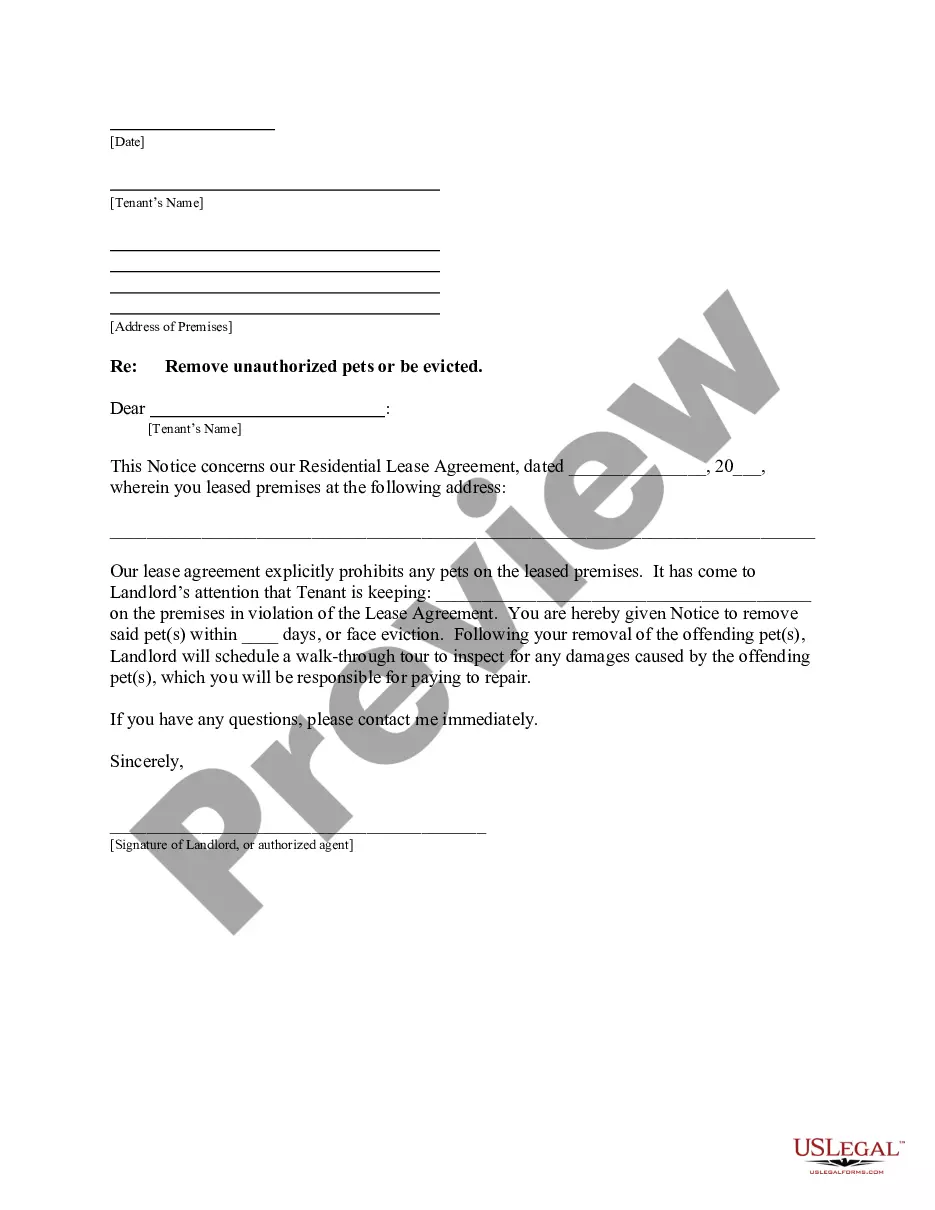

This form is a sample letter in Word format covering the subject matter of the title of the form.

Title: Streamline Your Loan Closure Process with Indiana Sample Letters for Payoff of Loan Held by Mortgage Companies Introduction: When it comes to finalizing your mortgage, ensuring a smooth and hassle-free payoff process is crucial. Indiana's residents can refer to industry-approved sample letters for payoff of loans held by mortgage companies. These letters provide a comprehensive framework, addressing the necessary details and fulfilling legal requirements. In this article, we will dive into the various types of Indiana sample letters available, to help you navigate this important phase with ease. 1. Indiana Sample Letter for Payoff of Loan held by Mortgage Company (Standard Version): This straightforward template ensures that all essential information required for loan payoff is included. It typically includes details such as borrower name, loan account number, a request to provide a payoff statement, and a completed acceptance and satisfaction of mortgage agreement. Keywords: Indiana, sample letter, payoff, loan, mortgage, standard version, template, borrower, loan account number, request, payoff statement, acceptance, satisfaction, mortgage agreement. 2. Indiana Sample Letter for Payoff of Loan held by Mortgage Company (Modified Version): Sometimes borrowers encounter specific situations, such as incomplete documentation or discrepancies in loan information. The modified version of the sample letter can be used to address these unique circumstances. It includes tailored clauses requesting clarification or rectification, ensuring a complete and accurate mortgage payoff process. Keywords: Indiana, sample letter, payoff, loan, mortgage, modified version, template, borrower, loan account number, incomplete documentation, discrepancies, unique circumstances, tailored clauses, clarification, rectification. 3. Indiana Sample Letter for Payoff of Loan held by Mortgage Company (Escrow Information Request): For borrowers who have been making monthly escrow payments toward property taxes, homeowners' insurance, or other related expenses, this additional sample letter is useful. It requests the mortgage company to provide detailed information on the status of the escrow account, including any remaining balances or refunds to be issued upon the loan's payoff. Keywords: Indiana, sample letter, payoff, loan, mortgage, escrow information request, template, borrower, escrow payments, property taxes, homeowners' insurance, related expenses, status, remaining balances, refunds. Conclusion: By utilizing these Indiana sample letters for payoff of loans held by mortgage companies, you can expedite the process while ensuring accuracy and compliance. Whether you choose the standard version, modified version, or need to request escrow information, these templates are designed to simplify the documentation aspect of loan closure. Remember to tailor the letters as per your unique circumstances and consult legal counsel if necessary.