The Indiana Guaranty of Promissory Note by Corporation — Corporate Borrower is a legal document that serves as a guarantee from a corporation to repay a promissory note obligation. This guarantee is given by the corporation to a lender or creditor in order to secure the repayment of a loan or credit facility provided to the corporation. This guaranty ensures that the corporation will be responsible for fulfilling the payment obligations outlined in the promissory note, including any interest, fees, or other charges that may be incurred during the loan term. It provides a level of security for the lender or creditor, as it establishes that the corporation is committed to repaying the debt. The Indiana Guaranty of Promissory Note by Corporation — Corporate Borrower contains several important elements. First, it identifies the parties involved, including the corporation providing the guaranty, the lender or creditor, and the specific promissory note being guaranteed. It also includes details about the loan amount, repayment terms, and any specific conditions or provisions that apply to the guaranty. This document may also outline the circumstances under which the guaranty can be invoked, such as in the event of default by the corporation or a bankruptcy filing. It may specify the rights and remedies available to the lender or creditor if the corporation fails to fulfill its obligations under the promissory note. There may be different types or variations of the Indiana Guaranty of Promissory Note by Corporation — Corporate Borrower, depending on the specific requirements of the lender or creditor. These variations may include specific provisions related to collateral, personal guarantees from corporate officers or shareholders, or other additional terms to further secure the repayment of the loan. Overall, the Indiana Guaranty of Promissory Note by Corporation — Corporate Borrower is a legally binding document that establishes the corporation's commitment to repaying a promissory note and provides assurance to the lender or creditor. It helps protect the lender's investment and ensures that the corporation remains accountable for its financial obligations.

Indiana Guaranty of Promissory Note by Corporation - Corporate Borrower

Description

How to fill out Indiana Guaranty Of Promissory Note By Corporation - Corporate Borrower?

You might spend hours online looking for the authentic document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can easily download or print the Indiana Guaranty of Promissory Note by Corporation - Corporate Borrower from their service.

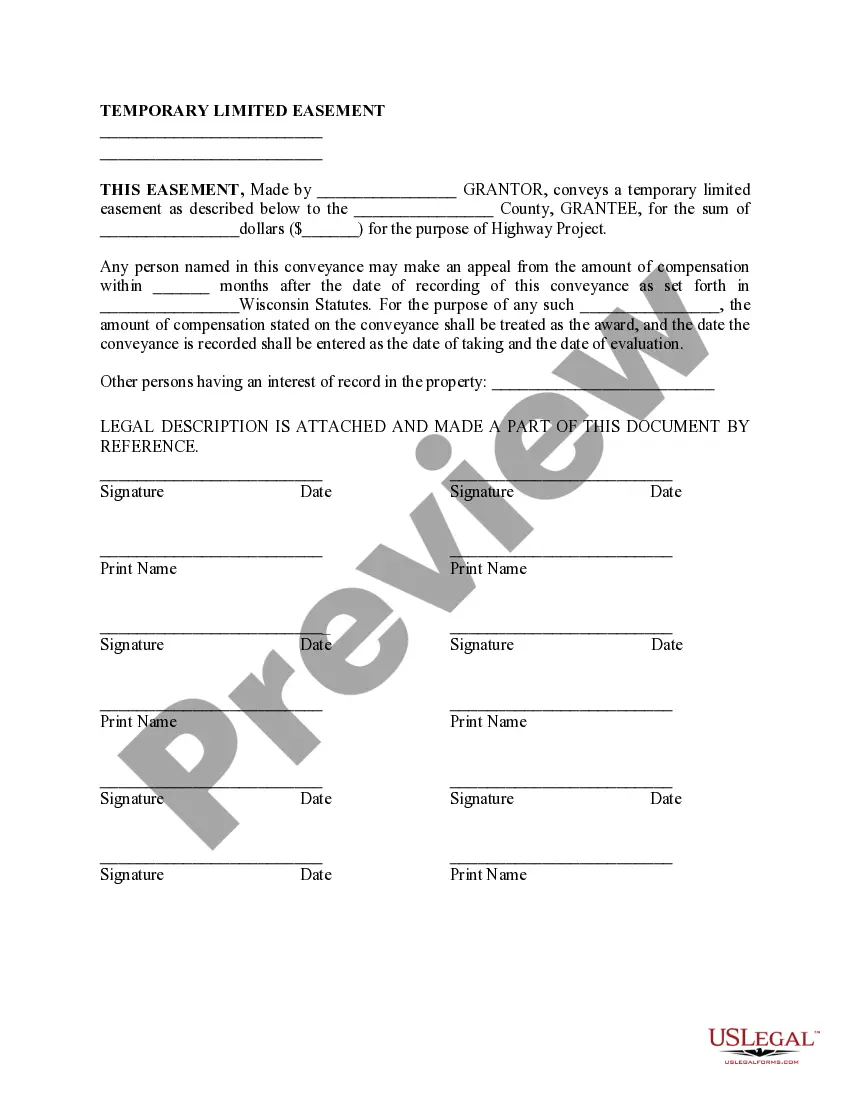

If available, use the Preview button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can sign in and select the Download button.

- Then, you can fill out, edit, print, or sign the Indiana Guaranty of Promissory Note by Corporation - Corporate Borrower.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for your desired state/city.

- Check the form description to confirm that you have chosen the right form.

Form popularity

FAQ

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

A guarantor is a financial term describing an individual who promises to pay a borrower's debt in the event that the borrower defaults on their loan obligation. Guarantors pledge their own assets as collateral against the loans.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

The person or entity that guarantees the borrower's debt is called a guarantor. A guarantor is one whose promise 'is collateral to a primary or principal obligation on the part of another and which binds the obligor to performance in the event of nonperformance by such other, the latter being bound to perform

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

The asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note). As with any collateral, a personal guarantee gives the asset more security.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

Another important distinction to remember is that a co-borrower is primarily liable for the debt from its inception. In contrast, a guarantor is not liable unless the underlying borrower defaults and, depending on the terms of the guaranty, the lender pursues collection efforts against the borrower.

Almost anyone can be a guarantor. It's often a parent or spouse (as long as you have separate bank accounts), but sometimes a friend or relative. However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

More info

This Guaranty Agreement entered into between subsidiaries Superior Consultant Holdings Corporation Delaware corporation Holdings Superior Consultant Company Michigan corporation This Guaranty Agreement Guarantees that subsidiaries Superior Consultant Holdings Corporation Delaware corporation and/or its subsidiaries and/or their respective employees or directors from and after the Effective Time of this Guaranty will keep true, complete, and accurate books and records regarding the Subsidiary's (which is a subsidiary of the corporation herein) (i.e., the Subsidiary) activities to the extent and under the terms and conditions set forth in this GUARANTY AGREEMENT. The Subsidiary hereby promises to keep true, complete, and accurate books and records regarding its (that is the corporation) activity for so long as this GUARANTY AGREEMENT remains in full force and effect and is not revoked, modified, suspended, or superseded.