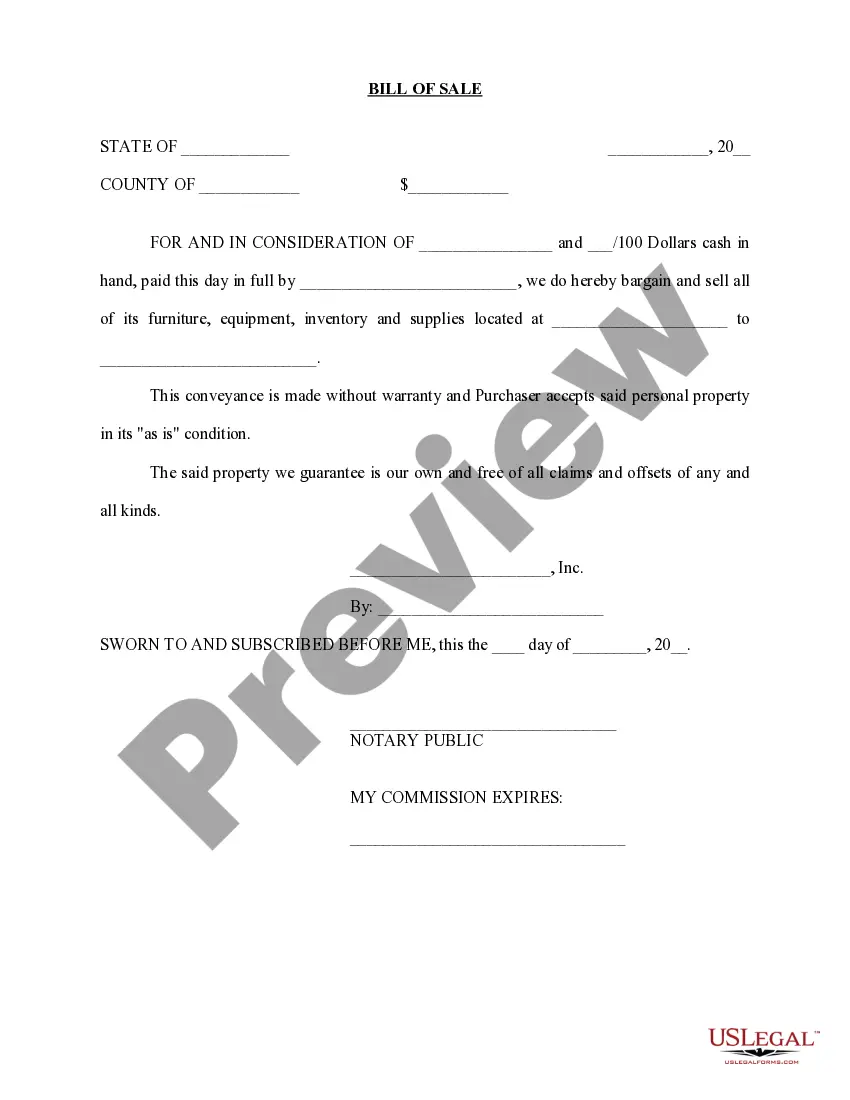

Indiana Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legal document that outlines the terms and conditions of selling a business and its personal assets in the state of Indiana. This agreement serves as proof of the transfer of ownership and protects the rights of both the buyer and the seller. In the state of Indiana, there are several types of Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transactions that are commonly used: 1. Business entity sale: This type of transaction involves the sale of an entire business entity, including its assets and liabilities. The buyer purchases the business entity as a whole, assuming all obligations and responsibilities associated with it. 2. Asset sale: In an asset sale, only the specific assets of the business are sold, rather than the entire business entity. This type of transaction allows the seller to retain ownership of the business entity and transfer only the selected assets to the buyer. 3. Stock sale: A stock sale occurs when the buyer purchases the ownership shares of a corporation, effectively acquiring control of the business. This transaction type is different from an asset sale, as the buyer assumes both the assets and liabilities of the corporation. The Indiana Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction typically includes the following key information: 1. Parties involved: The agreement clearly identifies the buyer and the seller, along with their contact details and legal entities involved in the transaction. 2. Assets included: The document provides an itemized list of all personal assets being sold as part of the transaction. This may include equipment, inventory, furniture, intellectual property rights, customer lists, and any other tangible or intangible assets. 3. Purchase price: The agreed-upon purchase price and the payment terms are mentioned in the bill of sale. It may specify whether it is a lump sum payment or installment payments, as well as the due dates and methods of payment. 4. Representations and warranties: The seller typically provides certain assurances regarding the assets being sold, such as ownership rights, absence of liens or encumbrances, and the assets' condition. The buyer may require the seller to provide indemnification if any misrepresentations are discovered later. 5. Closing date and conditions: The agreement specifies the date on which the sale will be finalized and any conditions that need to be fulfilled before the closing. These conditions may include obtaining necessary regulatory approvals or the buyer's satisfactory due diligence review. 6. Governing law: The bill of sale will state that it is governed by the laws of the state of Indiana, ensuring that any disputes arising from the transaction will be resolved according to Indiana law. It is important for both the buyer and the seller to carefully review the Indiana Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction and seek legal advice if required. The document should be signed by both parties and notarized to make it legally binding and enforceable.

Indiana Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

How to fill out Indiana Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

Have you been in a place in which you need documents for possibly company or person functions almost every working day? There are a lot of lawful papers themes accessible on the Internet, but locating types you can trust is not easy. US Legal Forms offers thousands of type themes, much like the Indiana Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, which are published in order to meet federal and state specifications.

In case you are currently familiar with US Legal Forms web site and have an account, merely log in. Afterward, you can acquire the Indiana Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction format.

Unless you offer an bank account and wish to start using US Legal Forms, abide by these steps:

- Obtain the type you need and make sure it is for that correct area/area.

- Use the Review key to analyze the form.

- Read the information to ensure that you have chosen the appropriate type.

- In case the type is not what you are looking for, make use of the Look for area to get the type that meets your requirements and specifications.

- Whenever you obtain the correct type, just click Acquire now.

- Select the costs prepare you would like, submit the desired details to make your money, and buy an order utilizing your PayPal or credit card.

- Pick a convenient data file format and acquire your backup.

Get all the papers themes you possess bought in the My Forms food selection. You can obtain a more backup of Indiana Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction whenever, if necessary. Just select the necessary type to acquire or print the papers format.

Use US Legal Forms, probably the most comprehensive selection of lawful types, in order to save some time and avoid errors. The support offers skillfully made lawful papers themes which can be used for an array of functions. Make an account on US Legal Forms and commence producing your life easier.