Indiana Loan Form Corporation is a reputable financial institution located in the state of Indiana that specializes in providing loan services to individuals and businesses. With a strong presence in the market, Indiana Loan Form Corporation is committed to helping its customers achieve their financial goals. Corporate resolutions are an essential part of Indiana Loan Form Corporation's operations. These resolutions refer to legally binding decisions made by the corporation's board of directors or shareholders to authorize specific actions or changes within the company. Corporate resolutions are crucial in maintaining proper corporate governance practices and ensuring compliance with legal requirements. There are various types of Indiana Loan Form Corporation — Corporate Resolutions that are commonly encountered. Some of these include: 1. Loan Approval Resolutions: These resolutions pertain to the approval of loan applications received by the Indiana Loan Form Corporation. The board of directors or relevant personnel review the loan requests, assess the risk factors, and make an informed decision to approve or reject the loan. Loan approval resolutions ensure a streamlined process, guaranteeing that loan applications are thoroughly evaluated before being granted or denied. 2. Loan Restructuring Resolutions: In situations where borrowers face financial difficulties or need to modify the terms of their loans, loan restructuring resolutions come into play. Indiana Loan Form Corporation considers these requests on a case-by-case basis, evaluating the borrower's financial circumstances and negotiating new terms or repayment schedules. Loan restructuring resolutions aim to assist borrowers in managing their financial obligations effectively. 3. Loan Extension Resolutions: When borrowers require additional time to repay their loans, an extension resolution may be initiated. Indiana Loan Form Corporation's board of directors or authorized personnel examine the borrower's request, assess the reasons behind the extension, and decide whether it should be granted. Loan extension resolutions help borrowers prevent default situations by giving them the necessary time to fulfill their repayment obligations. 4. Loan Refinancing Resolutions: If borrowers want to renegotiate the terms of their existing loan or secure better interest rates, they can submit a loan refinancing request. Indiana Loan Form Corporation considers refinancing requests in accordance with its policies and internal evaluation criteria. Loan refinancing resolutions aim to support borrowers in reducing their financial burden and improving loan terms. 5. Loan Termination Resolutions: Once borrowers successfully complete their loan repayments, loan termination resolutions are required to officially close the loan accounts. Indiana Loan Form Corporation ensures that the necessary paperwork and legal procedures are completed, enabling borrowers to conclude their loan agreements successfully. In summary, Indiana Loan Form Corporation is a reputable financial institution in Indiana, offering various types of loans to individuals and businesses. Corporate resolutions play a vital role in the organization's operations, enabling proper decision-making and ensuring compliance with legal requirements. Loan approval resolutions, loan restructuring resolutions, loan extension resolutions, loan refinancing resolutions, and loan termination resolutions are examples of different types of corporate resolutions encountered when dealing with Indiana Loan Form Corporation.

Indiana Loan Form Corporation - Corporate Resolutions

Description

How to fill out Indiana Loan Form Corporation - Corporate Resolutions?

Choosing the best legal document web template can be a struggle. Needless to say, there are a lot of themes available on the Internet, but how would you discover the legal develop you require? Use the US Legal Forms web site. The service delivers a large number of themes, such as the Indiana Loan Form Corporation - Corporate Resolutions, which you can use for company and private demands. Each of the varieties are examined by pros and meet state and federal needs.

In case you are currently registered, log in for your profile and click on the Download button to have the Indiana Loan Form Corporation - Corporate Resolutions. Make use of profile to check with the legal varieties you may have purchased in the past. Proceed to the My Forms tab of your own profile and acquire yet another duplicate in the document you require.

In case you are a new end user of US Legal Forms, listed below are easy instructions that you should adhere to:

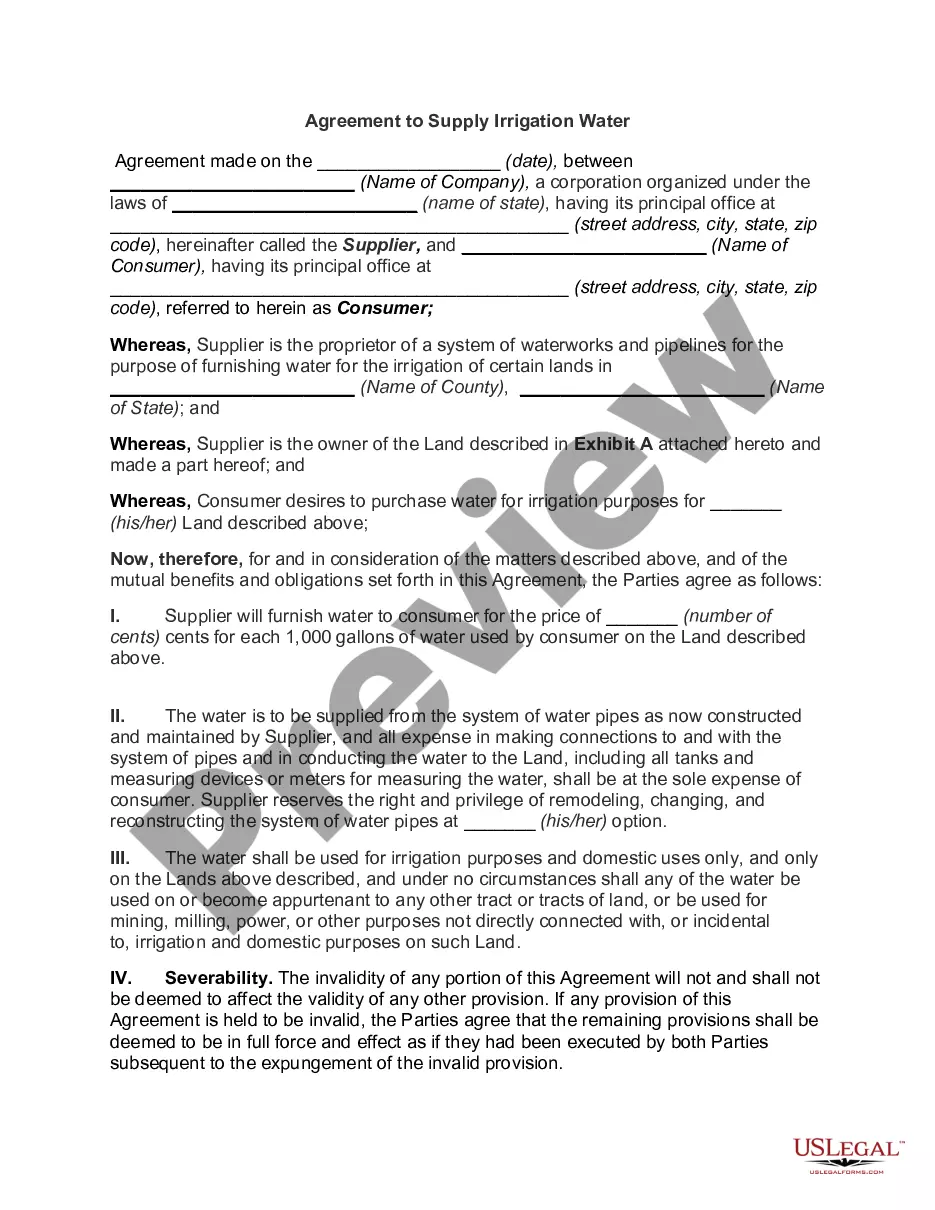

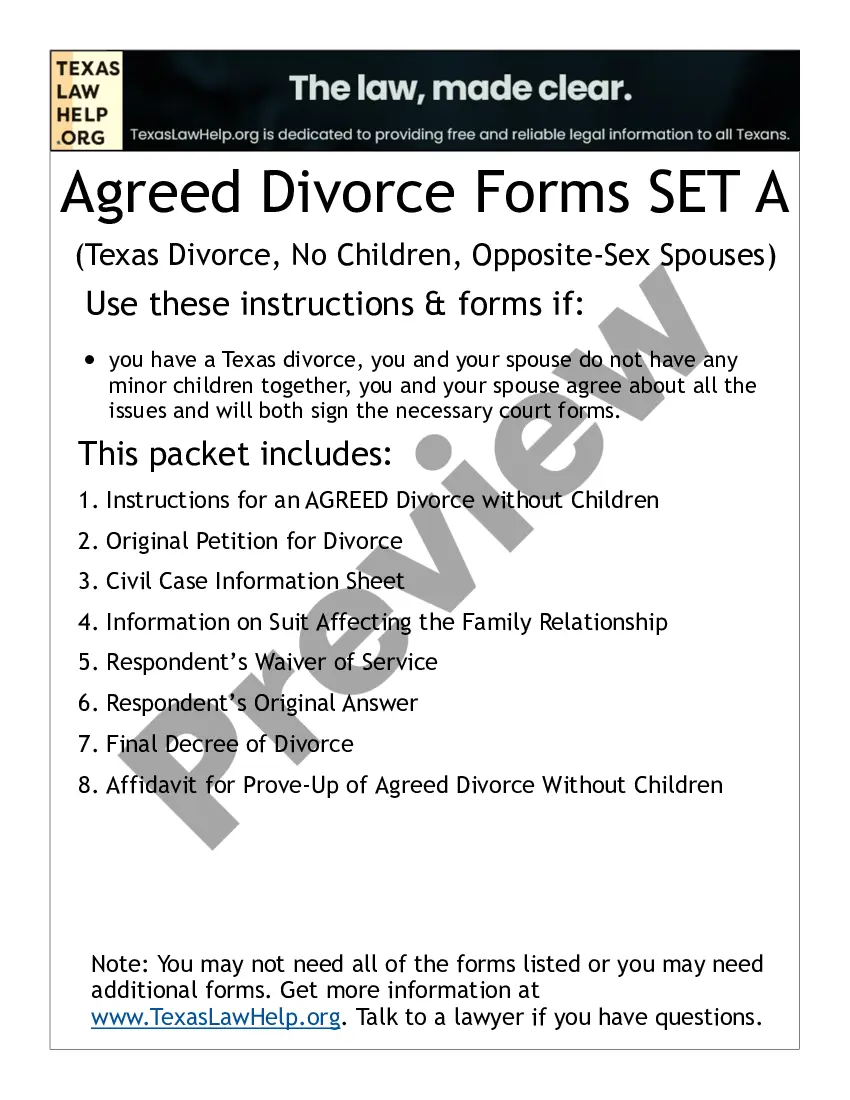

- First, ensure you have selected the correct develop for the town/area. It is possible to examine the form using the Review button and read the form outline to make sure this is basically the best for you.

- In the event the develop will not meet your requirements, make use of the Seach field to find the appropriate develop.

- Once you are sure that the form is suitable, click on the Purchase now button to have the develop.

- Pick the prices strategy you want and enter the required info. Build your profile and purchase an order utilizing your PayPal profile or credit card.

- Choose the data file formatting and obtain the legal document web template for your device.

- Total, change and print and signal the received Indiana Loan Form Corporation - Corporate Resolutions.

US Legal Forms is the greatest catalogue of legal varieties in which you can see different document themes. Use the company to obtain expertly-created paperwork that adhere to condition needs.

Form popularity

FAQ

A borrowing resolution is a legally binding document that approves a corporation's management or executives to borrow funds on behalf of the corporation. The company's board generally approves it.

A corporate resolution is a formal declaration made by a board of directors that officially records specific decisions that are material to a business. These resolutions are passed by the board, officially recorded by a corporate secretary and filed among a company's official records.

Examples of corporate resolutions include the adoption of new bylaws, the approval of changes in the board members, determining what board members have access to certain finances, such as bank accounts, deciding upon mergers and acquisitions, and deciding executive compensation.

Here is an example of a conclusion versus a resolution: Resolution: The team happily celebrated their victory after a challenging face-off with their rival. Here, the resolution marks the end of a story.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is a legal document that provides the rules and framework for how the board can act under various circumstances.

APPOINTMENT OF AUTHORISED SIGNATORY IT WAS NOTED, that {insert name} had indicated {his/her} willingness to act as authorised signatory of the Company. IT WAS THEREFORE RESOLVED that {insert name} be and is hereby appointed as authorised signatory of the Company with effect from {insert effective date of appointment}.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

Outlined below is a detailed description of the process to guide you to produce legally binding corporate resolution documents. Step 1: Write the Company's Name. ... Step 2: Include Further Legal Identification. ... Step 3: Include Location, Date and Time. ... Step 4: List the Board Resolutions. ... Step 5: Sign and Date the Document.