Indiana Revocable Living Trust for Grandchildren

Description

How to fill out Revocable Living Trust For Grandchildren?

If you want to thorough, acquire, or produce legal document templates, utilize US Legal Forms, the widest selection of legal forms, available online.

Employ the site's straightforward and efficient search feature to locate the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the payment.

- Use US Legal Forms to find the Indiana Revocable Living Trust for Grandchildren in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and then click the Download button to obtain the Indiana Revocable Living Trust for Grandchildren.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct jurisdiction.

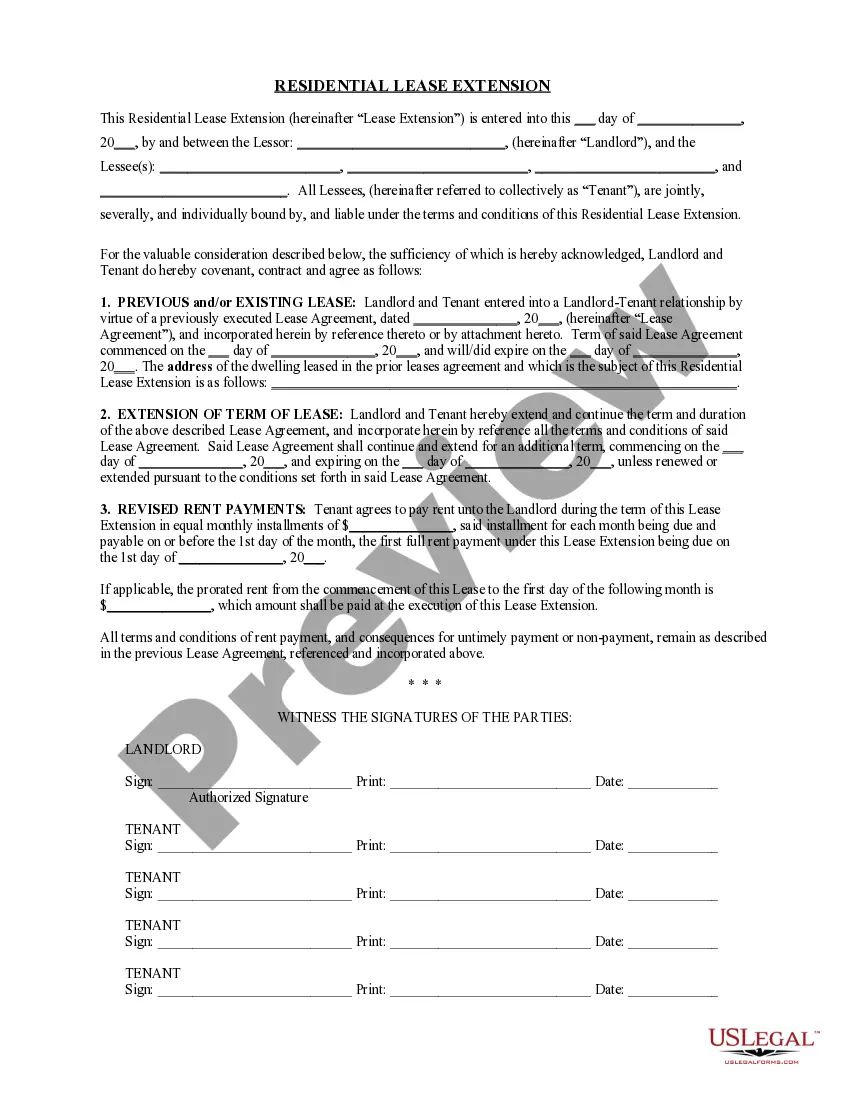

- Step 2. Use the Review option to check the form's contents. Remember to read the information.

- Step 3. If you are not satisfied with the document, use the Search area at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

Yes, an Indiana Revocable Living Trust for Grandchildren effectively avoids probate in Indiana. When you create a trust, your assets are held within it, allowing for direct transfer to your beneficiaries upon your passing. This process bypasses the court system entirely, saving time and preserving privacy for your family. It's a practical solution for ensuring that your grandchildren inherit smoothly and without legal complications.

To avoid probate in Indiana, you can establish an Indiana Revocable Living Trust for Grandchildren, or you can incorporate payable-on-death designations for your financial accounts. Another option is to own property jointly with rights of survivorship. By using these strategies, you can ensure that your assets transfer efficiently to your heirs without entering the probate system.

In Indiana, certain assets such as joint ownership property, accounts with payable-on-death (POD) designations, and assets held in an Indiana Revocable Living Trust for Grandchildren are exempt from probate. This means they are transferred directly to the beneficiaries outside of the probate process. Understanding these exemptions can significantly simplify the transfer of your assets and reduce the challenges your grandchildren may face.

Generally, assets like retirement accounts, health savings accounts, and certain life insurance policies cannot be placed in an Indiana Revocable Living Trust for Grandchildren. These types of accounts often have beneficiary designations that transfer assets directly. Therefore, it is essential to consult with a legal professional to ensure proper asset allocation and to understand which assets can effectively be included in the trust.

An Indiana Revocable Living Trust for Grandchildren offers a streamlined way to transfer assets to your loved ones without the delays of probate. By placing assets in a trust, you can avoid the lengthy court process that often accompanies probate. This helps ensure that your grandchildren receive their inheritance promptly, preserving your intended distribution. Additionally, it maintains privacy since a trust does not go through public probate.

While an Indiana Revocable Living Trust for Grandchildren provides many benefits, it also comes with a few drawbacks. One major disadvantage is that it does not protect assets from creditors since you maintain control over the trust. Additionally, establishing and managing a trust can involve legal fees and paperwork. However, considering these factors can help you weigh whether the advantages outweigh the inconveniences.

An Indiana Revocable Living Trust for Grandchildren is often considered the best option for holding real estate. It allows you to retain control over your property while also simplifying the transfer process upon your death. By placing your house in this type of trust, you can help ensure that your grandchildren inherit the property without the complications of probate. This arrangement can provide peace of mind for you and your family.

The main difference lies in control and flexibility. An Indiana Revocable Living Trust for Grandchildren allows you to alter or revoke the trust during your lifetime, giving you full control over the assets. In contrast, an irrevocable trust permanently transfers ownership of assets and cannot be changed without the consent of beneficiaries. This makes irrecoverable trusts useful for asset protection, while revocable trusts offer adaptable estate planning.

Yes, upon your passing, an Indiana Revocable Living Trust for Grandchildren typically becomes irrevocable. This change occurs because the trust can no longer be altered or revoked. The trust now serves to manage and distribute your assets according to your initial directives, ensuring that your grandchildren receive their intended inheritance. This transition simplifies the distribution process and maintains your wishes.

An Indiana Revocable Living Trust for Grandchildren offers a strong layer of security for your assets. Unlike a will, a revocable trust can help avoid probate, thus keeping your affairs private. While it is important to maintain and update the trust, its flexibility allows you to make changes as your situation evolves. This means you can customize the trust to meet your family's needs over time.