Indiana Lease or Rental of Computer Equipment refers to the legally binding agreement between a lessor (the owner or provider of the computer equipment) and a lessee (the party who desires to use the equipment) in the state of Indiana. This agreement allows the lessee to rent or lease computer equipment for a specified period of time in exchange for regular rental payments. This type of lease or rental agreement covers various types of computer equipment, including but not limited to desktop computers, laptops, servers, networking equipment, printers, scanners, and peripherals. The purpose of the lease or rental may vary, such as for personal use, business operations, or event/short-term projects. The Indiana Lease or Rental of Computer Equipment typically contains several key components to ensure the rights and responsibilities of both parties are clearly defined. These components include: 1. Parties Involved: The agreement identifies the lessor (the company or individual providing the computer equipment) and the lessee (the individual or entity renting or leasing the equipment). 2. Description of Equipment: The lease or rental agreement provides a detailed description of the computer equipment being leased, including make, model, serial numbers, and any additional accessories or software included. 3. Lease Term: The agreement specifies the duration of the lease, including the start date and end date. It may also include provisions for renewing or terminating the lease before its expiration. 4. Rental Payments: The agreement outlines the amount of rent or lease payments required, as well as the frequency (monthly, quarterly, etc.). It may also define late payment penalties or additional fees for damage or loss of equipment. 5. Security Deposit: In some cases, a security deposit may be required to cover any potential damage, loss, or default on the lease agreement. The terms regarding the security deposit, its amount, and the conditions for its return are included. 6. Maintenance and Repairs: The lease or rental agreement specifies the responsibilities of both parties regarding equipment maintenance, repairs, and technical support. It may outline whether the lessor or lessee is responsible for these services. 7. Terms and Conditions: The agreement includes various terms and conditions that govern the use, care, and return of the leased computer equipment. This may cover restrictions on modifying the equipment, insurance requirements, and procedures for equipment return at the end of the lease. Different types of Indiana Lease or Rental of Computer Equipment may include: 1. Personal Computer Equipment Lease: This type of lease is designed for individuals who want to rent computer equipment for personal use, such as home-based work or entertainment. 2. Corporate Computer Equipment Lease: This type of lease is specifically tailored for businesses or organizations that require computer equipment for office operations, software development, data storage, or other business-related purposes. 3. Event Equipment Rental: This type of lease is intended for short-term equipment rental for events, conferences, trade shows, or exhibitions. It may include renting computer equipment for temporary use during the duration of the event. In summary, Indiana Lease or Rental of Computer Equipment acts as a legal document that outlines the terms, obligations, and rights of the lessor and lessee regarding the rental or lease of computer equipment in the state of Indiana.

Indiana Lease or Rental of Computer Equipment

Description

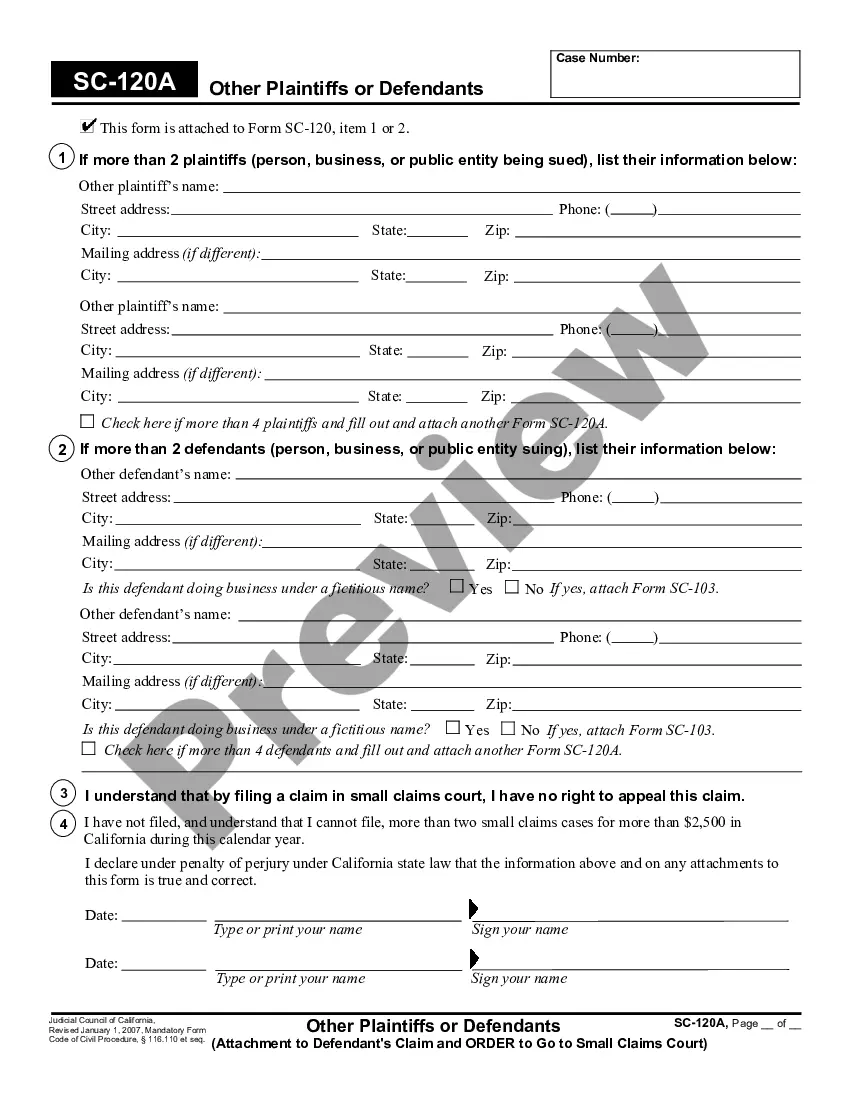

How to fill out Indiana Lease Or Rental Of Computer Equipment?

You are capable of dedicating time online searching for the valid document template that meets the federal and state requirements you will require.

US Legal Forms offers a vast array of valid forms that are examined by experts.

It is easy to download or print the Indiana Lease or Rental of Computer Equipment from my service.

Firstly, ensure you have selected the correct document template for the region/town you have chosen. Check the form description to confirm you have selected the appropriate one.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Indiana Lease or Rental of Computer Equipment.

- Every valid document template you obtain is yours permanently.

- To get another copy of the downloaded form, head to the My documents section and click on the corresponding option.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions provided below.

Form popularity

FAQ

Gudema also points out that if you buy computers online, it's often cheaper than buying them in person at the store.

Many individuals find that computer rental is a low cost option to purchasing and owning a computer. The value of renting depends on the need you have right now versus the need you will have in the future. If it's a short-term need, rent. You may need many computers for a very short time.

If you're in the market for a new desktop computer for one or multiple employees, expect to pay between $400 for a basic model with limited storage space to $3500 for a top of the line desktop with a large hard drive. Desktops also range in price based on operating system as well.

Renting is totally flexible. If you plan to use a particular computer for just a few days or weeks, computer rental is definitely the right choice. However, there are other reasons to rent. Many individuals find that computer rental is a low cost option to purchasing and owning a computer.

Leasing provides you with a laptop with the most current software, and many arrangements allow you to trade in your laptop for a more up-to-date model after a specified period. Leasing agreements come with technical support, so you never have to worry about your laptop warranties expiring.

It may be for just a week, a month, half a year, or for an indefinite period of time; depending on what you and your provider have agreed on. A typical computer rental setup usually comes with the system unit (or the computer tower), a monitor (LCD, LED, etc.), a keyboard, and a mouse.

If your equipment requirements are relatively small and you have the money--or can get a low-interest loan--then just buy it. You'll save money in the long run. However, if you require a substantial amount of equipment, such as computers for your new company's 10 employees, leasing may be a better option.

Basically, if you'll only going to need it for a short period of time, it's always better to just rent one rather than buying a new equipment. Whether you need it for an online exam, or need it for a temporary work from home set-up, it's better to borrow it.

The Computer Rental industry comprises companies that rent or lease desktop and laptop computers to consumers and businesses on a short-term, long-term and rent-to-own basis.