The Indiana Notice to Debtor of Authority Granted to Agent to Receive Payment is a legal document that informs a debtor about the appointment of an agent or authorized representative to receive payments on behalf of a creditor. This notice is crucial in ensuring clear communication and proper handling of debt repayments. The Notice to Debtor of Authority Granted to Agent to Receive Payment is typically used in situations where a creditor assigns their rights to collect a debt to another party, often referred to as an agent or representative. This commonly occurs in cases involving unpaid debts, loans, or other financial obligations. The purpose of this notice is to inform the debtor about the change in the payment collection process. It ensures that the debtor is aware of the agent's authority and legitimacy to receive payments, preventing any confusion or potential fraud. Keywords relevant to this document may include: 1. Notice: This refers to the communication sent by the creditor or their authorized representative to inform the debtor about the change in payment collection methods. 2. Debtor: The individual or entity that owes a debt or is obligated to make payments to the creditor. 3. Authority Granted: The legal permission given by the creditor to the agent, allowing them to act as the authorized representative in collecting payments on their behalf. 4. Agent: The appointed person or entity responsible for receiving payments on behalf of the creditor. 5. Receive Payment: This signifies the act of collecting the owed funds from the debtor. Different types or variations of the Indiana Notice to Debtor of Authority Granted to Agent to Receive Payment may depend on specific factors such as the nature of the debt, the creditor's requirements, or any unique circumstances of the debt collection process. However, it is essential to consult with a legal professional or reference the specific forms and guidelines provided by the state of Indiana to identify any specific subtypes of this notice.

Indiana Notice to Debtor of Authority Granted to Agent to Receive Payment

Description

How to fill out Indiana Notice To Debtor Of Authority Granted To Agent To Receive Payment?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

Using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Indiana Notice to Debtor of Authority Granted to Agent to Receive Payment within seconds.

If you already have an account, Log In and download the Indiana Notice to Debtor of Authority Granted to Agent to Receive Payment from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finish the payment.

Select the format and download the form to your device. Edit. Fill out, modify, and print as well as sign the downloaded Indiana Notice to Debtor of Authority Granted to Agent to Receive Payment. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Obtain the Indiana Notice to Debtor of Authority Granted to Agent to Receive Payment with US Legal Forms, the largest collection of legal document templates. Access thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

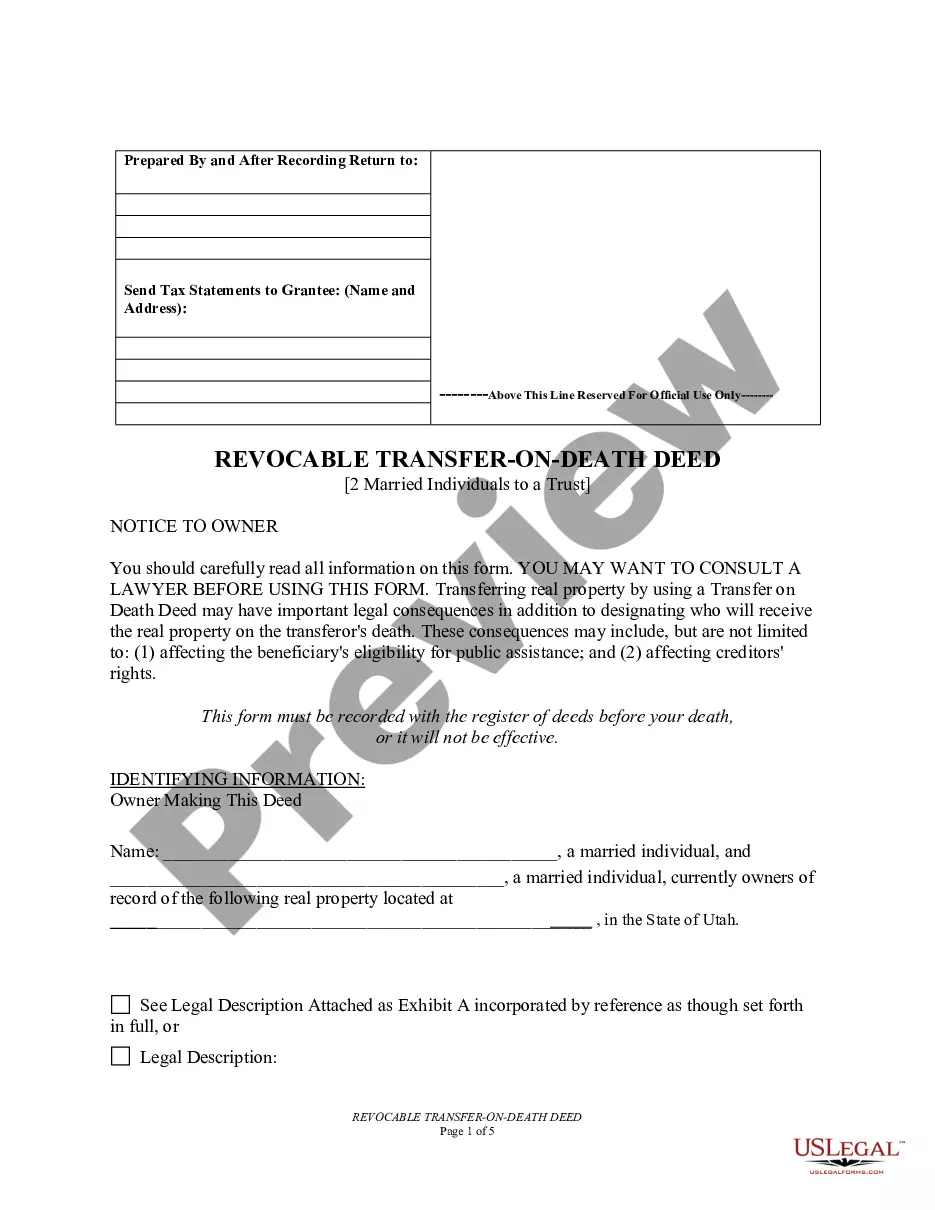

- Make sure you have selected the correct form for your city/county. Click the Preview button to review the form's details.

- Check the form's information to ensure that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Next, select the payment plan you prefer and provide your details to register for an account.

Form popularity

Interesting Questions

More info

Ads Legal Related News Source Insurance Resources.