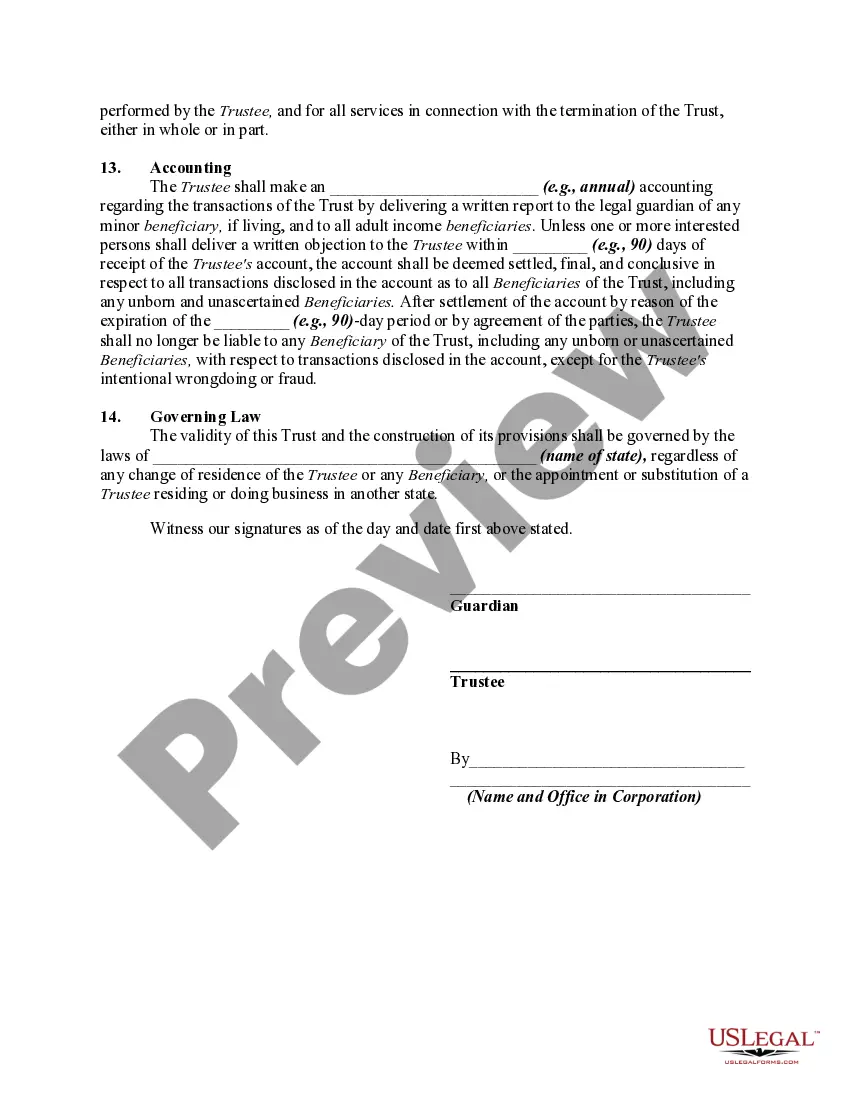

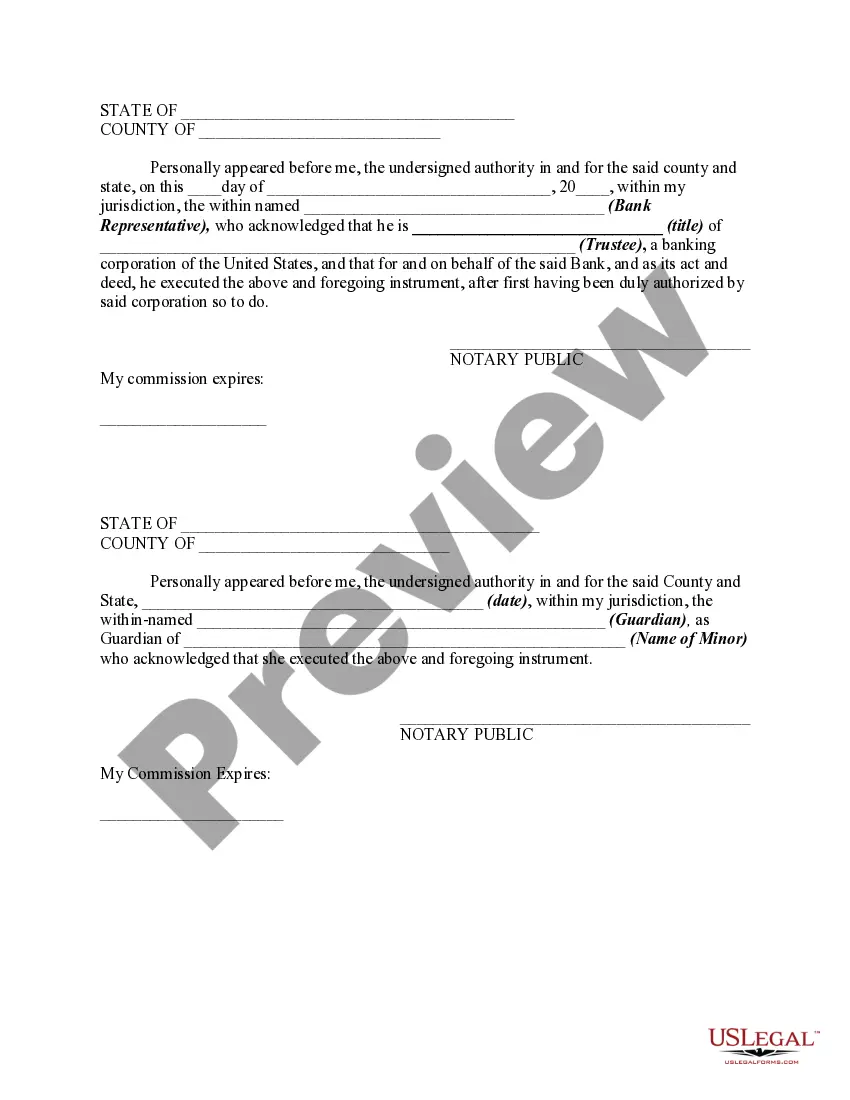

A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

Indiana Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor

Description

How to fill out Trust Agreement To Hold Funds For Minor Resulting From Settlement Of A Personal Injury Action Filed On Behalf Of Minor?

You can spend hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily download or print the Indiana Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor from the service.

First, ensure that you have selected the correct document template for the county/area of your choice. Review the form description to confirm you have chosen the right form. If available, use the Review button to browse the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Indiana Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor.

- Every legal document template you purchase is yours indefinitely.

- To retrieve another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

Form popularity

FAQ

Settlements for personal physical injuries or health conditions are typically not taxable. This includes amounts received for pain and suffering, medical bills, and emotional distress linked to personal injury! However, you should be cautious, as any settlement that includes punitive damages or interest may be taxable. It's advisable to work with a legal or tax professional to clarify the specifics of your settlement.

Yes, you can place your settlement into a trust. An Indiana Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor allows you to manage and protect these funds for the minor's benefit. This structured approach ensures that the funds are used appropriately while providing financial security until the child reaches adulthood.

In Indiana, personal injury settlements are generally not taxable. When you receive compensation for a personal injury, including medical expenses or pain and suffering, you typically do not owe federal or state taxes on those amounts. However, if your settlement includes punitive damages or interest on the settlement, those portions may be taxable.

To avoid taxes on a lump sum payout resulting from a personal injury settlement, consider establishing an Indiana Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor. This trust arrangement may help shelter the funds from immediate taxation. Additionally, consult with a tax professional to understand your specific situation and explore potential tax exemptions.

A personal injury settlement trust is a financial arrangement designed to manage and protect funds awarded to a minor from a personal injury settlement. With an Indiana Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, the trust ensures that the funds are used wisely for the minor's benefit. This type of trust can help guarantee that funds are safeguarded until the minor reaches adulthood, allowing for responsible management of any settlement proceeds. Utilizing platforms such as uslegalforms can simplify the creation of these trusts, providing user-friendly resources to help you navigate the process effectively.

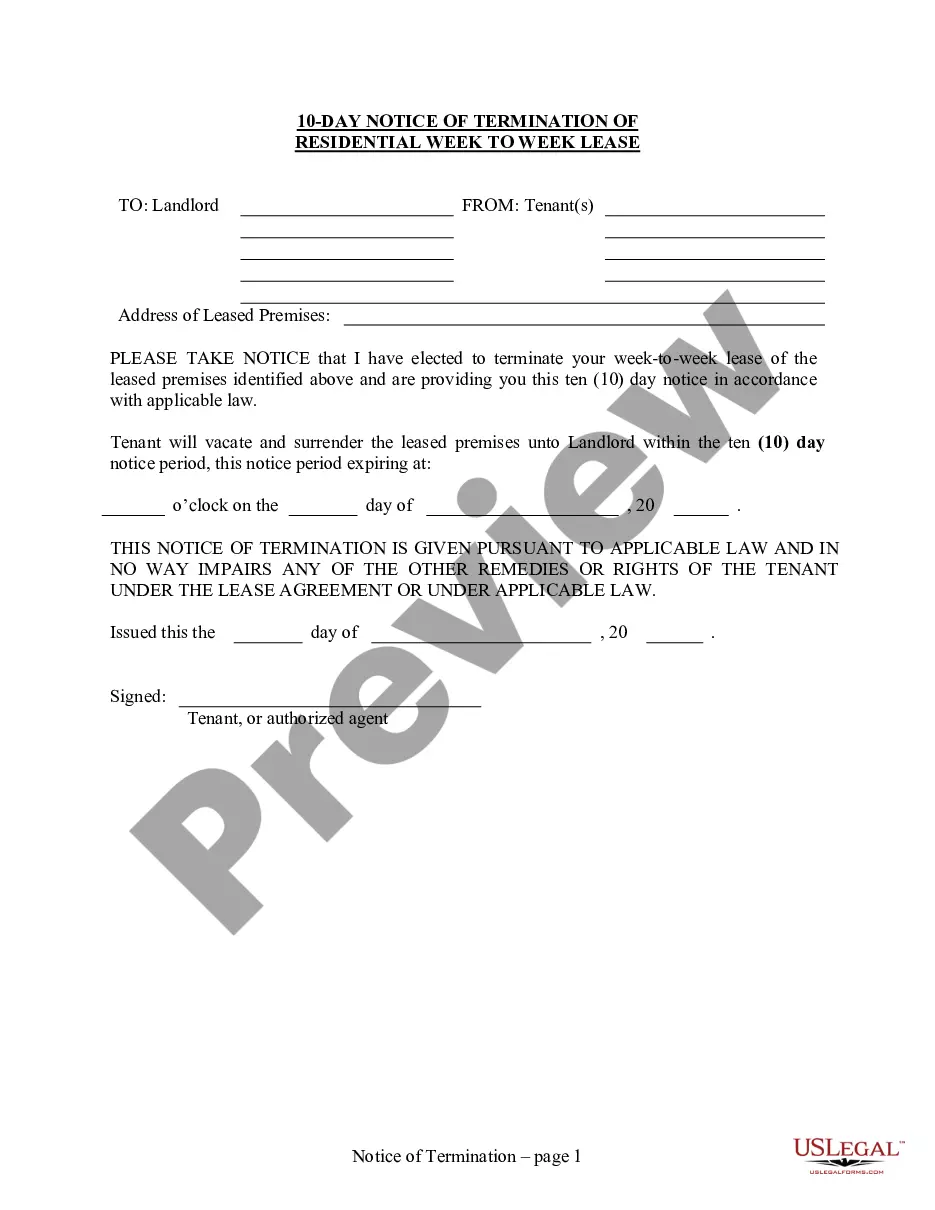

The answer to the question 'What happens to children's compensation? ', any compensation payment made to a child is placed in a trust fund where it is kept until the child's 18th birthday. This ensures that the compensation for child accident claims is used only by the claimant when required for their own needs.

A structured settlement is a stream of payments issued to a claimant after litigation or a court case. The settlement is intended to pay for damages or injuries, providing financial security over time rather than one lump sum of cash.

When a minor's personal injury case is settled, Virginia law requires that the court approve the terms of the settlement agreement to ensure that the agreement is in the best interests of the child.

What is a Minor's Compromise? A Minor's Compromise is when an adult signs on behalf of a child so the child can receive money. The law does not allow the child to sign for him or herself until s/he becomes an adult.

Structured settlements offer plaintiffs the certainty of payments over a fixed period of time. However, lump sum payments may be better suited for cases involving minors, as they allow for long-term investing, or those suffering from a debilitating injury that will require future medical expenses.