Indiana Acknowledgment by Debtor of Correctness of Account Stated

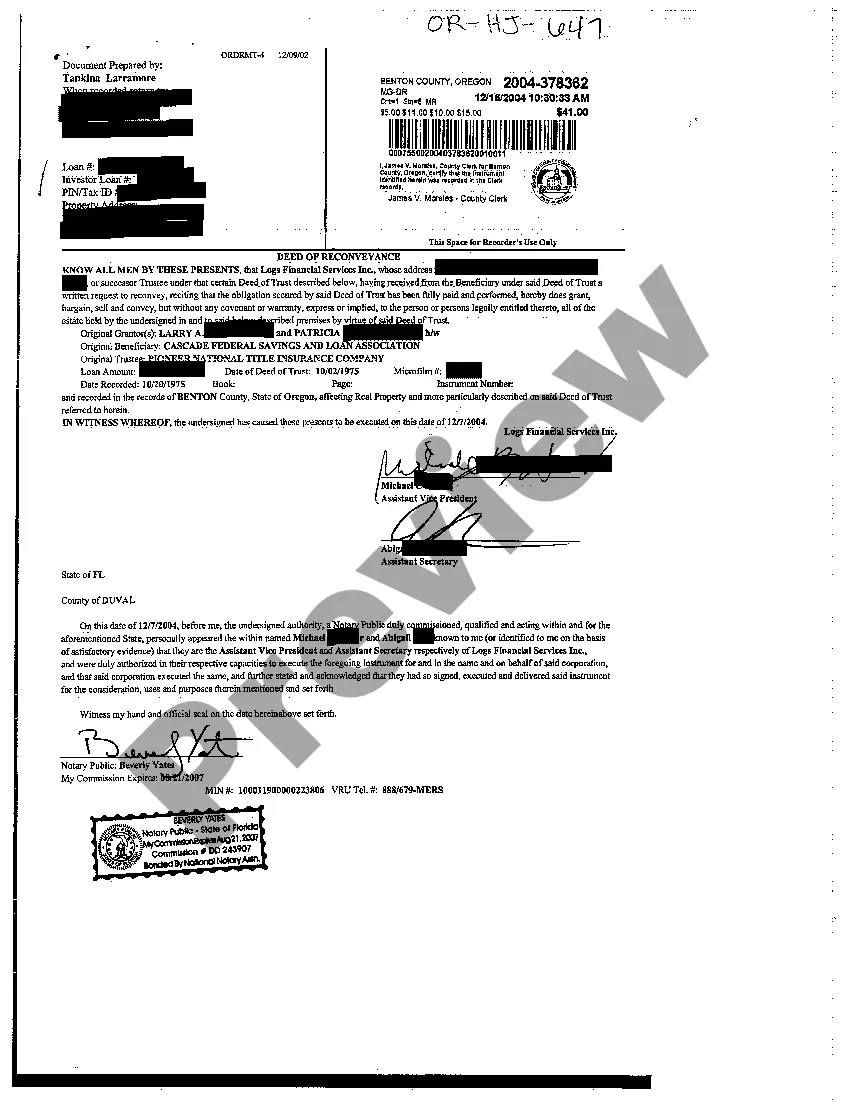

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

Have you been in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t straightforward.

US Legal Forms offers a multitude of form templates, including the Indiana Acknowledgment by Debtor of Correctness of Account Stated, created to comply with state and federal regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you desire, fill in the necessary information to create your account, and complete your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Indiana Acknowledgment by Debtor of Correctness of Account Stated template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/state.

- Utilize the Review button to examine the form.

- Check the outline to ensure you have selected the appropriate form.

- If the form isn’t what you’re looking for, make use of the Search field to find the form that meets your needs.

Form popularity

FAQ

A Debt Acknowledgment Letter is a document signed by one primary party, the debtor, as an acknowledgment of a specific amount of money owed to another party, the creditor.

In it the debtor acknowledges that he or she owes a particular sum of money to the creditor and undertakes to repay what is owing. An AOD requires no more than this in order for it to be legally valid and binding on the signatory.

In California, the statute of limitations on most debts is four years. With some limited exceptions, creditors and debt buyers can't sue to collect debt that is more than four years old.

An Acknowledgment of Debt is a contract which both a debtor and creditor sign acknowledging that a debtor is indebted to the creditor and for how much as well as setting out the payment terms of paying off the debt owed.

Most Indiana debt has a six-year statute of limitations, with the exception of auto loan debt (four years) and state tax debt (10 years).

The Creditor's claim will only prescribe after the period of three years have lapsed from the date of the acknowledgement of debt, even if the debt was admitted without prejudice.

An acknowledgment of a debt or liability by a debtor in writing or a partial payment of the outstanding dues, during the subsisting period of limitation, extends the period of limitation. There are several cases pending before the Supreme Court in which these issues have cone up for consideration.

The statute of limitations inIndianafor a judgment is 10 years unless renewed by the collector. That means once a creditor has a judgment against a consumer, that judgment is collectible for up to 10 years.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.