defendant. An actual controversy means there is a connection between the challenged conduct and injury, and redressability that the court could order.

A common way of eliminating this uncertainty is with a declaratory judgment action, also called a declaration. This is a court-issued judgment that has the court clarify and affirm any rights, obligations and responsibilities of one or more parties involved in insurance litigation or other civil disputes.

issued declaratory judgment outlines the rights and responsibilities of each involved party. This judgment does not require action or award damages. It helps to resolve disputes and prevent lawsuits.

For example, a party may bring an action for declaratory relief before an actual breach or invasion of rights has occurred. However, the action must be based on an actual controversy with known parameters. It is not available to determine hypothetical or abstract questions.