Indiana Employment Application for Secretary

Description

How to fill out Employment Application For Secretary?

Locating the appropriate legal document template can pose quite a challenge.

Of course, there are numerous formats accessible online, but how do you identify the legal template you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Indiana Employment Application for Secretary, which can be used for both professional and personal purposes.

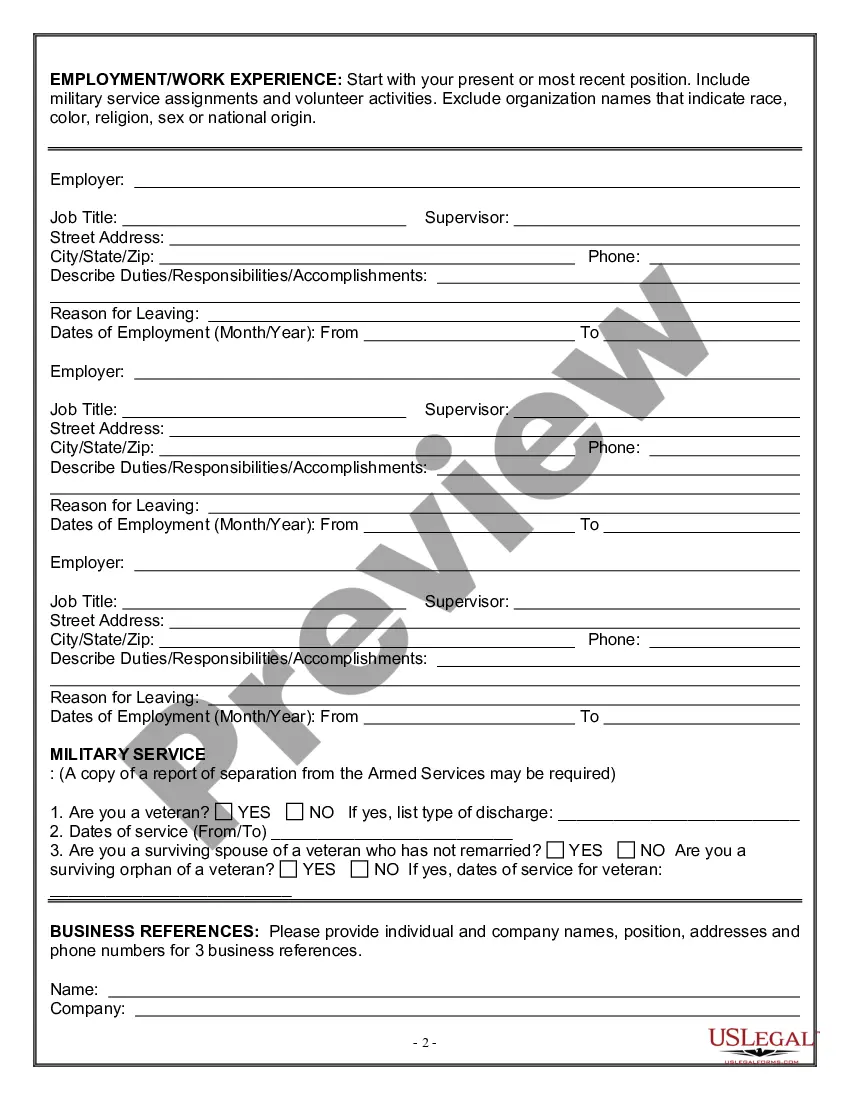

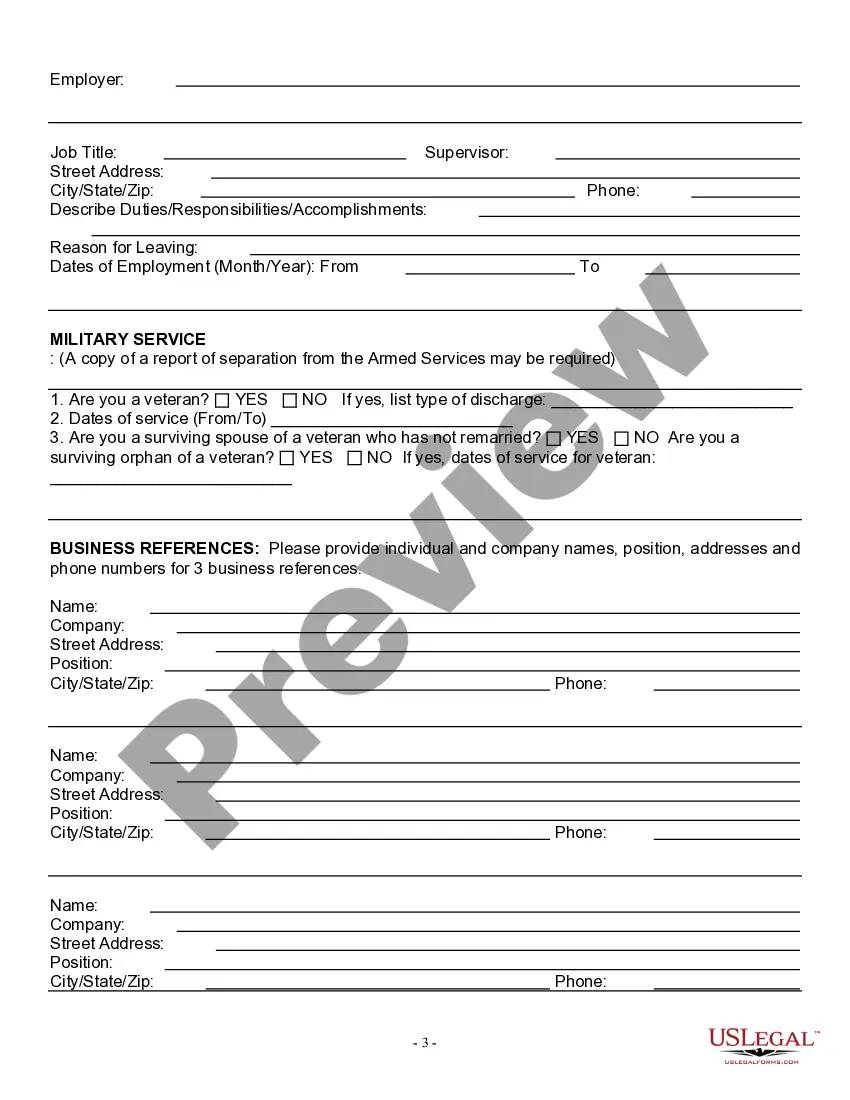

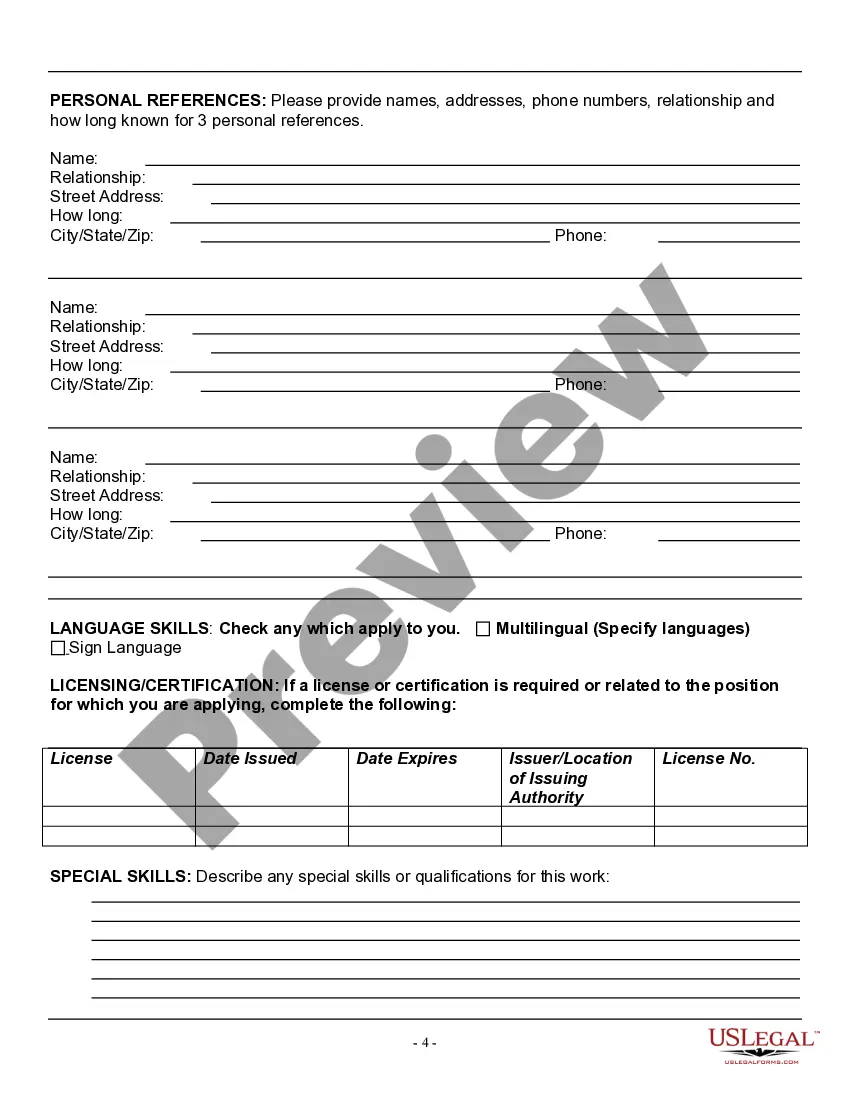

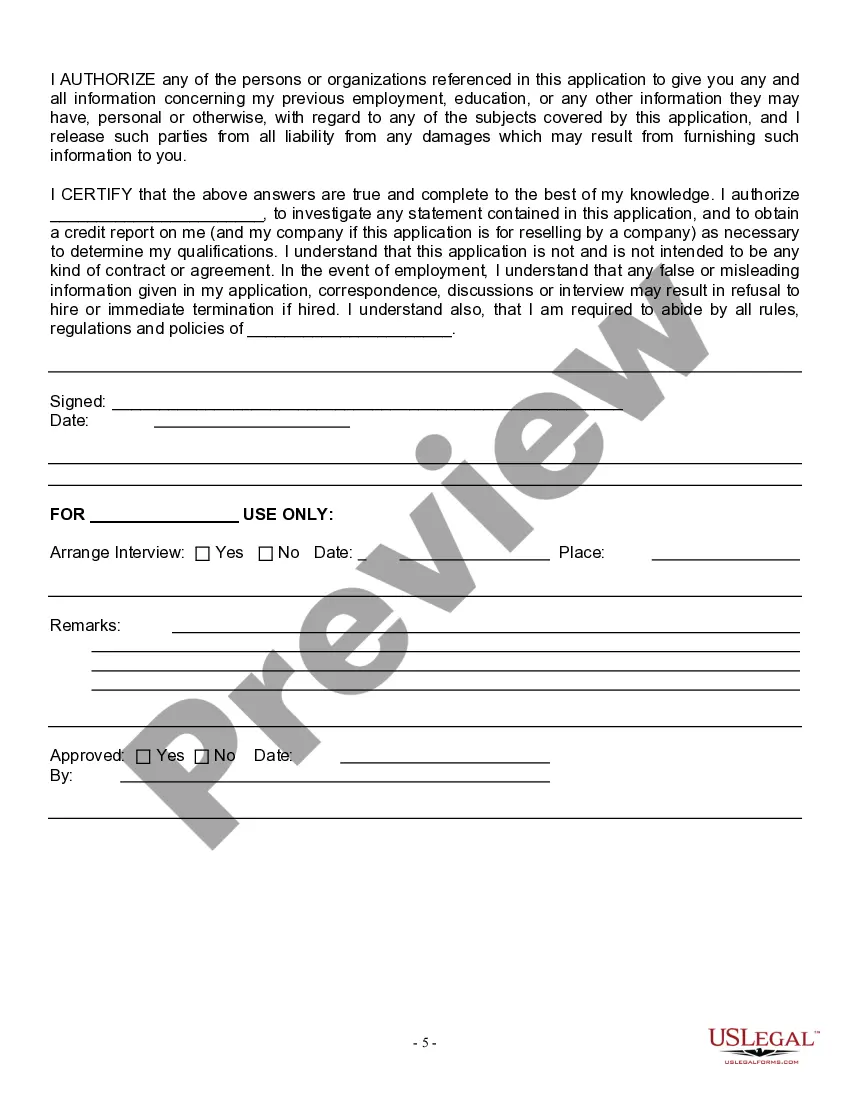

You can view the form using the Review button and read the form description to confirm it meets your requirements.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Indiana Employment Application for Secretary.

- You can also use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure that you have chosen the correct form for your city/state.

Form popularity

FAQ

Required Employment Forms in IndianaSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Indiana State/County Withholding WH-4 form.Employee Personal Data Form (Template)Company Health Insurance Policy Forms.More items...?23-Feb-2018

Cost to Form an LLC in Indiana. The cost to start an Indiana limited liability company (LLC) is $95. This fee is paid to the Indiana Secretary of State when filing the LLC's Articles of Organization. Use our free Form an LLC in Indiana guide to do it yourself.

Steps to Hiring your First Employee in IndianaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

To register your Indiana LLC, you'll need to file the Articles of Organization with the Indiana Secretary of State Business Services Division. You can apply online or by mail. Read our Form an LLC in Indiana guide for details. Or use a professional service like ZenBusiness or to form your LLC for you.

How to Form a Corporation in IndianaChoose a Corporate Name.File Articles of Incorporation.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Initial Directors and Hold First Board Meeting.File Biennial Report.Obtain an EIN.

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?31-Aug-2021

What is the cost of starting a business in Indiana? In order to form an LLC in Indiana, you must submit your Articles of Organization along with a $100 filing fee to the Indiana Secretary of State. The state of Indiana also charges $100 to form a corporation.

Indiana Secretary of State Holli Sullivan Holli Sullivan serves as Indiana's 62nd Secretary of State.

Follow these steps to set up payroll:Get an Employer Identification Number (EIN)Find out whether you need state or local tax IDs.Decide if you want an independent contractor or an employee.Ensure new employees return a completed W-4 form.Schedule pay periods to coordinate tax withholding for IRS.More items...

Go to to access the service....The initial search results displayed will indicate:Entity Name.Business.Entity Type.City/State.