Indiana Sample Letter to State Tax Commission concerning Decedent's Estate Dear [State Tax Commission], Subject: Estate of [Decedent's Name], Tax Notification and Request for Information I am writing to you on behalf of the Estate of [Decedent's Name], reference number [Estate Reference Number], to discuss matters related to the estate's tax obligations and seek clarification on certain aspects of the tax filing process. As the appointed representative of the estate, I understand the importance of complying with Indiana's tax regulations and fulfilling our responsibilities accordingly. I would appreciate your guidance and support in ensuring that we meet all our tax obligations accurately and in a timely manner. Firstly, we have recently completed the inventory assessment of the decedent's assets, liabilities, and potential sources of income. In accordance with the Internal Revenue Service (IRS) guidelines, we have populated the necessary forms, such as the Federal Estate Tax Return (Form 706) and the Indiana Inheritance Tax Return (Form IH-6), to determine the estate's tax liability. However, we have encountered certain uncertainties and require additional assistance from your esteemed commission. Below, I outline our specific concerns: 1. Valuation of Assets: We kindly request guidance on determining the fair market value of the estate's assets, such as real estate properties, investments, and personal belongings, as of the decedent's date of death. Accurate valuations are essential for the correct calculation of the federal and Indiana estate taxes. 2. Deductions and Exemptions: Clarification is needed for properly identifying any deductions and exemptions that may be applied to the estate's tax liability. We seek your guidance on eligible deductions such as funeral expenses, administrative costs, debts, and any specific exemptions available under Indiana state law. 3. Credits and Benefits: We would appreciate your advice regarding any eligible credits and benefits that the estate may be entitled to, including applicable tax incentives or exemptions specific to Indiana. It is crucial to ensure that the estate can claim all the benefits it is eligible for, reducing the overall tax burden. 4. Payment of Taxes and Deadlines: We acknowledge the requirement to settle the estate's tax liabilities promptly. We kindly request clarification on the due dates for submitting the Federal Estate Tax Return (Form 706) and the Indiana Inheritance Tax Return (Form IH-6), along with any necessary extensions available. 5. Auditing and Dispute Resolution: In the event of any potential audits, disputes, or inquiries related to the estate's tax filings, we request your guidance on the procedures, documentation, and additional information that may be required to address these matters adequately. We genuinely appreciate your prompt attention to these concerns and understandings, enabling the estate to fulfill its tax obligations accurately and efficiently. Please find enclosed the documents and forms related to the estate's tax filing for your review. Should you require any additional information or documentation, kindly let us know, and we would be glad to provide the requested details promptly. We look forward to your invaluable assistance throughout the tax filing process and appreciate your commitment to ensuring the fair implementation of Indiana's tax laws. Thank you for your time and consideration. Sincerely, [Your Name] [Your Title/Role] [Contact Information] Types of Indiana Sample Letter to State Tax Commission concerning Decedent's Estate: 1. Indiana Sample Letter to State Tax Commission regarding Valuation of Decedent's Estate Assets 2. Indiana Sample Letter to State Tax Commission seeking Clarification on Deductions and Exemptions for Decedent's Estate 3. Indiana Sample Letter to State Tax Commission requesting Information on Tax Credits and Benefits for Decedent's Estate 4. Indiana Sample Letter to State Tax Commission regarding Deadlines and Payments for Decedent's Estate Taxes 5. Indiana Sample Letter to State Tax Commission seeking Guidance on Auditing and Dispute Resolution for Decedent's Estate.

Indiana Sample Letter to State Tax Commission concerning Decedent's Estate

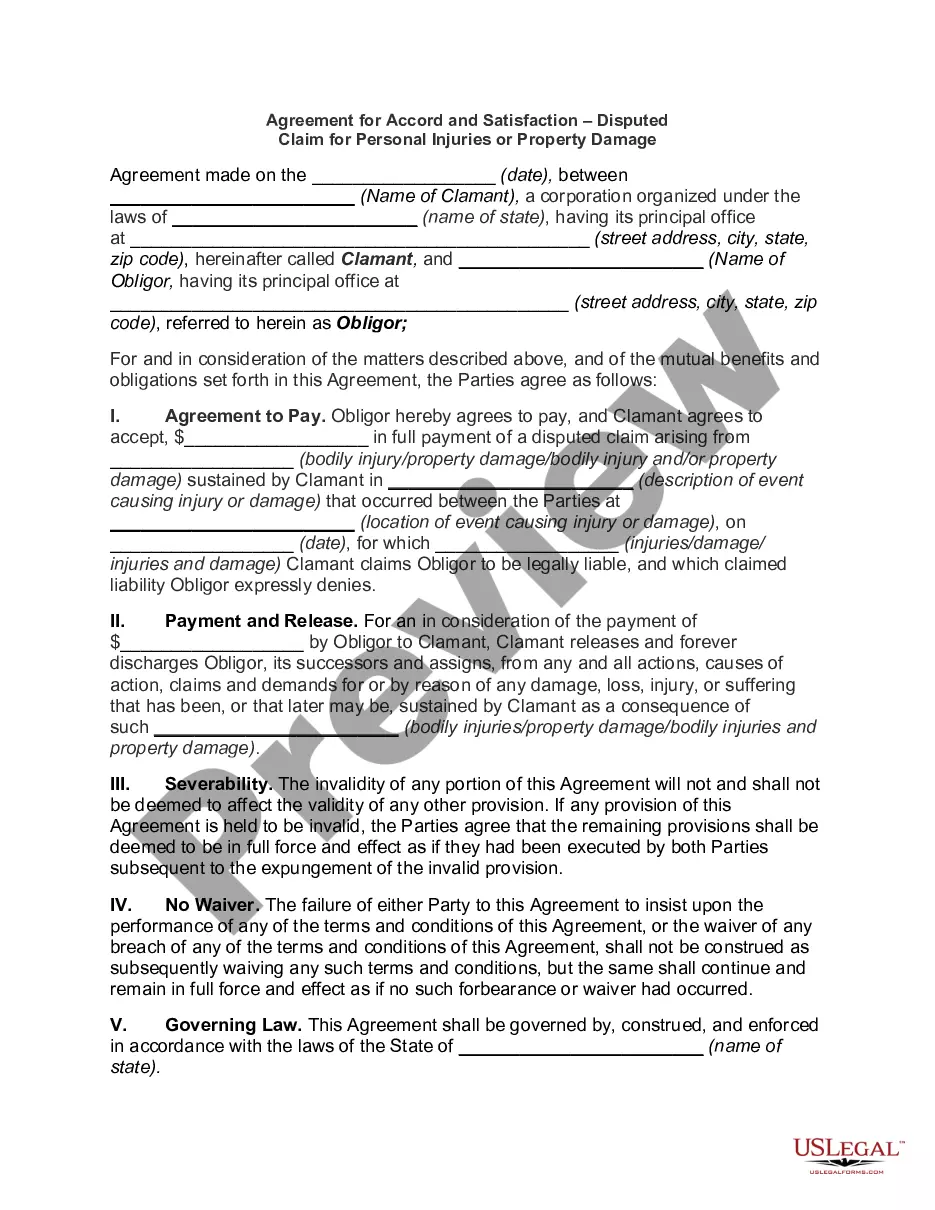

Description

How to fill out Indiana Sample Letter To State Tax Commission Concerning Decedent's Estate?

You may invest time on-line searching for the lawful file web template which fits the federal and state specifications you will need. US Legal Forms offers thousands of lawful forms that happen to be analyzed by pros. You can actually down load or produce the Indiana Sample Letter to State Tax Commission concerning Decedent's Estate from the assistance.

If you already have a US Legal Forms profile, you can log in and click the Download switch. Next, you can total, change, produce, or indication the Indiana Sample Letter to State Tax Commission concerning Decedent's Estate. Each and every lawful file web template you get is the one you have for a long time. To have one more backup associated with a acquired kind, proceed to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms site for the first time, follow the straightforward recommendations beneath:

- Initial, make sure that you have chosen the best file web template for the state/city that you pick. Look at the kind description to make sure you have selected the right kind. If readily available, make use of the Review switch to look through the file web template also.

- If you want to locate one more model of your kind, make use of the Lookup industry to find the web template that suits you and specifications.

- When you have found the web template you desire, click Get now to proceed.

- Choose the costs strategy you desire, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can use your credit card or PayPal profile to pay for the lawful kind.

- Choose the file format of your file and down load it to your gadget.

- Make alterations to your file if necessary. You may total, change and indication and produce Indiana Sample Letter to State Tax Commission concerning Decedent's Estate.

Download and produce thousands of file layouts while using US Legal Forms web site, that offers the most important collection of lawful forms. Use expert and condition-particular layouts to handle your company or person demands.