These consent minutes describe certain special actions taken by the Board of Directors of a corporation in lieu of a special meeting. It is resolved that the president of the corporation may borrow from a bank any sum or sums of money he/she may deem proper. The minutes also state that the bank will be furnished with a certified copy of the resolutions and will be authorized to deal with the officers named within the document.

Indiana Minutes regarding Borrowing Funds

State:

Multi-State

Control #:

US-00068

Format:

Word;

Rich Text

Instant download

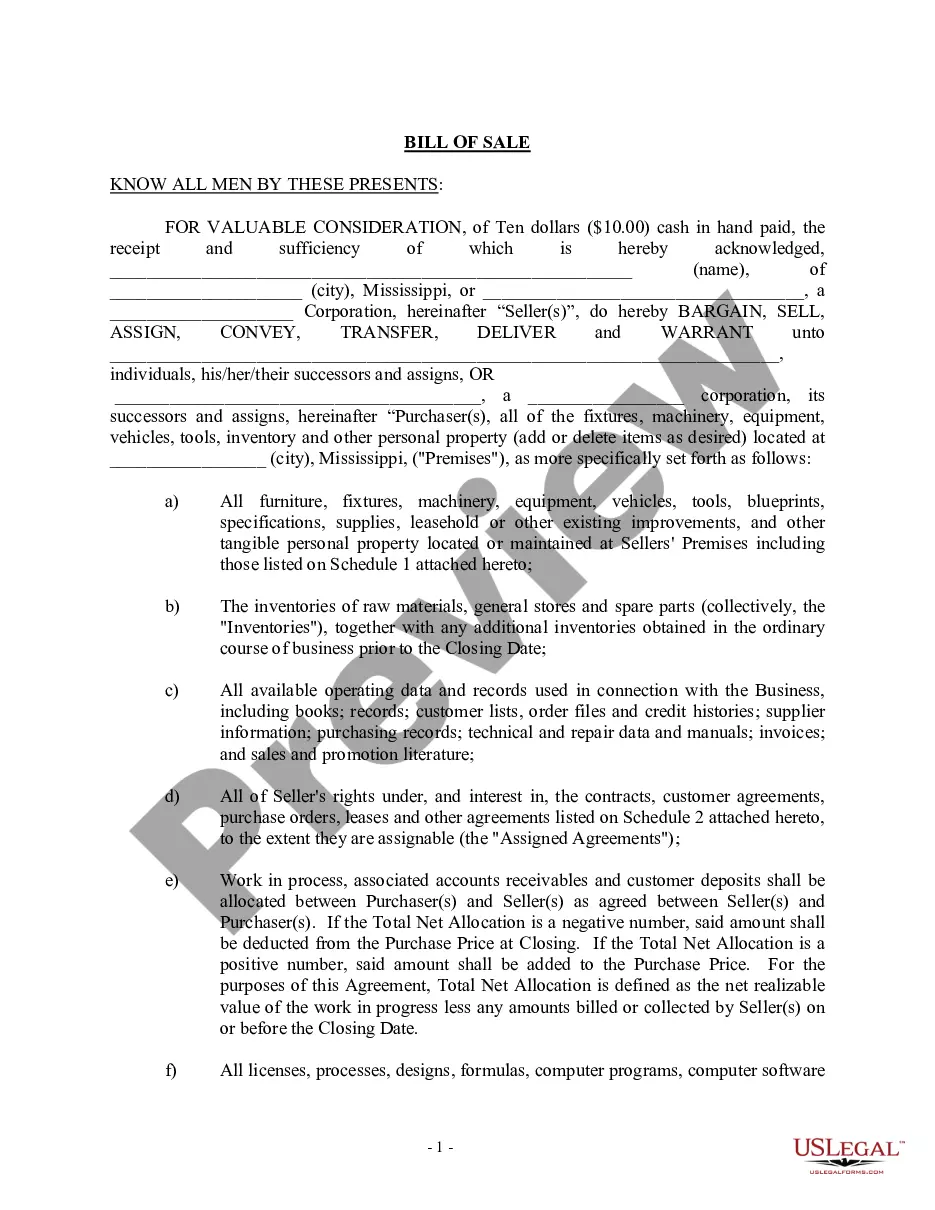

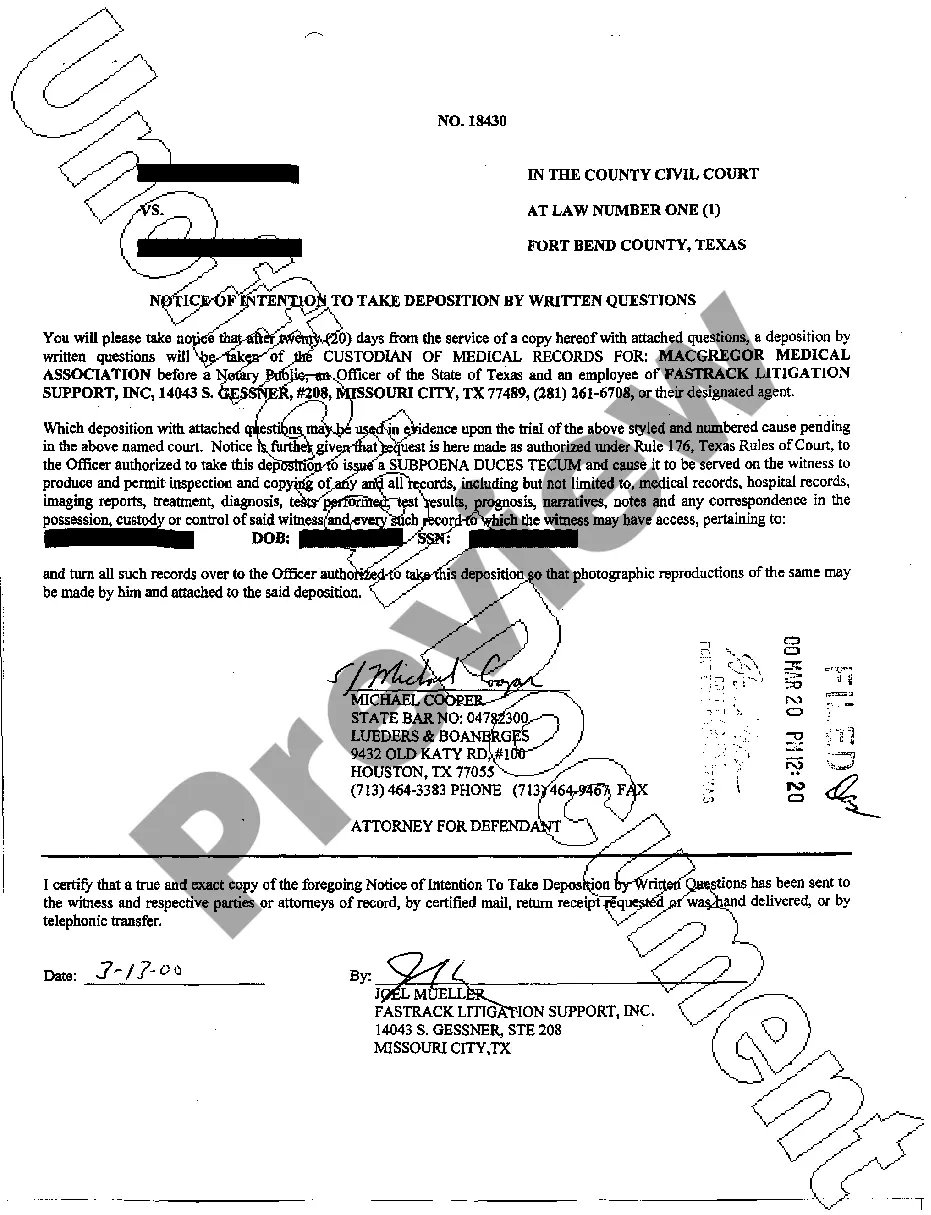

Description

Free preview

How to fill out Minutes Regarding Borrowing Funds?

You can spend hours online searching for the approved document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been vetted by professionals.

You can download or create the Indiana Minutes regarding Borrowing Funds from our service.

If you want to find another version of your form, use the Search section to locate the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you may Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the Indiana Minutes regarding Borrowing Funds.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

- First, ensure that you have selected the correct document template for the area/city you prefer.

- Review the form details to confirm that you have chosen the correct form.