Description: Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift The Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is an important legal document required by charitable and educational organizations in Indiana to formally acknowledge the receipt of a pledged gift from a donor. This acknowledgment is crucial to maintaining transparency and adhering to compliance guidelines under Indiana state law. The Indiana Acknowledgment includes specific information related to the pledged gift, such as the donor's name, address, and contact details, along with a detailed description of the gift itself. It also mentions the intended purpose of the gift and any restrictions or conditions associated with it. This helps ensure that the donor's intentions are clearly understood by the institution. By issuing this acknowledgment, charitable and educational institutions publicly recognize the generosity of their donors while providing assurance that the pledged gift has been received. This acknowledgment serves as proof of the institution's commitment to fulfilling its fiduciary responsibilities towards the donor and reinforces their trust in the organization. Different Types of Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift: 1. Standard Acknowledgment: This is the most common type of acknowledgment used for general pledged gifts, where there are no specific conditions or restrictions imposed by the donor. 2. Conditional Acknowledgment: When a donor specifies certain terms or conditions for their gift, this type of acknowledgment is utilized. It outlines the conditions and ensures that the institution accepts the gift subject to those conditions. 3. Restricted Acknowledgment: In cases where the donor places restrictions on how their gift should be utilized, a restricted acknowledgment is employed. This type of acknowledgment clarifies the specific use or purpose of the gift, allowing the institution to comply with the donor's wishes. 4. In-Kind Acknowledgment: If the pledged gift is in the form of non-monetary items such as goods or services, an in-kind acknowledgment is required. It provides a detailed description of the items received, including their estimated value, and confirms their acceptance by the institution. Compliance with the Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is essential for organizations to maintain their tax-exempt status and uphold their ethical responsibilities towards donors. By diligently adhering to the requirements outlined in this acknowledgment, institutions contribute to a transparent and accountable charitable sector in Indiana.

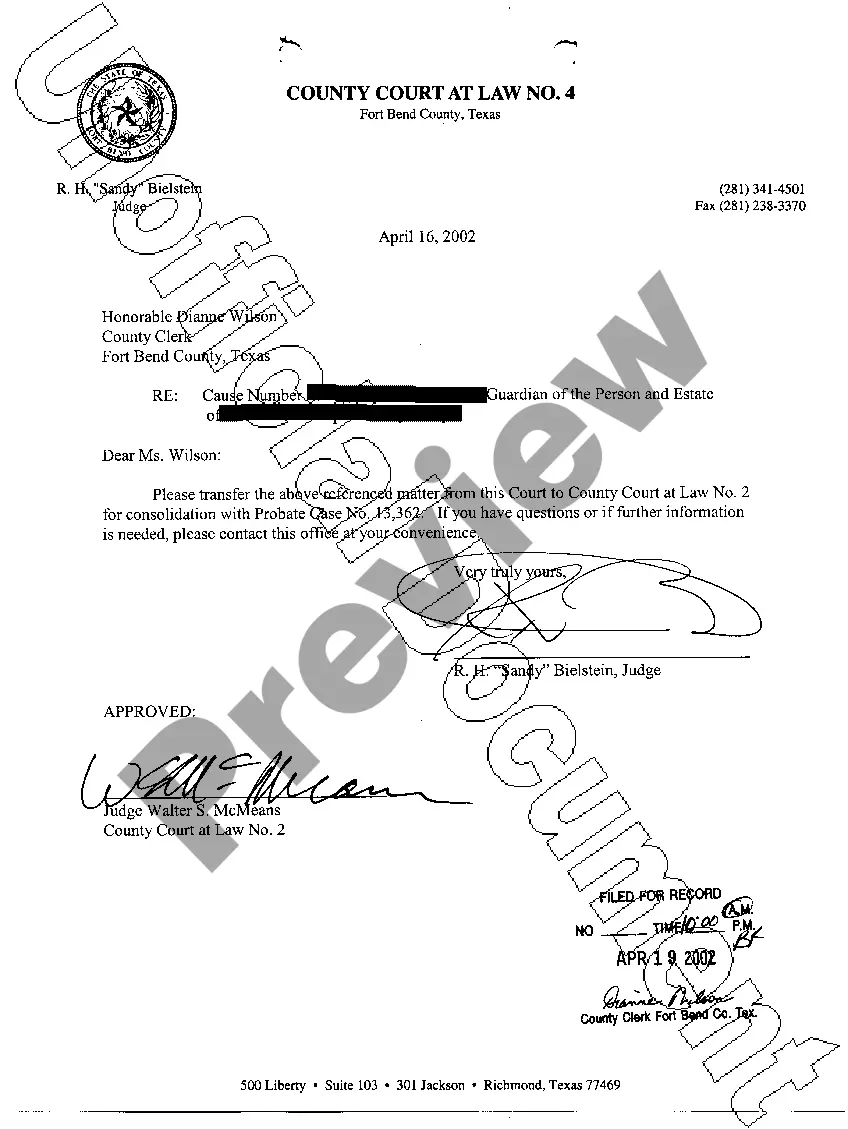

Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

How to fill out Indiana Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

US Legal Forms - one of the greatest libraries of authorized forms in the States - offers a wide range of authorized papers templates you may down load or produce. Making use of the website, you may get a huge number of forms for organization and personal reasons, sorted by groups, claims, or key phrases.You can get the latest variations of forms such as the Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift in seconds.

If you already have a subscription, log in and down load Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift from your US Legal Forms local library. The Download key will show up on each kind you view. You get access to all in the past downloaded forms from the My Forms tab of your own account.

If you wish to use US Legal Forms initially, allow me to share simple guidelines to help you get started out:

- Ensure you have chosen the proper kind for your area/county. Go through the Review key to check the form`s content material. See the kind description to ensure that you have selected the correct kind.

- If the kind doesn`t match your requirements, utilize the Research industry at the top of the monitor to discover the one who does.

- Should you be content with the form, confirm your choice by clicking the Acquire now key. Then, choose the rates prepare you favor and give your qualifications to sign up for an account.

- Approach the transaction. Make use of your charge card or PayPal account to perform the transaction.

- Choose the format and down load the form on your gadget.

- Make adjustments. Load, modify and produce and signal the downloaded Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift.

Each format you put into your account lacks an expiry time and is also yours eternally. So, if you wish to down load or produce one more version, just go to the My Forms area and click around the kind you want.

Get access to the Indiana Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift with US Legal Forms, the most extensive local library of authorized papers templates. Use a huge number of professional and express-particular templates that satisfy your business or personal demands and requirements.