In Indiana, an account stated for construction work is a legal mechanism used to ensure prompt and fair payment between parties involved in a construction project. It is a type of contract claim that arises when the contractor and the owner have agreed upon the amount owed for work performed and materials supplied. The account stated for construction work serves as a formal acknowledgement and agreement by both parties as to the final balance owed. It is typically established through a series of invoices, purchase orders, change orders, and other written or oral communications documenting the agreed upon costs and scope of the project. Key keywords related to Indiana Account Stated for Construction Work include: 1. Construction project: Refers to any building or infrastructure-related work, such as residential or commercial construction, road works, or renovation projects. 2. Contractor: The individual or company responsible for performing the construction work, supplying materials, and coordinating the project. 3. Owner: The individual or entity who owns the property or project for which the construction work is being performed. The owner may hire the contractor directly or through a general contractor or construction manager. 4. Payment dispute: Occurs when there is a disagreement between the contractor and the owner regarding the amount owed for the construction work or any change orders. 5. Final balance: The total amount calculated after considering all the work performed, materials supplied, and any approved change orders. 6. Invoices: Written documents provided by the contractor to the owner, detailing the costs of labor, materials, and other expenses incurred during the construction project. 7. Purchase orders: Contracts initiated by the owner to authorize the contractor to purchase specific materials or services related to the project. 8. Change orders: Modifications or additions to the original scope of work, agreed upon by both the contractor and the owner. Change orders often entail adjustments to the final balance owed. 9. Written communication: Refers to any form of written documentation, such as emails, letters, or contracts, that establishes the agreed-upon costs, materials, and scope of the construction project. 10. Oral communication: Verbal conversations and agreements made between the contractor and the owner, often relating to changes in the work or additional costs. There are no specific types of Indiana Account Stated for Construction Work recognized. However, different construction projects may have their unique requirements and specifications, which can vary based on the nature of the project (residential, commercial, public infrastructure, etc.), contract type (lump sum, cost-plus, unit price, etc.), and the parties involved.

Indiana Account Stated for Construction Work

Description

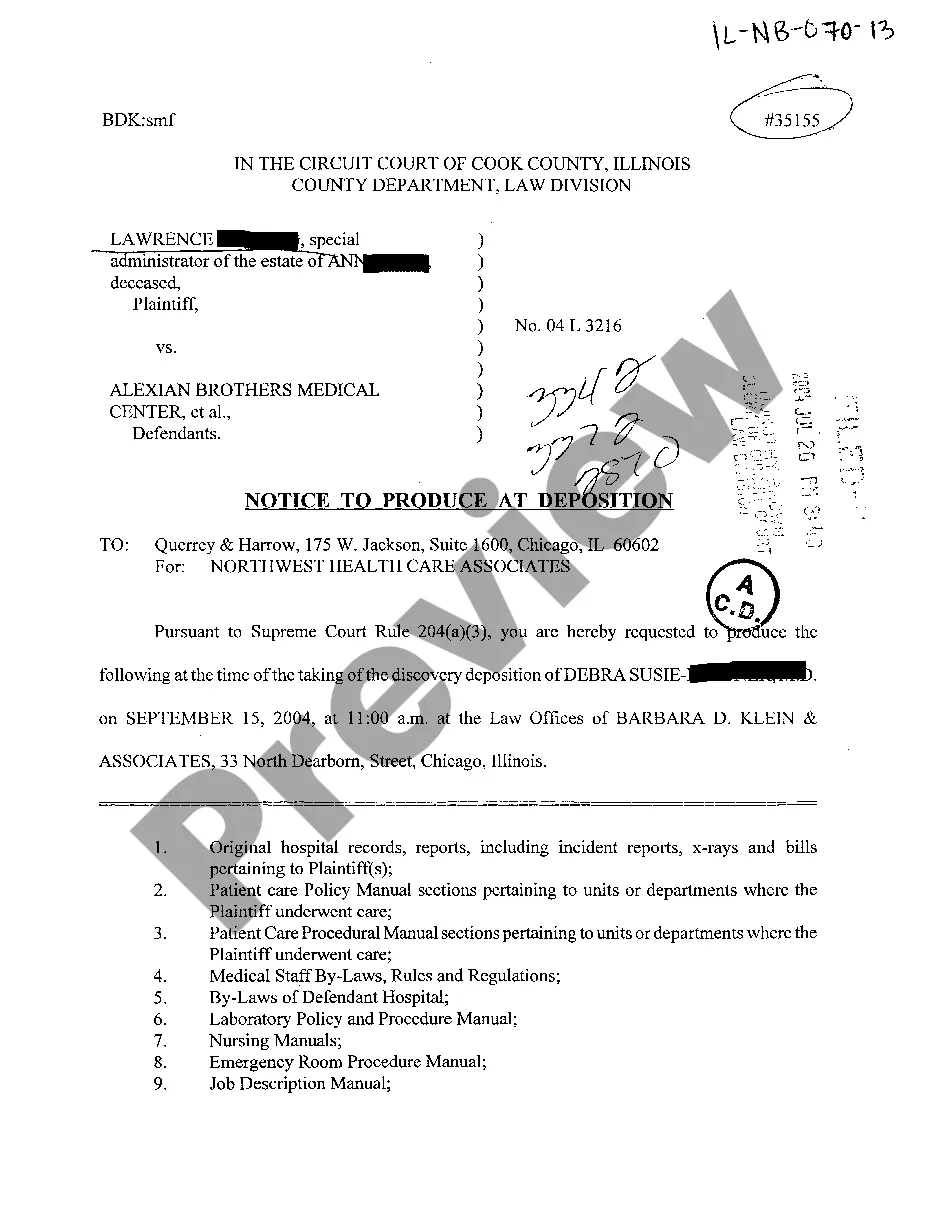

How to fill out Indiana Account Stated For Construction Work?

If you require complete, obtain, or print lawful document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and convenient search function to acquire the documents you need.

A selection of templates for commercial and personal purposes is organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your pricing plan and enter your credentials to register for the account.

Step 5. Complete the purchase. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Indiana Account Stated for Construction Work with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to find the Indiana Account Stated for Construction Work.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are new to US Legal Forms, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's contents. Don’t forget to verify the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

PURCHASES OF CONSTRUCTION MATERIAL Generally, all sales of tangible personal property, including sales of construction material, are subject to Indiana sales tax, while sales of real property are not.

Retainage is the withholding of a portion of each progress payment earned by a contractor or subcontractor until a construction project is complete. Retainage is calculated as a percentage of each progress payment, typically 5% to 10% of the payment.

Separately stated charges for installation that occurs after delivery and transfer of the tangible personal property are not subject to sales tax. Installation charges that are not separately stated from the selling price of an item or the delivery charge for an item will continue to be subject to sales tax.

Independent contractors doing business in the State of Indiana are required to file a statement and documentation with the Indiana Department of Revenue (DOR) stating independent contractor status. There is a five dollar filing fee and the certificate is valid for one year.

Tangible personal property makes up the bulk of the base, although certain services, mainly utility services, transient accommodations and intrastate cable TV and telecommunications, are also taxed.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Indiana is one of the few states that do not regulate general contractors directly with any statewide requirements. The only contracting work that does require a state license is plumbing.

Purchases of tangible personal property, accommodations, or utilities made directly by the United States government, its agencies, and instrumentalities are exempt from Indiana sales tax. Sales by these same entities are also exempt from sales tax.

Can You 1099 Someone Without A Business? Form 1099-NEC does not require you to have a business to report payments for your services. As a non-employee, you can perform services. In your case, the payer has determined that there is no relationship between you and your employer.

Goods that are subject to sales tax in Indiana include physical property, like furniture, home appliances, and motor vehicles. The purchase of groceries and prescription medicine are tax-exempt.

Interesting Questions

More info

The free wiki is home to hundreds of thousands of volunteer editors working collectively to bring every aspect of life with the largest database of factual information on the web and to educate the world with reliable sources of human knowledge. Wikipedia is an open encyclopedia where anyone can easily add, edit and improve content to provide useful information. The content is created by volunteer editors. All content remains free for everyone to modify and use as an essential reference. The editors of Wikipedia are called editors. The Wikipedia project is completely free and operated by the Wikimedia Foundation. The Wikimedia Foundation believes that a free knowledge base such as Wikipedia provides a great resource for people to gain knowledge and provide information to those who cannot otherwise access it. For more information, contact: Contact.org. Edit] Help us! We can't do it without you! Here are some ways you can help. Edit] Contribute Edit] Help us!